Daily Technical Strategy Video (5/28/25)

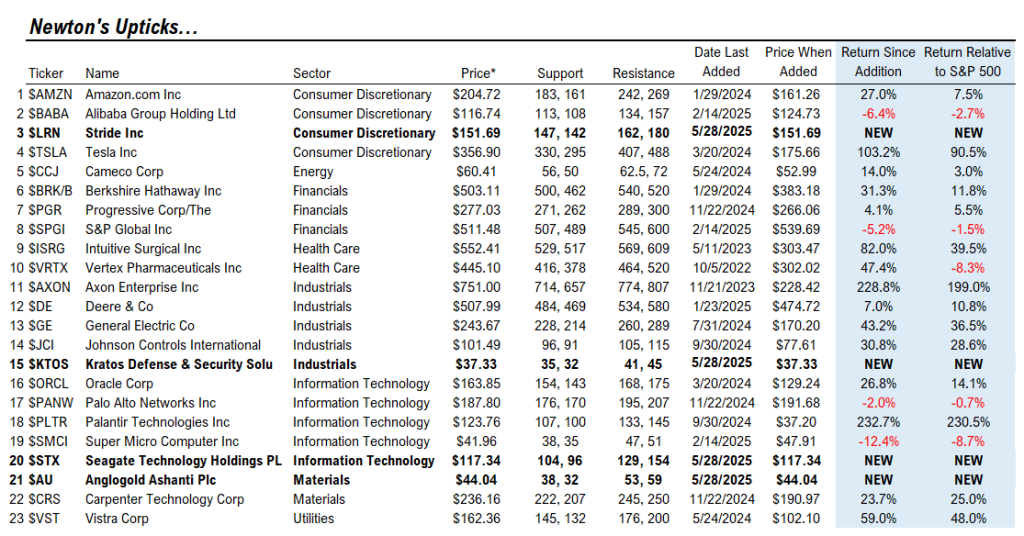

Upticks – Newton’s Law

Upticks Additions

- Stride Inc (LRN -1.35% – $151.69)

- Kratos Defense & Security Solutions (KTOS 1.13% – $37.33)

- Seagate Technology Holdings PLC (STX -1.46% – $117.34)

- Anglogold Ashanti PLC (AU -1.62% – $44.04)

Upticks Deletions

- Deckers Outdoor Corp (DECK -0.36% – $155.07)

- Core Natural Resources Inc (CNR -0.25% – $79.44)

- Upstart Holdings Inc (UPST 4.02% – $82.42)

- Eli Lilly & Co (LLY 0.22% – $844.27)

- Dover Corp (DOV 0.63% – $202.33)

- Accenture PLC (ACN -0.95% – $388.00)

- Arista Networks Inc (ANET 0.48% – $106.87)

- Salesforce Inc (CRM 1.34% – $326.54)

- HubSpot Inc (HUBS 1.47% – $811.95)

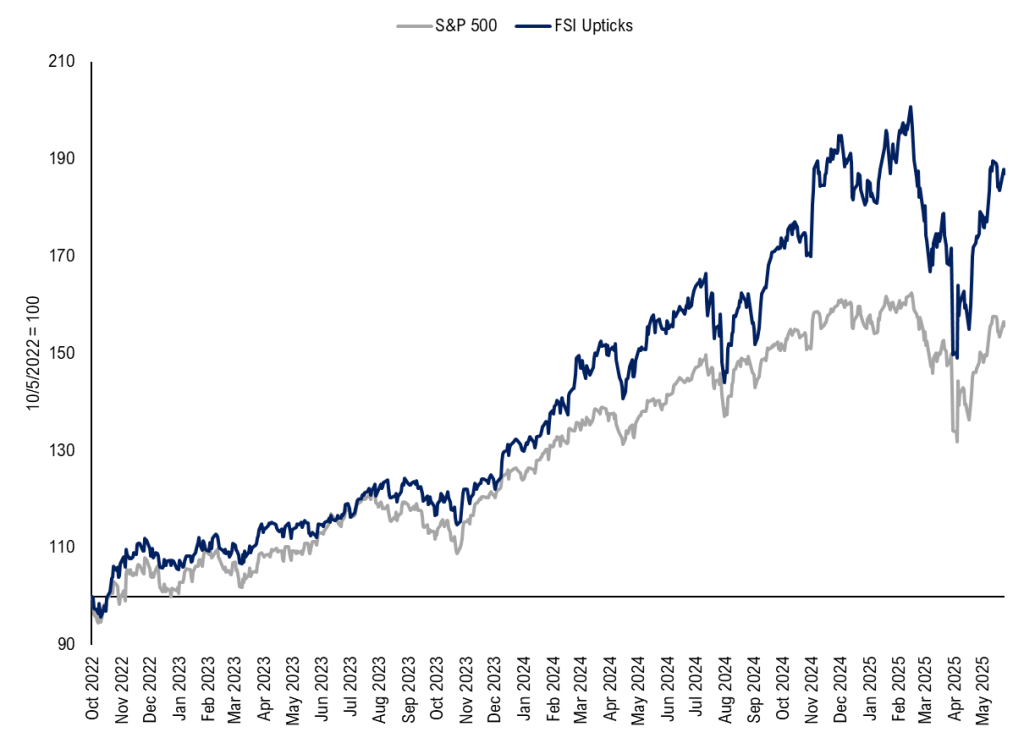

UPTICKS Total Return vs. SPY, Year to Date

UPTICKS Return vs. S&P 500, Since Inception

Upticks One Month Contribution to Performance Relative to SPY (April 28 to May 28)

Upticks Additions Commentary

Seagate Technology (STX -1.46% - $117.34) – Bullish; Breakout bodes well for Follow-through

Support $104, $96, Resistance $129, $154,

- STX -1.46% has just broken back out to new all-time highs on a weekly basis which bodes well for upside continuation in the weeks to come.

- Technical Cup-and-handle pattern should help STX -1.46% likely push up into August, and it remains one of the best technical stocks within Tech Hardware given recent progress.

- While the near-term momentum has grown overbought, DeMark-related exhaustion signals are premature on weekly basis, and I anticipate further near-term follow-through.

- Following some late June consolidation, a strong period of follow-through higher looks likely to targets near $154.

Anglo-gold Ashanti PLC (AU -1.62% - $44.04) – AU -1.62% remains strong within Gold mining stocks

Support- $38.60, Resistance- $46.90

- AU -1.62% has pushed up sharply to test intermediate-term resistance near $45

- Coiling price action since early April is suggestive of a forthcoming upside breakout which likely can take AU -1.62% to the high $50’s.

- My expectation is for Gold to rise to $3,800 in the next 4-6 months. This should be bullish for Gold miners like AU -1.62% which likely will break out and show signs of upside progress as Gold moves higher.

Kratos Defense & Security Solutions, Inc. (KTOS 1.13% -$37.33) – Recent breakout of pattern since early 2025 is constructive for KTOS 1.13% in the months ahead

Support- $35, $32.85- Resistance – $46

- Short-term breakout is constructive technically and also has achieved a large breakout back to new all-time highs above 2021 peaks in the last few weeks

- Very good price action from KTOS 1.13% which should push higher to >$40 and potentially $46 before much consolidation takes place.

- Defense sector continues to show attractive technical strength this year despite the possibility of an eventual ceasefire between Russia and Ukraine.

Stride Inc. (LRN -1.35% - $151.69) – Consolidation represents bullish risk/reward opportunity

Support- $140 Resistance- $162, 170

- LRN -1.35% consolidation in recent weeks has done little to alter its ongoing bullish trend and pullback has created an attractive risk/reward opportunity.

- Uptrend began to turn more parabolic early this year and the recent outperformance in Small-caps in May should bode well for LRN -1.35% to turn back higher to new highs in the weeks to come.

- Bullish technical pattern of higher highs and higher lows has not signaled any evidence of exhaustion.

Technical Writeups of Interesting Pattern Developments of Existing UPTICKS names

Cameco (CCJ -1.72% – $60.41) – Retest of all-time highs is quite bullish technically

- CCJ -1.72% could potentially record a new all-time high monthly close at the end of May with a close this Friday over $59.45.

- Despite a lack of an official daily close over its December 2024 intra-day peak of $62.55, the recent gains back to test all-time highs is quite bullish technically speaking.

- Long-term charts show a former peak at $56 from 2007 which could be definitively broken after having been tested for approximately one year.

- This consolidation from last May forms an intermediate-term Cup and Handle pattern that should give way to strength in the months to come.

Johnson Controls (JCI -1.23% - $101.49) – Technically, JCI -1.23% has finally exceeded 2021 peaks

Support- $82, Resistance- $126, $140

- JCI -1.23% was added to UPTICKS during its consolidation phase, and the breakout back to new highs has resulted in quick acceleration higher.

- While short-term overbought, this remains a very attractive intermediate-term pattern.

- Gains likely into mid-June ahead of minor consolidation into July which would create a very attractive risk/reward opportunity.

Deere (DE 0.60% - $507.99) – Acceleration back to new all-time highs in May is a positive

Support- $490, Resistance- $534, $600

- DE 0.60% multi-year breakout last year has resulted in some acceleration in this name lately, and DE 0.60% remains preferred over Caterpillar in the short run.

- Its lengthy multi-year base was resolved by a breakout higher last year and has materially improved its short-term pattern.

- Signs of the Grains within commodities starting to lift might help jumpstart some of the agricultural commodity names, which DE 0.60% is a part of.

- Four-year base breakout should result in further intermediate-term gains for DE in the months ahead.

Axon Enterprises (AXON 0.62% - $751.00) – Push back to new all-time highs in May is technically bullish

- AXON 0.62% ’s breakout of a consolidation pattern that started six months ago is quite bullish and bodes well for gains into Fall 2025.

- Former all-time highs from February 2025 near $716 were just exceeded earlier this month and should help AXON 0.62% extend its recent gains, technically speaking.

- Defense sector remains appealing despite the efforts to help Russia and Ukraine start to negotiate a peace treaty. At present, it’s right to favor higher prices over the next 2-3 months.

GE Aerospace (GE 0.21% -$243.67) – Overbought above $240, but still quite technically positive

Support- $214, Resistance- $260, $290

- GE 0.21% has gotten stretched following the breakout of this year’s former Double Top in February and March of 2025. However, no evidence of any trend failure is apparent which would suggest this might be vulnerable.

- Daily and weekly momentum have begun to show negative divergence, but it’s necessary for GE 0.21% to show a trend reversal before expecting even minor consolidation to unfold.

- Key intermediate-term resistance lies near peaks seen more than 20 years ago, and despite $260 standing out as being important near-term resistance, it’s likely that GE 0.21% could test its all-time highs from 2000 before finding intermediate-term resistance.

- Charts remain quite bullish, and dips, if/when they occur into late June/July, should provide an attractive risk/reward opportunity.