The near-term decline in SPX has now closed in on important support, which should likely provide a possible low to this pullback sometime over the final three days of this short week.

Despite SPX having logged the worst trading day performance-wise in over two months’ time, volume was sub-par. While many blame the shortened holiday week for this lack of volume spike, one would think that volume would be at least a bit more than average on the worst trading day of the year.

Importantly, prices are now hovering right above the all-important 50% retracement area of the prior low to high range. Additionally, this week represents a 50% time retracement of the prior low to high swing from late December 2022. (In other words, from 12/22/22-2/2/23 markets rallied for 42 calendar days. 50% in time will arrive on 2/23/23, this Thursday). Thus, some short-term price and time confluence is approaching.

Additionally, Treasuries look to have sold off in a near-perfect 5-wave decline from 1/19/23, which means that this bounce in yields also should be nearing completion.

I discussed a week ago that the larger cycle composite still looks to trend higher into mid-March but that the back half of February might show weakness. While looking back 10 and 20 years provides some clues that these prior cycles both bottomed between 2/17 and 2/15 of the month, the 60-year lookback showed an extended decline until 3/1 before bottoming.

Overall, US equities should be nearing an appealing area to expect some stabilization and a reversal back higher. Only if SPX undercuts 3945 would I fear that a larger decline might be in store. (For those that wish to give this rally a bit more slack, 3900 should also be important.)

Such a move would involve slicing back under the 200-day moving average in SPX as well as undercutting the 61.8% retracement zone of the prior low to high range. Finally, this would also involve breaking the larger uptrend from last October’s lows. At present, all of these are premature, and pullbacks should be buyable this week, with the first meaningful support level just fractionally below current levels.

Additional SPX micro-trend study that suggests we’re close

While my prior commentary centered on the daily charts for SPX, it’s also worthwhile to study the intra-day charts to gain a feel for how price and time relationships might align in the near future.

First, Relative strength index (RSI) readings are now officially back to oversold levels on hourly charts.

Second, the first decline from early February (2/2/23) appeared very much like a three-wave decline into 2/10/23. That’s a huge positive from an Elliott-wave perspective that this entire consolidation is just “corrective” /overlapping and not something which should lead to meaningful weakness back to new lows. Additionally, it signals that a subsequent bounce should push back above these former highs from early February.

Third, projecting the length of the first decline in order to project to targets for the second shows potential confluence between 3976 and 3990. The max level of pullback likely would project to a 1.618 multiple of the first decline, which could take SPX down to 3945. However, prices look very close from a price perspective.

Overall, I have no technical issues with turning tactically bearish if the price action turns overwhelmingly negative and starts to cause real damage. However, the majority of technical tools still suggest that this weakness should prove buyable by end of week.

Staples bounce looks to be nearing important resistance

The last few trading days have finally begun to provide some strength in Consumer Staples, a sector which has widely underperformed in recent months and has undercut former lows vs SPX going back over the past year.

While Staples proved to drift down only marginally in Tuesday’s trading, its one-week performance has been positive, and has proven far stronger than other defensive groups.

The chart below highlights a relative relationship of Invesco’s Equal-weighted Consumer Staples ETF (RHS) vs Invesco’s Equal-weighted S&P 500 ETF (RSP -0.24% ). The prior violation of meaningful support resulted in severe underperformance in this group. However, the last few days have seen a bounce back to test this area of the breakdown. Thus, I feel this area likely might hold on this recent strength.

Overall, I don’t mind favoring Staples vs Utilities, or REITS, but do not feel this sector deserves an overweight. Furthermore, as mentioned, its rally in this shortened week looks to be nearing (or at currently) meaningful resistance which might cause a stalling out in relative terms to S&P 500 and a turn back lower.

Signs of SPX breaking 3945 while Staples rally further might allow this group to shine a bit more in the near-term. However, its longer-term technical picture remains sub-par, and I expect underperformance over the next few months.

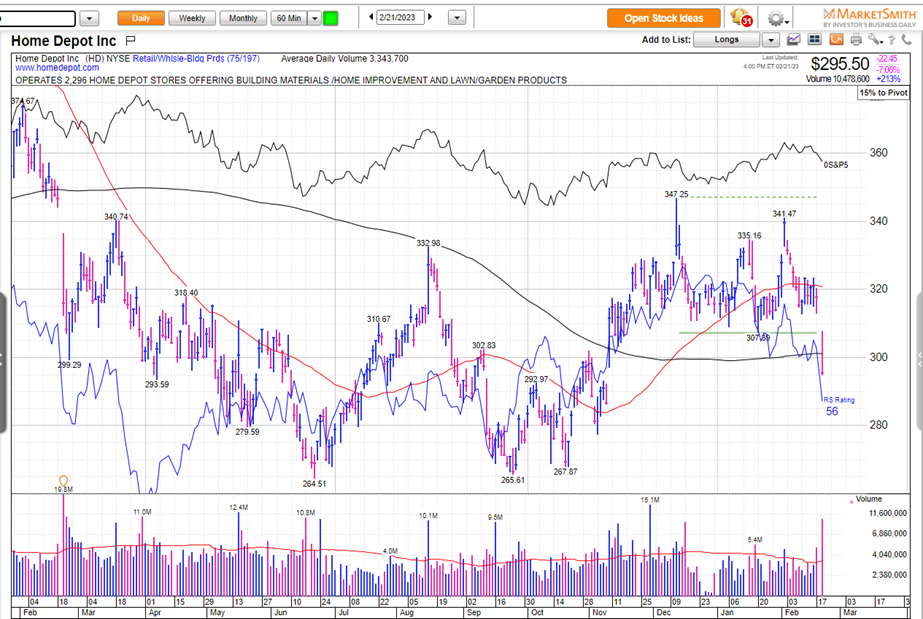

Home Depot slices through support on heavy volume

Home Depot (HD -1.87% -$295.50) has officially broken support on Tuesday’s high-volume decline.

This is a short-term technical negative and likely results in HD moving lower to $283, but could make a complete round-trip decline to the rally which began last September 2022 ($265.61).

Until/unless HD recovers $307.39 from 1/20/23, the near-term trend has turned from neutral since November 2022 to bearish.

To the bulls’ credit, the large rally off last September’s 2022 lows looked important and positive structurally while this latest pullback looks to be in its latter stages.

Yet, in the short run, meaning the next few weeks, this high-volume decline on HD’s support violation doesn’t look immediately buyable. I am removing this stock from my UPTICKS list and will find a replacement.