Near-term US Equity trends are bullish, and Wednesday’s recovery helped to carve out a short-term trading low despite a few days of consolidation since late October. As discussed, AMZN, GOOGL, TSLA, NVDA, PLTR, and AAPL all still look quite bullish and have not shown proper evidence that they have peaked out. While the bifurcation between large-cap Technology/Discretionary and the broader market has grown more severe, it’s still likely that SPX could power higher into mid-November given the momentum of this rally alone. Overall, I expect that US stock indices have entered a much choppier trading environment between now and the end of November. Ideally, this might play out as follows: A short-term rally back to new highs for SPX and QQQ, which is then followed by some backing and filling into late November. This would align with my cycles and provide a very attractive entry point into late November or the first week of December, before a push back to new high territory.

Wednesday’s recovery was a much-needed step higher after numerous risk assets had begun to trade lower into early November. While the deterioration in cryptocurrencies proved to be far more damaging to the near-term trends than that of Equity indices, both look to be attractive at current levels for a push back to new highs.

Despite no encouraging news yet regarding a possible end of the government shutdown, Polymarket does show the highest likelihood based on the wagering amounts to center on November 8-12th of this month.

Overall, as I discussed yesterday, reasons for optimism have less to do with when a shutdown ends and have more to do with the attractiveness of many “Magnificent 7” stocks, which haven’t yet shown any real evidence of having peaked out.

As seen below, the first step to this rally happened on Wednesday with a lift to test the area near prior lows from earlier this week. ^SPX achieved just one trading hour over 6820 before stalling out and promptly pulling back.

I don’t take this to mean the rally is failing. However, it will be important for ^SPX not to spend much time back near Tuesday’s lows, but rather to push higher to exceed 6830 and, more importantly, 6850.

The next couple of days should provide the answer, which shows us how this pattern is resolved. I remain betting that it should be to the upside.

S&P 500 Index

Any short-term reprieve in Energy should prove short-lived into mid-November before a larger decline

Energy showed a few “signs of light” on Wednesday, despite WTI Crude oil finishing lower by more than 1%.

Many Oil Services names have been strengthening lately and look to be in better technical shape than the Exploration and Production stocks.

However, what has been interesting lately is the strengthening in the Equal-weighted Energy ETF (RYE 0.58% ), which appears to be trying to break out of a one-month triangle pattern after Wednesday’s push to multi-day highs.

While I disagree with Energy being a sector to overweight between now and year-end, I do sense that a possible bounce could happen with Energy stocks into mid-November, which might lift this sector and provide some support for the Equal-weighted S&P 500 ETF (RSP 0.59% ) to show some outperformance over ^SPX.

Overall, any minor boost in Energy into November would likely lift Energy to a poor area from a risk/reward standpoint before this starts to decline into year-end.

Given the cycles and technical structure, Crude makes a strong case for falling back to the low $ 50s. I’m reluctant to chase any minor lift in Energy in the weeks ahead.

Invesco S&P 500 Equal Weight Energy ETF

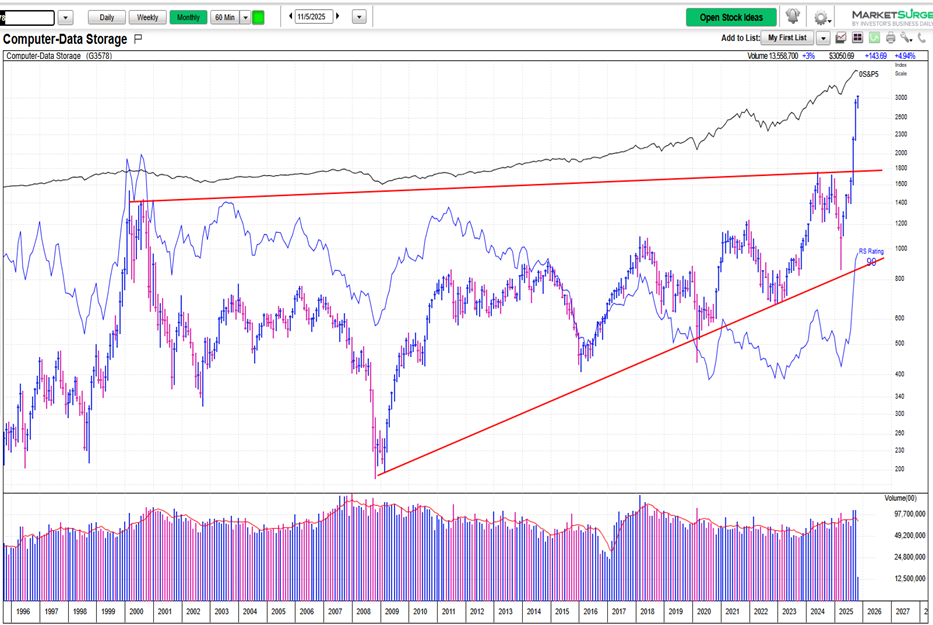

Computer-Data Storage remains the #1 sector out of 197 industry groups ranked by Investors’ Business Daily

Disk drive makers like WDC 5.80% or STX 10.68% have begun to press back higher aggressively after just a couple of days of consolidation. These are quite bullish in the short run, and I expect STX 10.68% to push up to $310, which is roughly a 100% alternate extension of the 10/28-10/31 swing.

It looks right to be bullish on this group, which continues to impress in its resilience, aside from being overbought on many metrics. This next push to new highs likely will encounter resistance into mid-November and consolidate, however, as negative momentum divergence is building and will likely affect many of these stocks in late November.

As this Sector chart of Computer-Data Storage shows below, this group remains parabolic following the breakout of former all-time highs achieved nearly 20 years ago.

While many look at stocks like STX 10.68% and WDC 5.80% and claim they’re overbought (and they’re right, in my view), that’s a notoriously poor way of stock selection. The act of a multi-year breakout back to new highs often can lift these names far higher than many who utilize daily charts might feel is possible.

Overall, while Data Storage currently is quite overbought, I still like this sector to outperform between now and early next year.

Computer-Data Storage

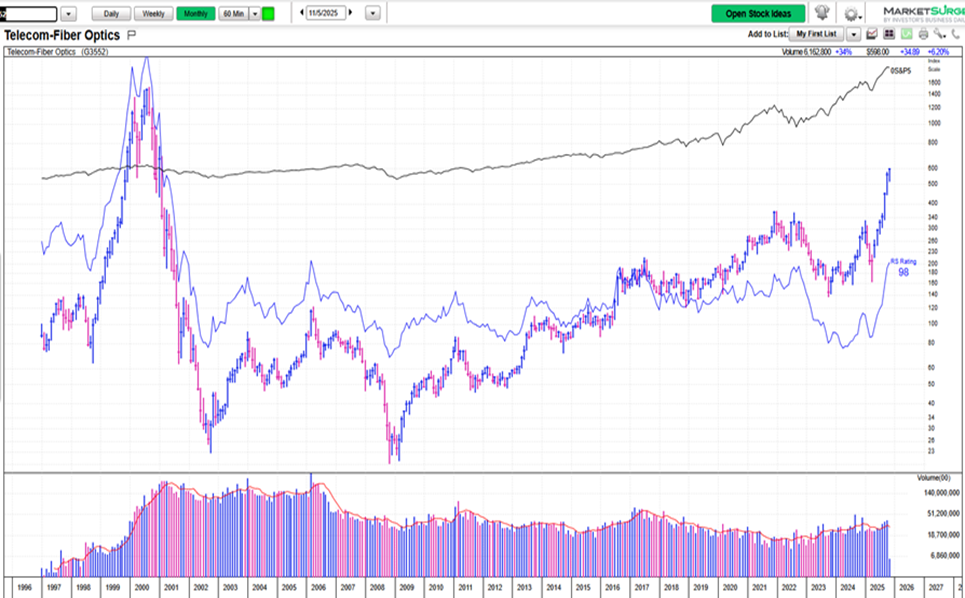

Telecom-Fiber Optics sub-sector continues to have appeal

Telecom-Fiber Optics has been showing tremendous strength and ranks quite highly among sub-sectors across all industries. We see that high flyers like Lumentum Holdings (LITE 25.56% ) and Ciena (CIEN 8.07% ) have dominated performance lately and both are pushing back to new highs today. This is an attractive area in the near term, but it is growing overbought. (Other key names within this group are VIAV 2.74% , LPTH 1.06% , CLFD -1.51% and OCC -0.51% .)

I like both LITE 25.56% and CIEN 8.07% and still feel Telecom-Fiber Optics will strengthen further into the year-end. Overall, this remains an attractive area technically, and one to overweight between now and year-end.

Telecom-Fiber Optics