VIDEO: Stocks rallied Tuesday, reversing last week’s weakness. The takeaway, in our view, is that White House negative headlines have more “bark than bite.” And because this is the most hated V-shaped rally, pullbacks remain shallow.

Please click below to view our Macro Minute (duration: 4:49).

Equities rallied Tuesday, essentially reversing the decline of last week, a reminder that pullbacks are shallow (as we expected) due to excessive cautious positioning of investors. In our conversations with clients, we find many investors remain skeptical of this equity rally. Part of this is their view that tariff headlines will keep resurfacing, and this could lead to setbacks that push stocks lower:

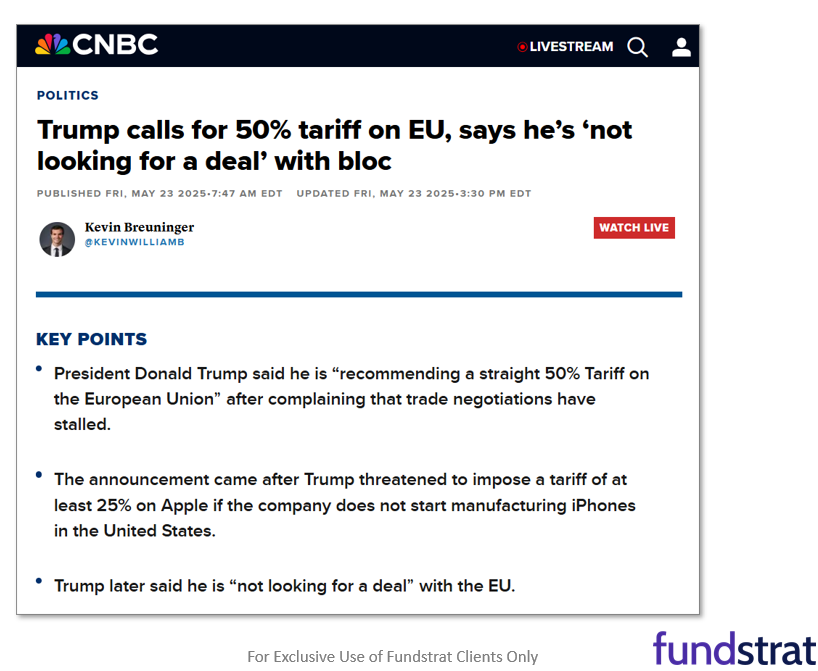

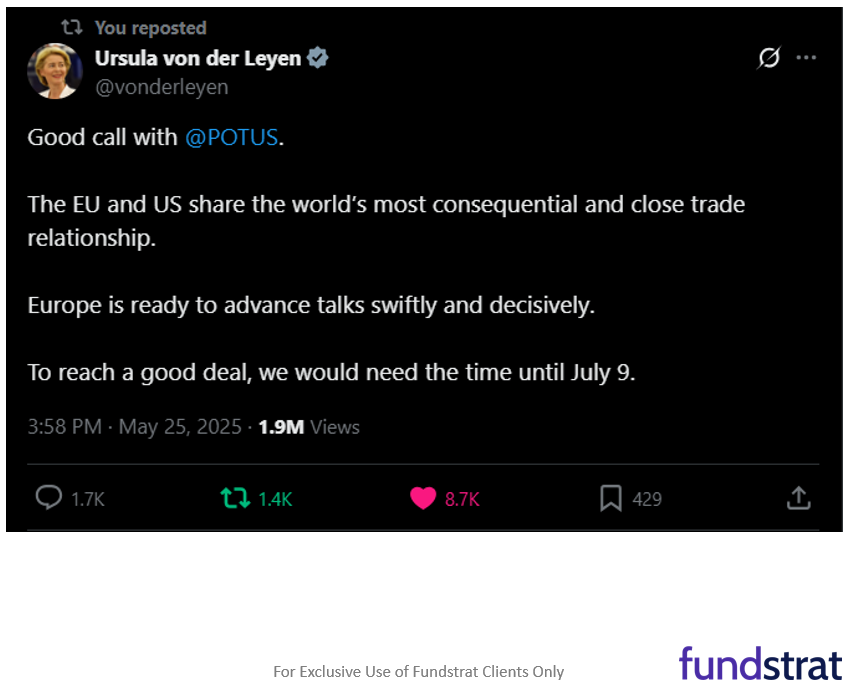

- Late last week, equities fell after President Trump tweeted that he recommends 50% tariffs on Europe. This was the type of headline that skeptics have been expecting, and stocks fell sharply. But over the weekend, the EU and White House agreed to delay the implementation to July 9th. And Tuesday, equities were rallying sharply.

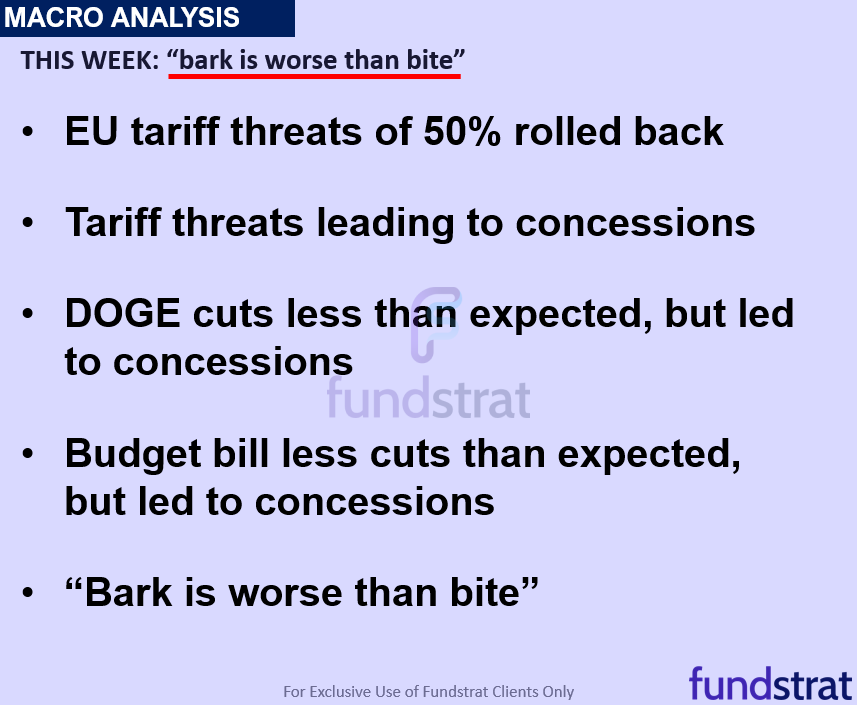

- Should equities be surprised? That is, if one takes a step back, the 3 White House initiatives since Feb have been more of a situation of “bark worse than the bite”:

– EU tariff threats of 50% rolled back

– Tariff threats leading to concessions

– DOGE cuts less than expected, but led to concessions

– Budget bill less cuts than expected, but led to concessions

– “Bark is worse than bite” - In other words, as long as there are concessions to be had, we expect the White House to demonstrate some level of flexibility. And this is good for stocks. In other words, we believe investors keep forgetting the Trump “put” remains intact. This has been demonstrated multiple times in the past 6 weeks.

- As for macro, there was quite a bit of data reported Tuesday, but the key event is Friday, with April Core PCE and U Mich inflation:

– 5/25 Sun 2:40 PM ET: Powell Gives Baccalaureate Remarks

– 5/26: Memorial Day (Market Closed)

– 5/27 Tue 8:30 AM ET: Apr P Durable Goods Orders MoM -6.3% vs -7.8%e

– 5/27 Tue 9:00 AM ET: Mar S&P CS home price 20-City MoM -0.12% vs 0.30%e

– 5/27 Tue 10:00 AM ET: May Conference Board Consumer Confidence 98 vs 87e

– 5/27 Tue 10:30 AM ET: May Dallas Fed Manuf. Activity Survey -15 vs -23e

– 5/28 Wed 10:00 AM ET: May Richmond Fed Manufacturing Survey -9.0e

– 5/28 Wed 2:00 PM ET: May FOMC Meeting Minutes

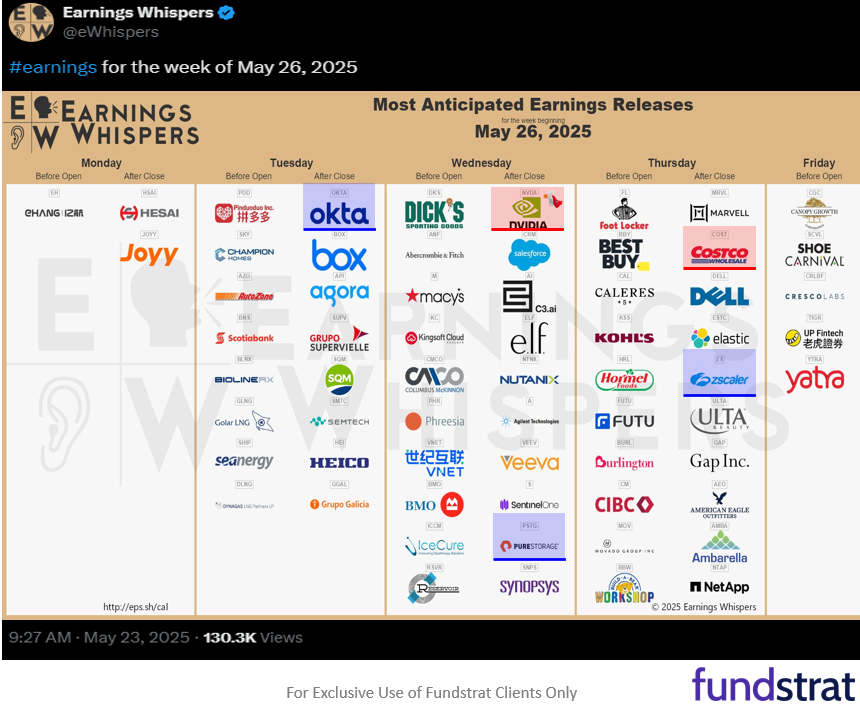

– 5/28 Wed 4:20 PM ET: NVDA Earnings Release

– 5/29 Thu 8:30 AM ET: 1Q S GDP QoQ -0.3%e

– 5/30 Fri 8:30 AM ET: Apr Core PCE MoM 0.13%e

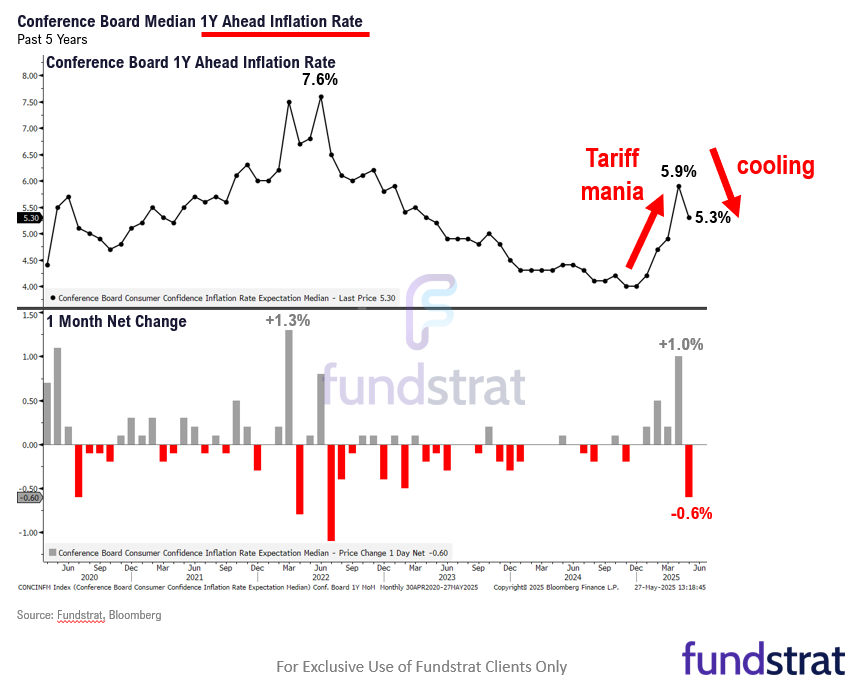

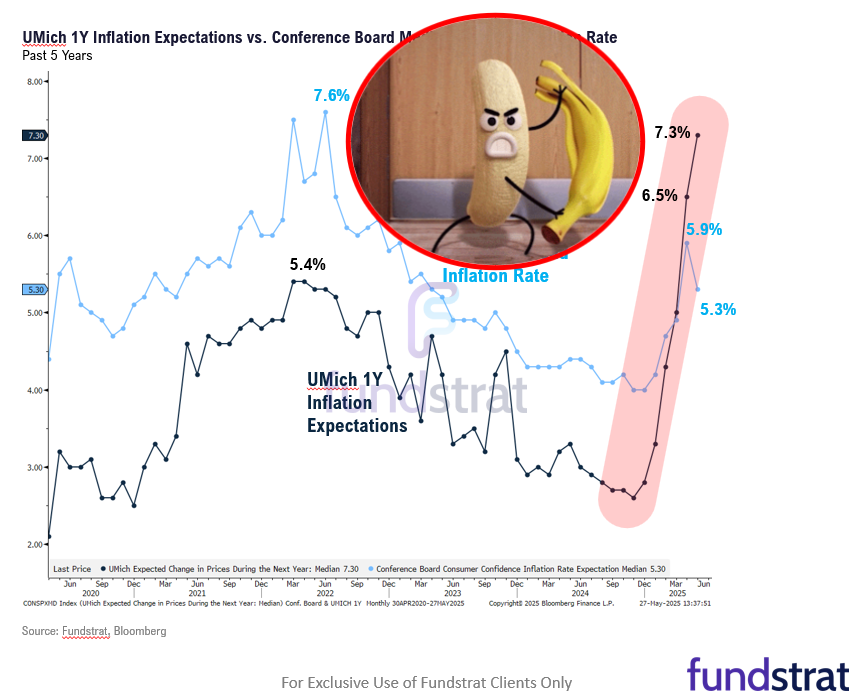

– 5/30 Fri 10:00 AM ET: May F U. Mich. 1yr Inf Exp - The Conference Board today showed a sizable drop in forward inflation expectations from 5.9% to 5.3% and the first drop 5 months. To us, this is a reflection of the perception gap:

– consumers are expecting exploding inflation

– but actual inflation is low

– this gap closing is positive for stocks, if “expectations” fall, which is our view - On Friday, we get April Core PCE and U Mich inflation expectations, and there is a chance both are confirming the softening of inflation. And this too would be a positive.

- There is also Fed speak this week, and the May FOMC minutes (see above):

– 5/25 Sun 2:40 PM ET: Powell Gives Baccalaureate Remarks

– 5/27 Tue 4:00 AM ET: Kashkari Speaks at Bank of Japan Event

– 5/27 Tue 9:30 AM ET: Barkin Appears on Bloomberg TV

– 5/27 Tue 8:00 PM ET: Williams Speaks in Moderated Discussion in Tokyo

– 5/29 Thu 8:30 AM ET: Barkin Participates in Fireside Chat

– 5/29 Thu 10:40 AM ET: Goolsbee Participates in Moderated Q&A

– 5/29 Thu 2:00 PM ET: Kugler Gives Opening Remarks

– 5/29 Thu 4:00 PM ET: Daly Speaks in a Fireside Chat

– 5/29 Thu 8:25 PM ET: Logan Gives Remarks, Speaks in Q&A

– 5/30 Fri 7:30 PM ET: Goolsbee on The Interview Show

BOTTOM LINE: Still “most hated rally”

This still remains the “most hated” V-shaped stock rally. We view Bitcoin as a leading indicator and thus, we expect stocks to reattain all time highs, which Bitcoin achieved last week. We see S&P 500 reaching 6,600 by year-end.

And the drivers for this upside are:

- Still most hated rally

- Sizable perception gap: Tariff “bark worse than bite”

- Hedge funds increased short interest recently

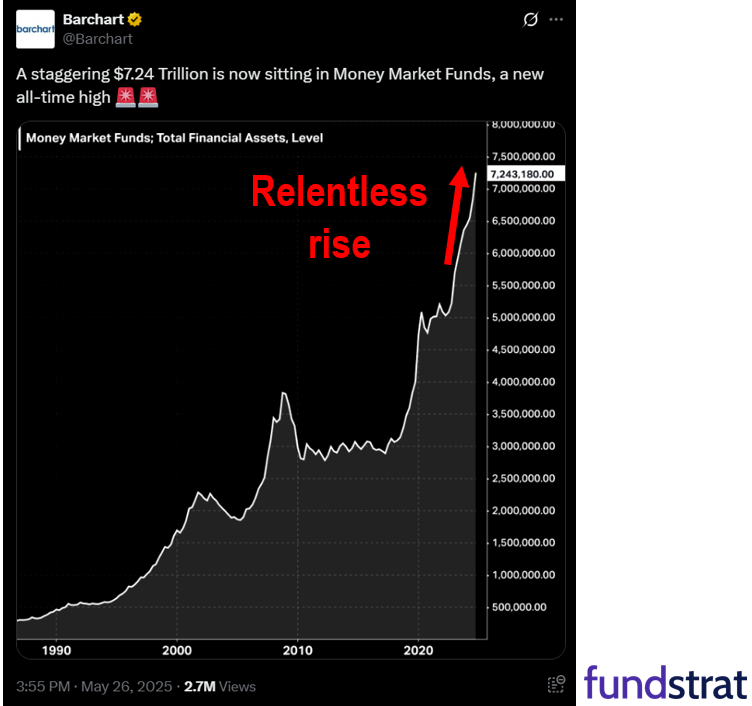

- $7 trillion cash on sidelines

- Investment outlook better now than in Feb 2025:

– tariff visibility

– tax and de-regulation visibility

– US cos survived 5th major “stress test”

– Fed more dovish in 2026

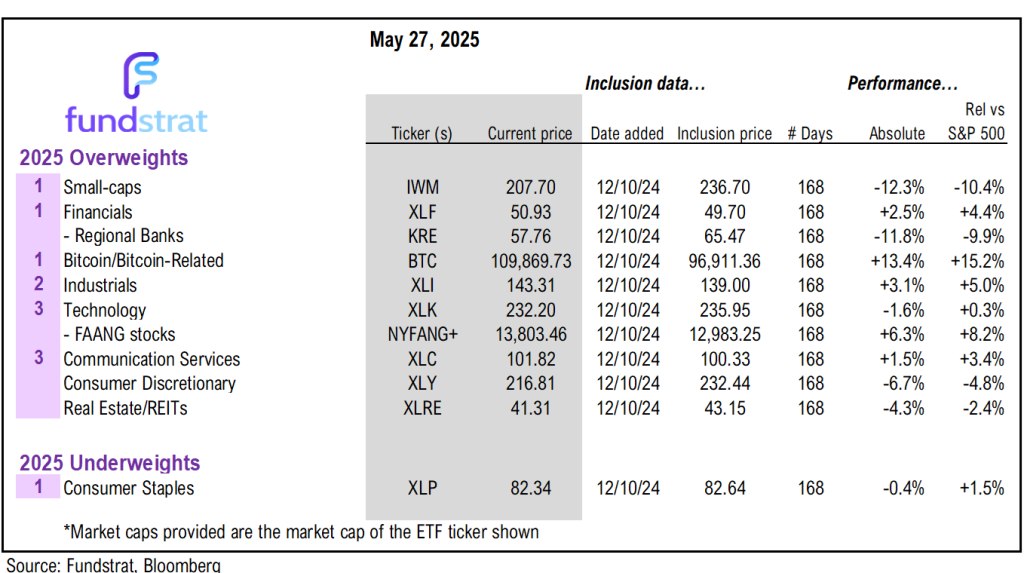

As for what we would buy

- Washed out stocks

- MAG7 & Bitcoin

- Industrials

- Financials: Large-cap and regional banks

- Small-caps

_____________________________

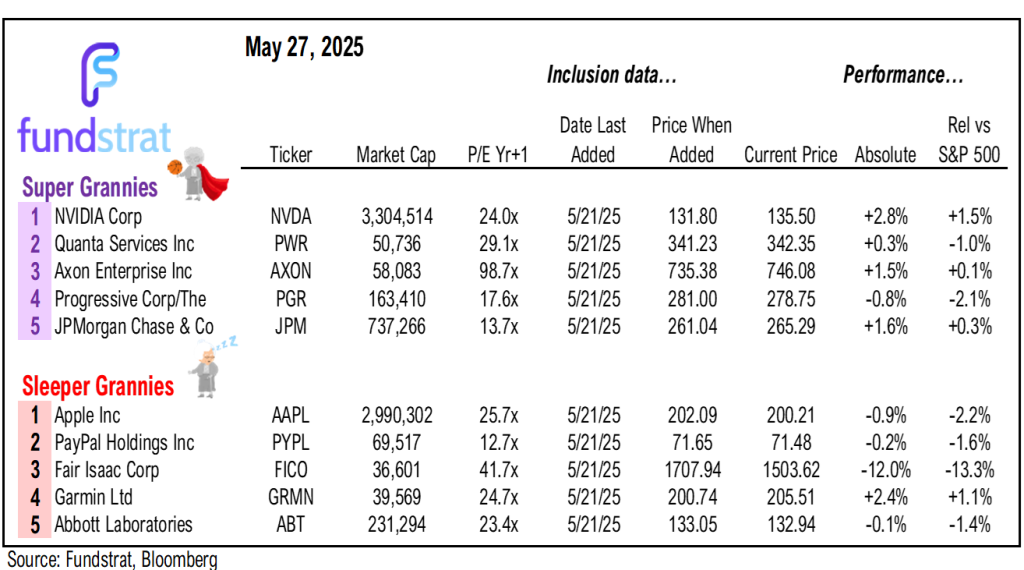

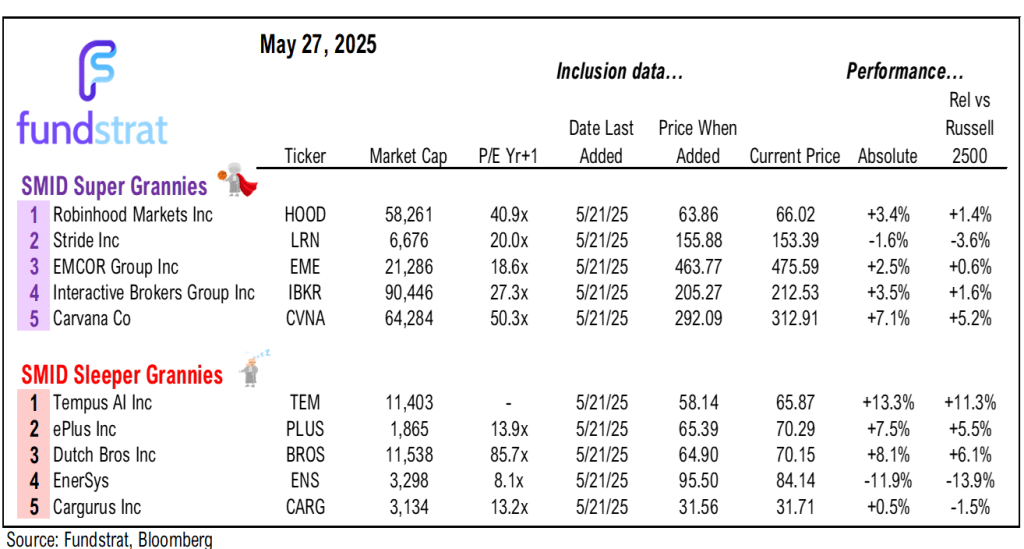

45 SMID Granny Shot Ideas: We performed our quarterly rebalance on 5/22. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

Key Incoming Data May:

5/1 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/1 10:00 AM ET: Apr ISM Manufacturing PMITame5/2 8:30 AM ET: Apr Non-Farm PayrollsTame5/2 10:00 AM ET: Mar F Durable Goods Orders MoMTame5/5 9:45 AM ET: Apr F S&P Global Services PMITame5/5 10:00 AM ET: Apr ISM Services PMITame5/6 8:30 AM ET: Mar Trade BalanceTame5/7 9:00 AM ET: Apr F Manheim Used Vehicle IndexHot5/7 2:00 PM ET: May FOMC DecisionMixed5/8 8:30 AM ET: 1Q P Unit Labor CostsTame5/8 8:30 AM ET: 1Q P Non-Farm Productivity QoQTame5/8 11:00 AM ET: Apr NY Fed 1yr Inf ExpMixed5/13 6:00 AM ET: Apr Small Business Optimism SurveyTame5/13 8:30 AM ET: Apr Core CPI MoMTame5/15 8:30 AM ET: May Philly Fed Business OutlookTame5/15 8:30 AM ET: Apr Core PPI MoMTame5/15 8:30 AM ET: May Empire Manufacturing SurveyTame5/15 8:30 AM ET: Apr Retail SalesTame5/15 10:00 AM ET: May NAHB Housing Market IndexTame5/16 10:00 AM ET: May P U. Mich. Sentiment and Inflation ExpectationHot5/16 4:00 PM ET: Mar Net TIC FlowsTame5/19 9:00 AM ET: May M Manheim Used Vehicle IndexTame5/22 8:30 AM ET: Apr Chicago Fed Nat Activity IndexTame5/22 9:45 AM ET: May P S&P Global Services PMITame5/22 9:45 AM ET: May P S&P Global Manufacturing PMITame5/22 10:00 AM ET: Apr Existing Home SalesTame5/22 11:00 AM ET: May Kansas City Fed Manufacturing SurveyTame5/23 10:00 AM ET: Apr New Home SalesTame5/27 8:30 AM ET: Apr P Durable Goods Orders MoMTame5/27 9:00 AM ET: Mar S&P CoreLogic CS home priceTame5/27 10:00 AM ET: May Conference Board Consumer ConfidenceTame5/27 10:30 AM ET: May Dallas Fed Manuf. Activity SurveyTame- 5/28 10:00 AM ET: May Richmond Fed Manufacturing Survey

- 5/28 2:00 PM ET: May FOMC Meeting Minutes

- 5/29 8:30 AM ET: 1Q S GDP QoQ

- 5/30 8:30 AM ET: Apr Core PCE Deflator MoM

- 5/30 10:00 AM ET: May F U. Mich. Sentiment and Inflation Expectation

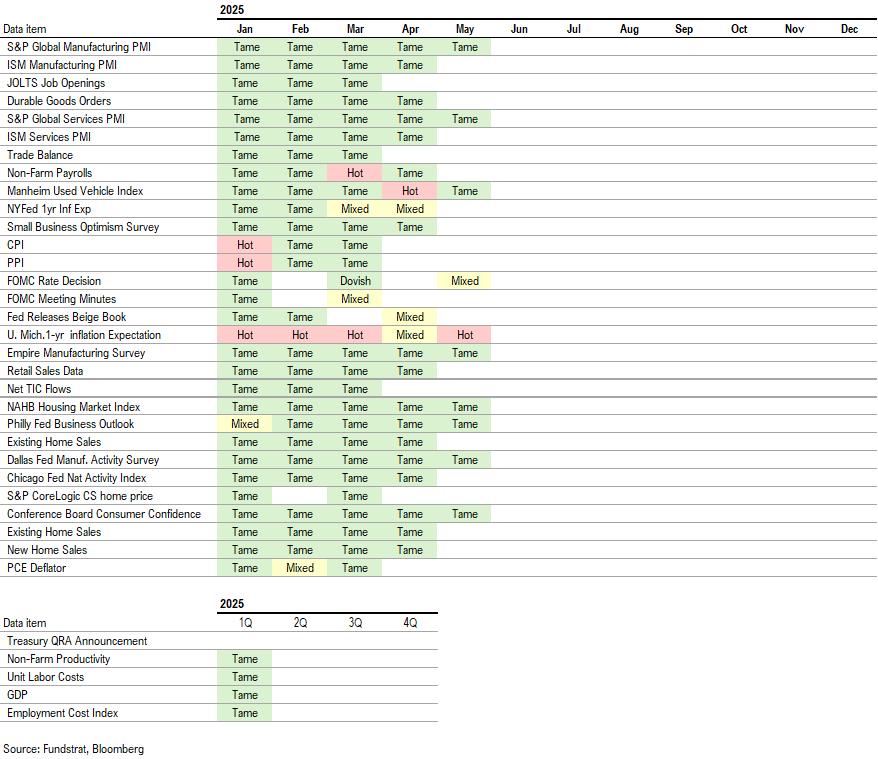

Economic Data Performance Tracker 2025:

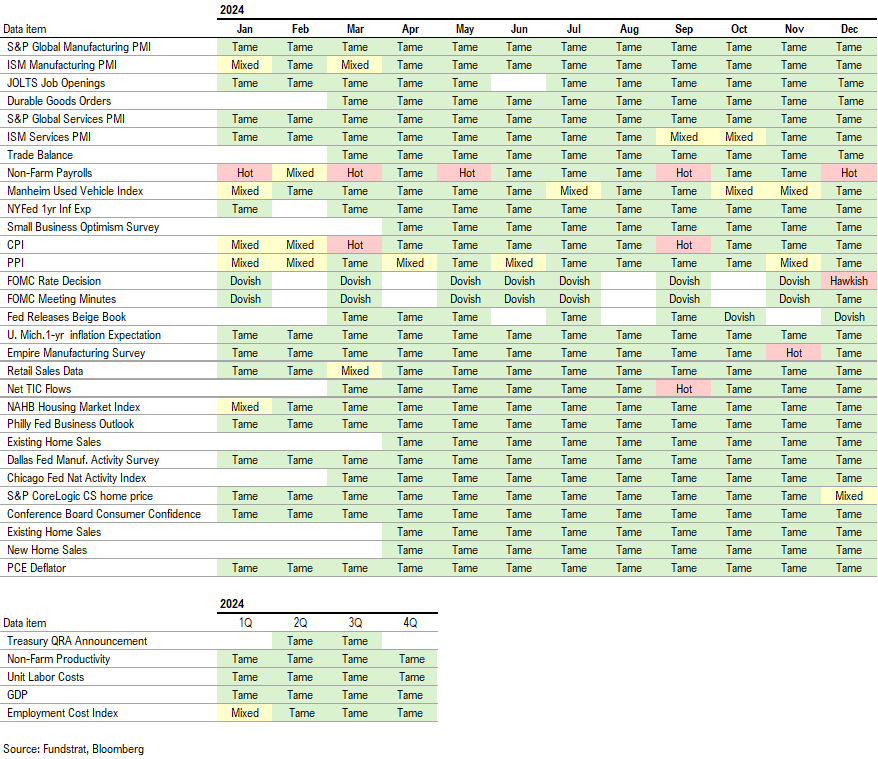

Economic Data Performance Tracker 2024:

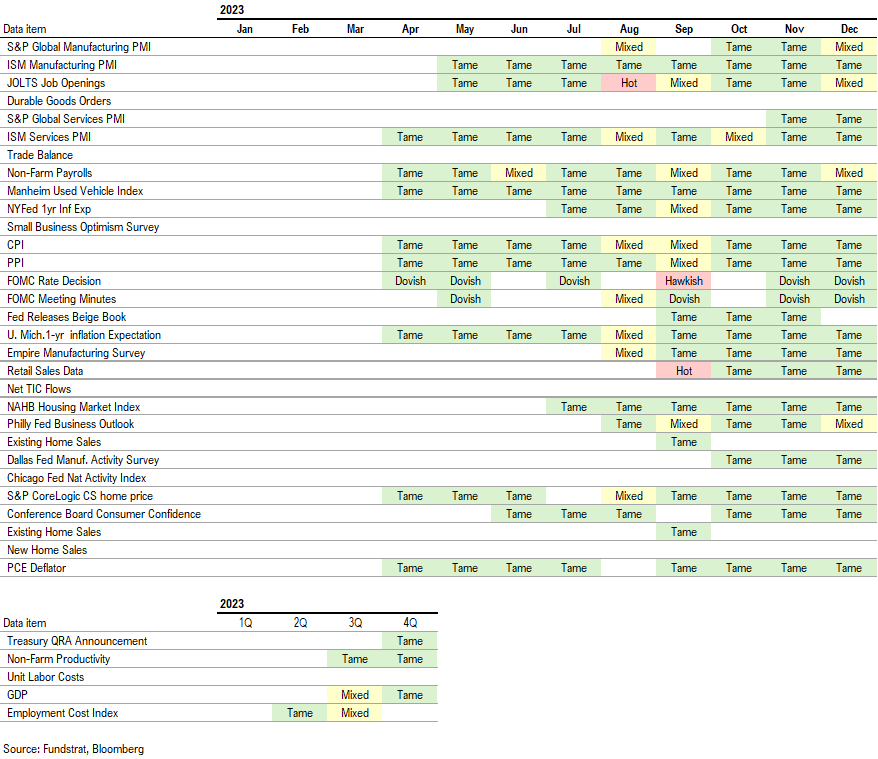

Economic Data Performance Tracker 2023: