Divergence between the top performing stocks within Technology and the broader market continues to be one of the most discussed topics of 2024. Performance disparity has reached extreme levels. Yet, this doesn’t necessarily imply a large selloff is imminent. A broadening out in performance can also happen to allow sectors to play catchup to recent large-cap Technology performance, and this seems to have started with Healthcare and Financials in recent weeks. Near-term, some negative breadth and momentum divergences likely could prove problematic into March. Yet, there’s been no evidence of any price weakness in the larger indices yet to warrant concern just yet.

A few days of stalling out largely hasn’t provided many clues for either Bulls nor Bears alike. However, it’s thought that any minor setback to SPX likely does not undercut 1/31/24 lows at 4845 right away before pushing higher into the time near the Presidents’ Day holiday for February.

Despite all the concern about Technology being stretched, other sectors like Financials, Healthcare and Industrials have come to the rescue. This is a bullish factor when viewing sector rotation on an Equal-weighted basis that few are taking the time to mention.

The chart below highlights the Industrials sector in Equal-weighted form relative to the Equal-weighted S&P 500. This ratio has begun to push higher again after eight straight months of sideways consolidation. Despite stocks like BA -2.39% , MMM 0.68% , and/or ROK 1.79% having dragged down performance in XLI 0.57% with returns of 14-20% year-to-date, there are plenty of stocks which look quite attractive technically speaking.

Overall, Industrials remains a technical Overweight, and stocks like AXON -1.14% , CPRT 0.62% , TDG -0.26% , J -2.33% , JBHT -0.55% , DOV 0.39% , CAT 1.34% , TNC -0.16% , DHR -1.65% , and ROL 1.16% are some of my favorite technical names within Industrials.

Equal Weight Industrials ETF / S&P 500 Equal Weight ETF

Alibaba breakout suggestive of a potential bottoming out in momentum which could lead to rallies in Chinese Equities

China is starting to look interesting again as pressure ramps up on Chinese government to try to end the country’s Equity bear market and Regulators led by China Securities Regulatory Commission (CSRC) are set to meet with President XI on the market as soon as today. Chinese Equities responded positively on Tuesday (FXI and KWEB up 5%+ ) and Alibaba (BABA -0.21% ) successfully broke out of an intermediate-term downtrend since last year.

This meeting with Xi follows some supportive additional news of Central Huijin Investment Ltd. (the unit that holds Chinese government stakes in big Financial institutions) to begin buying more Exchange-traded funds, which was reported Tuesday by Bloomberg.

Additionally, while US Markets have shown recent outflows from SPY, there’s been a surge in foreign inflows lately of more than 12 billion Yuan ($1.7 Billion).

Overall, given the recent developments, it appears that the stock market rout could finally be starting to cause concern to Central authorities. Thus, following a 3 year bear market that’s wiped out 7 trillion in assets, this could have approached its capitulatory moment following the near exact bottoming in Chinese Equity ETF’s coinciding with the Evergrande news.

Bottom line, while a rally will require some progress before confirming some of the weekly and monthly TD-based exhaustion signals now evident on charts of KWEB -1.10% , FXI -0.84% and relative charts of EEM -0.15% vs. SPY 0.35% (weekly) this looks to be a step in the right direction ahead of the China Lunar New Years celebration on 2/10/24.

The daily chart of BABA -0.21% highlighting its breakout in absolute terms, is shown below. This represents between 8-10.5% of both FXI -0.84% and KWEB -1.10% .

Alibaba Group Holding Equity

KWEB looks preferred over FXI for China exposure

While both KWEB -1.10% (KraneShares CSI China Internet ETF) and FXI -0.84% (Ishares China Large-cap ETF) hold heavy weightings in BABA -0.21% and TCHEHY, the capitalization is a bit smaller with KWEB and this has a much larger focus on Technology.

Over the last two years, KWEB has been trending higher vs FXI within a choppy intermediate-term uptrend, and the consolidation thus far in 2024 likely should find technical support and turn back higher.

Daily ratio charts of KWEB vs. FXI are shown below. Technically speaking, KWEB looks more attractive than FXI and is preferred technically. Finally, while not shown below, KWEB shows the first Monthly TD Sequential 13 countdown which has appeared since a similar (but opposite) monthly signal appeared near the peak in Feb 2021.

KraneShares CSI China Internet ETF / Ishares China Large-cap ETF

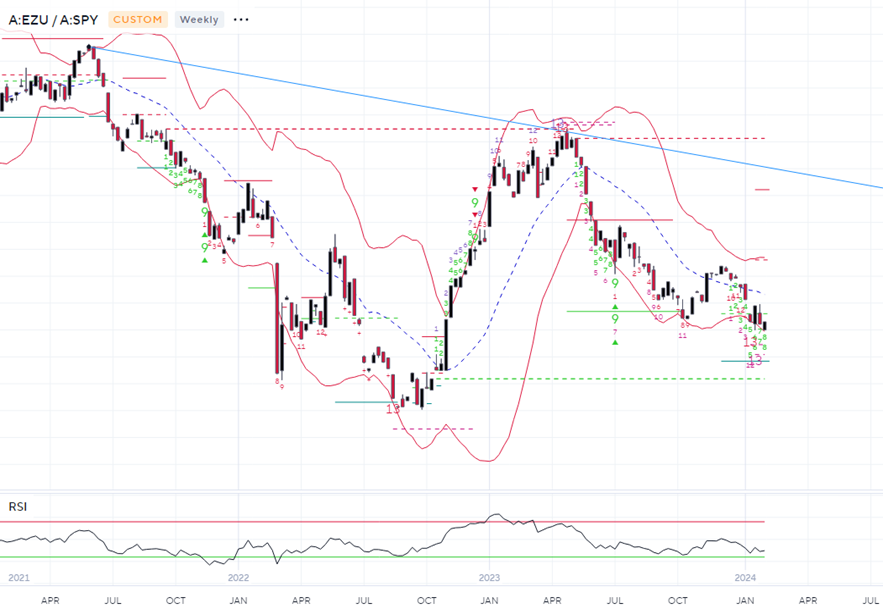

Europe also starting to look relatively attractive following a steep slide from Spring 2023

Given movement to multi-year highs in EuroSTOXX 50, German DAX, STOXX 600, and other indices, Europe’s technicals have started to “kick into gear”.

US ETF’s like EZU -0.08% and VGK -0.21% which are priced in US Dollars, underperformed SPX since last Spring but could be on the verge of turning back higher.

Counter-trend exhaustion indicators from DeMark which correctly signaled a peak in Europe vs. US in relative terms are now signaling monthly TD Sequential “13 Exhaustion” signals which could allow Europe to begin relatively outperforming. Weekly signals are also present, which are shown on the chart below. (These correctly gave indications of strong resistance and “13 Exhaustion signals” on the upside last Spring, which proved to be a time when US began to sharply outperform Europe.)

Given the long-term upward sloping bias of US vs. the All-country world index (ACWI 0.36% ) any setback for SPY relatively likely could prove temporary before US strength helps outperformance. However, it’s worth mentioning that this weekly signal is now in place again along with a monthly signal in the relative chart of EZU vs. SPY which makes favoring Europe preferred in the months ahead (if/when these signals are officially confirmed).

For now, it appears like both China and Europe could begin to show better performance than the US following this steep runup in US indices back to new all-time highs. I interpret this to mean that Technology might require consolidation in the months ahead (which could make SPY turn down relatively speaking vs. both Europe and China).

Bottom line, for those looking to diversify away from US Technology and US Equities (which I suspect might prove to be a short-lived period of consolidation in 1st-to-2nd quarter 2024), the equity ETF’s in both Europe and also China seem to be suggesting that a counter-trend period of strength could be around the corner.

MSCI Eurozone ETF / SPY ETF