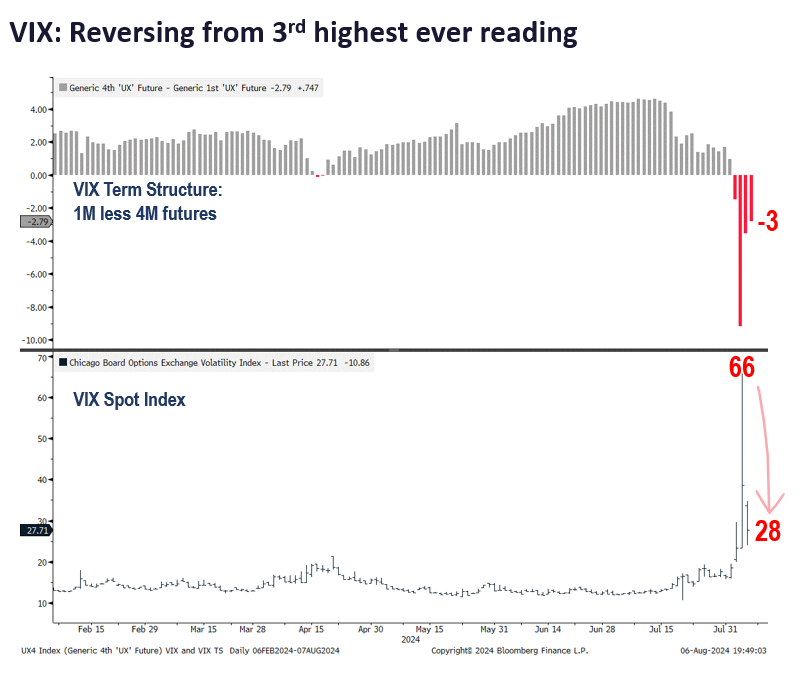

VIDEO: The VIX is beginning to normalize, affirming the view this is a “growth scare” and less likely a systematic crisis.

Please click below to view our Macro Minute (duration: 5:47).

After a crushing 3 consecutive days of selling, equity markets managed to rally strongly Tuesday. To us, this is very constructive and strongly supports the idea the “worst of the selling is behind us.”

- August historically is a bad month (39% win-ratio, as we noted) but with the S&P 500 down -3% in just the first trading day (Monday), we wonder if stocks could climb the rest of the month. Thus, the “badness” is front-loaded.

- The VIX closed at 28 Tuesday, down from 66 peak intraday Monday. And that Monday reading was the 3rd highest ever, after the GFC and after COVID panic lows. So there was certainly a lot of anxiety built over 3 days.

- On Friday, we had noted there were VIX surged +65% in 3D to >25. And this was a clue that markets could bottom this week, something Mark Newton, Head of Technical Strategy, spoke of last week.

– Looking at surges of VIX +65% in 3D and closing >25

– 9 times since 1990

– half the time (4 times), S&P 500 bottomed within 2-4 days

– this seems to be the case in 2024

– S&P 500 was higher 3M 100% time with median gain of 7% - The technical picture for JPY (weakening), Nikkei (stronger) and equity futures (stronger) remain collectively supportive that the intense selling is abating. As we noted Sunday evening, we believe this will ultimately be viewed as a growth scare about US economy.

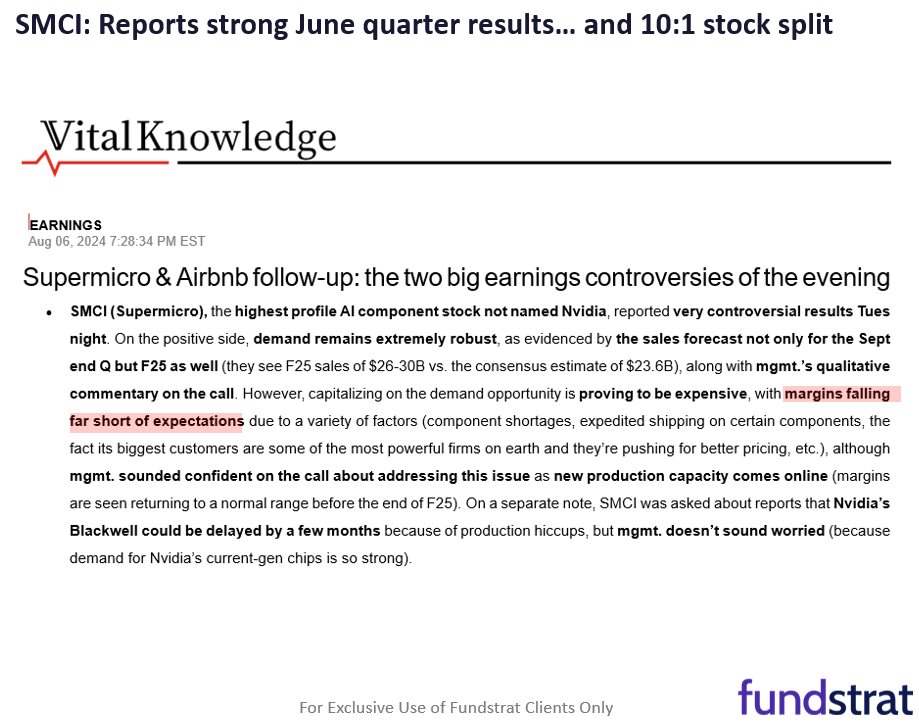

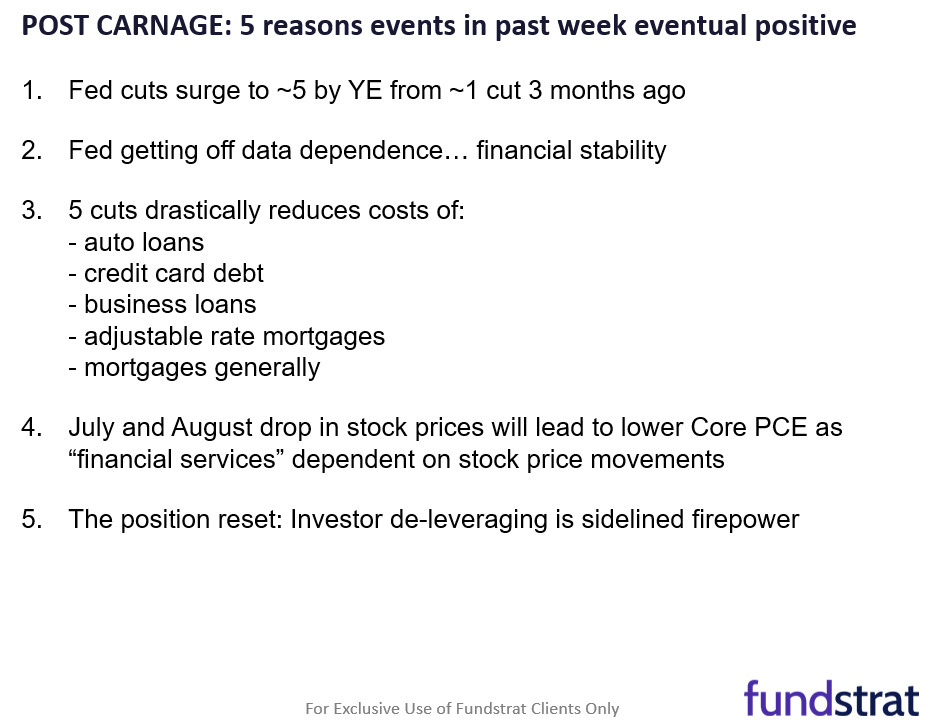

- In our view, there are 5 incremental positives, once the dust has settled

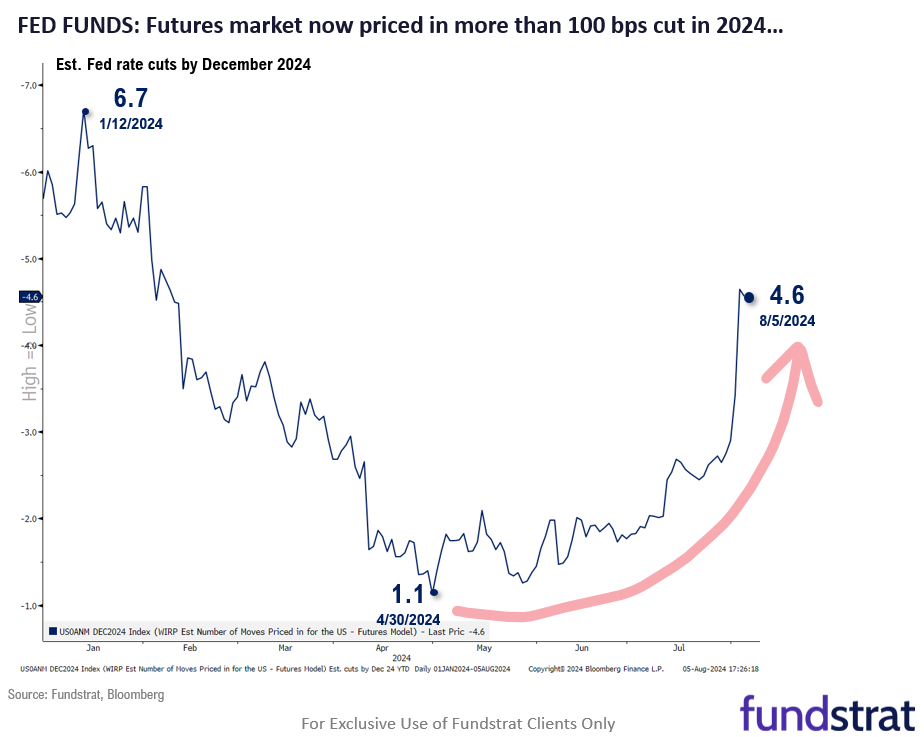

1. Fed cuts surge to ~5 by YE from ~1 cut 3 months ago

2. Fed getting off data dependence… and become forward looking

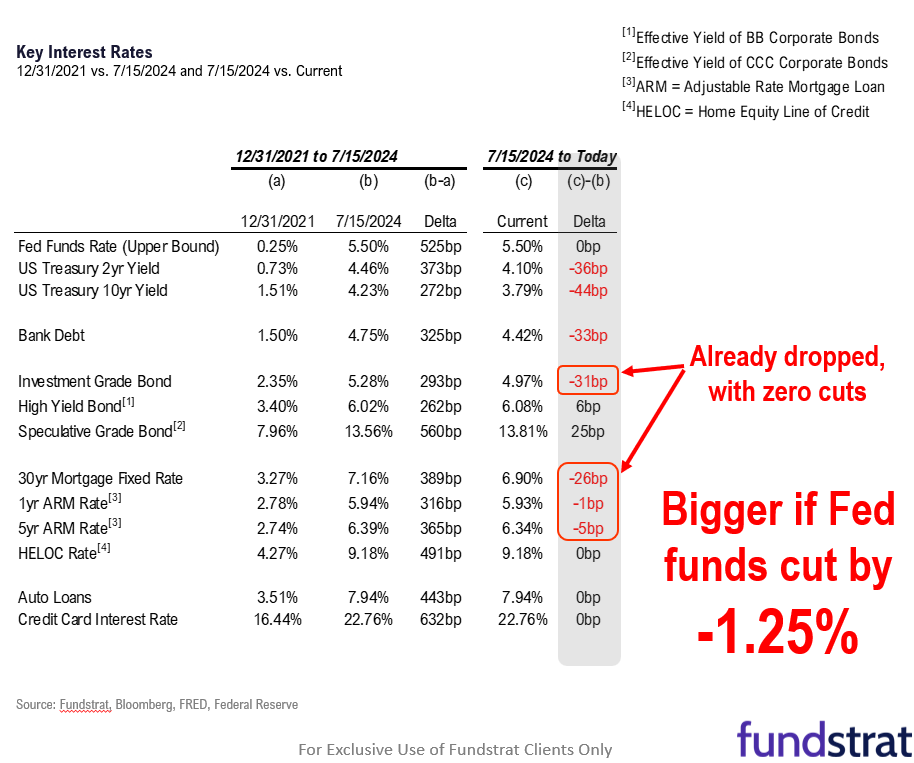

3. 5 cuts drastically reduces costs of:

– auto loans

– credit card debt

– business loans

– adjustable rate mortgages

– mortgages generally

4. July and August drop in stock prices will lead to lower Core PCE as “financial services” dependent on stock price movements

5. The position reset: Investor de-leveraging is sidelined firepower - There is a growing chorus of economists urging the Fed to shift away from data dependence for logical reasons. But as evidence grows of a softening labor market, being data dependent risks Fed being too late. We found it interesting that Austan Goolsbee, Chicago Fed President, use the word “forward looking” in his CNBC interview on Squawk Box Monday morning.

- There is still a wall of worry out there, but it is getting “chipped away”

– Equity indices suffer technical damage, requiring time to heal

– Seasonals poor for August historically

– July jobs report raises concerns Fed is “too late”

– Bank of Japan raised policy rates to +0.25% highest since GFC

– Geopolitical risks heightened in Middle East

– Large-cap rotation out of MAG7 causing “portfolio pain”

– 2024 Presidential election tightened dramatically since debates - Markets have been anticipating an Iran retaliatory attack this week. And once that happens, we likely see markets “sell the buildup, buy the invasion.”

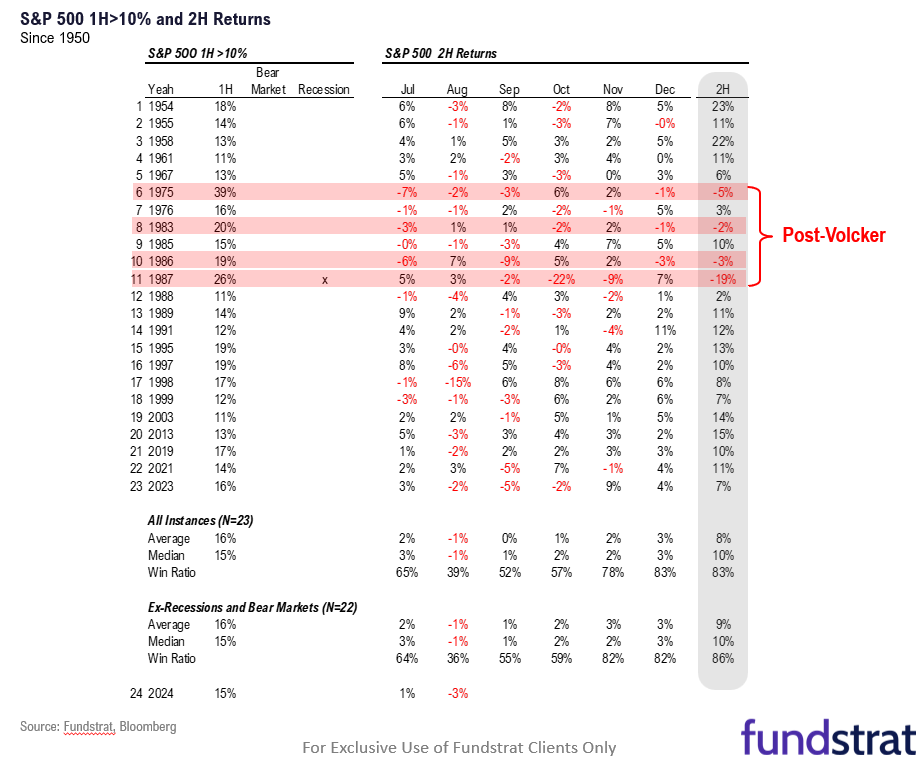

- Incidentally, August to October have seasonally never been strong periods. And this is something we noted that is a stronger pattern in years when the S&P 500 is up >10% in the first half. Just keep in mind Mark Newton also sees challenges in October based upon his cycle work.

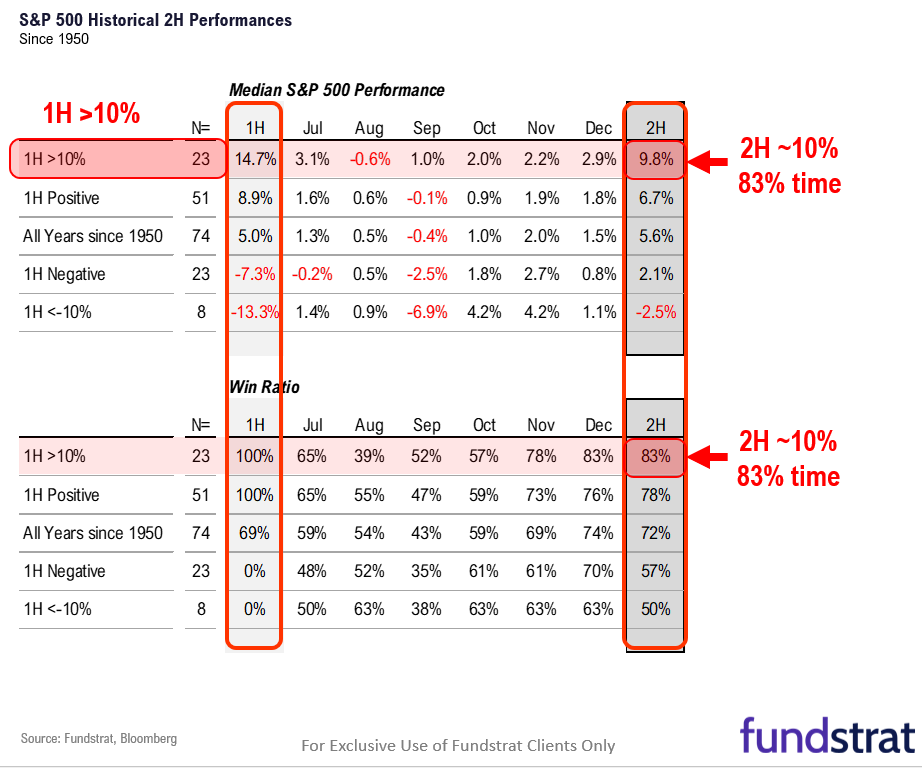

- But just because markets might have some headwinds near term does not change the probabilities of a strong second half. As we noted previously:

– Since 1950, when S&P 500 is up >10% in the first half

– 23 instances

– 2H (second half) gains +9.8%, 83% win-ratio

– the 4 negative 2H instances were 1975, 1983, 1986, 1987

– essentially, all the negative 2H were during Volcker era

Bottom line, markets are certainly showing strong signs of gaining their footing. And we also view this panic as ultimately being a growth scare (coupled with a carry trade unwind).

_____________________________

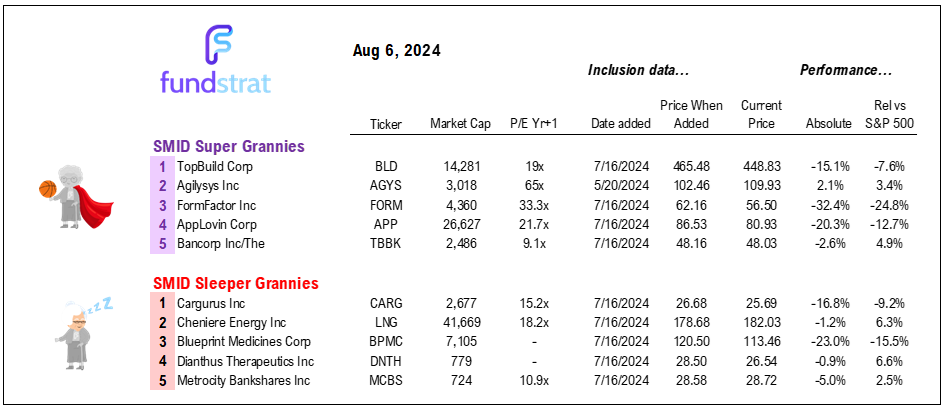

42 SMID Granny Shot Ideas: We performed our quarterly rebalance on 7/16. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

Key incoming data August 2024:

8/1 8:30 AM ET: 2Q P Nonfarm ProductivityTame8/1 8:30 AM ET: 2Q P Unit Labor CostsTame8/1 9:45 AM ET: Jul F S&P Global Manufacturing PMITame8/1 10:00 AM ET: Jul ISM Manufacturing PMITame8/2 8:30 AM ET: Jul Jobs ReportTame8/2 10:00 AM ET: Jun F Durable Goods OrdersTame8/5 9:45 AM ET: Jul F S&P Global Services PMITame8/5 10:00 AM ET: Jul ISM Services PMITame8/6 8:30 AM ET: Jun Trade BalanceTame- 8/7 9:00 AM ET: Jul F Manheim Used vehicle index

- 8/12 11:00 AM ET: Jul NYFed 1yr Inf Exp

- 8/13 6:00 AM ET: Jul Small Business Optimisim Survey

- 8/13 8:30 AM ET: Jul PPI

- 8/14 8:30 AM ET: Jul CPI

- 8/15 8:30 AM ET: Jul Retail Sales Data

- 8/15 8:30 AM ET: Aug Empire Manufacturing Survey

- 8/15 8:30 AM ET: Aug Philly Fed Business Outlook

- 8/15 10:00 AM ET: Aug NAHB Housing Market Index

- 8/15 4:00 PM ET: Jun Net TIC Flows

- 8/16 10:00 AM ET: Aug P U. Mich. Sentiment and Inflation Expectation

- 8/19 9:00 AM ET: Aug M Manheim Used vehicle index

- 8/21 2:00 PM ET: Jul FOMC Meeting Minutes

- 8/22 8:30 AM ET: Jul Chicago Fed Nat Activity Index

- 8/22 9:45 AM ET: Aug P S&P Global Manufacturing PMI

- 8/22 9:45 AM ET: Aug P S&P Global Services PMI

- 8/22 10:00 AM ET: Jul Existing Home Sales

- 8/23 10:00 AM ET: Jul New Home Sales

- 8/26 10:00 AM ET: Jul P Durable Goods Orders

- 8/26 10:30 AM ET: Aug Dallas Fed Manuf. Activity Survey

- 8/27 9:00 AM ET: Jun S&P CoreLogic CS home price

- 8/27 10:00 AM ET: Aug Conference Board Consumer Confidence

- 8/29 8:30 AM ET: 2Q S 2024 GDP

- 8/30 8:30 AM ET: Jul PCE Deflator

- 8/30 10:00 AM ET: Aug F U. Mich. Sentiment and Inflation Expectation

Key incoming data July 2024:

7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMITame7/1 10:00 AM ET: Jun ISM Manufacturing PMITame7/2 9:30 AM ET: Powell, Lagarde, Campos Neto Speak in SintraTame7/2 10:00 AM ET: May JOLTS Job OpeningsTame7/3 8:30 AM ET: May Trade BalanceTame7/3 9:45 AM ET: Jun F S&P Global Services PMITame7/3 10:00 AM ET: Jun ISM Services PMITame7/3 10:00 AM ET: May F Durable Goods OrdersTame7/3 2:00 PM ET: Jun FOMC Meeting MinutesTame7/5 8:30 AM ET: Jun Jobs ReportTame7/8 11:00 AM ET: Jun NY Fed 1yr Inflation ExpTame7/9 6:00 AM ET: Jun Small Business Optimism SurveyTame7/9 9:00 AM ET: Jun F Manheim Used vehicle indexTame7/9 10:00 AM ET: Fed’s Powell Testifies to Senate BankingTame7/10 10:00 AM ET: Fed’s Powell Testifies to House Financial ServicesTame7/11 8:30 AM ET: Jun CPITame7/12 8:30 AM ET: Jun PPIMixed7/12 10:00 AM ET: Jul P U. Mich. Sentiment and Inflation ExpectationTame7/15 8:30 AM ET: Jul Empire Manufacturing SurveyTame7/15 12:00 PM ET: Fed’s Powell Interviewed by David RubensteinTame7/16 8:30 AM ET: Jun Retail Sales DataTame7/16 10:00 AM ET: Jul NAHB Housing Market IndexTame7/17 9:00 AM ET: Jul M Manheim Used vehicle indexMixed7/17 2:00 PM ET: Jul Fed Releases Beige BookTame7/18 8:30 AM ET: Jul Philly Fed Business OutlookTame7/18 4:00 PM ET: May Net TIC FlowsTame7/22 8:30 AM ET: Jun Chicago Fed Nat Activity IndexTame7/23 10:00 AM ET: Jun Existing Home SalesTame7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMITame7/24 9:45 AM ET: Jul P S&P Global Services PMITame7/24 10:00 AM ET: Jun New Home SalesTame7/25 8:30 AM ET: 2QA 2024 GDPTame7/25 10:00 AM ET: Jun P Durable Goods OrdersTame7/26 8:30 AM ET: Jun PCE DeflatorTame7/26 10:00 AM ET: Jul F U. Mich. Sentiment and Inflation ExpectationTame7/29 10:30 AM ET: Jul Dallas Fed Manuf. Activity SurveyTame7/30 9:00 AM ET: May S&P CoreLogic CS home priceTame7/30 10:00 AM ET: Jul Conference Board Consumer ConfidenceTame7/30 10:00 AM ET: May JOLTS Job OpeningsTame- 7/31 8:30 AM ET: 2Q ECI QoQ

- 7/31 2:00 PM ET: Jul FOMC Decision

Key incoming data June 2024:

6/3 9:45 AM ET: May F S&P Global Manufacturing PMITame6/3 10:00 AM ET: May ISM Manufacturing PMITame6/4 10:00 AM ET: Apr JOLTS Job OpeningsTame6/4 10:00 AM ET: Apr F Durable Goods OrdersTame6/5 9:45 AM ET: May F S&P Global Services PMITame6/5 10:00 AM ET: May ISM Services PMITame6/6 8:30 AM ET: 1Q F Nonfarm ProductivityTame6/6 8:30 AM ET: Apr Trade BalanceTame6/6 8:30 AM ET: 1Q F Unit Labor CostsTame6/7 8:30 AM ET: May Jobs ReportHot6/7 9:00 AM ET: May F Manheim Used vehicle indexTame6/10 11:00 AM ET: May NYFed 1yr Inf ExpTame6/11 6:00 AM ET: May Small Business Optimism SurveyTame6/12 8:30 AM ET: May CPITame6/12 2:00 PM ET: Jun FOMC DecisionTame6/13 8:30 AM ET: May PPITame6/14 10:00 AM ET: Jun P U. Mich. Sentiment and Inflation ExpectationTame6/17 8:30 AM ET: Jun Empire Manufacturing SurveyTame6/18 8:30 AM ET: May Retail Sales DataTame6/18 9:00 AM ET: Jun M Manheim Used vehicle indexTame6/18 4:00 PM ET: Apr Net TIC FlowsTame6/19 10:00 AM ET: Jun NAHB Housing Market IndexTame6/20 8:30 AM ET: Jun Philly Fed Business OutlookTame6/21 9:45 AM ET: Jun P S&P Global Manufacturing PMITame6/21 9:45 AM ET: Jun P S&P Global Services PMIMixed6/21 10:00 AM ET: May Existing Home SalesTame6/24 10:30 AM ET: Jun Dallas Fed Manuf. Activity SurveyTame6/25 8:30 AM ET: May Chicago Fed Nat Activity IndexTame6/25 9:00 AM ET: Apr S&P CoreLogic CS home priceTame6/25 10:00 AM ET: Jun Conference Board Consumer ConfidenceTame6/26 10:00 AM ET: May New Home SalesTame6/27 8:30 AM ET: 1Q T 2024 GDPTame6/27 10:00 AM ET: May P Durable Goods OrdersTame6/28 8:30 AM ET: May PCE DeflatorTame6/28 10:00 AM ET: Jun F U. Mich. Sentiment and Inflation ExpectationTame

Key incoming data May 2024:

5/1 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/1 10:00 AM ET: Apr ISM Manufacturing PMITame5/1 10:00 AM ET: Mar JOLTS Job OpeningsTame5/1 2:00 PM ET: May FOMC DecisionDovish5/2 8:30 AM ET: 1Q P Nonfarm ProductivityTame5/2 8:30 AM ET: Mar Trade BalanceTame5/2 8:30 AM ET: 1Q P Unit Labor CostsMixed5/2 8:30 AM ET: Mar F Durable Goods OrdersTame5/3 8:30 AM ET: Apr Jobs ReportTame5/3 9:45 AM ET: Apr F S&P Global Services PMITame5/3 10:00 AM ET: Apr ISM Services PMITame5/7 10:00 AM ET: Apr F Manheim Used vehicle indexTame5/10 10:00 AM ET: May P U. Mich. Sentiment and Inflation ExpectationMixed5/13 11:00 AM ET: Apr NYFed 1yr Inf ExpTame5/14 6:00 AM ET: Apr Small Business Optimism SurveyTame5/14 8:30 AM ET: Apr PPIMixed5/15 8:30 AM ET: Apr CPITame5/15 8:30 AM ET: Apr Retail Sales DataTame5/15 8:30 AM ET: May Empire Manufacturing SurveyTame5/15 10:00 AM ET: May NAHB Housing Market IndexTame5/15 4:00 PM ET: Mar Net TIC FlowsTame5/16 8:30 AM ET: May Philly Fed Business OutlookTame5/17 10:00 AM ET: May M Manheim Used vehicle indexTame5/22 10:00 AM ET: Apr Existing Home SalesTame5/22 2:00 PM ET: May FOMC Meeting MinutesTame5/23 8:30 AM ET: Apr Chicago Fed Nat Activity IndexTame5/23 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/23 9:45 AM ET: Apr F S&P Global Services PMITame5/23 10:00 AM ET: Apr New Home SalesTame5/24 8:30 AM ET: Apr P Durable Goods OrdersTame5/24 10:00 AM ET: May F U. Mich. Sentiment and Inflation ExpectationTame5/28 9:00 AM ET: Mar S&P CoreLogic CS home priceTame5/28 10:00 AM ET: May Conference Board Consumer ConfidenceTame5/28 10:30 AM ET: May Dallas Fed Manuf. Activity SurveyTame5/29 2:00 PM ET: May Fed Releases Beige BookTame5/30 8:30 AM ET: 1Q S 2024 GDPTame5/31 8:30 AM ET: Apr PCE DeflatorTame

Key incoming data April 2024:

4/01 9:45 am ET: Mar F S&P Global Manufacturing PMITame4/01 10:00 am ET: Mar ISM ManufacturingMixed4/02 10:00 am ET: Feb JOLTS Job OpeningsTame4/03 9:45 am ET: Mar F S&P Global Services PMITame4/03 10:00 am ET: Mar ISM ServicesTame4/05 8:30 am ET: Mar Jobs ReportHot4/05 9:00 am ET: Mar F Manheim Used Vehicle IndexTame4/10 8:30 am ET: Mar CPIHot4/10 2pm ET: Mar FOMC Meeting MinutesTame4/11 8:30 am ET: Mar PPITame4/12 10:00 am ET: Apr P U. Mich. Sentiment and Inflation ExpectationTame4/15 8:30 am ET: Apr Empire Manufacturing SurveyTame4/15 8:30 am ET: Mar Retail Sales DataMixed4/15 10:00 am ET: Apr NAHB Housing Market IndexTame4/16 8:30 am ET: Apr New York Fed Business Activity SurveyTame4/17 9:00 am ET: Apr Mid-Month Manheim Used Vehicle IndexTame4/17 2:00 pm ET: Fed Releases Beige BookTame4/18 8:30 am ET: Apr Philly Fed Business Outlook SurveyTame4/22 8:30 am ET: Mar Chicago Fed Nat Activity SurveyTame4/23 9:45 am ET: Apr P S&P Global PMITame4/25 8:30 am ET: 1QA 2024 GDPTame4/26 8:30 am ET: Mar PCETame4/29 10:30 am ET: Apr Dallas Fed Manufacturing Activity SurveyTame4/30 8:30 am ET: 1Q ECI Employment Cost IndexMixed4/30 9:00 am ET: Feb S&P CoreLogic CS home priceTame4/30 10:00 am ET: Apr Conference Board Consumer ConfidenceTame

Key incoming data March 2024:

3/01 9:45 am ET: Feb F S&P Global Manufacturing PMITame3/01 10:00 am ET: Feb ISM ManufacturingTame3/01 10:00 am ET: Feb F U. Mich. Sentiment and Inflation ExpectationTame3/05 9:45 am ET: Feb F S&P Global Services & Composite PMITame3/05 10:00 am ET: Feb ISM ServicesTame3/06 10:00 am ET: Powell Testimony before US House Financial Services CommitteeDovish3/06 10:00 am ET: Jan JOLTS Job OpeningsTame3/06 2:00 pm ET: Fed Releases Beige BookTame3/07 8:30 am ET: 4QF 2023 Nonfarm ProductivityTame3/07 9:00 am ET: Feb F Manheim Used Vehicle IndexTame3/07 10:00 am ET: Powell Testimony before US Senate Committee on Banking, Housing, and Urban AffairsDovish3/08 8:30 am ET: Feb Jobs ReportMixed- 3

/12 8:30 am ET: Feb CPISlightly Hot (as anticipated) 3/14 8:30 am ET: Feb PPIMixed3/14 8:30 am ET: Feb Retail Sales DataTame3/15 8:30 am ET: Mar Empire Manufacturing SurveyTame3/15 10:00 am ET: Mar P U. Mich. Sentiment and Inflation ExpectationTame3/18 8:30 am ET: Mar New York Fed Business Activity SurveyTame3/18 10:00 am ET: Mar NAHB Housing Market IndexTame3/19 9:00 am ET: Mar Mid-Month Manheim Used Vehicle IndexTame3/20 2:00 pm ET: Mar FOMC Rate DecisionDovish3/21 8:30 am ET: Mar Philly Fed Business Outlook SurveyTame3/21 9:45 am ET: Mar P S&P Global PMITame3/25 10:30 am ET: Mar Dallas Fed Manufacturing Activity SurveyTame3/26 9:00 am ET: Mar S&P CoreLogic CS home priceTame3/26 10:00 am ET: Mar Conference Board Consumer ConfidenceTame3/28 8:30 am ET: 4QT 2023 GDPTame3/28 10:00 am ET: Mar F U. Mich. Sentiment and Inflation ExpectationTame3/29 8:30 am ET: Feb PCETame

Key incoming data February 2024:

2/01 8:30am ET 4QP 2023 Nonfarm ProductivityMixed2/01 9:45am ET S&P Global Manufacturing PMI January FinalTame2/01 10am ET January ISM ManufacturingMixed2/02 8:30am ET January Jobs ReportHot2/02 10am ET: U. Mich. Sentiment and Inflation Expectation January FinalTame2/05 9:45am ET S&P Global Services & Composite PMI January FinalTame2/05 10am ET January ISM ServicesTame2/07 9am ET Manheim Used Vehicle Index January FinalMixed2/09 CPI RevisionsTame2/13 8:30am ET January CPIMixed2/14 PPI RevisionsTame2/15 8:30am ET February Empire Manufacturing SurveyTame2/15 8:30am ET February Philly Fed Business Outlook SurveyTame2/15 8:30am ET January Retail Sales DataTame2/15 10am EST February NAHB Housing Market IndexTame2/16 8:30am ET January PPIMixed2/16 8:30am ET February New York Fed Business Activity SurveyTame2/16 10am ET U. Mich. Sentiment and Inflation Expectation February PrelimTame2/19 9am ET Manheim Used Vehicle Index February Mid-MonthTame2/21 2pm ET January FOMC Meeting MinutesTame2/22 9:45am ET S&P Global PMI February PrelimTame2/26 10:30am ET February Dallas Fed Manufacturing Activity SurveyTame2/27 9am ET February S&P CoreLogic CS home priceTame2/27 10am ET February Conference Board Consumer ConfidenceTame- 2/

28 8:30am ET 4QS 2023 GDPTame 2/29 8:30am ET January PCETame

Key incoming data January 2024:

1/02 9:45am ET S&P Global Manufacturing PMI December FinalMixed1/03 10am ET December ISM ManufacturingTame1/03 10am ET JOLTS Job Openings NovemberTame1/03 2pm ET December FOMC Meeting MinutesTame1/04 9:45am ET S&P Global Services & Composite PMI December FinalTame1/05 8:30am ET December Jobs ReportMixed1/05 10am ET December ISM ServicesTame1/08 9am ET Manheim Used Vehicle Index December FinalTame- 1/

11 8:30am ET December CPIDetails Suggest Tame 1/12 8:30am ET December PPITame1/16 8:30am ET January Empire Manufacturing SurveyTame1/17 8:30am ET January New York Fed Business Activity SurveyTame1/17 8:30am ET December Retail Sales DataStrong1/17 9am ET Manheim Used Vehicle Index January Mid-MonthTame1/17 10am EST January NAHB Housing Market IndexMixed1/18 8:30am ET January Philly Fed Business Outlook SurveyTame1/19 10am ET U. Mich. Sentiment and Inflation Expectation January PrelimTame1/24 9:45am ET S&P Global PMI January PrelimMixed1/25 8:30am ET 4QA 2023 GDPMixed1/26 8:30am ET December PCETame1/29 9:30am ET Dallas Fed January Manufacturing Activity SurveyTame1/30 9am ET January S&P CoreLogic CS home priceTame1/30 10am ET January Conference Board Consumer ConfidenceTame1/30 10am ET JOLTS Job Openings DecemberMixed1/31 2pm ET FOMC Rate DecisionTame

Key incoming data December 2023:

12/01 9:45am ET S&P Global Manufacturing PMI November FinalTame12/01 10am ET November ISM ManufacturingStrong12/05 9:45am ET S&P Global Services & Composite PMI November FinalStrong12/05 10am ET JOLTS Job Openings OctoberTame12/05 10am ET November ISM ServicesStrong12/06 8:30am ET 3QF 2023 Nonfarm ProductivityStrong12/07 9am ET Manheim Used Vehicle Index November FinalTame12/08 8:30am ET November Jobs ReportTame12/08 10am ET U. Mich. Sentiment and Inflation Expectation December PrelimTame12/12 8:30am ET November CPITame12/13 8:30am ET November PPITame12/13 2pm ET FOMC Rate DecisionDovish12/14 8:30am ET November Retail Sales DataTame12/15 8:30am ET December Empire Manufacturing SurveyTame12/15 9:45am ET S&P Global PMI December PrelimTame12/18 8:30am ET December New York Fed Business Activity SurveyTame12/18 10am ET December NAHB Housing Market IndexTame12/19 9am ET Manheim Used Vehicle Index December Mid-MonthTame12/20 10am ET December Conference Board Consumer ConfidenceTame12/21 8:30am ET 3QT 2023 GDPMixed12/21 8:30am ET December Philly Fed Business Outlook SurveyMixed12/22 8:30am ET November PCETame12/22 10am ET: U. Mich. Sentiment and Inflation Expectation December FinalTame12/26 9am ET December S&P CoreLogic CS home priceTame12/26 10:30am ET Dallas Fed December Manufacturing Activity SurveyTame- 12/29 9:45am ET December Chicago PMI

Key incoming data November 2023:

11/01 9:45am ET S&P Global PMI October FinalTame11/01 10am ET JOLTS Job Openings SeptemberMixed11/01 10am ET October ISM ManufacturingTame11/01 10am ET Treasury 4Q23 Quarterly Refunding Press ConferenceTame11/01 2pm ET FOMC Rate DecisionDovish11/02 8:30am ET: 3Q23 Nonfarm ProductivityTame11/03 8:30am ET October Jobs ReportTame11/03 10am ET October ISM ServicesMixed11/07 9am ET Manheim Used Vehicle Index October FinalTame11/10 10am ET U. Mich. November prelim Sentiment and Inflation ExpectationHot11/14 8:30am ET October CPITame11/15 8:30am ET October PPITame11/15 8:30am ET November Empire Manufacturing SurveyResilient11/15 8:30am ET October Retail Sales DataResilient11/16 8:30am ET November New York Fed Business Activity SurveyTame11/16 8:30am ET November Philly Fed Business Outlook SurveyTame11/16 10am ET November NAHB Housing Market IndexTame11/17 9am ET Manheim Used Vehicle Index November Mid-MonthTame11/21 2pm ET Nov FOMC Meeting MinutesTame11/22 10am ET: U. Mich. November final Sentiment and Inflation ExpectationTame11/24 9:45am ET S&P Global PMI November PrelimMixed11/27 10:30am ET Dallas Fed November Manufacturing Activity SurveyTame11/28 9am ET November S&P CoreLogic CS home priceTame11/28 10am ET November Conference Board Consumer ConfidenceTame11/29 8:30am ET 3QS 2023 GDPStrong11/29 2pm ET Fed Releases Beige BookTame11/30 8:30am ET October PCETame

Key incoming data October 2023:

10/2 10am ET September ISM ManufacturingTame-

10/3 10am ET JOLTS Job Openings AugustHot -

10/4 10am ET September ISM ServicesTame 10/6 8:30am ET September Jobs ReportMixed-

10/6 9am ET Manheim Used Vehicle Index September FinalTame 10/10 11am NY Fed Inflation ExpectationsMixed-

10/11 8:30am ET September PPIMixed 10/11 2pm ET Sep FOMC Meeting MinutesTame-

10/12 8:30am ET September CPIMixed -

10/13 10am ET U. Mich. September prelim 1-yr inflationMixed 10/16 8:30am ET October Empire Manufacturing SurveyTame10/17 8:30am ET October New York Fed Business Activity SurveyTame10/17 8:30am ET September Retail Sales DataHot10/17 9am ET Manheim October Mid-Month Used Vehicle Value IndexTame10/17 10am ET October NAHB Housing Market IndexTame10/18 8:30am ET September Housing StartsTame10/18 2pm ET Fed releases Beige BookTame10/19 8:30am ET October Philly Fed Business Outlook SurveyTame10/19 10am ET Existing Home SalesTame10/19 12pm ET Fed (including Powell) at Economic Club of New York10/24 9:45am ET S&P Global PMI October PrelimTame-

10/26 8:30am ET 3Q 2023 GDP AdvanceStrong 10/27 8:30am ET September PCETame10/27 10am ET Oct F UMich Sentiment and Inflation expectationTame10/30 10:30am ET Dallas Fed September Manufacturing Activity SurveyTame10/31 8:30am ET 3Q23 Employment Cost IndexMixed10/31 9am ET August S&P CoreLogic CS home priceMixed10/31 10am ET October Conference Board Consumer ConfidenceTame

Key incoming data September 2023:

9/1 8:30am ET August Jobs ReportTame9/1 10am ET August ISM ManufacturingTame9/6 10am ET August ISM ServicesMixed9/6 2pm ET Fed releases Beige BookTame9/8 9am ET Manheim Used Vehicle Index August FinalTame9/8 2Q23 Fed Flow of Funds ReportTame-

9/13 8:30am ET August CPIMixed -

9/14 8:30am ET August PPITame -

9/15 8:30am ET September Empire Manufacturing SurveyTame 9/15 10am ET U. Mich. September prelim 1-yr inflationTame-

9/18 8:30am ET September New York Fed Business Activity SurveyTame -

9/18 10am ET September NAHB Housing Market IndexTame 9/19 9am ET Manheim September Mid-Month Used Vehicle Value IndexMixed9/20 2pm ET September FOMC rates decision-

9/21 8:30am ET September Philly Fed Business Outlook SurveyMixed 9/22 9:45am ET S&P Global PMI September Prelim9/25 10:30am ET Dallas Fed September Manufacturing Activity Survey9/26 9am ET July S&P CoreLogic CS home price9/26 10am ET September Conference Board Consumer Confidence

Key incoming data August 2023:

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame8/23 9:45am ET S&P Global PMI Aug PrelimWeak8/25 10am ET Aug Final U Mich 1-yr inflationMixed8/28 10:30am ET Dallas Fed Aug Manufacturing Activity SurveyTame8/29 9am ET June S&P CoreLogic CS home priceTame8/29 10am ET Aug Conference Board Consumer ConfidenceTame8/29 10 am ET Jul JOLTSTame8/31 8:30am ET July PCETame

Key incoming data July 2023:

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June 2023:

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May 2023:

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings