US Equity indices and Treasury yields remain quite choppy, but it’s thought that SPX and QQQ stall out and might reverse before exceeding 9/1 peaks (SPX-4541.25, QQQ-380.83) Treasury yields look likely to break out to new 2023 highs, and I suspect this will be short-term negative for Equities. Only on a TNX break under 4.05% would it be right to trust an Equity bounce in September

It might seem unusual to experience a 1% equity rally when Treasury yields, US Dollar and Crude are all pushing higher, but that’s exactly what happened on Thursday.

It’s doubtful that Stocks and bonds are breaking their recent correlation, and the path of least resistance remains higher for Treasury yields.

Interestingly enough, Utilities and Real Estate were the biggest sector gainers in Thursday’s trading. However, this doesn’t look to be a one-day rotation. Utilities have trounced Technology over the last week, and still look to have some further relative strength after breakouts in XLU and also relative to SPX.

Importantly, both SPX and QQQ are now nearing the “moment of truth”. Daily closes over 9/1 peaks would temporarily postpone any correction likely until October, as structurally this would be a sign of technical improvement.

While it’s certainly intriguing to see bullish price action out of the major indices when equal-weighted SPX dropped to new weekly lows yesterday, I remain open to all outcomes, as long as prices confirm a breakout above September highs.

Technically speaking, I’ll remain defensive barring a breakout over SPX-4541 and QQQ-380, as breadth, momentum and sector rotation doesn’t support a meaningful rally. If this were to happen, however, markets could take on a 2021-like character and rally temporarily into late September despite not much participation. (As many remember, Equity markets largely peaked in Spring of 2021, but SPX was able to power higher until January 2022 before topping out NASDAQ, DJ Transports, Russell 2000 all made their all-time highs on November 17, 2021 and have not exceeded this over the last 22 months)

Thus, 2 scenarios seem likely, in absence of TNX breaking 4.05% right away.

- S&P peaks out this coming Friday/Monday with price having pushed higher to within striking distance of triangle resistance under September peaks in SPX and QQQ.

- Both SPX and QQQ exceed 9/1 highs, which would lead to push higher into the final few days of September before a likely short-term top.

Overall, given Technology’s strength over the last month, any setback is likely to prove temporary, but might mirror the cycle composite thesis, which calls for a choppy market until mid-November before prices can truly start to push aggressively back higher.

This week’s critical SPX areas lie at the following levels:

Support 4450, 4430, 4335, 4260

Resistance- 4541, 4600

Overall, a defensive bounce has led S&P to near triangle resistance, which normally would be expected to cause a stallout. Technical structure remains negative from 9/1 and from 7/27. However, I’ll respect an SPX cash close above 4541 along with a QQQ close above 380.

Equal-weighted SPX fell to new September lows on Wednesday

Despite Thursday’s bounce, the Equal-weighted SPX’s price action has proven to be anything but bullish in recent weeks. The early part of September has resulted in RSP 0.86% pulling back to multi-week lows to test August lows.

It’s important to monitor this gauge to get a feel for how healthy our SPX and QQQ rallies have been lately.

Until Equal-weighted S&P 500 ETF by Invesco (RSP 0.86% ) climbs back above early September peaks and/or TNX falls to breach 4.05%, this seasonally weak time remains a period which is still largely defensive, and sector rotation has borne that out lately.

This pullback to multi-week lows in RSP likely argues for a test of August lows either in September, or October. If/when counter-trend exhaustion signals show up on weakness, that would be a better time to consider owning SPX vs. current levels.

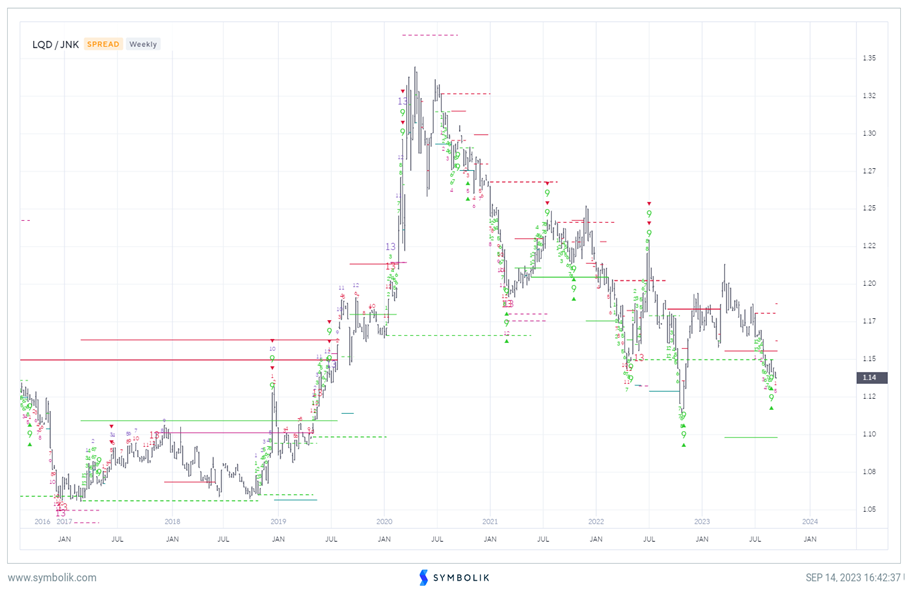

Investment Grade Corporates relative to High Yield corporates look to be close to bottoming out

Weakness in ratios of LQD -0.20% vs. JNK 0.06% have been trending down most of 2023. This looks to be nearing a time when this might bounce, which involved High Yield underperforming more than Investment grade.

DeMark exhaustion triggered its first TD Weekly Buy Setup of 2023 in the last week. Historically this has proven to be a time when it was important to pay attention to the ratio of LQD to JNK for evidence of this peaking or making a bottom.

Near-term, it’s necessary for this ratio to turn higher in the next week. Failure to do that would likely postpone any weakness out of High Yield corporates, and lead the ratio of LQD to JNK down into early October before bottoming.

Overall, this has not yet changed trend. However, this ratio has neared an area of importance, and given the resilience in the Junk Bond market this year, bears watching into late September.

Utilities have begun to strengthen and outperform

This week’s top performing group has shifted rapidly to Defensive groups like Utilities, which are now leading all other S&P Level 1 Sectors with performance of +3.98% over the rolling one-week period.

This compares to Technology’s -3.12% loss, showing that sector rotation presents a more defensive picture than what QQQ showed in Thursday’s session.

Weekly relative charts of Equal-weighted Utilities (RYU 1.13% ) vs the Equal-weighted S&P 500 (RSP 0.86% ) have broken out above the multi-month downtrend from this past Spring 2023.

This has catapulted this Utilities atop the sector leaderboard over the last week. Equal-weighted Utilities now stands in 3rd place over the last month, beating out nine other S&P groups and only trailing Energy, and Technology.

In the short run, this outperformance should continue over the next week before finding resistance and likely “backing and filling”.

Until the larger downtrend from last Fall is broken in relative terms of RSPU to RSP, this bounce is thought to prove short-term only, and not the start of an intermediate-term move.

However, it remains unusual for SPX and QQQ to rally sharply being led by Utilities, while Treasury yields remain within striking distance of 2023 highs.

Bottom line, I expect XLU 1.38% to likely rally to $67-$67.50 before consolidating gains. As weekly strength begins to build, this might be a sector to consider in October after it pulls back. At present, I anticipate about another 3-5 days of absolute and relative outperformance.