Over the past month, equity markets and financial assets broadly, have been attempting to price in the dual shock of a pandemic and the sudden collapse in oil prices (which is viewed by markets as negative given effect on high-yield and drilling-related GDP). Already, equity markets are down 30% from their highs and as we noted last week, this is pricing in >100% probability of a recession (based on price decline).

– Since 1900, there have been 22 equity drawdowns of 20% or more and the current 30% slide would rank #14 overall. Notably, the typical bear market during a recession period is 30%, so the S&P 500 has already discounted a recession.

REMOTE WORKING FOR FINANCIAL MARKETS — MAKING THIS EVEN MORE A FOCUS ON SELLING LIQUID ASSETS

Equities are responding to the growing stresses across financial markets. The 100% basis point Fed cut was completed ignored by investors Sunday evening and on top of the already fragile sentiment, likely contributed to the further selling we saw Monday.

The VIX just posted an all-time closing high, at 83. This is higher than during the Great Financial Crisis (which had an intraday high). Was part of this due to the growth of “remote working” for financial employees? Many have posed this question and there are anecdotes that today was particularly disorderly. And under such circumstances, one would not be surprised to see the most “liquid” assets being sold — hence, the particularly brutal selling for equities.But stocks are not attempting to discount the fundamental outcome of this pandemic.

Additionally, last week, investment grade bonds were the latest victims, as shown below. Yields surged last week to 3.24%. But in all fairness, that puts the level of yields where there were in September 2019. Not a huge rollback. Spreads (options adjusted spread) is at 4-year wides.

HAS THE STOCK MARKET BECOME UNINVESTIBLE? IS THE MARKET DISTINGUISHING WINNERS VS LOSERS

SEVERAL THINGS BREAK DOWNWARD FEEDBACK LOOP: (I) FISCAL POLICY, (II) PANDEMIC CURVE FLATTENING AND/OR (III) SAUDI/RUSSIA PEACE

The relentless selling in equity markets has made the stock market virtually impossible to distinguish winners vs loser.

In a business cycle downturn, stronger companies should be able to gain market share and actually improve market position. Similarly, weaker industries, with poor fundamentals and higher leverage, should be decimated by a business cycle turn.

In this current context, the market does not seem to be distinguishing winners and losers. Witness the broadbased selling across all companies and even high-quality companies saw relentless declines. There are multiple reasons this could happen. For instance:

– if markets are seeing broad-based liquidation via passive vehicles ETFs, etc, then there is no “winners vs losers”

– perhaps the sell-off is exposing the risk of an asset light economy. The problem with this argument, is the industries that should be hurt the most are those negatively impacted by slowing human interaction (travel, restaurants, hotels, entertainment, etc).

– But once position squaring has taken place, we expect there to be significant recovery of the “winners”

Tom Block observes Conditions supportive of Washington to bring on “Mother of all fiscal plans”

The market is making clear that the “cure” for the pandemic is as bad as the disease.

Social distancing is creating enormous ripple effects that we initally failed to appreciate. And this has created a growing sense of hopelessness among our clients. Several even suggested that equity markets should be shuttered until COVID-19 peaks.

To me, it is incredible to see the change in character stemming from a pandemic shock. Understandably, stocks are discounting “long term outcomes” but the path of economy and the World is made uncertain by the corona virus. The key question, therefore, is whether markets can gain confidence without the end of the crisis visible. 2008-2009 was certainly an example where markets were able to begin to stabilize long before fundamental visibilty improved. In fact, 2009 was still characterized by contracting GDP and negative EPS revisions but equity markets managed to bottom before those took place.

But unlike 2008-2009, Washington is likely to be less reluctant to provide substantial fiscal relief, perhaps even larger than what was seen during the GFC. This is, of course, purely observational.

But what I found intriguing are comments from Tom Block, Fundstrat’s Policy Strategist, who noted that the White House is in touch with corporate executives and have a fairly clear picture of the disruptions developing across a broad set of industries in the economy.

– Washington does not develop “fiscal plans” on its own, but rather bases it on the requests made by beleagered industries.

– Because the circumstances today do not have the “bad actors” seen in GFC (blaming banks), the process, according to Block’s perspective, is more likely to be based on “asks” and “what do you need”–and uniquely, Washington might be willing to give.

– This means that we could ultimately see a comprehensive plan emerge in a few weeks, encompassing many industries and reliefs and also address all the suffering seen by the US worker and household.

This, of course, would be a big step in containing the mounting fear. And perhaps, break this cycle and enable stocks to bottom before pandemic cases peak in US.

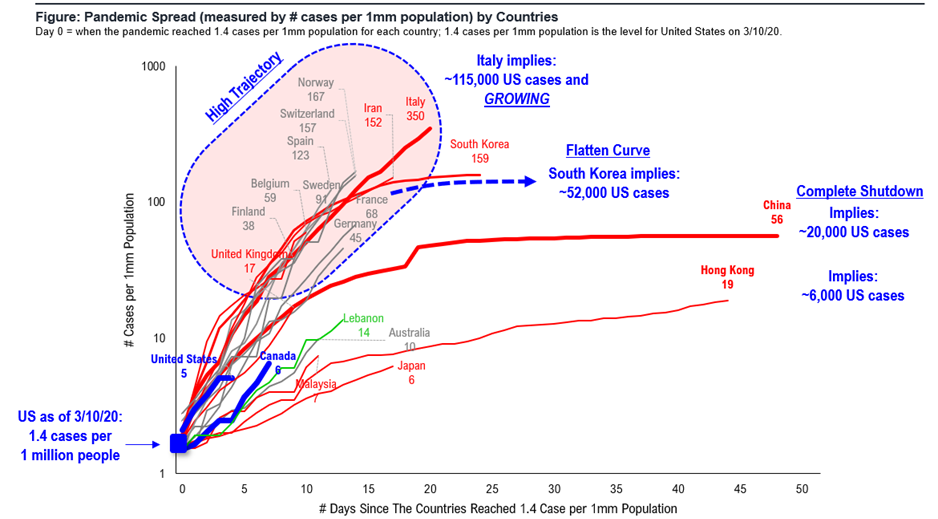

Corona curve can be flattened with social distancing…Below are some updated analytics around Corona progression across nations, based on data by the WHO.

Notably, Europe remains the area with the worst spread, with high trajectories (measured by daily growth, as shown below, by cases per 1mm people) and Western Europe seems to be following closely the spread seen in Italy. Even Iran seems to be flattening. Flatter curves are seen with South Korea and China and Japan (all known),

– if the US is tracking Italy, in approximately 2-3 weeks, we could see 115,000 cases across the US.

– If tracking Korea, the cases would peak ~50,000

Thus, the current case count of 4,000 is sure to grow

Mortality, measured as deaths per million (rather, than % of cases) also varies widely. Europe is a high trajectory region and most of Western Europe seems to be following the path of Italy.

– This implies that US deaths would reach 8,000 in the next few weeks, from about <100 today. This is the reason markets are so concerned. But if the US were to manage the curve to match Korea, we could see peak deaths in next few weeks at around 500.

THE LONG-TERM YIELD CURVE AND EVEN 10Y-2Y IS STEEPENING, WHICH HISTORICALLY SUPPORTS CONSTRUCTIVE FORWARD OUTLOOK

A few weeks ago, we thought markets were setting up for such a V-shaped bounce, but instead, financial conditions broadly have deteriorated. We have seen the fastest move from new high to bear market in history.

And of course, stocks are discounting mechanisms, attempting to price in an uncertain outcome (COVID-19 path), but at the moment, the market is essentially choosing not to decide.

Among the “good things” starting to develop in the financial markets is a pronounced steepening of the long-term yield curve (30Y-10Y). While some may argue this could be aberrant given the turmoil across markets and the limited liquidity. Moreover, some have advanced this is technical in nature, as some risk-parity/ systematic strategies have been de-leveraging. The technical noise is usually the rule and not the exception.

One might wonder why this curve should matter. Consider a few things. We have written extensively how this has a very good track record of leading PMIs by 18 months. The steepening further argues for a economic resilience scenario. But the risk is that a pandemic perhaps short circuits these signals. Is that possible — meaning, the US is lurching into a recession without the typical high leverage and diminishing cost of capital?

IT COULD BE THIS MINORITY VIEW IS CORRECT