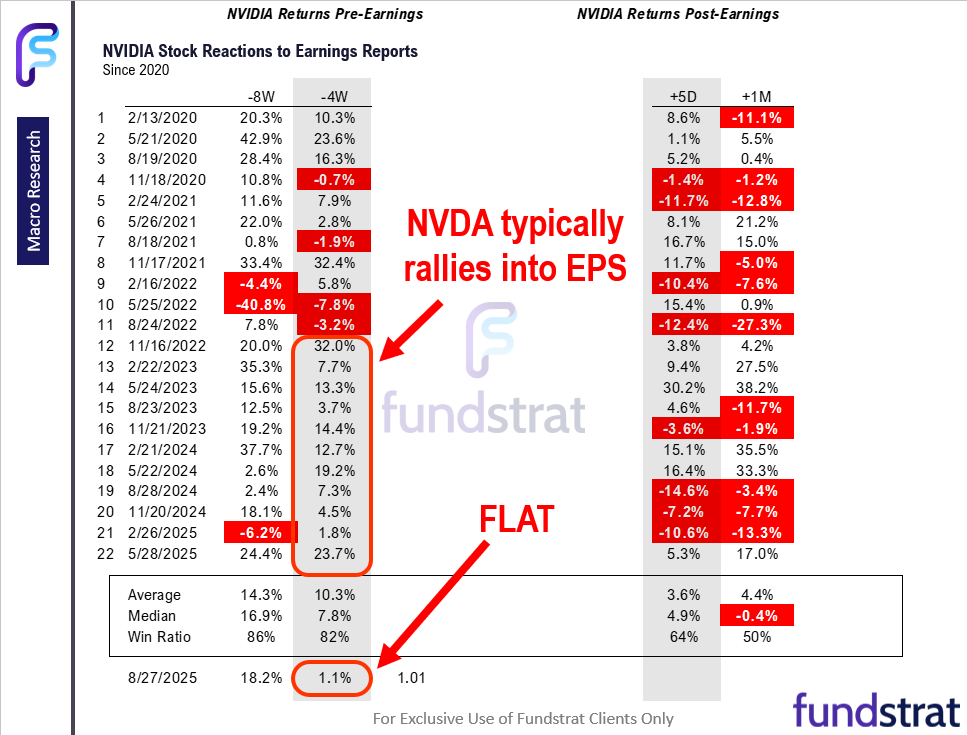

VIDEO: NVDA reports quarterly results after the close Wed. The stock has been flat for the past 4 weeks, reflecting investor apprehension into results. Thus, we think odds favor a rally post-quarterly results (Thu am)

Please click here to view our Macro Minute (duration: 3:22).

NVDA, the most important company in the World, reports quarterly results after the close on Wed. We believe the stock is likely to rally post-EPS results, meaning a rally on Thursday.

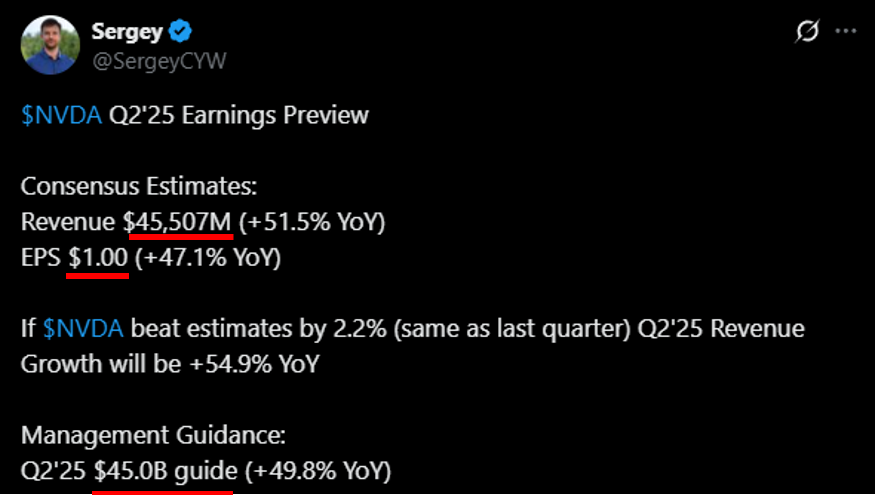

- We do not have any idea whether NVDA will beat consensus expectations, which are currently:

– Q Revs $45.5B, +51.5% YoY

– Q EPS $1.00, +47.1% YoY

– 2Q Revs guidance $45.0B - But what is observable is the following:

– over the last 11 quarters, NVDA 4.45% saw positive gains 4 weeks into earnings

– the 90%-tile range is 4% to 24% gains

– NVDA this year is +1.1%, or flat - This tells us investors are apprehensive, or holding muted expectations for quarterly results. There are multiple reasons including Sam Altman’s recent comments about a potential AI bubble. And general concerns that investors simply do not know where we are in this AI cycle.

- But keep in mind, NVDA remains the most important company in AI and AI remains one of the most important structural themes for the next decade. There is a dearth of pure play AI stocks, and NVDA is the best of these. Moreover, until we see many IPOs of AI stocks, we can hardly view this as peak AI.

- Since 2022, NVDA seen a median gain of 30% from -8 weeks to +1M post-EPS. So, we think the probabilities favor a sizable move for NVDA post-EPS. But more importantly, NVDA is a stock that has shown every dip has proven to be profitable. So we would recommend buying any dip.

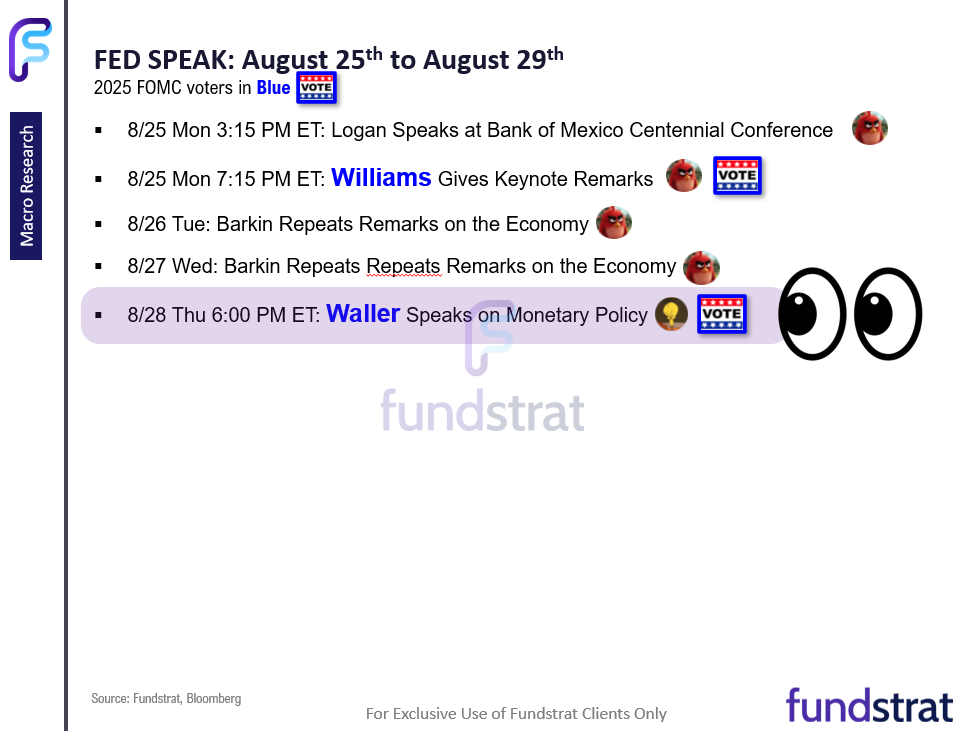

- There are some important data points this week, most important is the Core PCE Release on Friday. But also Fed’s Waller speaks:

– 8/25 Mon 8:30 AM ET: Jul Chicago Fed Nat Activity Index

– 8/25 Mon 10:00 AM ET: Jul New Home Sales 635ke

– 8/25 Mon 10:30 AM ET: Aug Dallas Fed Manuf. Activity Survey

– 8/25 Mon 3:15 PM ET: Logan Speaks at Bank of Mexico Centennial Conference

– 8/25 Mon 7:15 PM ET: Williams Gives Keynote Remarks

– 8/26 Tue 8:30 AM ET: Jul P Durable Goods Orders MoM -4.0%e

– 8/26 Tue 9:00 AM ET: Jun S&P CS home price 20-City MoM -0.05%e

– 8/26 Tue 10:00 AM ET: Aug Conference Board Consumer Confidence 96e

– 8/26 Tue 10:00 AM ET: Aug Richmond Fed Manufacturing Survey

– 8/26 Tue: Barkin Repeats Remarks on the Economy

– 8/27 Wed: Barkin Repeats Repeats Remarks on the Economy

– 8/28 Thu 8:30 AM ET: 2Q S GDP QoQ 3.1%e

– 8/28 Thu 11:00 AM ET: Aug Kansas City Fed Manufacturing Survey

– 8/29 Fri 8:30 AM ET: Jul Core PCE MoM 0.29%e

– 8/29 Fri 10:00 AM ET: Aug F U. Mich. 1yr Inf Exp

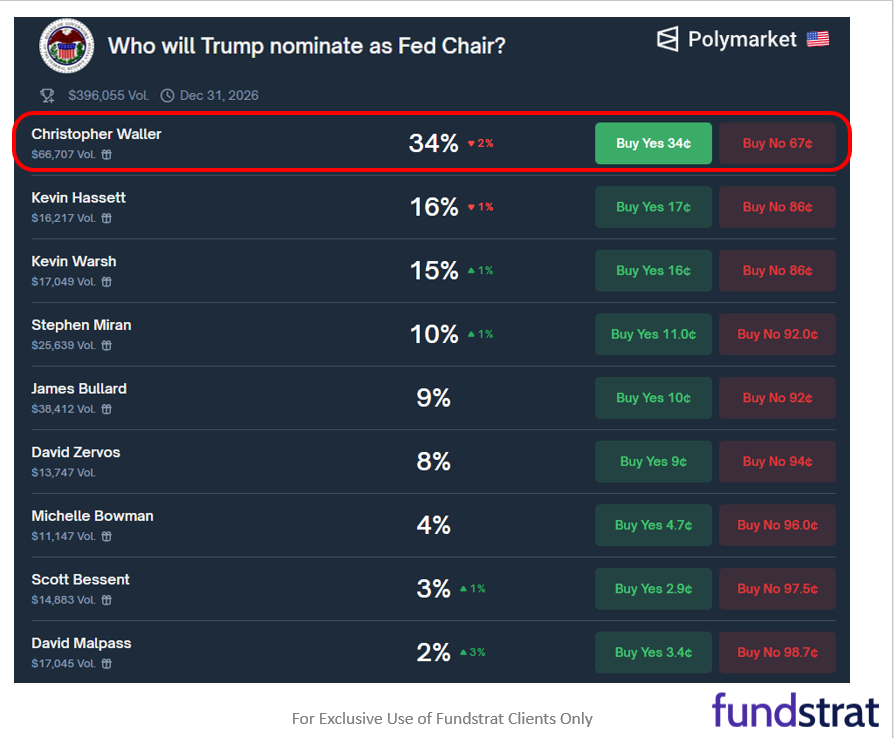

– 8/28 Thu 6:00 PM ET: Waller Speaks on Monetary Policy - We are keeping an eye on Waller as Polymarket gives him a 33% chance of being the next Fed Chair. So markets are keeping an eye on his comments.

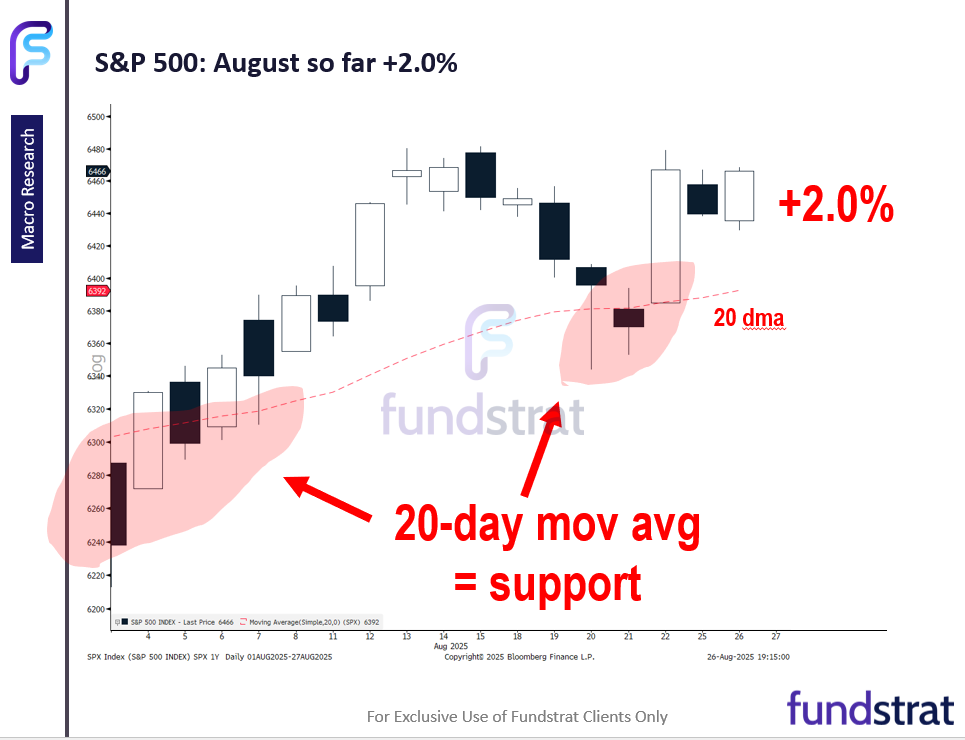

- Lastly, the S&P 500 has bounced off the 20-day moving average twice in August. To us, this is the key support level and as long as we stay above the 20dma, trends remain positive. In fact, this has been the case since the tariff lows (see below), with the 20dma acting as support.

- So for us, the risk/reward for stocks remains positive. We realize we are nearing the quiet September period. But for now, the risk/reward is positive.

BOTTOM LINE: Still “most hated rally”

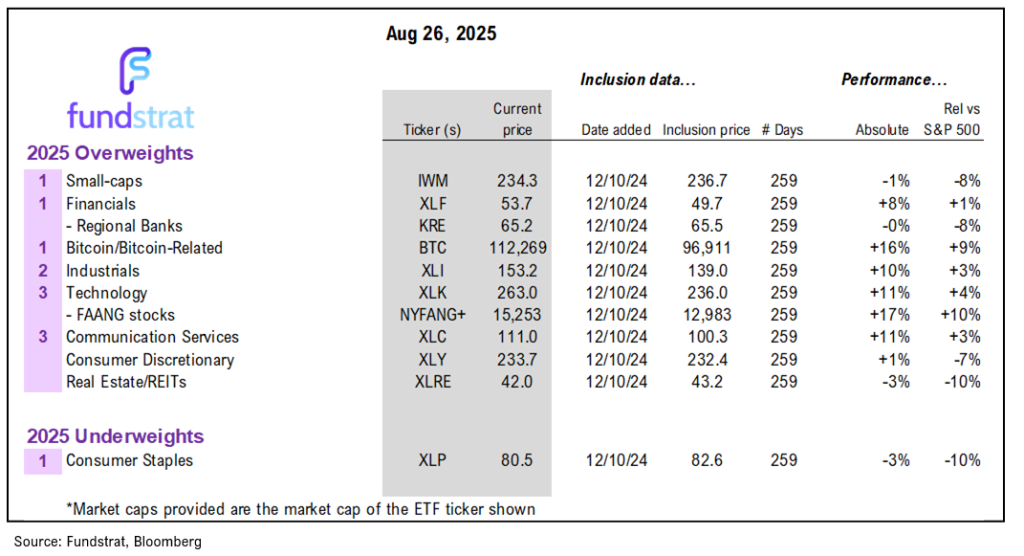

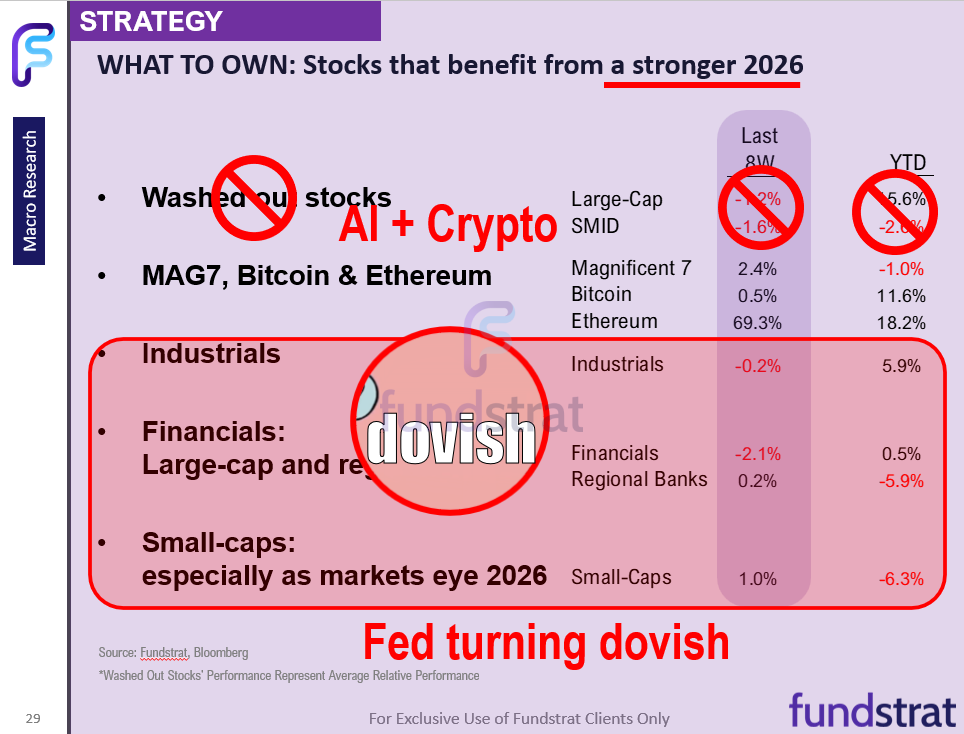

This still remains the “most hated” V-shaped stock rally. As for what we would buy

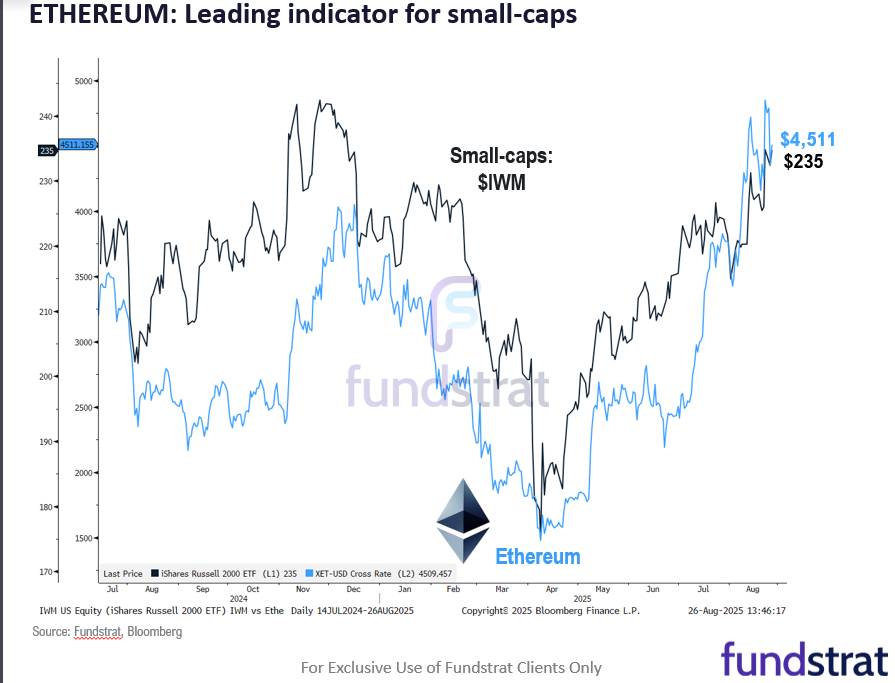

- MAG7 & Bitcoin & Ethereum

- Industrials

- Financials: Large-cap and regional banks

- Small-caps

_____________________________

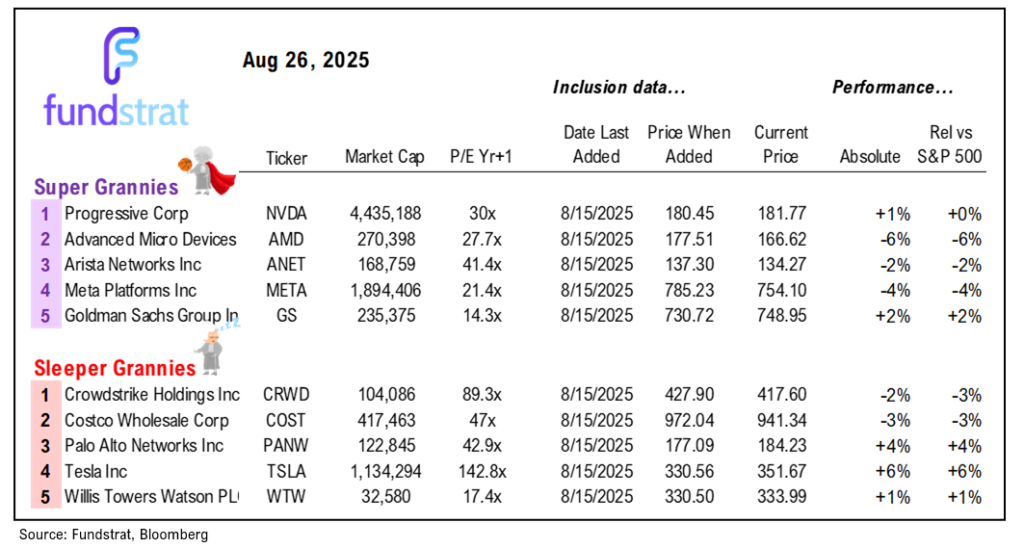

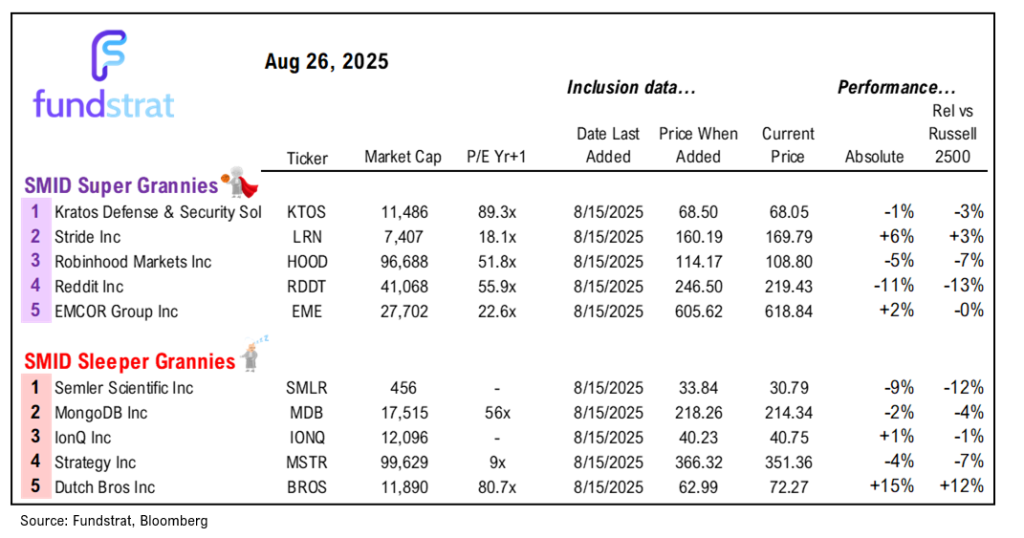

50 SMID Granny Shot Ideas: We performed our quarterly rebalance on 8/17. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review

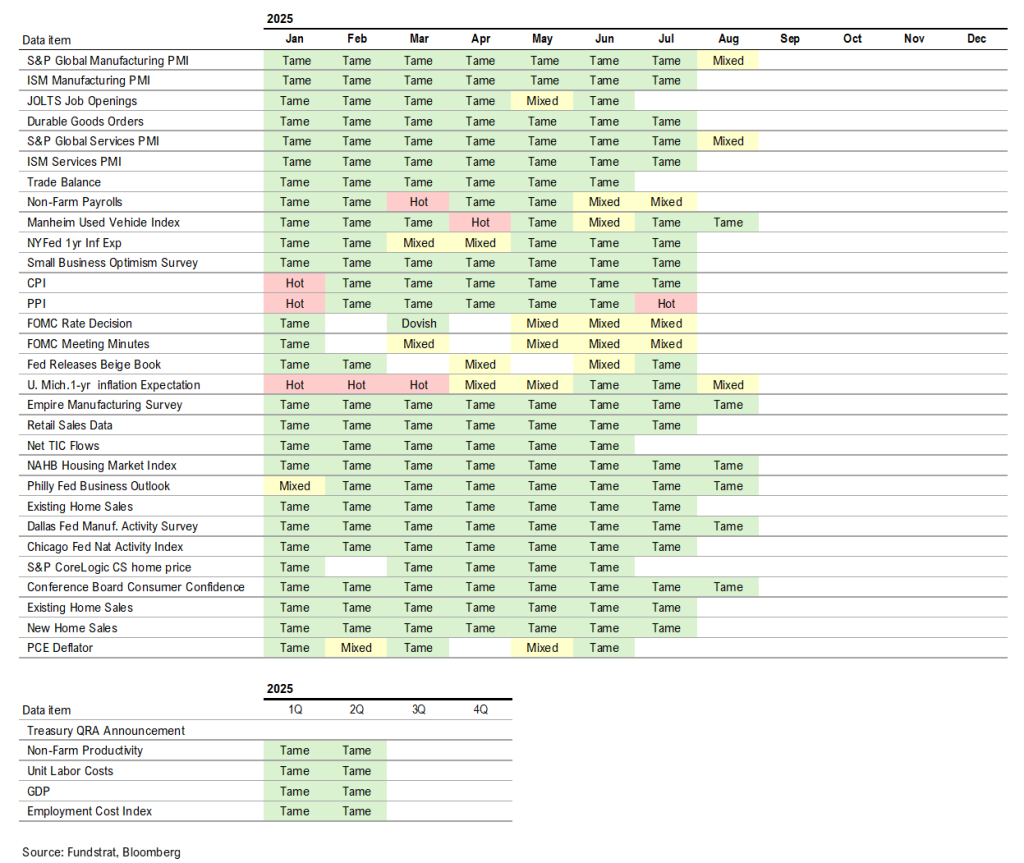

Key Incoming Data August:

8/1 8:30 AM ET: Jul Non-farm PayrollsMixed8/1 9:45 AM ET: Jul F S&P Global Manufacturing PMITame8/1 10:00 AM ET: Jul F U. Mich. 1yr Inf ExpTame8/1 10:00 AM ET: Jul ISM Manufacturing PMITame8/4 10:00 AM ET: Jun F Durable Goods Orders MoMTame8/5 8:30 AM ET: Jun Trade BalanceTame8/5 9:45 AM ET: Jul F S&P Global Services PMITame8/5 10:00 AM ET: Jul ISM Services PMITame8/7 8:30 AM ET: 2Q P Unit Labor CostsTame8/7 8:30 AM ET: 2Q P Nonfarm Productivity QoQTame8/7 9:00 AM ET: Jul F Manheim Used Vehicle IndexTame8/7 11:00 AM ET: Jul NYFed 1yr Inf ExpTame8/12 6:00 AM ET: Jul Small Business Optimism SurveyTame8/12 8:30 AM ET: Jul Core CPI MoMTame8/14 8:30 AM ET: Jul Core PPI MoMHot8/15 8:30 AM ET: Aug Empire Manufacturing SurveyTame8/15 8:30 AM ET: Jul Retail SalesTame8/15 10:00 AM ET: Aug P U. Mich. 1yr Inf ExpMixed8/15 4:00 PM ET: Jun Net TIC FlowsTame8/18 10:00 AM ET: Aug NAHB Housing Market IndexTame8/19 9:00 AM ET: Aug M Manheim Used Vehicle IndexTame8/20 2:00 PM ET: Jul FOMC Meeting MinutesMixed8/21 8:30 AM ET: Aug Philly Fed Business OutlookTame8/21 9:45 AM ET: Aug P S&P Global Services PMIMixed8/21 9:45 AM ET: Aug P S&P Global Manufacturing PMIMixed8/21 10:00 AM ET: Jul Existing Home SalesTame8/25 8:30 AM ET: Jul Chicago Fed Nat Activity IndexTame8/25 10:00 AM ET: Jul New Home SalesTame8/25 10:30 AM ET: Aug Dallas Fed Manuf. Activity SurveyTame8/26 8:30 AM ET: Jul P Durable Goods Orders MoMTame8/26 9:00 AM ET: Jun S&P CS home price 20-City MoMTame8/26 10:00 AM ET: Aug Conference Board Consumer ConfidenceTame8/26 10:00 AM ET: Aug Richmond Fed Manufacturing SurveyTame- 8/28 8:30 AM ET: 2Q S GDP QoQ

- 8/28 11:00 AM ET: Aug Kansas City Fed Manufacturing Survey

- 8/29 8:30 AM ET: Jul Core PCE MoM

- 8/29 10:00 AM ET: Aug F U. Mich. 1yr Inf Exp

Economic Data Performance Tracker 2025:

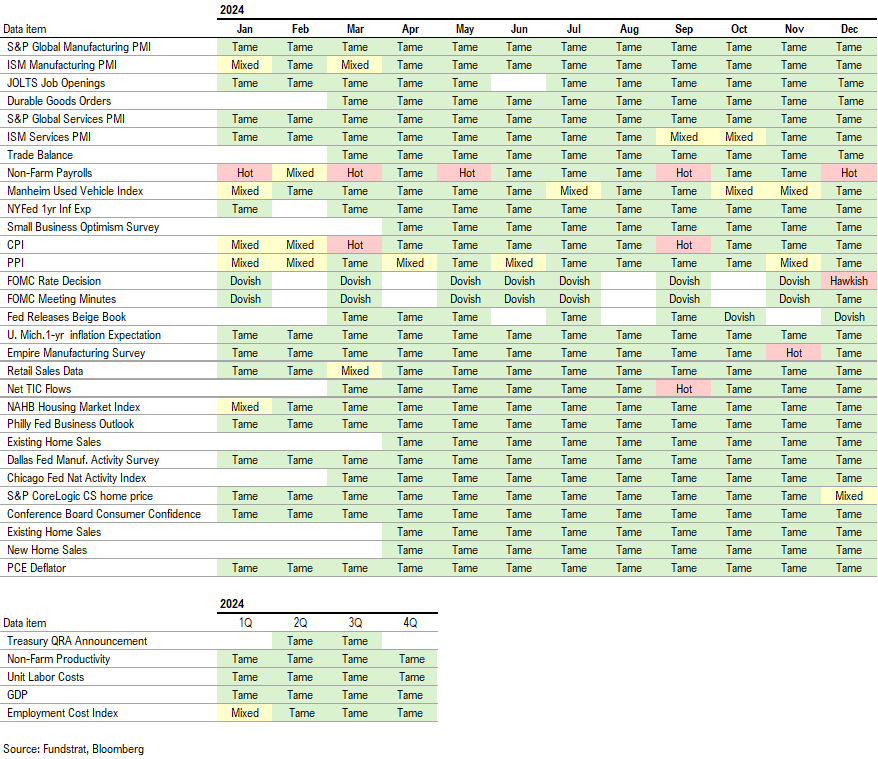

Economic Data Performance Tracker 2024:

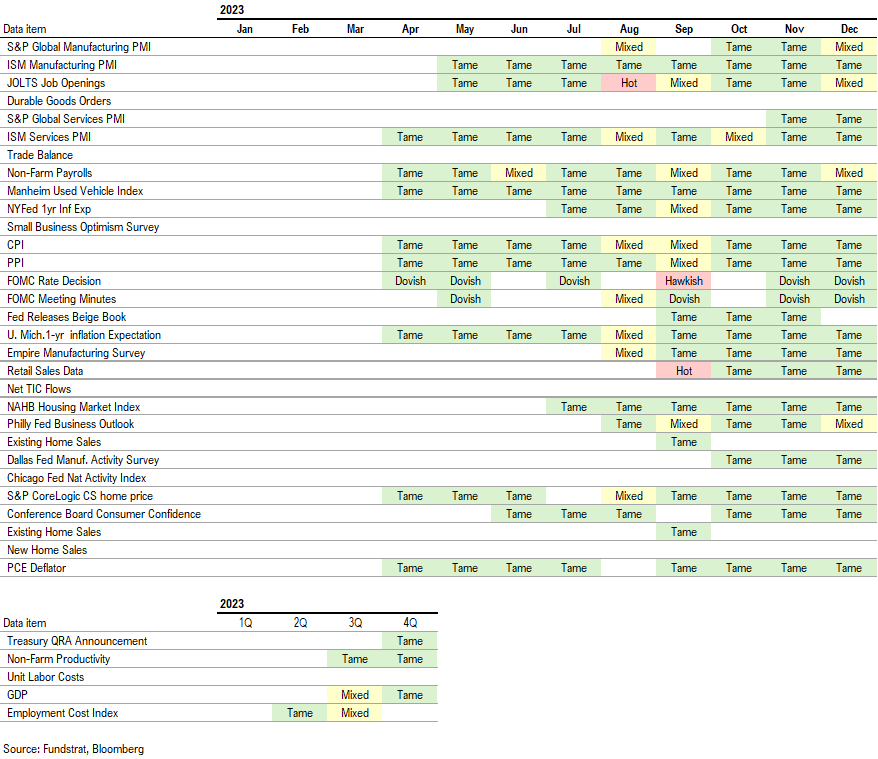

Economic Data Performance Tracker 2023: