The rally which started Monday likely should carry SPX back to 5400. A five-wave advance higher represented the first real positive structural effort off the lows, and both US Dollar and Treasury yields look close to turning back lower. While META’s after-market plunge on soft guidance might have set a high bar for Tech earnings given its profits more than doubled in the first quarter, I feel that Technology as a sector is near support and should not have much more downside. Furthermore, earnings from MSFT and GOOGL might set the tone for the start of an advance back to SPX-5200 and ultimately 5400.

Minor stalling out in Equity indices doesn’t represent any real concern for “market bulls” and the advance from Monday into Tuesday’s close still set the tone for what should be a stellar rally back to new all-time highs, in my view.

Near-term, the consolidation that started Wednesday might continue briefly into Thursday as META’s outsized presence in indices might cause some ripples throughout Technology and Communication Services.

Furthermore, the steepening in the 2s/10s yield curve has reached the highest levels since January, despite the lackluster result of the $70 billion 5-year auction. At present, yields have not turned down substantially enough to argue that a new downtrend is in place. However, my thinking is that following the May 1st quarterly refunding announcement, yields should start to move steadily lower.

However, the five-wave advance from this past Monday’s lows looks bullish for SPX and QQQ, and it’s thought that any minor consolidation into Thursday should prove to be a buying opportunity, with support found near 5037 or 5021, and should not get under 5000 before turning higher. Movement back over 5090 would confirm that a rally back to 5200 should be underway.

S&P 500

Transportation has taken a Nose-dive, and regaining $15,500 should be key

This recent decline in Transportation stocks is a minor concern given that this sector has leading properties, along with sectors like Semiconductors and Homebuilders.

Dow Jones Transportation Average broke under a multi-month area of support and its retest looks to have failed just under 15,500 before making a sharp downturn today.

Overall, one cannot rule out weakness to follow-through on this move Thursday into Friday. However, given my bullish view on Equities, I’m expecting further downside to prove short-lived before this turns back up to exceed $15,500.

ODFL 1.61% , CSX 0.51% , NSC 0.76% , along with many of the Airlines were particularly hard-hit during Wednesday’s trading. However, I suspect that this weakness likely proves short-lived, and might stabilize and start to rebound by end of week.

Dow Jones Transportation Average

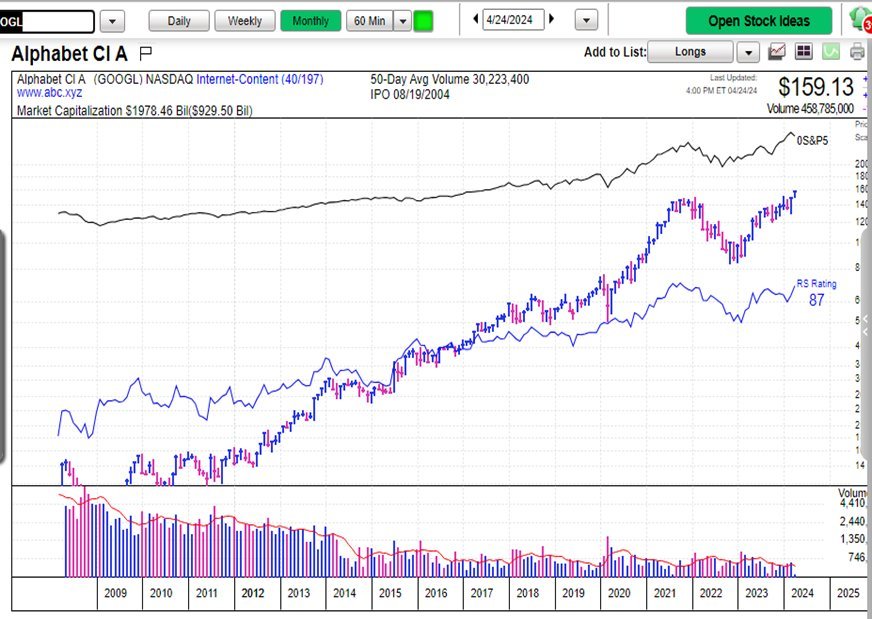

GOOGL looks extremely attractive among the Magnificent 7 stocks

Overall, Alphabet (GOOGL -1.99% ) shares appear like the best technical setup heading into earnings of any of the “Magnificent 7” stocks and GOOGL appears headed for $180 in short order.

As weekly chart of GOOGL shows below from MarketSurge, GOOGL has made a clean breakout of its former 2021 peaks which could possibly pave the way for a push higher to $180 in the near future.

Following a lengthy period of consolidation since 2021 which saw GOOGL underperform many of its peers, this has come back in dramatic fashion and looks to be in great shape technically with the stock trading at/near all-time highs following its breakout.

Pullbacks to $150-$154 should represent an appealing risk/reward opportunity, as I expect a move back over $160 following Thursday’s earnings report.

Technically speaking, momentum remains bullish and not overbought on monthly charts, and GOOGL has engineered a clean breakout which hasn’t yet occurred in NFLX 0.68% nor AMZN 0.70% . GOOGL -1.99% looks quite constructive and I favor long exposure in this name, and a continued push higher in the days/weeks to come.

Alphabet

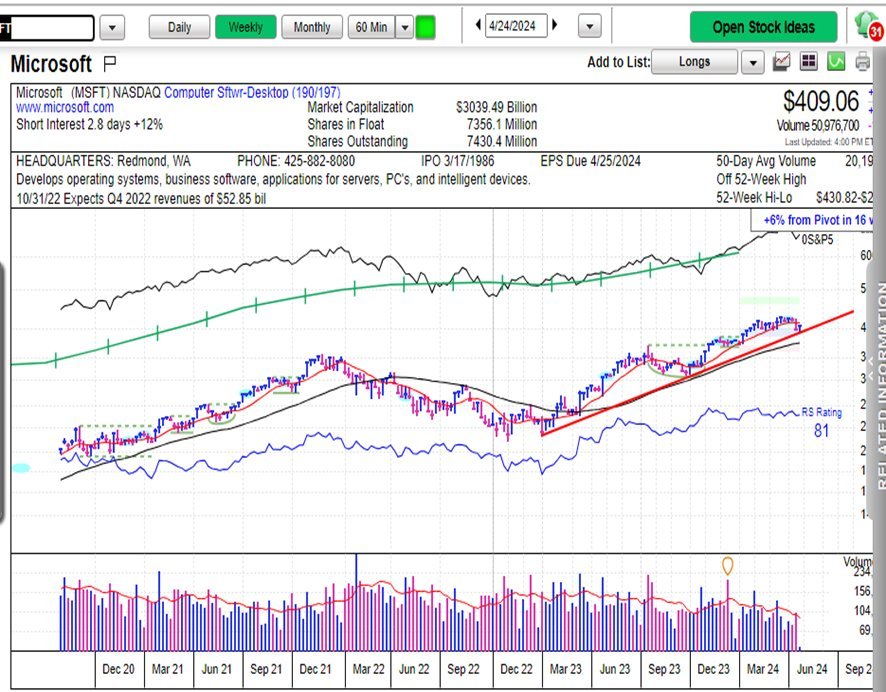

MSFT – Short-term stallout only; No major deterioration

The key towards how I believe it’s correct to view MSFT -0.02% stock is to take a longer-term approach. Many have commented that the break of the uptrend since last Fall is quite serious technically.

I tend to disagree with this given that its uptrend from late 2022 remains very much intact. Furthermore, the stock remains within striking distance of all-time highs and has done little damage despite a short-term break in the uptrend.

As weekly MarketSurge charts show below, the long-term trend is very much intact. Thus, one can’t make too much of a 5-7% consolidation off its all-time highs if not major technical damage has occurred.

One arguably should consider this to be an outstanding risk/reward candidate at $385-$405 and any early weakness on Thursday to this range (on the heels of META 0.58% weakness) likely should prove to find strong support before turning higher post earnings after the close on Thursday.

Microsoft