US Equity trends remain bullish and mildly overbought after this recent early July run-up, and it remains difficult to fade SPX or QQQ ahead of this week’s all-important CPI report. Minor evidence of strength is apparent from Consumer Discretionary, Financials, Industrials and Materials, but still largely hasn’t proven broad-based enough to suggest a bigger period of outperformance from these groups has gotten underway. Overall, cycles, seasonality, and ongoing strength in Technology argues for a bullish stance in US Equities into at least mid-July before some backing and filling. SPX targets could materialize initially between 5600-5700.

Tuesday failed to bring about much change in near-term trends in US Equities from a broader index level, and until price can retreat to violate last week’s lows (approximately 5446 in ^SPX) it’s right to continue to expect higher Equity prices as well as higher Treasury prices (anticipating a pullback in Treasury yields).

There looks to be important resistance directly above over the next 4-6 trading days, which might lead indices higher into next week’s expiration ahead of late July weakness. This would align with July seasonality, and might bring about some consolidation in late July ahead of yet another runup into late August/early September.

I’ll forego any lengthy short-term analysis on SPX until there is some evidence of trend change, and/or price gets up above 5600 or below 5446. For now, it’s increasingly important to show the divergences in some of the main S&P 500 sectors when looking at these on an Equal-weighted basis.

Consumer Discretionary is a prime example, as this sector’s cap-weighted ETF (XLY -1.00% - SPDR S&P Select Consumer Discretionary ETF) has now shown better performance than all other 10 sectors that make up the S&P 500 over the last week. Moreover, this now is 2nd best of any of the major 11 over the last month.

Importantly, I should stress that AMZN -1.58% , TSLA 1.02% and HD -0.99% make up more than 50% of the XLY -1.00% , making this ETF a largely flawed gauge towards measuring true Discretionary performance.

However, this doesn’t translate into XLY not being able to go higher, and XLY’s push to new two-year highs is seen as a bullish development. Furthermore, this still looks to be able to show further strength. Until/unless this were to breach $185, XLY looks quite positive following last week’s move to the highest levels of 2024.

Any minor consolidation in XLY should still lead to buying opportunities into August/early September, and XLY might be able to push higher to $200.

Equal-weighted Consumer Discretionary looks quite choppy and range-bound

The recent slowdown in Retail and Consumer Durables stocks has resulted in “Discretionary” appearing far more range-bound, and neutral technically speaking.

The differences in performance between RCD -1.61% to XLY -1.00% are fairly pronounced, with RSPD having returned +0.38% over the past week compared to a +3.48% return on XLY.

Meanwhile, over the last month, the difference is even greater, as RSPD was down by -1.64%, while XLY returned +6.60%.

Thus, for investors who care about Discretionary performance, it’s necessary to view this sector in Equal-weighted terms, as shown below.

Price of RCD -1.61% (Invesco’s Equal-weighted Consumer Discretionary ETF) has pulled back to three-month area of trendline support, and it’s right technically to view this sector as an attractive short-term risk/reward given the ability of price having held at this important level.

However, rallies into August/September likely would warrant my technically neutral rating being lowered, as the disappointment out of groups like Retailing, and Durables make Discretionary a difficult sector to consider as an Overweight.

Furthermore, any evidence of recent economic weakness continuing might also translate into a more difficult final few months of the year for Discretionary, in a time that’s normally proven quite sub-par and potentially volatile ahead of the US Election.

Retailing looks choppy and mixed, and selectivity is important in this sub-industry

Weakness in SPDR S&P Retail ETF, or XRT -0.97% , is largely trading at similar levels as it did back in December 2023.

While I do expect that $72-$72.50 can provide support for XRT and help this turn higher, it could prove to be a difficult area to have much confidence in until it begins to show much better signs of strength.

Given that selectivity remains important within Retailing sector at this time, I prefer stocks like the following, from a technical perspective: ANF -0.60% , WMT 0.22% , ORLY 0.57% , AGYS -4.33% , NSIT -1.15% , BURL -1.80% , OLLI -1.80% , SFM 0.76% , COST -0.90% , CASY 0.76% , NGVC -0.80% , AZO -0.06% , and TJX -0.35% .

However, one should concentrate on stocks within striking distance of 52-week highs, vs. attempting to buy laggards in this group, in my view. The daily XRT chart is shown below.

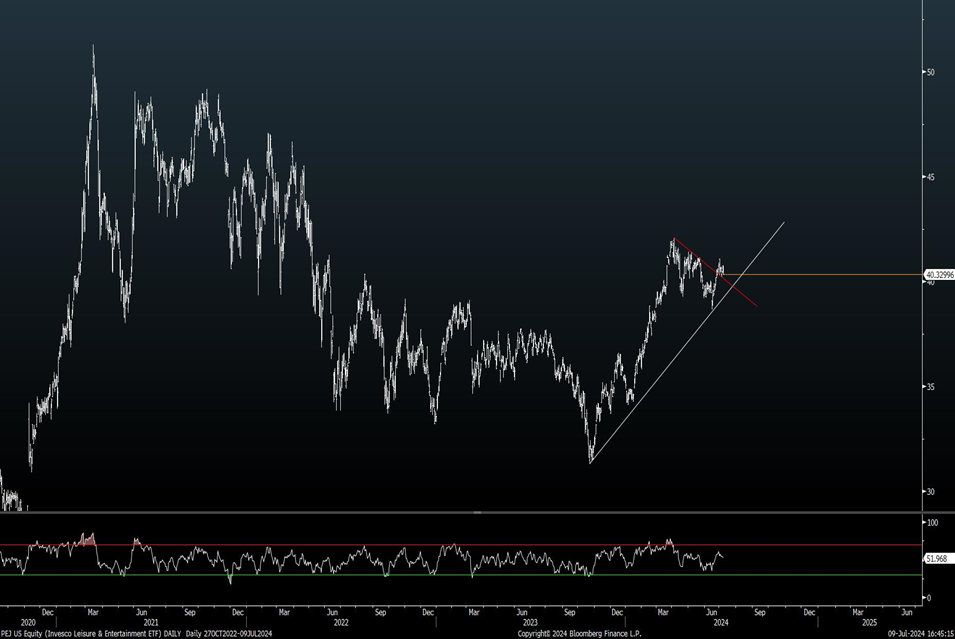

Dynamic Leisure and Entertainment ETF looks far better technically

For those looking for areas within Discretionary which might show outperformance outside of Retailing, one might seek Restaurants, Hotels, Cruise-liners, and/or booking agencies.

Invesco’s PEJ -1.67% (ETF) covers Leisure and Entertainment, and it’s top 10 holdings are HLT -1.18% , RCL -2.03% , BKNG -4.22% , ABNB -3.45% , DPZ -0.97% , SYY 1.16% , CMG -3.15% , WBD -1.85% , CNK -1.27% , and SKYW -2.70% and each of these holdings comprises between 3-5% of the PEJ (ETF).

As can be seen, PEJ looks far superior to XRT technically speaking, and is also much more diversified than XLY. I expect this should be able to push higher to $45 in the months to come.

Discretionary vs. Staples still looks to be in good shape

One of the main gauges for risk appetite that many investors watch is the ratio of Discretionary to Staples, shown below in Equal-weighted form.

The idea behind this is that if Discretionary is outperforming, such a move likely happens during “risk-on” periods, while an uptick in Defensiveness tends to happen as market selloffs grow closer and/or are ongoing.

As shown below, the ratio of RCD -1.61% to RHS -0.20% remains upward sloping and bullish, and this still should be able to carry higher into this Fall before finding much resistance.

The minor stalling out seen near early Spring peaks looks innocuous and should prove temporary ahead of further strength out of Discretionary.

Overall, I expect that Cruise-liners along with Retail and Consumer Durables can likely begin to show some strength over the next couple months and this could help the broader Discretionary sector show a bit better relative strength than what’s happened in recent months.

However, on any test of 2021 peaks, I expect a stalling out, as this level signifies meaningful upside resistance.