Near-term trends are bullish for SPX and I anticipate a sharp rally to finish the month of October after an interesting period of sector rotation in recent weeks. Monday’s success in climbing over last week’s highs for SPX and QQQ should enable these to both push back to new all-time high territory. Despite some minor warnings regarding breadth, high yield spread widening, and/or lack of broad-based participation, it looks like breakouts in AAPL GOOGL and NFLX should help Technology show sufficient leadership to carry US stock indices over the next few weeks. At present the Treasury rally along with Precious Metals rally both seem to be continuing this week but should be vulnerable to trend change upon October coming to a close.

Overall, the minor triangle pattern of the last few weeks was successfully resolved by an upside breakout in both ^SPX and QQQ 2.28% today.

This is bullish for a push back to highs, despite no evidence of the Govt. shutdown abating, nor any further confidence about the FOMC’s plans at the end of October.

As shown below, appears like a constructive near-term breakout, and there appears to be added conviction given that stocks like AAPL 0.35% , GOOGL 4.03% and NFLX 1.51% have all engineered short-term breakouts as of Mondays’ close.

While some backing and filling might happen this week similar to last week’s occurrence (10/13-10/14 minor weakness) filled the gap from 10/10-10/13 in SPY 1.40% . A similar gap filling would suggest SPY 1.40% might have strong support at 665.76.

As seen on daily charts of the ^SPX cash index below, the pullback into early September had successfully bottomed along a trendline that had formerly made a low near this same uptrend which had been ongoing since mid-May.

The 10/10 sharp decline also successfully bottomed near this spot (652 in SPY 1.40% , 6550 in ^SPX) and makes this something to watch carefully in the future given that it’s now held on four separate occasions since mid-May.

At present, I’m expecting a push up to 6764 while 6679 could hold on any near-term “backing and filling” of Monday’s rally.

Overall, Monday’s minor breakout for ^SPX and QQQ 2.28% helps to gain conviction about this minor sideways trend from mid-September now turning back to new all-time high territory.

S&P 500 Index

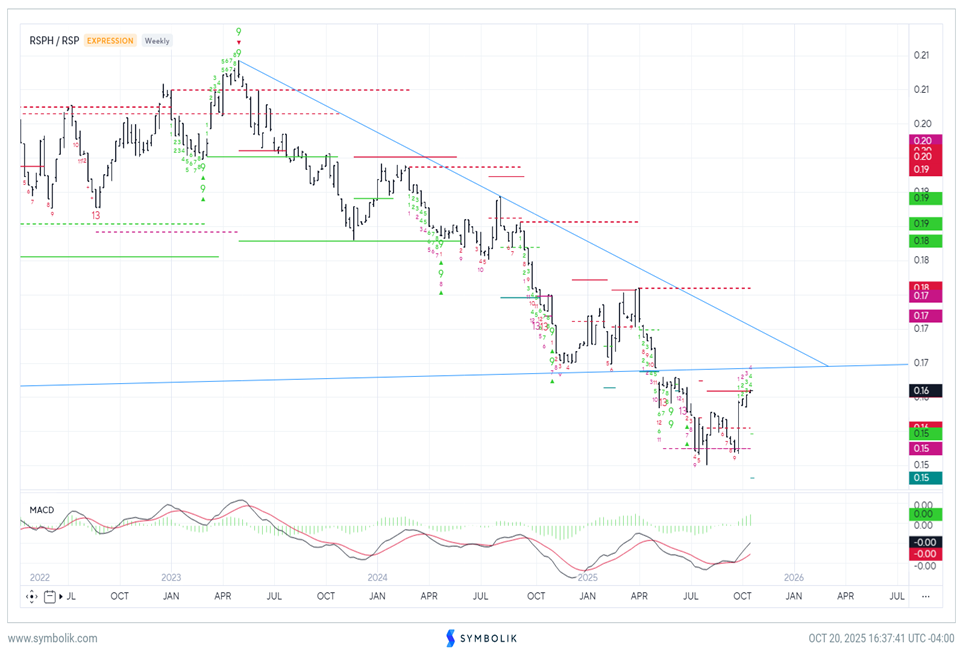

AAPL push back to new highs is helpful for SPX, QQQ given its weight

AAPL 0.35% back at new highs as of today! Investors should pay attention to what’s moving back to new highs today as AAPL 0.35% ’s 6.4% weighting keeps this as the 2nd largest within ^SPX.

Today’s volume reached 89 million shares which represented the highest levels since mid-September. That’s encouraging and along with its large low to high range on Monday, I anticipate AAPL 0.35% should push up to technical targets near $283.

But at a current price of $262.24, I expect this does have some follow-through as a result of today’s move and can help to lift US equity markets given its weighting within ^SPX and NASDAQ.

Apple

GOOGL also breaking back out to new highs

While not as large of a holding within SPX, GOOGL 4.03% ’s (A & C shares) 5% weighting makes Monday’s push back to new highs also important and positive for ^SPX and NASDAQ 100.

The minor consolidation over the last month failed to do much damage and as of today’s close, GOOGL’s $256.46 close surpassed the prior peaks from 919/25.

I expect a rally up to near $270 in the short run, while intermediate-term levels to watch lie at $281, representing approximately double the April 2025 lows.

Overall, while some of the “Magnificent 7” have lagged since September, it’s interesting that both TSLA 3.59% and GOOGL 4.03% which were laggards int eh first part of 2025, have both begun to show signs of leadership within “Mag 7” and are stronger technically than stocks like AMZN 1.62% , or MSFT 1.83% at present.

Alphabet Inc (Google) Class A

Healthcare’s recent October strength should help to carry this sector higher into November before a stalling out

Monday’s gains in Healthcare as seen from the perspective of the Equal-weighted Invesco Healthcare ETF (RSPH -0.07% ) proved to be the second strongest performing sector ETF with gains over +1.35%.

As seen below, this rally was quite important and positive technically and should likely help this sector continue higher over the next few weeks.

Some of my favorite healthcare names right now are: LH 3.33% , MCK 0.87% , JNJ 1.30% , GILD -0.58% , BSX 0.89% , DGX 0.63% , HCA -3.63% , CAH 0.86% , IQV 1.23% , and ABBV -0.21% .

Unfortunately, despite the near-term outperformance of Healthcare in October, its intermediate-term downtrend warrants selectivity when picking names from this sector. However, the ones I’ve listed below look technically attractive at current levels and have excellent structure.

Invesco S&P 500 Equal Weight Health Care ETF

Healthcare’s strength has its work “cut out for it” before this can become a sector to Overweight for the medium term, technically

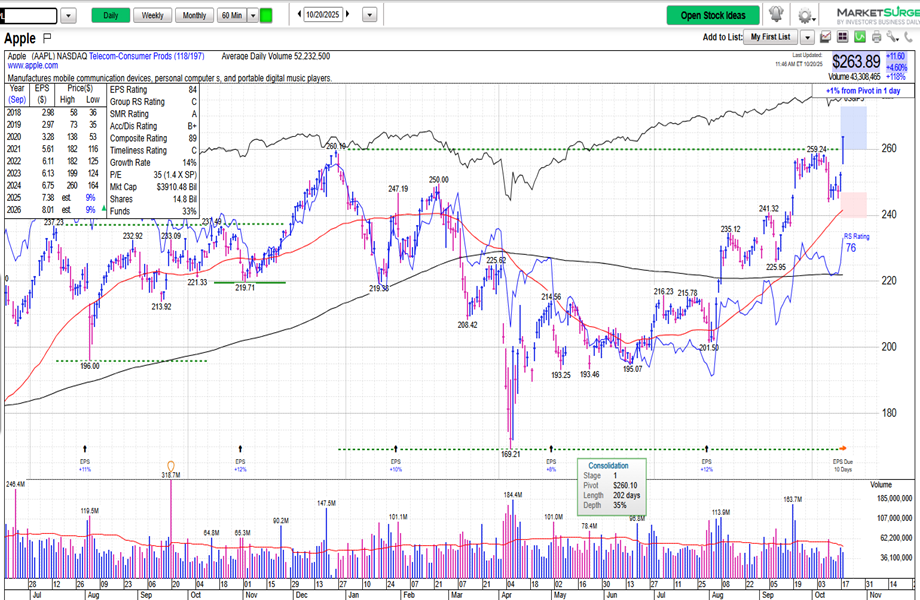

It’s important to show this weekly ratio chart below, as despite the near-term outperformance in October, Healthcare remains in a multi-year downtrend (when viewed in relative terms vs the Equal-weighted ^SPX).

As seen below, following a difficult period for this sector since 2023, Healthcare managed to bottom out in relative terms and has begun to strengthen in recent weeks.

While I do suspect this recent strength continues, it’s difficult yet to make the case for intermediate-term outperformance.

In the weeks to come, I anticipate that Healthcare should rise in relative terms and might challenge the prior lows from late 2024 into Spring of 2025. However, to have real conviction about this sector’s ability to outperform, it’s necessary to see a breakout of this intermediate-term downtrend.

This looks premature at this time, but will be important to watch this sector carefully on further signs of strength into November. (Chart below illustrates the weekly ratio chart of RSPH -0.07% vs RSP 0.66% .)

RSPH/RSP