SPX and QQQ have made their short-term bottom as of last Friday and are now likely on a three-wave bounce into late next week. Interest rates can drop further into next week, but likely will not make the larger breakdown many are expecting before pushing back to highs into mid to late November. Overall, given widespread technical damage in many sectors it’s going to be important to see more evidence of a rolling over in both US Dollar and Treasury yields to have confidence of a sustainable rebound.

The early day bounce in SPX to test its former October lows near 4216 was a bit deceptive Wednesday, as more than eight sectors were negative on the day, and Technology in Equal-weighted terms was negative despite a big rally in XLK 0.58% .

Fortunately for the Bulls, this changed dramatically post Powell’s comments at November’s FOMC meeting. Of the former eight sectors which showed lower prices into Europe’s Wednesday close, three rallied back to positive territory and only Energy, Materials, Industrials, Communication Services and Staples finished negative.

Utilities led the rally, but both Technology and Financials finished over +0.75% which was a real positive for the US stock market. SPX and QQQ gains can sometimes prove deceptive when XLK 0.58% outperforms RSPT -0.09% by more than 100 basis points (bps.)

Thus, Market breadth expanded to nearly 3/1 bullish, but it’s not wrong to say Wednesday was a large-cap Technology and Financials rally with some meaningful bounce out of the defensive Utilities. Meanwhile, the broader market did manage to gain +0.34% per the Equal-weighted S&P 500’s ETF, RSP -0.31% , yet this paled compared to QQQ 0.01% ’s +1.74% gains and ^SPX’s +1.05%.

SPX targets into late next week lie up near 4330 (Between 38.2% -50% retracement) then 4357-63, which represents both Gann targets and the 50% retracement area of the first meaningful resistance from the recent three-month decline.

To expect that mid-September peaks of SPX- 4511.99 are exceeded in November is doubtful, but could occur if ^TNX undercuts 4.35% (also a difficult task)

QQQ targets into late next week lie near 362 initially, then 369-372. I suspect that exceeding 373.60 from mid-October should prove challenging for November, but will assess following a rally into next week.

Software looks to be close to breaking out vs. Semiconductor shares for 1st time in four years

Interestingly enough, after five straight months of outperformance, Software looks to be on the verge of a large breakout vs. Semiconductors.

This is solely based on the relative charts of the Ishares Expanded Tech Software Sector ETF (IGV 0.56% ) vs. the VanEck Semiconductor ETF (SMH 0.05% )

IGV is heavily concentrated in MSFT 1.33% , CRM 1.34% , ADBE -0.73% , ORCL 2.04% , INTU 1.89% , and NOW 0.09% , PANW 0.25% , and SNPS -1.11% which make up over 50% of IGV.

Meanwhile 50% of SMH is comprised of NVDA 1.70% , TSM 0.95% , AVGO 0.71% , ASML -1.26% , and AMD -0.19% which collectively represent 49.64% (This calculation is based on weightings of both IGV and SMH as of the end of September, 9/30/23)

As seen below, this ratio is now challenging and arguably exceeding the entire downtrend since 2019 peaks. Counter-trend monthly exhaustion signals per DeMark indicators were confirmed on monthly Symbolik charts, and positive monthly momentum divergence has been in place for the last few months.

Overall, more might need to happen to officially say Software should steadily outperform Semiconductor shares, but this appears to be at a key inflection point for this ratio. November month-end closes and also end-of-2023 month-end closes above this downtrend would argue that Software can finally start to lead performance vs. Semiconductor shares as a group for the first time in over four years.

Apple Technicals- Short-term this requires improvement above $179 to be bullish. Intermediate-term, AAPL is attractive for gains back to new highs in 2024 but is gradually losing momentum

Let’s discuss AAPL ahead of earnings. Here are some technical positives and negatives on both a short and intermediate-term basis.

What’s positive:

- The decline from mid-July has proven choppy and overlapping from an Elliott-wave standpoint. Thus, I feel it’s highly likely that AAPL pushes back to new highs into 2024.

- The long-term trendline from 2020 has not been breached. Thus, despite weakness from $198 down to $165 from July into late October, this remains well within the intermediate-term uptrend. In fact this has not even given back 50% of the rally from January of this year.

- The minor decline over the past few months has alleviated AAPL’s overbought status on both a weekly and monthly basis.

- AAPL bottomed in October right near the 50% Time-based retracement of its former 1/3/23-7/17/23 rally. This was a perfect 50% time retracement on 10/22/23. Additional time-based periods of importance for AAPL could happen near 11/14/23, then 1/28/24 (this latter January time might prove to be a peak for AAPL)

What’s Negative:

- Negative monthly momentum divergence was present on AAPL’s push back to new highs into July 2023. The decline over the last three months has subsequently caused monthly MACD to roll over to negative. (A Bearish technical break of the signal line in MACD)

- TD Sequential monthly Exhaustion per TD Sequential indicator) was confirmed on September’s close at $171.21. An additional signal is possible on a push back to new highs as TD Combo signals lie on an 11 count. (Yet this requires a push back to new highs)

Overall, I expect a rally to $179 in AAPL which marks an area of trendline resistance from July. Over $182.34 from mid-October would result in a stronger bounce. However, if this is rallying into mid-November, I would suspect that could mark a short-term peak. July peaks at $198.23 will prove important whenever this is tested, and is likely improbable for November.

Furthermore, support lies near $162 which I feel is strong support for AAPL into late November/early December on any mid-to-late November weakness. This would be an excellent entry point, technically speaking, from a risk/reward standpoint for a push back to new all-time highs.

However, ultimately, I expect that any push to new highs, if it takes three months, likely would be insufficient to make momentum too bullish and the negative drag on AAPL given its lengthy 2021-2022 decline would result in this ongoing negative momentum divergence persisting.

Thus, while I like AAPL between now and late January 2024 and would look to buy dips down to $162, I fear that movement back to new highs likely shows strong resistance near $205-$215 which might result in shares stalling out following a fractional rally back to new highs.

None of the analysis above takes into account the fundamentals of AAPL. The bottom line analysis suggests that three-month decline has not afflicted AAPL too negatively thus far. However, the stock has gradually begun to lose momentum, and this needs to be rectified quickly to expect that any push back to new highs would be sustainable. At present, I am bullish over the next few months and feel like AAPL is an attractive risk/reward on any weakness into early December.

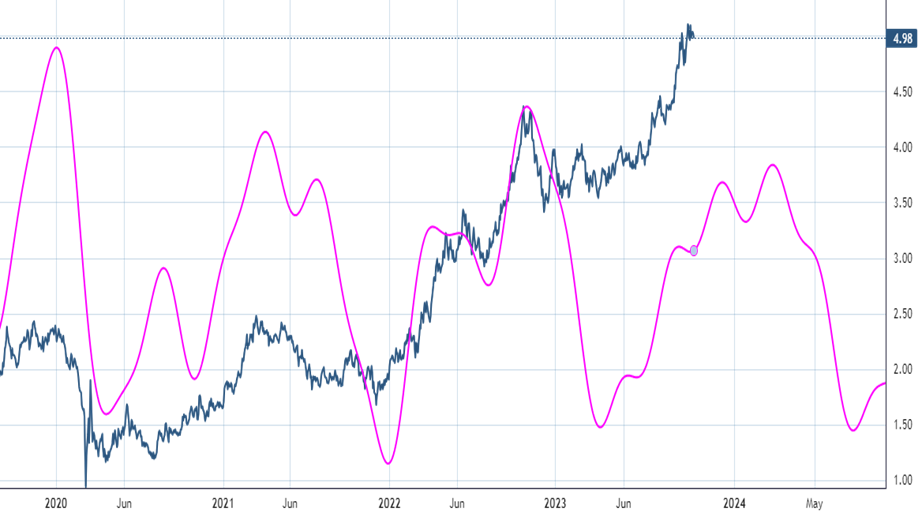

Peaking process for Treasury yields might last three months before a plunge down into next Summer

Many are wondering if the trifecta of lesser Treasury supply, coupled with lower than expected Manufacturing PMI along with worse ADP results might finally have put the “Peak in” for Treasury yields.

Technically speaking, any intermediate-term peak in yields looks to be a work in progress. While I suspect yields should drift lower into next week, the Elliott-wave pattern along with lack of confirmed DeMark monthly TLT “13 Countdown exhaustion (“Buys”) followed by the Cycle composite for Treasury yields all suggest that Yields might not make an initial peak until early December.

This is followed by a pullback into January followed by another stab at rates pushing higher into mid-to-late February 2024. This time period is important, as it would allow for a monthly TD Buy Setup to possibly be completed for TLT -0.56% which as of now looks to be three months away.

The cycle composite below shows an initial early December peak in rates, followed by rallies into January which likely coincide with a meaningful Equity bounce. Then rates push back higher until February. Notice below how dramatically this Treasury yield composite trends down from February into July.

I suspect that period coincides with either FOMC rate Cuts or some evidence of severe slowing in the US Economy.

Bottom line, I’m happy to obey any meaningful change in trend. For TNX this necessitates a breakdown under 4.35% to suggest the former intermediate-term uptrend in yields has given way to a downtrend. This appears quite early. Overall, while rates are likely to trend down into next week, my analysis suggests that its highly likely that yields trend back up above 5.00% in TNX sometime in November and a larger peak is premature.

Overall, “a peak” in yields is very different than “the peak” in my view.