Pullback in SPX and QQQ -0.17% has not damaged the uptrend heading into the busiest week of earnings for the quarter, and S&P Futures look to be indicated higher following earnings from AAPL -0.44% , META 0.58% , and AMZN 0.70% post close on Thursday. Overall, a push back above late January peaks doesn’t necessarily create a bullish rally to initiate new longs given the recent waning in momentum throughout January and the prospect of a five-wave advance being complete into early February which might show resistance near 4965, or 4995.

On the upside, I suspect that SPX 5000 represents strong near-term resistance while 4800 is an important floor to any early month February weakness. Seasonally speaking, Equities should be entering a choppy period in February, which tends to be seasonally a worse month than Januarys during Election years.

Below is the picture of March E-Mini S&P Futures following post-close earnings on Thursday. S&P has eclipsed prior highs from early this week, which is certainly a positive based on short-term technical structure. The negatives have to do with Elliott-wave patterns potentially nearing completion coinciding with a lower than preferred momentum and breadth readings compared to December 2023.

Overall, it’s difficult to contemplate selling technology on strength, and from my standpoint, holding out for weakness of some kind is an easier technical signal which might indicate downside follow-through. Two areas of downside support lie at ES 2.10% _F – 4866, then 4838, which lies up with 4802 in the SPX cash index. Until this is broken, it’s right to stick with this trend, with hopes that other sectors will gain ground quickly to help momentum and breadth begin to play catch-up.

S&P 500

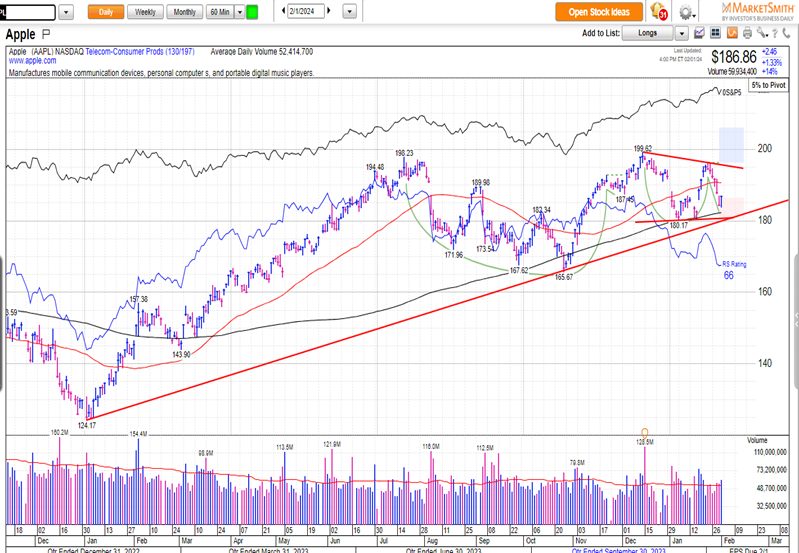

AAPL support at $180 has importance for investors

AAPL’s post earnings move, as of 5:30 pm EST, lacked the firepower that stocks like META 0.58% and AMZN 0.70% showed after hours (Each of the latter trading higher by more than 8% following Thursday’s market close, while AAPL -0.44% was lower by $1)

As shown, its recent pullback got close to, but did not undercut, serious support near $180 that looks important for AAPL -0.44% structurally.

$180 lines up near prior January 2024 lows, along with intersecting a lengthy uptrend line for AAPL since early last year.

While AAPL has underperformed its peers in recent months and has largely gone nowhere, its technical pattern hasn’t turned that bearish. This is due to lack of meaningful deterioration in its trend.

The ability to hold near its 52—week highs and churn sideways technically speaking normally can be thought of as minor consolidation that normally is resolved by a push higher.

Overall, I view AAPL as an attractive risk/reward at current levels. Strong support lies at $180 while gains appear likely in February above last week’s $196.38 peak which would lead back above $200 in the weeks to come.

$180 is a particularly important support level given AAPL’s concentration within SPX and QQQ -0.17% . Anny break of $180 could metastasize to the broader US equity market given AAPL -0.44% ’s size.

Thus, most investors should pay attention in the weeks and/or months ahead for any evidence of AAPL breaking $180 which is its technical “line in the sand”. Until/unless that happens, it’s right to not think too negatively of AAPL despite some consolidation and underperformance since last Summer.

No technical damage has been done, and this very likely could turn out to be the “pause that refreshes” before this rallies back to new highs.

Apple (AAPL -0.44% )

Source: Market Smith

Semiconductor Stock outperformance has proven stellar in recent weeks

I’ll analyze the SOXX -0.84% as the ETF for the Semiconductor sector within Technology, which continues to appear bullish despite being stretched.

SOXX- December’s rally back to new all-time highs solidified Semiconductors as one of the top sub-groups to favor for possible outperformance. In recent weeks, this has shown some mild consolidation following three straight months higher. However, it remains difficult to consider fading a move back to new all-time highs despite being near-term overbought. Monthly momentum indicators like RSI have begun to show negative divergence after this peaked back in 2021 and has not recouped this high despite the recent price spike back to new all-time highs.

However, with stocks like ASML -1.19% , NVDA 0.53% , AMD -1.56% , and AVGO -1.43% having all risen more than 25% in the last six months, it will be necessary to show at least some evidence of near-term momentum slowing further before expecting that price might be peaking out. The act of rising back to new all-time highs in the last few weeks often presents the opposite conclusion, and supports the idea of additional gains, as technical structure has improved, not deteriorated.

Upside targets for SOXX -0.84% lie near $680 and should involve further strength into mid-February by the recent outperformers like NVDA, AMD and other technically sound Semiconductor names which are at 52-week highs.

iShares Semiconductor ETF (SOXX -0.84% )

IHI breaking entire downtrend from 2021 peaks

IHI has proven to be even stronger within Healthcare than Biotech lately, so it makes sense to favor this sub-sector within Healthcare for additional absolute and relative outperformance..

As demonstrated in last night’s report, its ratio chart vs. IBB -0.47% just broke out to the highest level in weeks, which bodes well for better relative performance out of IHI 0.96% than IBB -0.47% . However, potentially more evident, but no less bullish is the absolute breakout which is happening this week, as IHI has exceeded the entire downtrend from 2021. (See below)

Overall, given Healthcare’s reemergence lately with XLV nearly having made new all-time high monthly close for January, Healthcare should be favored for outperformance in the months ahead. Medical Devices has started to show a bit more strength as interest rates have trended lower, and the last couple weeks of pullbacks in rates have directly coincided with above-average strength.

As this chart below illustrates, the act of being over $55.40 represents an IHI 0.96% breakout of a downtrend that has been ongoing since late 2021 and makes this appealing for additional short-term gains.

iShares US Medical Device (IHI 0.96% )