There will be no video on Wed, Thur, or Fri and no First Word on Fri this week due to travel plans.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– SKIP FRIDAY

______________________________________________________________

Today’s note will include a short video update. We discuss: why we timidly think it makes sense to add risk on Wed, ahead of NVDA 2.08% and ahead of Friday’s Jackson Hole. We cite 4 reasons and we want to be ahead of Friday (Duration: 7:47).

_______________________________________________________________

The 5% decline S&P 500 since the start of the month has felt like a straight line down. Incremental macro concerns (which we flagged) emerged in that timeframe including the BoJ tweaks to yield curve control, China growth concerns, rising oil prices and the sharp rise in interest rates. Given the paucity of US fundamental data, and the fact that Fed Chair Powell speaks this coming Friday, and one can easily see why markets are nervous now. At a lunch last week, one of my most seasoned investor clients told me (TL of CT) that the rise in interest rates is arguably the most troubling.

- That is self-evident as we know risk assets are essentially priced off prevailing interest rates. And much of borrowing by households and businesses are priced off 10-year yields from mortgages to corporate debt. The 50bp surge in past few weeks and the continued push higher, naturally, are going to put downward pressure on stocks.

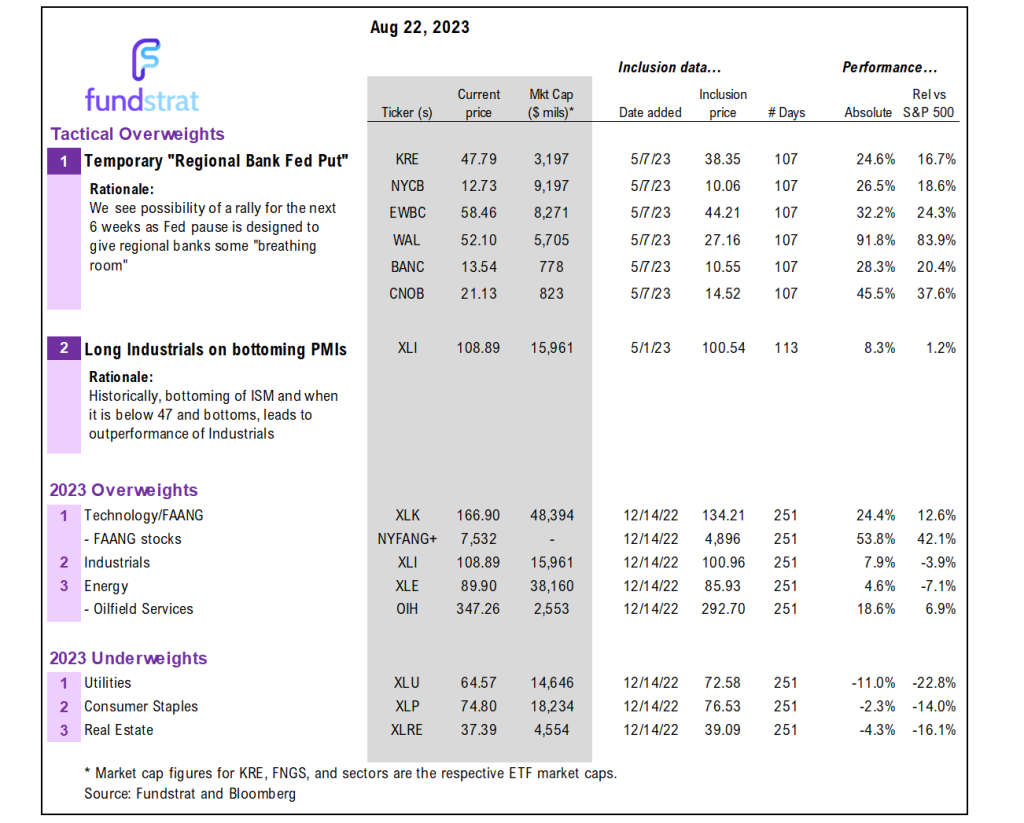

- Despite this rise in rates, we believe probabilities have shifted to favor stocks being higher in the short term. That is, we would be buyers of equities starting Wednesday, even if we are only in “close proximity” to a low. There are really 4 factors we highlight along with tactical views by our Head of Technical Strategy, Mark Newton.

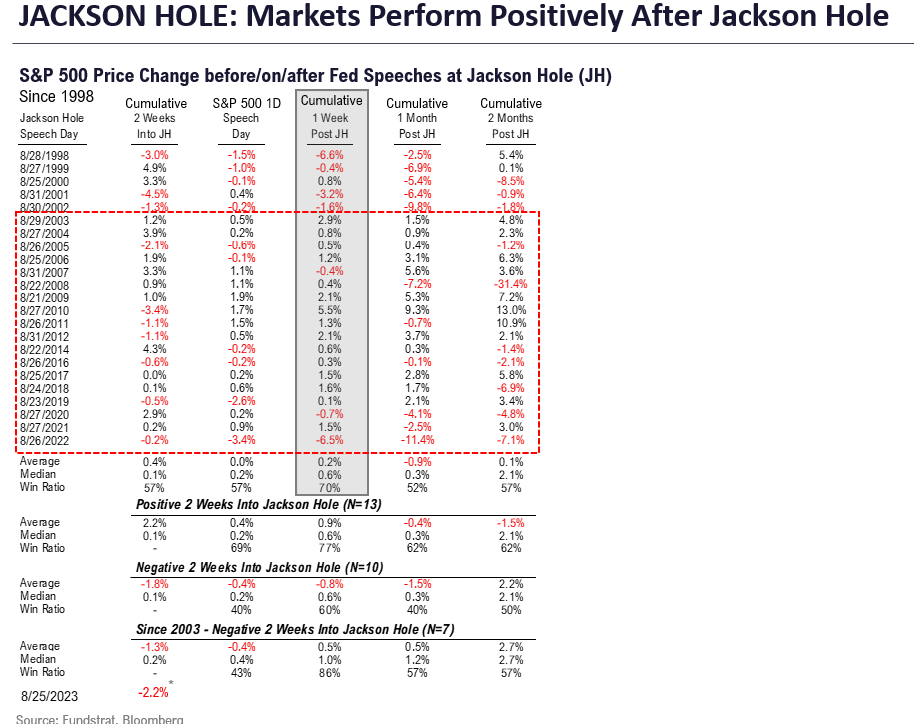

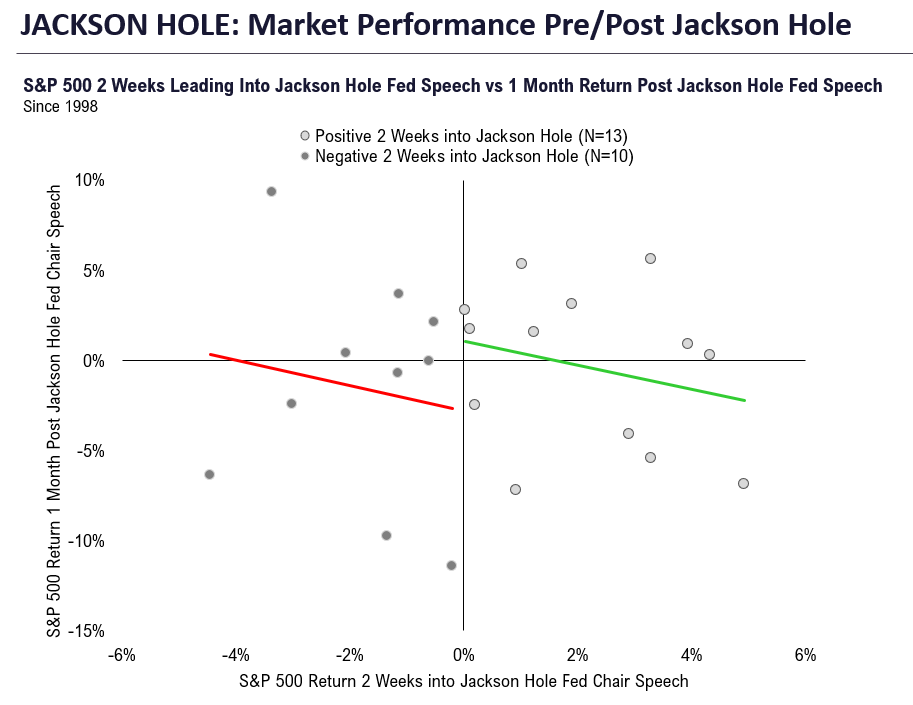

- First, looking at equity market behavior post-Jackson Hole (JH) since 2003, our analysis suggests there is a >80% equities rally post-Friday:

– since 2003, there are 7 instances S&P 500 down 2 weeks prior to JH

– 6 of 7 instances, equities rose in the week post-JH

– the range of gains was +0.5% to +5%

– the 1 exception was 2022 when S&P 500 fell -7% in the week post-JH

– but we know Fed Chair Powell comments were uber-hawkish then - The context is different in 2023, as inflation is not only on a glide path lower, but the surge in 10-yr yields threatens a potentially greater tightening of financial conditions (see comments earlier this week) and thus, we see probabilities favoring language addressing this surge in yields.

- Second, several media articles this week further support the view that forward inflation pressures are ebbing faster.

– first, an article how new hire pay declining versus a year ago (per WSJ).

– this certainly flies in the face of those arguing higher pay is “sticky”

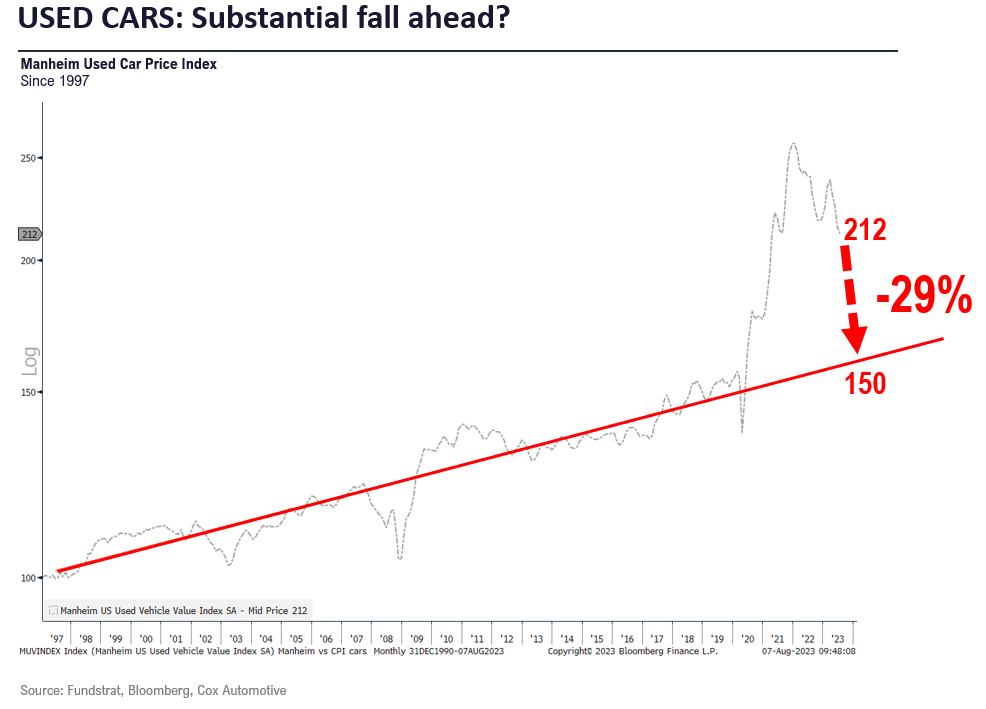

– second, another story on the surge in auto loan delinquencies (per WSJ)

– this portends a potentially even faster fall in auto prices

– we previously wrote how used car prices could fall another ~30% from here

– all of this argues for future inflation to be softer and for Fed path to turn dovish sooner - Third, while rates could be pushing higher (Newton thinks we are near a turn), equities are showing early signs of diverging from higher rates. This is a somewhat important development, if this is due to stocks sensing rates are about to roll over. So, it is a somewhat circular observation. Our view is a calculated bet that stocks are rising, despite higher rates, because the stock market is sensing this turn that Newton believes could happen in the next week or two. In other words, we are saying the last push higher in rates will not proportionately hit stocks.

- Fourth, a huge slate key macro data is on deck next week:

– 8/29 9am ET: Case-Shiller Home prices

– 8/29 10am ET: JOLTS job openings (should show drop in openings)

– 8/30 8:30am ET: 2Q GDP

– 8/31 8:30am July PCE (should be soft)

– 9/1 8:30am August jobs report

– 9/1 10am August ISM manufacturing - Just a ton of macro data and our view is this will support the picture of a glide path to lower inflation and a softening labor market. Given the hawish shift in investor expectations, I think this would further support a rise in equities.

- Lastly, Mark Newton has written extensively on how his analysis of cycles favors stocks bottoming in the next week or two. Now his view allows for the S&P 500 to fall towards 4,300-4,330 versus 4,395-4,400 currently. That is about 2% downside from here. So, it is not a “free gift” to make this calculated bet.

BOTTOM LINE: Probabilities favor using Wed as day to see positive risk/reward for equities

This is August, and we have held the view that this means it is a trickier time to be tactical given the reduced market liquidity. But as we approach the end of the month, and the fact that equities are oversold, we see two windows for stocks to be in range of bottom:

- The safer window is post-JH after Fed Chair Powell’s comments Friday. After all, the NVDA 2.08% quarterly results and the possible “hawkish surprise” by Powell would be in the rear view mirror

- The problem with that is stocks could see a strong rally post-NVDA results (Wed after the close) and Powell could make a dovish comment. So stocks would be rallying for 2 consecutive positive catalysts

- The “less safe” window is Wednesday. This is in front of those two events.

- Granted, the risk is both NVDA and JH are disappointing. And then, stocks could go into a deeper rout into September.

- Well, guess what?

- Many investors are taking this last point. The chance of a deeper rout. That is why so many talk about a “higher for longer” or “need to raise the neutral rate” or “bonds going to break something”

So our constructive stance on buying “risk” on Wednesday is that the bull market is intact and this August sloppiness is at the highest level of messiness.

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame- 8/23 9:45am ET S&P Global PMI Aug Prelim

- 8/25 10am ET Aug Final U Mich 1-yr inflation

- 8/28 10:30am ET Dallas Fed Aug Manufacturing Activity Survey

- 8/29 9am ET June S&P CoreLogic CS home price

- 8/29 10am ET Aug Conference Board Consumer Confidence

- 8/29 10 am ET Jul JOLTS

- 8/31 8:30am ET July PCE

- 9/1 8:30am ET August NFP jobs report

- 9/1 10am ET August ISM Manufacturing

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

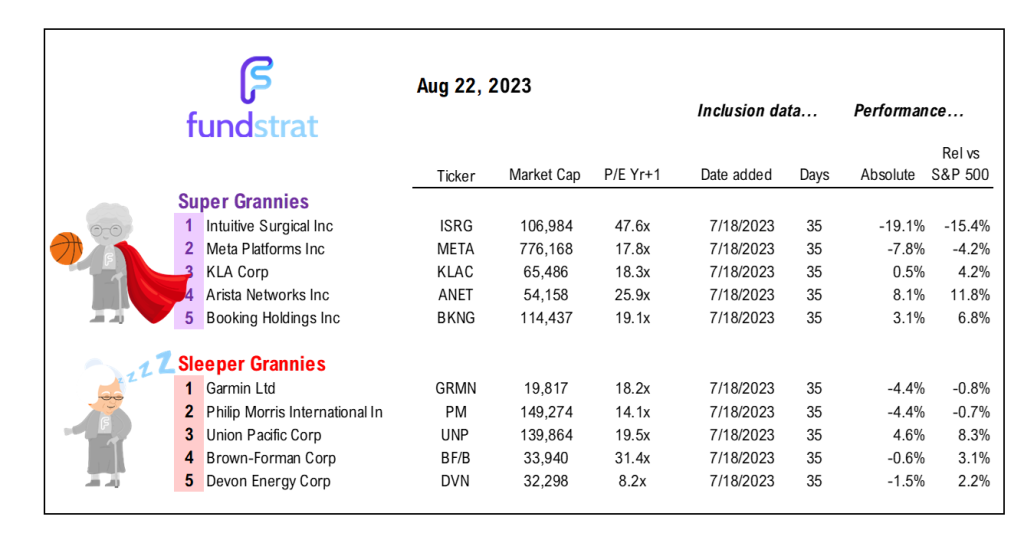

35 Granny Shot Ideas: We performed our quarterly rebalance on 7/18. Full stock list here –> Click here

______________________________