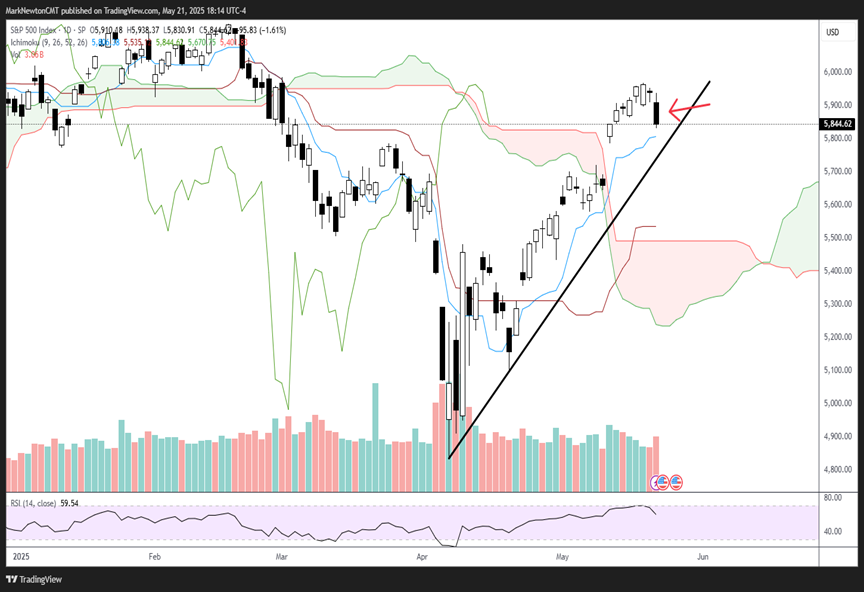

Short-term trends in US Equities remain bullish, but the decline to multi-day lows might allow for a bit more weakness on a 1-2 day basis before Equity indices stabilize and begin to push back to new highs. Precious metals have begun to turn back higher, but the bond yield breakout might also extend for another 1-2 days before finding resistance and reversing course. Meanwhile, the US Dollar made a meaningful break in trend and likely pulls back to new monthly lows. This should aid Emerging markets as well as Commodities, but the key focus remains on the bond market given the quickness of this Treasury move post-auction. My view is that this minor pullback likely gets to 5809 before finding strong support and should not violate 5700 and/or the uptrend from April without warning of a possible stronger decline. While various short-term cycles warned of a possible inflection at the 90-day mark of the February peak, other DeMark-related signals did not seem to be in place on either a daily nor weekly basis. I’ll monitor this in the days to come, but for now, it seems like the two-day dip might prove shallow before yet another stab at the all-time highs above SPX-6145.

Overall, the selloff to new multi-day lows warrants paying attention for any evidence of trend break in the days ahead. While the breadth slowdown last week along with abnormally low Equity Put/Call ratios were a minor concern of a possible pullback, it was right to ignore this until price itself began to pullback to multi-day lows.

At present, the decline in SPX has not broken its uptrend, and likely should find support near 4808, with an area near the open-gap from May 9th into May 12th at 5691.69 proving to be very strong support.

The area near 5700 also lines up with the uptrend for SPX from early April. Thus, while I didn’t expect this decline to happen right away, I also can’t make too much of it without further proof. For now, it’s right to buy dips until/unless this uptrend starts to give way.

S&P 500 Index

The 10-Year Treasury Note index is likely not to exceed 4.80 right away

While many are firmly convinced that the fiscal concerns might continue to cause Treasury yields to press higher in the months to come, this seems to go against what cycles and Elliott-wave analysis might suggest.

As seen below, the breakout to new monthly highs was certainly important for Wednesday’s trading and very well could result in another 2-3 days of yields backing up.

However, it’s wrong to think of the trend in yields as being higher on a 2-3 year basis, as both 10-year and 30-year Treasury yields have traded in neutral consolidation patterns since 2023.

Furthermore, this year’s decline in ^TNX (CBOE US-10-year Treasury note index) occurred very much in a five-wave decline, which was thought to bring about intermediate-term weakness in yields in the months ahead, not a move back to new highs.

Thus this three-wave counter-trend move might serve to spook some investors, but in my view, has little chance of exceeding 4.809%, the intra-day peaks from mid-January 2025.

Thus, this becomes an attractive risk-reward opportunity to buy dips in Treasuries with yields pushing higher as the risk/reward has grown more attractive.

Any spike above 4.809%, particularly on a weekly close, would warn of much greater weakness in the Treasury market ( yields spiking) and would be something to pay attention to.

At present, neither 10-year, nor 30-year Treasury yields have engineered intermediate-term breakouts, but merely short-term breakouts only which seem to be nearing resistance in yield terms. I suspect thar the next 1-2 weeks should bring about a meaningful stalling out followed by a downward reversal in yields.

US Government Bonds 10 YR Yield

30-year Treasury Bond Yield index has strong resistance near 5.15%

While the media tend to make much of the area at the psychologically important 5.0% level, the real level lies at 5.15%, which lines up near October 2023 peaks.

I’m skeptical that Bond yields start to push immediately higher technically as yields are nearing overbought levels, while DeMark-based indicators are now present on charts of TLT -0.22% and TBT 0.57% .

Furthermore, the cycle composite for Yields turns lower from Spring 2025 into August of this year, which should bring about strength in Treasuries (weakness in yields).

Thus, this appears to be an appealing area to consider fighting this uptrend in yields for those who care to do so.

CBOE 30 YR Treasury Bond Yield

Silver looks to be coming to life and should begin to play Catch-up with Gold

Interestingly enough, the gains in Precious metals weren’t erased despite the huge backing up in interest rates on Wednesday.

Today’s rally in Silver managed to exceed the mild consolidation trend that’s been intact since late April. This should allow for the start of a push higher to new highs for 2025.

I anticipate that Treasury yields likely begin to rollover and join the US Dollar in pulling back to new lows, and this should help Emerging markets like China which are large importers of Silver.

Technically, my target lies initially near $35.50 for front-month Silver Futures.

I suspect that the period from June into September should represent a time of massive outperformance for Silver, and Silver might outperform Gold.

In the short run, pullbacks under $31.75 would serve to stop out Silver longs, and while not expected, should be an area to watch on the event that this strength is given back.

Overall, I like owning SLV 0.83% and/or AGQ 1.91% for Silver, depending on one’s risk tolerance and timeframe for investment, and SILJ 2.78% looks appealing as a way to play Silver mining stocks.

Silver Futures