Short-term trends in US Equities remain bullish, and the minor consolidation this week in US Equity indices has not proven severe enough to cause any technical deterioration in the rally from early April lows. Overall, I remain encouraged about the technical progress and structural improvement that has occurred in SPX over the last six weeks, and feel that an upcoming move back to challenge February peaks should be forthcoming. Precious metals have begun to turn back higher, and the bond yield breakout is likely to prove short-lived into next week before yields start to reverse course and trend lower to join the US Dollar’s decline. I favor Industrials, Financials, Technology, and Utilities, while also favoring owning precious metals and Treasuries. Additionally, Emerging markets have appeal given the drop in the US Dollar and should be overweighted for further upside progress in the months ahead.

Overall, the selloff to multi-day lows got close to, but failed to exactly reach 5809 before starting to stabilize in Thursday’s session. There has been no violation of the current uptrend, and many Technology stocks look well-positioned to begin turning higher last week following minimal consolidation.

While a larger bond market rally would help to give more confidence to the idea of a stock market push back to new highs, markets might gain conviction after NVDA -2.88% earnings next week, which could benefit Semiconductors and most of Technology in the weeks ahead.

As shown below, SPX looks to be close to an area where this should bottom out, and my expectation is that this happens next week. Downside should be limited to 5809, while upside should carry SPX back to 6150.

S&P 500 Index

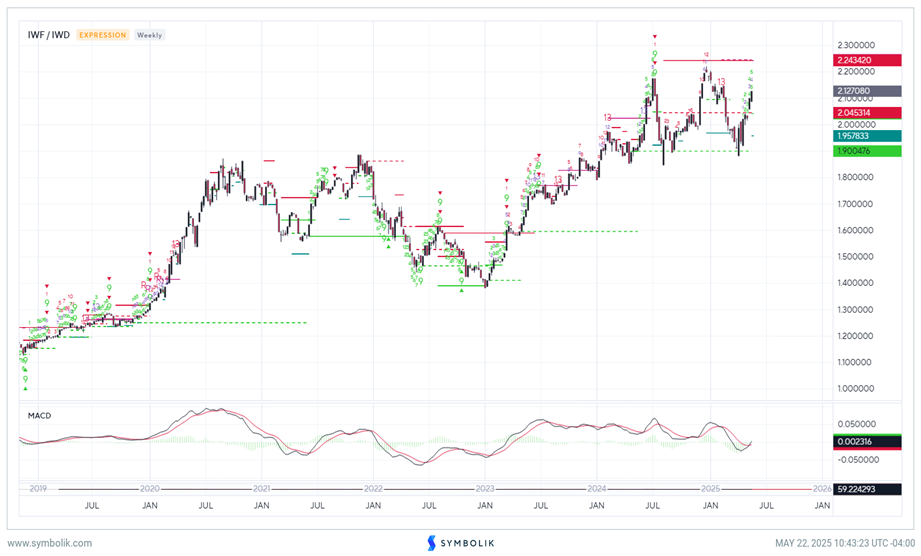

Large-cap Growth still looks to lead over Value into June

Ratios of Russell 1000 Growth (IWF -1.21% ) vs. Russell 1000 Value (IWD -0.12% ) have largely been neutral and choppy over the last year, as part of a lengthy, long-term uptrend.

However, the near-term strength in May has helped Growth to begin outperforming sharply over the last few weeks as the “Magnificent 7” have begun to claw back.

Overall, given a long-term bull market trend along with a short-term bullish trend from early May it looks right to still favor Large-cap Growth, despite a choppy period since last July.

I expect that this ratio should climb to test and exceed the highs made into late 2024, into the month of August.

IWF/IWD

Utilities pullback offers an opportunity

For those eyeing Defensive sectors for purpose of diversification, I favor Utilities as being the best of any of the defensive sectors for the weeks and months ahead.

This relative chart of the Equal-weighted Utilities ETF by Invesco (RYU -0.33% ) vs the Invesco Equal-weighted S&P 500 (RSP -0.07% ) made a multi-year breakout from its downtrend last year before accelerating higher in early 2025.

The last few weeks have brought about some relative underperformance as Technology has clawed back. However, I expect that pullbacks should present an attractive opportunity to overweight Utilities for a push higher over the next month.

While I’m not as keen on owning Consumer Staples, Energy, or Healthcare, I expect Utilities to offer a bit more technical strength, given that they have outperformed Technology by over 800 basis points since the beginning of 2025.

RSPU/RSP

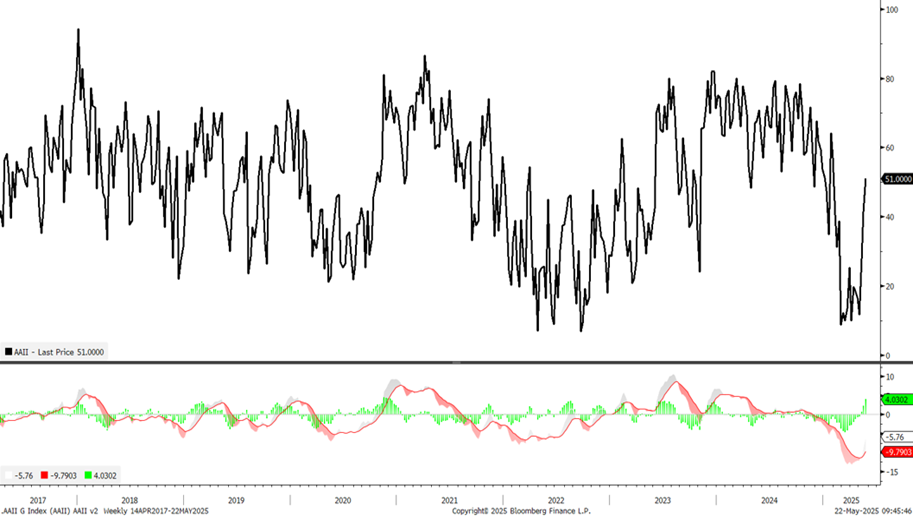

AAII has finally turned positive, but just fractionally so

Interestingly enough, following 12 straight weeks of negative AAII readings (meaning more bearish sentiment than bullish), the percentage of Bulls for AAII finally shows more Bulls than Bears, with a reading of 37.70 Bulls vs. 36.70 Bears.

Thus, this spread has moved back to neutral territory after having dropped to the most negative levels since 2022.

At its peak level of bearishness, the percentage Bears had been above 50% for 11 straight weeks, the longest on record.

While a return to Neutral certainly represents a tapering of that bearish sentiment, it also doesn’t represent bullish sentiment, which would likely occur if SPX were about to make a larger peak in price.

My view is that any consolidation that happens in June likely would cause investors to get bearish again quickly and subsequently lead Equities back to new all-time highs.

AAII

Hedge funds also look to be short stocks

Data from Hedge Fund Research (HFR) Macro/CTA index shows that nearly all of the 12 main hedge fund styles tracked by HFR have either reduced sensitivity to the SPX 500 or have gone negative.

While the AAII showed more Bulls and Bears for the first time in over 12 weeks, the HFR data shows the lowest exposure to the SPX since last Spring, 2024.

This looks to be a much different picture than last July, when US Technology made a peak. My expectation is that the rally in large-cap Technology will likely continue, and that Hedge Funds and Commodity Trading Advisors will be forced to chase in the months to come.