News outlets worldwide reacted with concern on Jan. 18 when China acknowledged that its population had shrunk for the first time since 1961. But China is far from alone. The so-called “silver tsunami” will hit most wealthy countries to varying degrees in the next decade or two – among them, Japan, Finland, Italy, Portugal, France, and the United States.

The transition is sure to be accompanied by discomfort and turbulence. Witness, for instance, the millions who took to the streets of France in January and February to protest a proposal to raise the country’s retirement age and ease the burgeoning cost of the nation’s generous pension benefits because of its increasingly large population of older people.

The U.S. population is not shrinking, but it’s heading in that direction. Population growth has slowed since the 1990s. In 2000, the annual rate of population increase was 1.5%. In 2010 it was 0.8%. By 2020, it was basically flat. Consequently, the percentage of working-age Americans is declining as the proportion of retired or elderly Americans increases.

For any aging country, the policy implications are troubling. A large percentage of working-age people is needed to generate a large enough tax base to fund retirement benefits and other government programs.

In addition, a decline in the percentage of working-age people poses challenges to GDP growth. Countries can expect labor shortages, decreased consumer spending, and possibly deflation, which are headwinds to the economy.

Despite the challenges an aging population can pose, it is in some ways an enviable problem. Aging populations are largely the result of rising life expectancies, generally caused by improved living standards and healthcare technology. Another significant cause seems to be rising economic prosperity, which is strongly associated with lower birth/fertility rates.

We will leave these discussions to the public policy experts. Right now, we are more interested in what this demographic trend might mean for our portfolios. After all, as our Head of Research Tom Lee likes to remind us, “Demographics are destiny.”

Demand from the older demographic

At FS Insight, we frequently talk about investing in the rise of the Millennial generation. Part of the rationale behind that thematic strategy is the enormous wealth they stand to inherit from their aging Boomer parents. But before that happens, Boomers are obviously going to spend some of it – maybe even a lot of it.

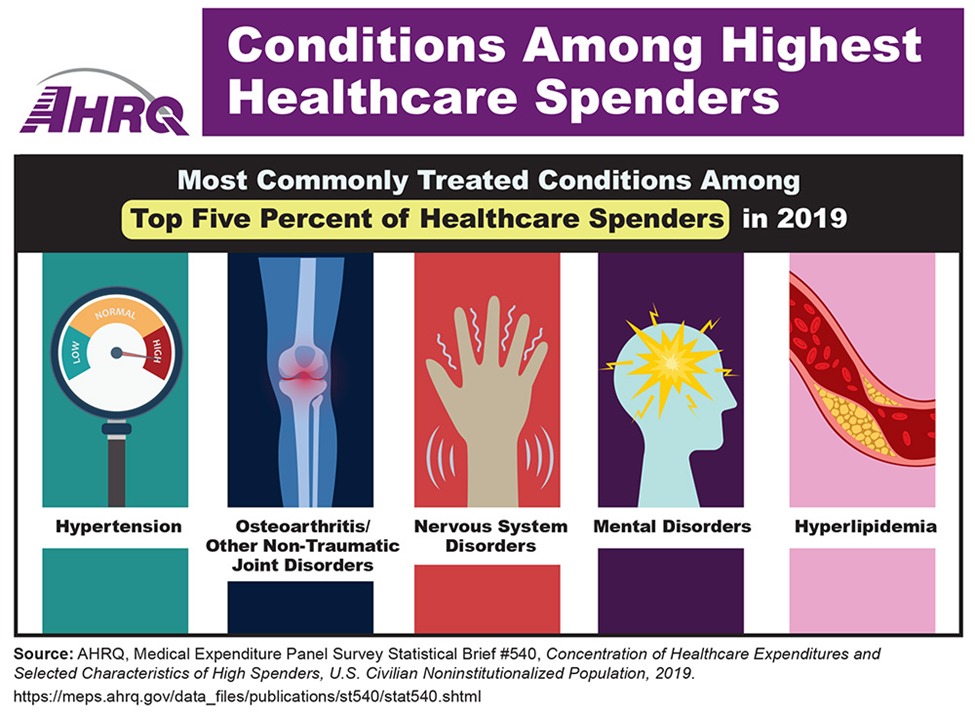

Companies that provide products and services that the older demographic demands will be poised to benefit as this demographic grows. And for obvious and understandable reasons, health care comes to mind as an example. In the U.S., the aging population has long been associated with the greatest share of healthcare expenditures, disproportionately so. People aged 65 and over account for 17% of the population but 35% of annual healthcare expenditures.

This includes both health care costs associated with the final years of life and expenditures related to chronic but non-life-threatening conditions.

This demographic shift benefits healthcare stocks because of increased demand and the sector’s inherently defensive nature, which will help in the deflationary environment that will likely result as the population ages. Profits in this sector tend to be more stable and less cyclical.

Of course, the retiree’s life is not just about illness and worry. After all, the same improved health care that has increased life expectancies has also resulted in a large percentage of older people being healthy enough to do more than just take medications and watch television. As an increasingly large pool of Americans enters retirement, this demographic will seek to enjoy this next stage of their lives to the fullest.

Two of the more popular pastimes for retirees are travel and home improvement. It is no coincidence that the post-pandemic travel boom has been driven by Boomers, including many who had retired early during the public-health crisis. The recently retired are likely to take advantage of their greater spending power and more-abundant free time, taking longer, more luxurious trips to destinations far from home. It might be true that Millennials take more trips, but on average, the older demographic spends more on travel. Indeed, in 2022, Boomers were the fastest-growing demographic for the travel industry.

Labor-market tightness

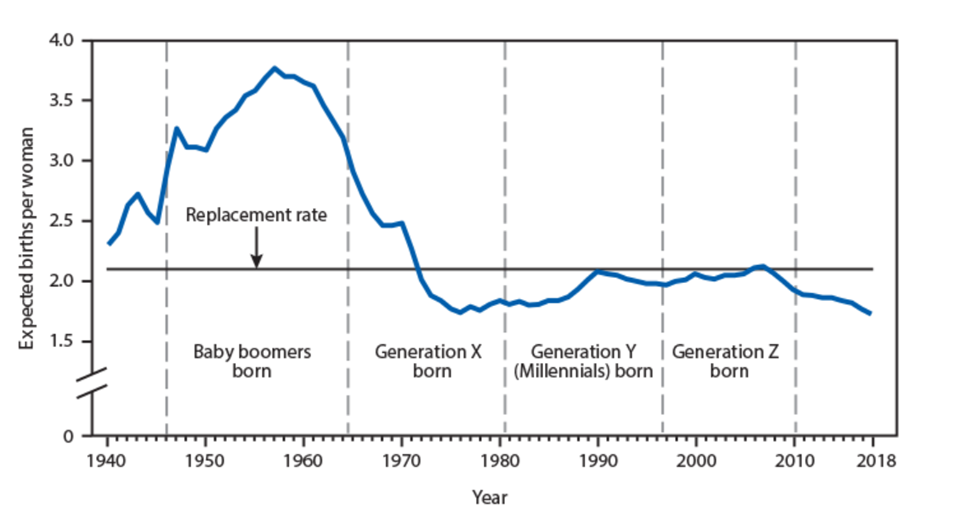

Another reason why older people are starting to constitute a larger demographic is because there aren’t enough people being born to balance them out on the younger side of the spectrum, causing a simultaneous decline in the percentage of a country’s population comprised of younger and working-age adults. One of the largest consequences is a reduction in the labor force, which makes it difficult for businesses to find the workers they need. In developed economies, experts believe that a fertility rate (births per woman) of 2.1 is needed to maintain the size of the population, assuming little or no immigration. The U.S. rate has been below that since the GFC and is currently at about 1.7.

The total fertility rate (TFR), the expected number of births that a woman would have over her lifetime, is the sum of the birth rates for women by 5-year age groups for ages 10–49 years in a given year, multiplied by 5 and expressed per woman.

Historically, incentivizing immigration has been one way to take care of such labor shortages, and various industries have made good use of it. The U.S. has, for example, found itself with a shortage of nurses multiple times since the end of World War II, and encouraging nurses from the Philippines to emigrate to the U.S. has routinely been a significant part of the solution. Some studies attribute much of the recent labor shortage to a virtual halt to all immigration to the U.S. for the two years of the COVID pandemic. One might be forgiven for assuming that the problem would naturally rectify itself now that the pandemic is over and immigration has resumed.

But the U.S. is facing some new, stiff competition for immigrants. Other aging countries have begun to view immigration as part of the solution to their labor shortages as well. Germany, Japan, Australia, Canada, Israel, Finland, Spain, Portugal, and Greece are just some of the countries that have relaxed immigration requirements or offered incentives in recent years to encourage foreigners to come bolster their working populations.

This impediment to the U.S. attracting immigrants therefore provides a strong tailwind to companies involved in automation and artificial intelligence.

Macro pressures

When trying to predict the effects of an aging population, Japan is the most commonly studied example, largely because it was the first developed economy in modern history to be confronted with this demographic shift. It is easily seen that as Japan’s population aged, its GDP growth came under pressure, and deflation emerged. Many economists have argued that what happened there will also happen in other countries as their respective populations age.

But it must be noted that one country’s example is not enough for a definitive conclusion. A paper by Finnish economist Mikael Juselius and Hungarian economist Előd Takáts found a “stable and significant correlation” between the share of dependents (both young and old) and inflation rates, but the opposite of the one suggested by Japan’s example. The authors concluded that “a larger share of dependents (i.e. young and old) is correlated with higher inflation, while a larger share of working age cohorts is correlated with lower inflation.” Drs. Juselius and Takáts are careful to note, however, that their methods are “less precise” regarding the impact on inflation by the “very old,” which is a segment expected to grow sharply in coming decades.

If, however, the aging of the American population brings about a period of low inflation, this suggests that defensive stocks and stocks with reliable dividends could benefit a portfolio.

Companies to consider

Below are five companies that meet the criteria we have described above. They are intended to be used as examples rather than recommendations. As always, we strongly urge readers to research these suggestions carefully and consider their own strategies, objectives, and risk tolerances before incorporating them into their portfolios.

United Healthcare (UNH 1.34% )

This insurer is one of Tom Lee’s Granny Shots and one of Upticks cited by Head of Technical Strategy Mark Newton. Over the longer term, United Healthcare is poised to benefit from rising demand for health care and a deflationary environment. United Healthcare’s work with AARP, as well as its offerings focused on preventive care and older individuals, shows that the company is aware of the needs and market potential of this growing demographic.

Intuitive Surgical (ISRG 0.62% )

Described by Head of Global Portfolio Strategy Brian Rauscher as “one of the leading innovators in the space,” Intuitive Surgical marries two of the leading industries poised to benefit from an aging population: Health Care and AI/Automation. The company is a leader in the field of robotic surgery, with its flagship Da Vinci surgical system providing minimally invasive capabilities in a growing range of cardiac, renal, gynecologic, and gastrointestinal procedures. The company was added to Granny Shots on Jan. 30.

Alphabet (GOOG 2.64% )

This big tech mainstay has invested heavily in healthcare-related technologies that go far beyond its fitness- and health-oriented wearable offerings (Fitbit, WearOS). Its efforts in smart-home technology have the potential to help aging seniors live independently for longer. Perhaps most importantly in this context, the company has also partnered with healthcare providers to develop AI-powered diagnostics (using machine learning to improve upon human capabilities in diagnostics such as scans for cancer, macular degeneration, and skin conditions) and genomics research. Alphabet is also actively partnering with healthcare organizations to improve the streamlining, management, and analysis of healthcare data.

American Tower (AMT -1.01% )

American Tower is one of the largest REITs in the S&P 500 by market cap. It specializes in owning and leasing out multi-tenant properties for wireless providers. This name is included for two reasons: firstly, because improved broadband connectivity is widely regarded as a key infrastructural requirement for the types of AI and technology-driven devices and services that are being developed to help the senior demographic live more independently and maintain quality of life. Also, AMT’s 2.87% dividend yield (as of this writing) makes it attractive under potentially deflationary conditions. AMT is well regarded by both Tom Lee and Brian Rauscher.

Booking Holdings (BKNG 0.44% )

BKNG operates six of the world’s leading online travel tools, including the namesake Booking.com, Priceline, and Kayak. With the vast majority of its revenue coming from outside the U.S., it is well-positioned to benefit from the surge in demand for longer, costlier international trips favored by the aging demographic.

Your feedback is welcome and appreciated. What do you want to see more of in this column? Let us know. We read everything our members send and make every effort to write back. Thank you.