“Right now only some people get to live in big houses, travel widely, and buy lots of nice things, but many more people want the same opportunity. The global economy has a good track record of turning this desire into reality.” ~ Knight Frank, Wealth Report 2022

On April 24, 2023, LVMH (LVMHUY) became the first European company to surpass the $500 billion market-cap milestone. The stock has been on a tear in 2023, rising almost 30% YTD as of this writing. It’s not hard to see why—after reporting record profits for 2022, the company disclosed a 17% increase in sales YoY for 1Q 2023, doubling Street expectations. Small wonder that LVMH’s founder, Bernard Arnault, is No. 1 on the Forbes list of The Richest People in the World—a rarity in an echelon dominated by tech moguls.

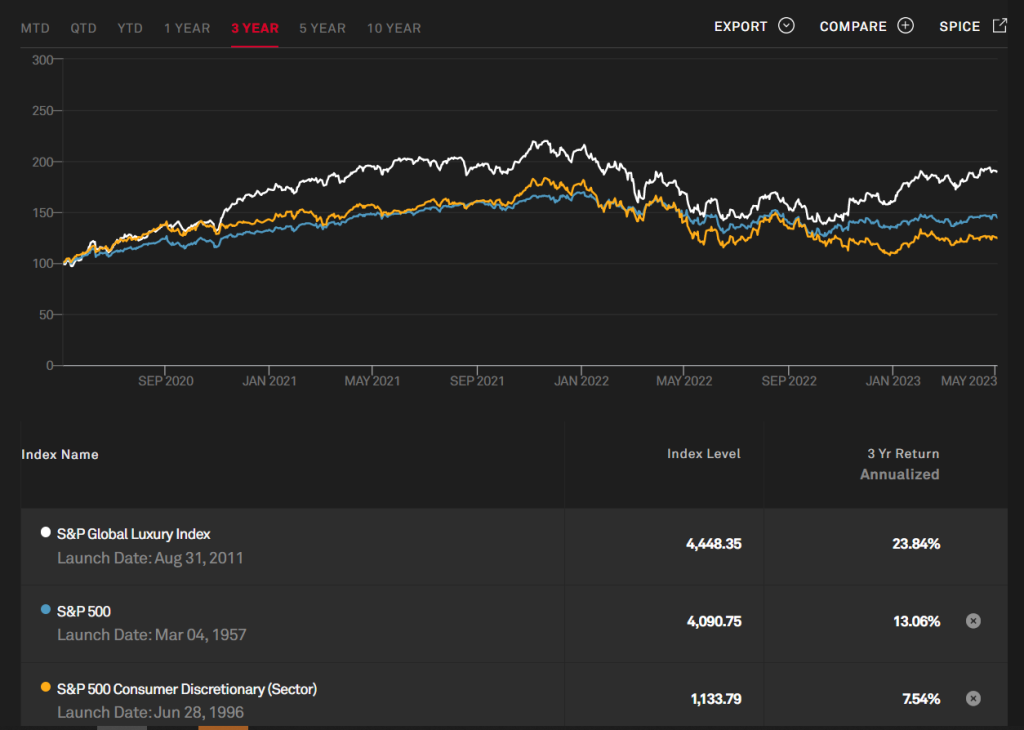

While LVMH is a leader in the luxury retail industry, its results are not atypical. Companies targeting wealthy and affluent consumers have done well in recent years. During the pandemic and since then, luxury (SPGLGUP) has outperformed not just the S&P 500, but also the consumer discretionary sector, which it has traditionally been regarded as a part of.

Price Returns: Luxury, Consumer Discretionary, and S&P 500

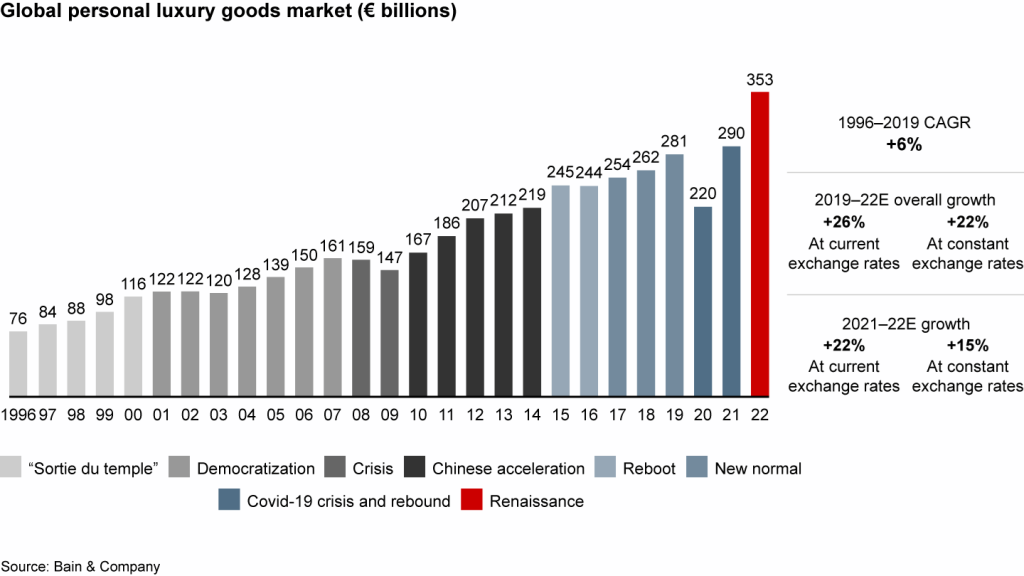

After a contraction in 2020, the luxury market saw record growth in 2021 due to so-called “revenge spending” by consumers coming out of pandemic lockdowns. In 2022, demand for nice things continued to grow despite global inflation and economic uncertainty in the United States (the biggest luxury market in the world) and a continued lockdown in China (the second-largest luxury market). Except for 2020, global demand for personal luxury goods has been on a strong uptrend since 2009, reaching a total of EUR 353 billion (USD $387.8 billion) last year.

It is not just sellers of personal luxury accessories such as shoes or watches or handbags. For example, Ferrari (RACE -0.90% ), set a sales and earnings record in 2022—delivering 13,221 vehicles and $1.024 billion in profits. For Q1 2023, the Modena, Italy-based company reported higher profits, stronger margins, and a 20% YoY revenue increase, beating expectations on both top and bottom. Demand for its vehicles is so high that CEO Benedetto Vigna reported, “Our order book already extends into 2025.” Part of that is deliberate: Vigna has said, “At Ferrari, we always deliver one car less than the market demands. I can assure you that this will never change.”

How has the luxury industry delivered such performance during such a challenging period? Much of that is due to the unique attributes of this sector’s customer base.

Luxury companies primarily sell to the wealthy and the nearly wealthy. The affluent, which we define as the ultra-high-net-worth demographic (net worth of at least $30 million) and the very high-net-worth demographic (investable assets of at least $5 million) don’t alter their spending during times of economic distress. Although this demographic makes up just 2% of the sector’s customer base, it accounts for as much as 40% of its revenues.

Most of its remaining customer base is affluent—not necessarily high-net-worth, but nearly so. While they are not immune to economic pressures, they are still comfortable enough not to need to give up on nice things entirely when times are tough.

Combined, these two groups give luxury companies strong pricing power. Higher prices do not deter their customers. In fact, higher prices sometimes drive up demand by increasing the prestige, exclusivity, and thus, desirability of their products.

This, in turn, facilitates higher profit margins for this sector, enabling below-average capital intensity. Since luxury sales are driven by factors unrelated to the quality of materials or manufacturing (though such attributes are not unimportant), much of the appeal is driven by intangible qualities.

The result has been a sector that has shown itself to be unexpectedly resilient to challenging economic conditions such as the ones with which we have been living since 2020.

However, for months, our Head of Research, Tom Lee, has repeatedly asserted that many of those challenging conditions are ending. Lee has provided strong arguments that inflation has peaked and is due to roll over—hard. And although it took a while, China has ended its pandemic lockdown and reopened. As of this writing, the stock market has posted gains for five out of the last seven months, and both of the last two quarters. The S&P 500 is up almost 6.5% YTD.

So the questions for investors are: Can luxury companies continue to perform well and to outperform? Can the luxury market continue to grow at the rates it has seen in the past decade? The answer to these might be found in one of Lee’s Seven General Principles of Investing—specifically, Principle No. 6:

Demographics are Destiny

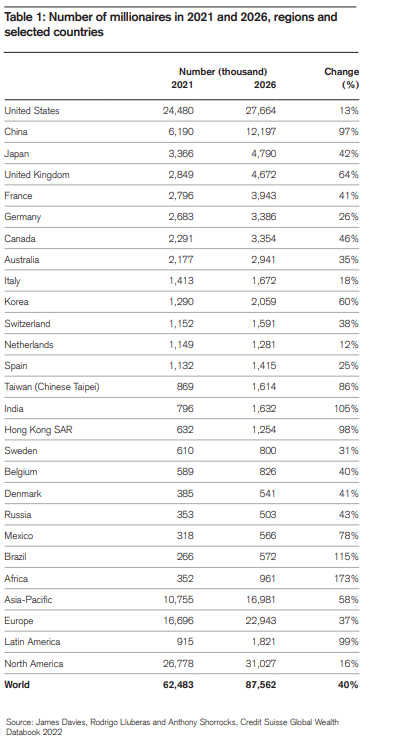

The demographics of the luxury market offer hope for investors. The target market for companies in this sector is set to grow sharply in China. One analysis predicts, for example, that the number of millionaires in the so-called Middle Kingdom could nearly double between 2021 and 2026, from an estimated 6.2 million to about 12.2 million. Earnings for China’s middle and upper-middle classes are also forecast to grow sharply in the coming years.

And in the intermediate term, those shoppers will have an extraordinary amount of money to burn. We are just months into China’s post-pandemic re-opening, but early reports suggest that the country is experiencing a wave of revenge spending similar to that of Americans and Europeans a year ago. During years of lockdown, Chinese consumers saved $2.6 trillion that they might have otherwise spent on going out, traveling, or shopping. It is not unreasonable to expect that a significant share of those renmenbi will now be used to splurge on things that are shiny, pretty, or decadent. Even before the pandemic, China was forecast to overtake the United States as a luxury market by 2025. For the reasons outlined here, this forecast still holds water.

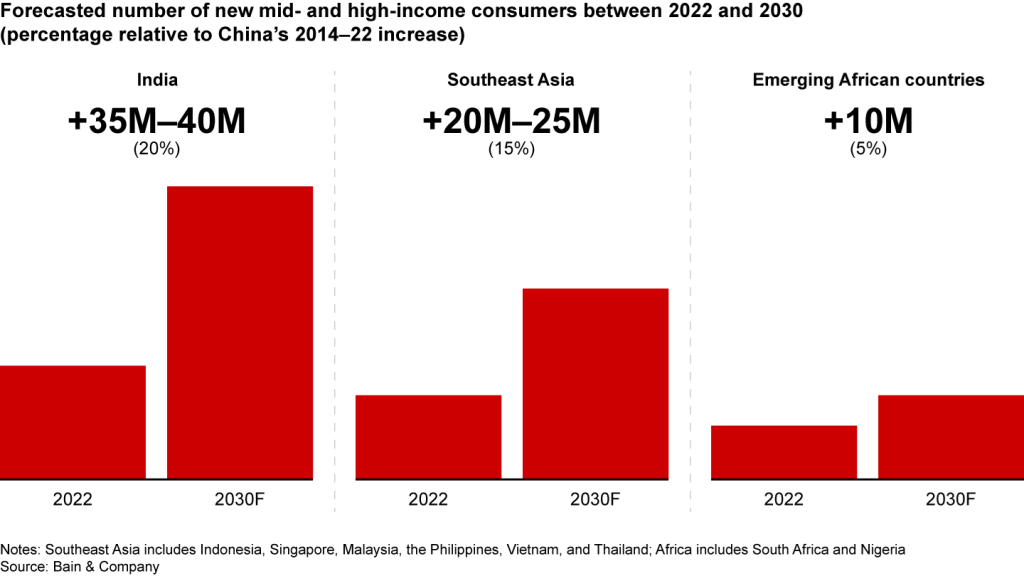

Experts caution that “there will never be another China” to drive luxury growth as it has done—witness the 2010-2014 period when increased demand from China drove the market up 49% (or an annualized ~8.3%). But the luxury market’s prospects do not rest on China alone. The U.S. will remain one of the most important markets for luxury goods for years to come, with its millionaire count projected to rise 13% to 27.7 million by 2026.

Around the world, the number of people who can afford—and will surely want—nice things is also set to grow sharply. Globally, the number of millionaires is projected to increase to as much as 87.5 million in 2026, up 40% from an estimated 62.5 million today. We can expect strong growth in countries not associated with high concentrations of wealth, such as India, Mexico, and Brazil. Growth is also expected in parts of Southeast Asia.

Policy-minded readers will observe that much of this growth comes from countries with high levels of wealth inequality. Indeed, wealth inequality is seen by some as a worsening and worrying problem even in China and the U.S. Interestingly, this helps the luxury sector. Several studies suggest that higher levels of wealth inequality correlate strongly with increased demand for luxury goods—across all wealth demographics.

The sector’s prospects do not just rely on a growing wealth demographic. The rise of Millennials, which has a core theme in our Granny Shots list, along with the coming rise of Generation Z, also bode well for these companies.

Demand for luxury goods is growing among younger generations. Part of that is due to their rising incomes as they get older, but there is a beneficial shift in generational attitudes, as well. People are starting to enter the luxury market at younger ages, despite still being in the earlier stages of their lives and careers. A study by Bain & Company found that Millennials started buying luxury items as early as age 18-20. Generation Z consumers are starting even earlier, at an average age of 15. The two generations, which now account for roughly half of the market as calculated by number of current customers, entered the luxury market earlier than Gen X and Boomers. The generation after that (Generation Alpha) is expected to continue the trend.

A Cautionary Note

Of course, demographics alone do not guarantee a luxury company’s success. While much of a luxury brand’s success rests on the quality of its products, the company’s intangible reputation for prestige, exclusivity, and desirability is essential as well. Witness what happened to Balenciaga, which in autumn 2022 was mired in a scandal from a marketing campaign that could most charitably be described as child exploitative—if not worse. In luxury, a reputational loss can indeed be quantified. Balenciaga’s corporate parent, Kering (PPRUY), blamed part of the conglomerate’s 7% revenue decline in Q4 2022 on the ensuing scandal.

Even without scandal, the need to continuously create new things that appeal to the luxury demographic can present challenges to even the most established of names. Despite its storied history and association with glamorous celebrities like Beyoncé and Zendaya, Roberto Cavalli nearly went bankrupt in 2021.

Major companies in this segment to consider

LVMH-Moet Vuitton (LVMHUY)

The largest company in Europe (in any sector), LVMH is a conglomerate owning a wide range of brands in industries such as alcoholic beverages (Château d’Yquem, Glenmorangie, Belvedere, Hennessy, etc.), fashion (Loro Piana, Christian Dior, etc.), fragrances and cosmetics (Guerlain, Acqua di Parma), watches and jewelry (Tiffany & Co, Hublot, etc.), and yachts (Royal Van Lent.) It also owns Belond, a luxury travel company, and several newspapers in Paris.

Richemont SA (CFRUY)

Unsurprisingly for a Switzerland-based company, Richemont owns prestigious watch brands, among them A. Lange & Söhne, Jaeger LeCoultre, Roger Dubuis, and Vacheron Constantin. It also has exposure to luxury fashion through its dunhill and MR. PORTER units and luxury accessories through its ownership of Montblanc.

Kering (PPRUY)

Kering is yet another Parisian company with a broad range of brands in fashion, accessories, leather goods, and other personal-luxury goods. Its brands include Gucci, Bottega Veneta, Brioni, and Balenciaga.

Ferrari NV (RACE -0.90% )

Perhaps one of the best-known manufacturers of high-end sports cars, Ferrari also operates theme parks in Abu Dhabi and Spain. In recent years it has ventured into branded apparel, though the company will likely be forever associated with its sleek, powerful automobiles. In recent years, these have included four hybrid models and an SUV. The company is actively developing an electric vehicle, currently slated for 2025 release.

Your feedback is welcome and appreciated. What do you want to see more of in this column? Let us know. We read everything our members send and make every effort to write back.

Thank you. Access our full Signal From Noise library here.