Key Takeaways

- This Signal updates our readers on key considerations and economic impacts from the unprecedented and dastardly Russian invasion of Ukraine.

- We discuss the military situation in Ukraine, the US, and allied response so far, and several key considerations for assessing whether the market impact will be minimal or enduring.

- We explain some of the key economic implications of the brewing conflict and the impact on commodity prices and supply-chains that could result from the war itself and associated sanctions.

- We provide five stocks that we’ve previously covered in this column that we believe are likely to outperform given the profoundly changing currents of geopolitical tensions and unprecedented threat to the post-war international order.

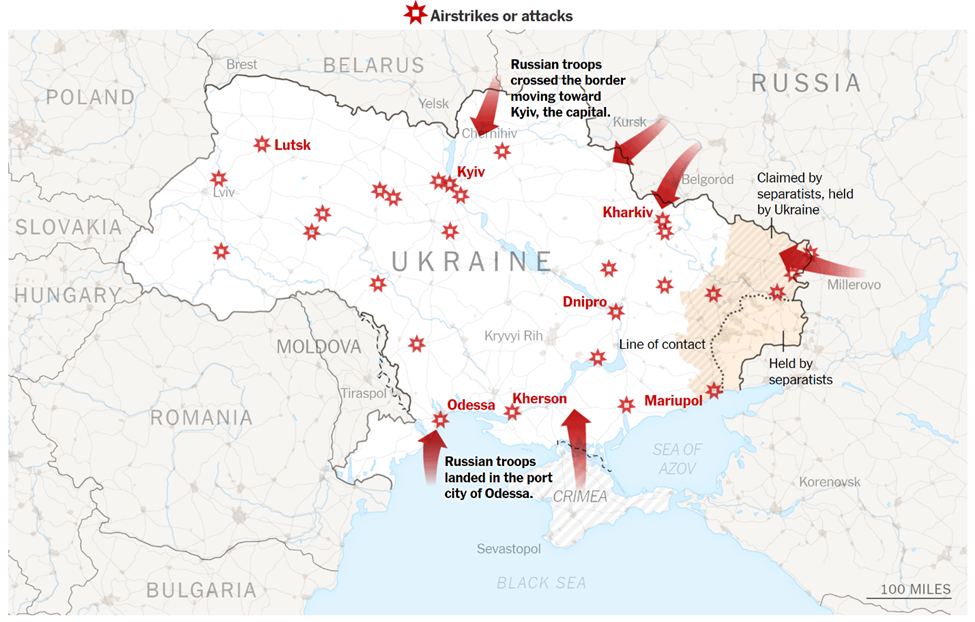

Just before dawn, Russian forces launched an unprovoked attack on Ukrainian military targets. Every major urban center in Ukraine has been attacked and Russian soldiers and armor have poured over existing frontiers from Russia itself, from annexed Crimea, and from the Russian client-state of Belarus. Last night, before the full-scale invasion, this piece was focused on describing potential outcomes and military options for Russia in Ukraine. Based on the events that have transpired today it appears that all but the worst-case scenarios are off the table.

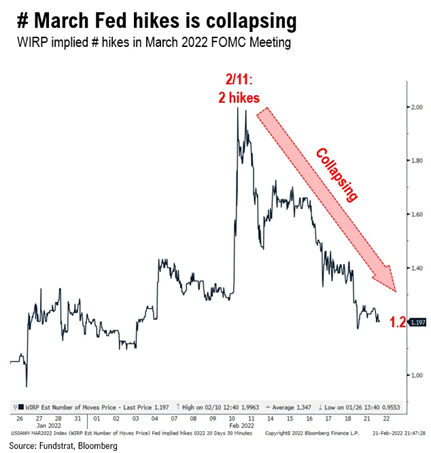

Markets initially were down big on the news across the world. The VIX spiked to $37.5 and the Nasdaq was down 20% from recent highs. However, markets staged a pretty stunning reversal and closed significantly higher. Oil spiked above $100 for the first time since 2014. Some Fed officials have also mentioned that the Ukraine War may factor into upcoming decision-making. Prospects for a 50 bps hike further declined on Thursday as well. However, the initial positive news shouldn’t discount the seriousness and potential implications of what could come. The American post-war order is facing one of its most significant challenges since its inception, and modern economic growth has occurred under the umbrella of that post-war order, sometimes referred to as “Pax Americana.”

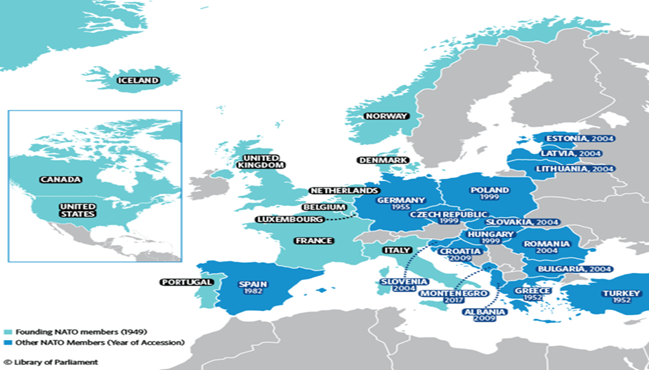

The best scenario for markets would have been that Putin stopped short of actual invasion and tried to claim the recognition of Ukraine’s rogue Eastern regions in Donetsk and Luhansk as a face-saving victory. It well could have been described as that, since this strategy has before successfully prevented Georgia from joining NATO despite it having been invaded in the past. This would have limited the economic fallout and obviously would have been much better for Ukraine. Current thinking at NATO has excluded countries with open conflicts with Russian proxy forces for good reason. That thinking, as much in the world, may change after the dastardly and unprecedented attack.

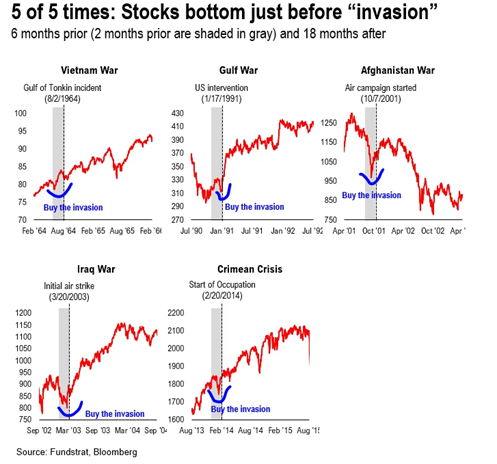

This is truly one of the scariest and most precarious moments in geopolitical affairs in decades and the prospects for a long and drawn-out ground war is a distinct possibility. However, as we have mentioned, historical precedents suggest ‘selling the runup and buying the invasion’ has been successful in the past. Every situation is different and this one certainly could still prove problematic for markets over the medium, or potentially even long term.

There are troubling reports from Western intelligence that Putin intends to subdue the country with extreme violence by rounding up Ukrainian nationalists for execution or imprisonment, and that he will likely crush any street demonstrations with ferocity, gives the conflict an added dimension of seriousness and raises the prospect of a potential military confrontation between Russia and NATO, though this is still a low probability event at this time. One surprising development is that protests have been breaking out against the war across Russia itself. In a past Ukrainian nationalist insurgency against the Soviet Union, very brutal tactics were used to suppress it. Recent operations in Syria illustrate that brutality is a go-to tactic for Russian forces.

A positive development in this saga for markets would be if Russia is imitating its strategy from the 2008 Georgia War where it feigned a full-scale invasion only to retreat after concessions were met. Even this scenario is seeming unlikely given Putin’s rhetoric. Not only did he seem to threaten the West with nuclear weapons in his speech announcing the operation in Ukraine, but he also said that he is dedicated to a full de-militarization of the country, quite an ominous goal. So, the length and intensity of the subsequent conflict will have a great bearing on how much this event will affect the world and markets.

Putin claimed a particularly ironic goal to “de-nazify” the country as well. In earlier days, his rhetoric about Ukrainian sovereignty indicates that he likely intends to replace the Ukrainian government by force. All indications now suggest that Russia is moving to occupy urban areas. Also, actions that Russia has already undertaken are likely to provoke the most draconian Western sanctions ever imposed, which means Putin may feel he has little to lose. In addition, he has bolstered his foreign reserves to over $600 billion to blunt the impact of Western sanctions.

Military Situation in Ukraine- Western Response and Key Issues to Watch

Early in the afternoon following the Russian attacks, President Biden announced new sanctions against Russia, as did many of our European allies. He did not take the action of banning Russia from SWIFT, ostensibly because European allies were not on board. The new sanctions did target most of the Russian banking system and the ruble reached its lowest level against the US dollar ever. The Russian stock market plummeted over 30% before being shut down by local authorities. Borrowing costs in Russia are around 25%. Initial developments in the ground fighting suggest Ukrainians may be making good use of their anti-tank weapons, which could slow Russian progress. Fighting at an airfield near Kyiv also was fierce. It is definitely not a complete route at this point as some predicted.

The President said the effect of sanctions would take time to play out. Sanctions of Vladimir Putin personally remain on the table but have not yet been activated. The West may be waiting to see how far Putin’s actions go, and the Biden Administration’s response so far seems aimed at building maximum international consensus rather than inflicting maximum pain on Russia with all available non-military options. The US currently has no public plans to send any soldiers into Ukraine, but the US and NATO are sending forces to reinforce the Eastern flank.

Russia’s military has a very different doctrine than the US and most Western militaries. It focuses on the overwhelming use of artillery, infantry, and armor. The quickest armored invasions in history were Germany’s Blitzkrieg punch through the Ardennes Forest that resulted in them surrounding French and British forces at Dunkirk.

The second-fastest one was the US to Baghdad from the Kuwaiti border in 2003. These advances averaged about 20 miles a day. It would be very optimistic to assume the Russian military could achieve such a pace and it still has relatively “old-school” logistics constraints like dependence on rail that could hold it back. Given the current military activities of Russia, it seems that a full conquest of the country, rather than more limited options are the goal.

If Russian forces make slower progress than planned, the infamous Rasputitsa that troubled German invaders and turns much of Ukraine into a mud-flat as ice thaws could be a major factor. This deters military mobility and may be a factor if an occupation is planned or the invasion faces setbacks. Ukraine has the distinct advantage of having prepared for an asymmetric conflict with Russia over the past eight years, but their most experienced forces in Donbas are ill-equipped to resist the overwhelming Russian tide. Nonetheless, intangible factors like weather and the poor road infrastructure in Ukraine could turn the Russian invasion into a traffic jam. Most of Russia’s recent military experience has been of a non-conventional nature, not a massive conventional coordinated attack.

Ukraine does not have an advanced and modern anti-aircraft ability. Much of the terrain in between Russia’s forces and the urban centers right now is open fields that would favor Russia’s overwhelming superiority in armor. However, if the forces choose to occupy or besiege urban centers let us remember that it took Russian forces well over a year to wrestle full control of Grozny in Chechnya. At 400,000 residents it is a considerably smaller city than Kiev, Kharkiv and Odessa. Ukrainian defensive efforts will likely be more effective in urban combat and President Zelensky has offered to arm anyone willing to fight. Russian military efforts in the southern thrust are likely designed to prevent Ukraine’s most experienced forces in the Donbas from reinforcing the embattled capital.

Ukraine also has a cultural history of fierce resistance to invaders and was at the center of the greatest military conflict in history, The Eastern Front in World War II. The close cultural ties and Soviet history means that Ukrainians are also eminently familiar with Russian tactics and military doctrine. This is the largest combined Russian military operation since the Battle of Berlin.

So, the Russian military is taking a big gamble and hasn’t executed anything on this scale in many decades. The US and NATO allies have openly stated they will provide the kind of proxy-war assistance that foiled our forces in Vietnam and Soviet forces in Afghanistan. Some pundits speculate that Putin’s judgment may be compromised by being surrounded by “yes men.”

Economic Effects Will Depend on Length and Severity of the Conflict and Sanctions

There has been a lot of coverage recently that suggests geopolitical tensions are often short-lived and abrupt, but that in most cases markets recover shortly after. This has been the case. A notable exception is the Yom Kippur War and the subsequent oil embargo that it triggered. Russia is a massive country by landmass and produces many commodities from grain to precious metals and of course energy. Russia produces about 12% of the world’s oil.

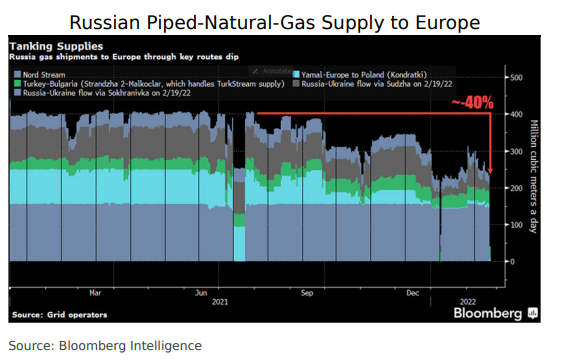

Together, Ukraine and Russia are responsible for over a quarter of the world’s grain exports. So, the US sanctions will likely increase inflationary pressure by isolating large portions of the supply of certain commodities. The longer the disruptions from sanctions and war lasts, the worse the economic consequences will likely be. The Nordstream 2 pipeline has been halted by Germany. Natural gas supply chains will have to respond quickly if Russia fully cuts off its gas exports to Europe, although they’ve declined substantially from levels even a year ago.

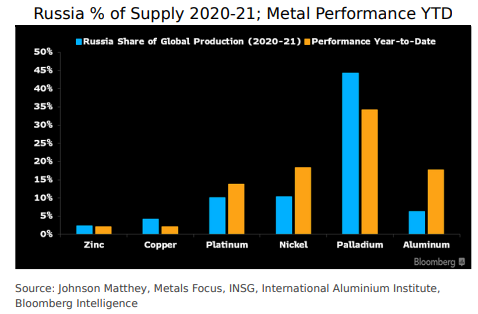

Many precious metals and commodities Russia produces are also subject to the winds of war now. Russia produces 43% of the world’s palladium. This is a crucial metal for fuel cells powering cars and buses amongst other things. It also produces 16.6% natural gas and given supply chains; it is responsible for the lion’s share used by Europe. In the event of prolonged conflict, these supply issues will compound and affect the economy more and more. However, the economic effects of this conflict appear, so far, to be most detrimental to Russia itself which has a GDP around the size of Brazil. Supply chains and inflationary pressures will undoubtedly be exacerbated. Europe’s gas prices rose by 30% this morning.

One effect of this event may be an increase in military spending by the US and NATO allies. Bi-partisan support for congressional sanctions and arms to Ukraine has been talked about by members of congress and should materialize soon. Many NATO members have underspent on defense, and this is likely to change. However, this also benefits US defense contractors, many of whom have substantial international business.

One potential area to watch is cryptocurrency. To what extent it may be used by a Russian oligarchy to avoid sanctions is unclear, but we’re hoping it doesn’t get caught up in US efforts to thwart Russia. Ukrainians have also used crypto during the crisis and given the Russian oligarchy’s proficiency at money laundering with traditional currency and hard assets, although we don’t think crypto will be the primary way they choose to move their capital compared to other methods.

Luckily, western banks have pretty low exposure to Russia. The economic shock faced by Russia itself, already somewhat isolated by sanctions from 2014, will likely not produce financial contagion in the west. Though, the war itself and associated development coupled with/or along with uncertainty could certainly result in a decline in investment and deterioration of credit markets. The commodity shocks seen today will likely continue for a bit and the task of taming inflation for the central banks of the world has become trickier by the largest conflict in Europe since the Yugoslavian Civil War.

5 Stocks for Peace of Mind In A World Of Escalating Geopolitical Tensions

General Dynamics (GD 0.12% ): General Dynamics is a leading US defense contractor with a strong history of rewarding shareholders and has a strong buyback and dividend strategy. It is also slated to benefit from several expanding areas of the US defense budget shifting toward big power confrontation and away from counterterrorism. Importantly, General Dynamics has a solid backlog associated with the modernization of the US nuclear triad which should remain a key priority considering recent developments. GD sells a lot of vehicles to European allies and produces the Abrams battle tank, a particularly useful weapon in a European ground war like that unfolding in Ukraine.

Microsoft (MSFT 0.08% ): There are a lot of things to like about a ubiquitous company like Microsoft. However, some may not know that it provides a lot of cyber security services to the US government. It has a growing role in helping to ensure the safety of the digital space on behalf of the United States and its allies. When Russian hackers breached US government agencies in 2020 with an offensive cyberattack, it was Microsoft, not the spooks who discovered the breach.

Chicago Mercantile Exchange (CME -2.89% ): CME is one of the most prominent exchanges in the world. Volatility is good business for the company that derives the majority of its revenue from volume-based income on energy and interest rate derivatives. The company has a countercyclical element to its price appreciation because when investors are buying more instruments to hedge during times of elevated uncertainty, CME makes more money. We suspect there will be a lot of energy risk management regarding this activity which CME should benefit from.

Baker-Hughes (BKR 0.59% ): Obviously an energy company was going to appear on this list. Since the beginning of 2022, Energy has been by far the best place to put your money. We like Baker-Hughes for a number of reasons in addition to just the energy adjacent side of the business. It has a great management team and also has a strong renewables business that will likely benefit from the continued European shift away from reliance on Russian energy. The company has a better balance sheet than its peers and its Turbomachinery & Process Solutions business is best in class and gives it ESG credentials as well.

Raytheon (RTX -0.13% ): In Putin’s chilling speech announcing the invasion he appeared to refer his recent advances in hypersonic nuclear delivery systems as a deterrent to western involvement. Raytheon is the US defense contractor leading our own hypersonic capabilities, which are likely much greater than the public knows. Like General Dynamics, we selected this defense contractor because of its special competencies. It is a leader in defense applications in the newest domain of space, cyber capabilities, and also missile defense. These are all areas of the defense budget that may benefit from the modern security situation and pivot toward Great-Power competition.