Technical Strategy Video (Recorded Monday, October 25th):

Key Takeaways

- Monday’s follow-through in New high territory for S&P, DJIA occurred on better market breadth than last week, while NASDAQ now just 1% away from new all-time highs

- Mid-Cap 400 breakout back to new highs to join Large-Caps is constructive technically, while Small-caps have begun to outperform; IWM breakout should follow

- Alt-Energy has begun to pick up strength lately after months of lagging the broader Energy move; Meanwhile, Fin-Tech breakout back to new highs should drive outperformance

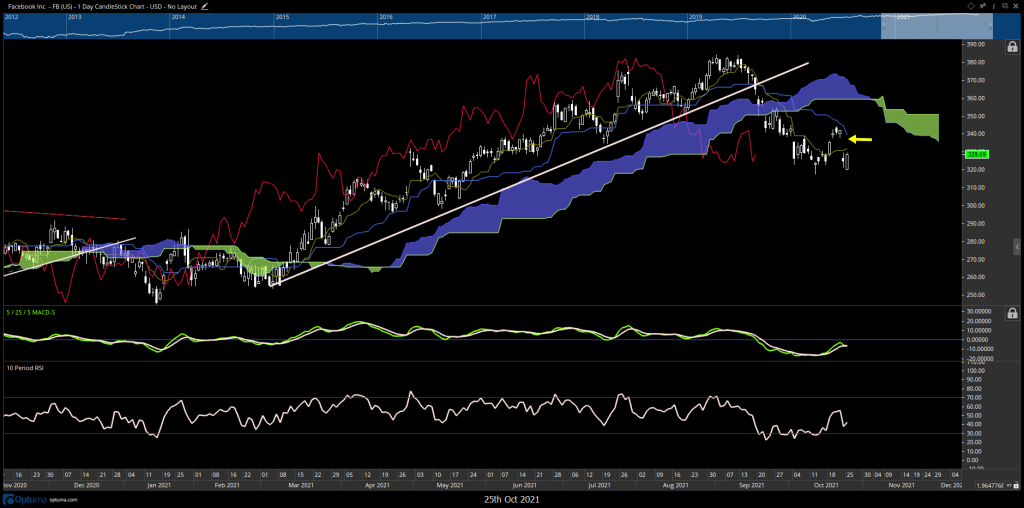

Tech earnings got kicked off with Facebook post-close Monday. Despite posting slower sales growth, the stock jumped after-hours to fill last week’s gap and traded over $342 before settling a bit (Trading $333 as of 5:30pmEST vs 10/25 close of $328.69) The recent stabilization is thought to be a technical positive in the short-run. Thus, after its recent underperformance since September, this ability to hold and turn higher looks to be a short-term bullish factor.

Global X FinTech ETF breaking out bodes well for further outperformance

- The FinTech group looks to be quickly coming back to life, following a lengthy 6-8 month consolidation in many of these names. The Global X FinTech ETF (FINX) looks to be one to overweight as this has just broken out of an eight-month Cup and Handle pattern after consolidating since February.

- FINX looks more bullish than the Ark Innovation FinTech ETF (ARKF 5.02% ) as the FINX holdings of UPST, AFRM, BILL look more bullish technically than ARKF’s holdings of more than 10% in TWLO, PYPL and Z, which all have been laggards in recent months and not as strong technically

- Upside targets for FINX lie near $57.85-$60 which represents a confluence of several different Fibonacci extensions

Alternative Energy ETF’s also beginning to play Catch-up

- Energy’s 21.19% gains over the last three months ( XLE 1.97% data through 10/25/21) and 55.15% gains Year-to-Date through 10/25/21 have outpaced many stocks within the Alternative Energy space

- ICLN , the Ishares S&P Global Clean-Energy index fund, (displayed below) showed some strength on Monday that indicates this group might be ready to play catch-up, as this rose to the highest levels since April 2021 following lengthy consolidation. This breakout from Monday argues for near-term acceleration to $25-$25.50 with medium-term targets at 27.35.

VanEck Low Carbon Energy ETF, SMOG, also looks quite bullish technically after breaking out of its consolidation since February. Additional upside gains look likely which should reach the low $180’s. Overall, an increasing number of alternative Energy stocks starting to break out to new weekly/monthly highs makes it seem likely that a rotation back into this group is starting.

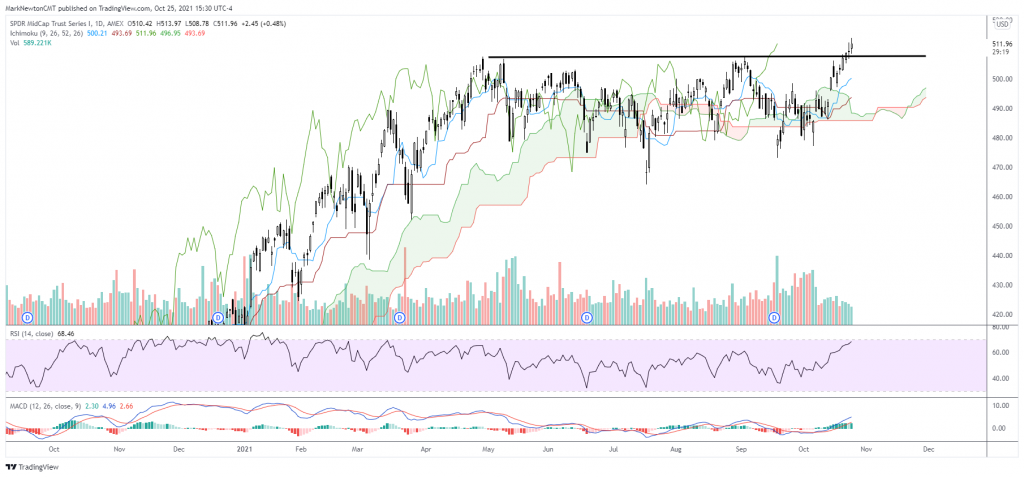

Finally, Mid-Caps have just broken back out to new all-time high territory (See below)

This MDY 0.94% Breakout (SPDR Mid-Cap Trust Series 1) looks important, as this area had lagged in absolute terms since the Spring and had not moved back to new all-time highs like the large-cap SPX, nor NDX. This recent outperformance is constructive towards thinking market breadth and participation is improving.

Small-cap outperformance also looks to be picking up lately and IWM is now within striking distance of its own Channel resistance that intersects near $233.64-$234. It’s expected that IWM likely does break back out to new high territory into mid-November, and that this entire trading pattern since February/March is just a temporary consolidation for IWM.