I continue to see the US stock market as being attractive, technically speaking, and do not feel sufficient risk is there to warrant a selloff at this time. While price action has been a bit choppy in the last couple weeks, there remain precious little other evidence with regards to frothy speculation to excessive valuation measures that would warrant a major selloff. Rallies up to SPX-5350-5400 look likely into mid-April before a consolidation gets underway. Treasury yields and US Dollar should have limited upside after this bounce, and both look close to rolling over.

Despite this past week’s minor weakness in US Equities, it’s worth remembering that US markets have only experienced five down weeks in the last five months’ time. Friday’s rally helped SPX recoup about half of the week’s early decline and seems to have repaired the minor technical damage caused by Thursday’s drop.

Large-cap Technology continues to hold up quite well despite QQQs underperformance vs. SPY in recent months, and Friday’s strength looked like an important signal that a bottom to this recent consolidation could be at hand.

As hourly SPX charts show below, SPX managed to successfully recoup the area near 4/2 intra-day lows of 5184 that had been violated. This is a bullish development which technically should begin to lead prices back up towards this past week’s highs.

The two key areas in question lie at 5257 on the upside and then 5146 on the downside. My thinking is that next week, these resistance highs should be challenged and exceeded.

S&P 500 Index

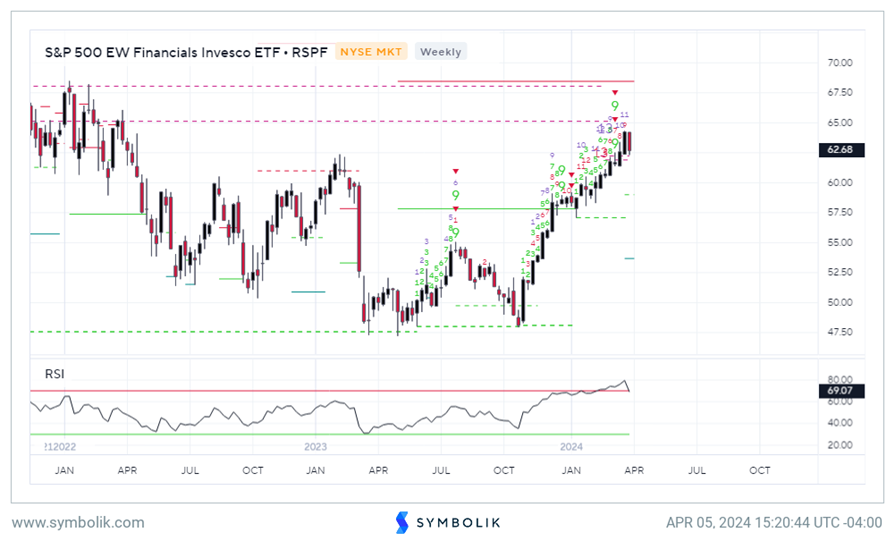

Financials are in fairly good shape heading into next week’s earnings

The Equal-weighted Financials ETF (RYF 0.70% ) has been trending up nicely over the past few months, having recently broken out above the prior peaks from late 2023.

While this past week proved to be negative for Financials, RSPF continues to trend higher and has not broken its intermediate-term uptrend.

This sets up nicely for a continued push higher to test January 2022 peaks near $68.50. This lies roughly 10% higher than current levels but appears like the only meaningful level of resistance for this sector.

Some of my favorite stocks within the Financials Sector across Banks, Financial Services companies and Insurance are as follows: BRK-B/B, JPM 1.52% , WFC 0.08% , ING 0.72% , PGR 0.89% , TRV 0.04% , BBVA 1.77% , ING 0.72% , SAN 2.41% , OWL 0.07% , KKR 2.21% , DB 2.41% , UBS 1.41% , and MFC 2.65% . Of the Exchange stocks, I prefer NDAQ here, while among the Credit card companies, V -0.01% , MA 0.52% and AXP 0.96% are all quite appealing technically.

Many of the Regional Bank names unfortunately do not screen as well as the stocks above, and warrant a bit more strength before favoring.

S&P 500 Equal-weight Financials ETF

KBE to KRE ratio still shows KBE to be a much more appealing alternative

The ratio of KBE 0.12% (SPDR S&P Bank ETF) to KRE N/A% (SPDR S&P Regional Banking ETF) has managed to continue trading meaningfully higher following the breakout which happened last Spring, 2023.

This happened during the Regional Banking crisis last March which resulted in severe underperformance in Regional Banks.

While some investors felt Regional Bank underperformance might have made this group attractive, this relative chart shows that the steady rise in the ratio of KBE to KRE has largely been unwavering.

It still looks to push higher in the months ahead and shows no evidence of any counter-trend exhaustion. Overall, in plain English, this means that for those considering new investments within the Financials space and/or are seeking areas of outperformance, the KBE looks like a far better technical option at the time than KRE.

S&P Bank ETF / S&P Regional Banking ETF

Regional Banks remain a relative laggard within Financials

While the Financials space has outperformed SPX over the past month, the Regional Banks remain an underperforming area within Financials.

As weekly charts of the S&P Regional Banking ETF (KRE N/A% ) show below, while KRE did successfully bounce more than 20% of its October 2023 lows, this was insufficient to break the ongoing downtrend which has lasted more than two years.

Unfortunately, KRE has trended back lower since last December 2023’s peak and requires a rally back over $51 to help exceed this downtrend.

At present, as I’ve shown in prior charts, other areas of Financials look more appealing, namely the Money Center Banks and Brokerage stocks.

S&P Regional Banking ETF

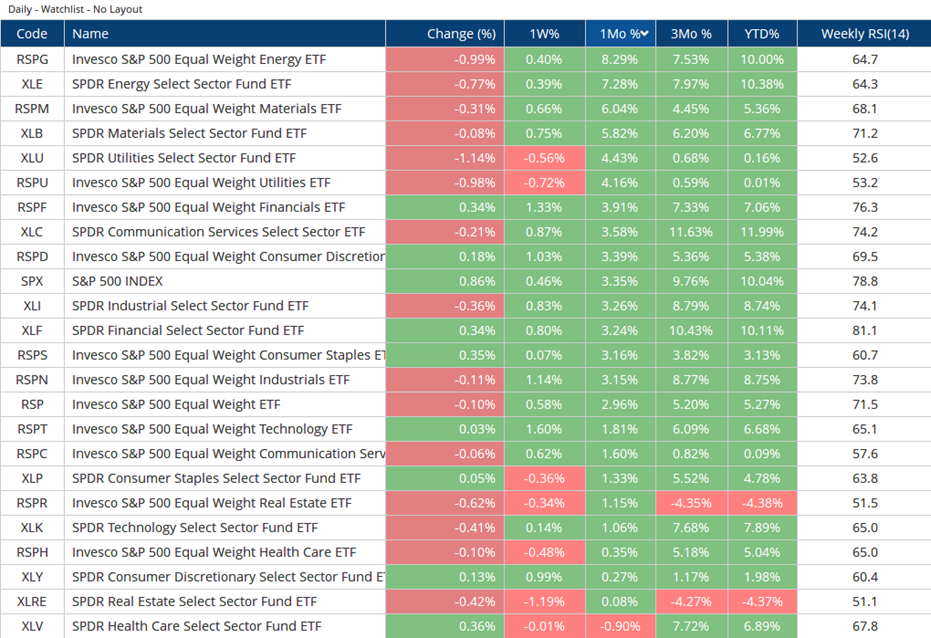

Performance continues to show healthy sector rotation

Despite the lagging in Technology over the last few months, SPX still managed to turn in Q1 performance of greater than 10%.

This was primarily due to rallies in Industrials and Financials. Both of these sectors have larger weightings within SPX than the recent outperformers of Materials, and Energy.

Until sectors like Consumer Staples starts to outperform Consumer Discretionary, and other sectors like REITS and Utilities turn in far better performance, it’s difficult to see this kind of performance being unhealthy.

Performance data for both the Equal-weighted and also Cap-weighted Sector ETF’s is shown below, ranked by 1-month returns, in data through 4/4/24.

S&P 500 Equal Weight and Select Sector Returns