Is the bottom in? Fundstrat Head of Research Tom Lee thinks so, putting the odds of that possibility at 90%. A confirmed bottom would certainly be a relief to most investors: Lee described the three weeks since April 2 (which President Trump had termed “Liberation Day”) as “the most difficult we have navigated in 30 years, more so than even Covid and the 2008 Global Financial Crisis.”

However, after peaking above 60 on April 8, the VIX has receded to around 25 (as of Friday close), and last Tuesday we saw another day in which over 90% of NYSE shares advanced. That followed a similar day of strong advances on April 9, when 94% of shares rose. This pattern is particularly noteworthy: Fundstrat’s Data Science team found just three historical precedents since 1979 in which NYSE percentage advances matched or exceeded the 90% mark twice within a nine-day period (March 10, 2009, Aug. 9, 2011, and April 6, 2020). In all three instances, S&P 500 forward returns were generally positive, with a 100% win ratio three, six, and 12 months later.

Much of last week’s gangbuster gains (the S&P 500 rose 4.59% while the Nasdaq surged 6.73%) were driven by what Lee calls “positive policy shock.” These include Trump walking back earlier comments that had suggested he might look for a way to fire Federal Reserve Chief Jerome Powell. Lee had previously described firing Powell as a move that “would deal a severe blow to investor confidence in the U.S. financial system.”

On the tariffs front, markets also appeared to view remarks by Trump and White House officials as de-escalatory. Trump told Time magazine that “we’re meeting with China” (though Chinese officials disputed this claim), while Treasury Secretary Scott Bessent described U.S.-China tensions as “an opportunity for a big deal” and eschewed the phrase “trade war” in favor of a gentler trade “rebalance.”

Yet both Lee and Head of Technical Strategy Mark Newton continue to urge caution. Although Newton sees the possibility that “we rally sharply for about a week,” he warned that “I do think that [choppiness] continues,” emphasizing that “I don’t think it’s going to be a straight shot higher.”

Chart of the Week

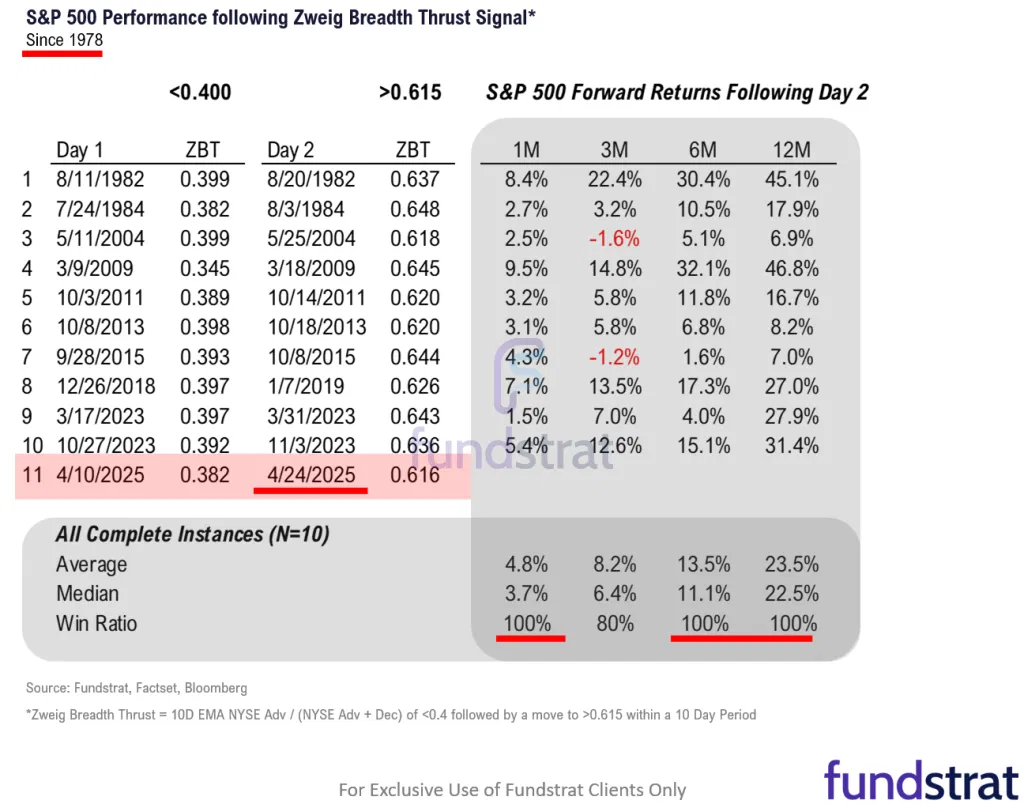

Both Head of Research Tom Lee and Head of Technical Strategy Mark Newton attached positive significance to the Zweig Breadth Thrust having been triggered on Thursday. Created by legendary investor Martin Zweig, this momentum indicator is triggered when a 10-day rolling average of advancing securities “thrusts” from below 40% (i.e., oversold) to above 61.5%. Our Chart of the Week illustrates Newton’s observation: “The median return going forward tends to be quite positive following a period of abnormally high market breadth happening from extremely low levels.”

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

4/23 9:45 AM ET: Apr P S&P Global Services PMITame4/23 9:45 AM ET: Apr P S&P Global Manufacturing PMITame4/23 10:00 AM ET: Mar New Home SalesTame4/23 2:00 PM ET: Apr Fed Releases Beige BookMixed4/24 8:30 AM ET: Mar P Durable Goods Orders MoMHot4/24 8:30 AM ET: Mar Chicago Fed Nat Activity IndexTame4/24 10:00 AM ET: Mar Existing Home SalesTame4/25 10:00 AM ET: Apr F U. Mich. 1yr Inf ExpMixed- 4/28 10:30 AM ET: Apr Dallas Fed Manuf. Activity Survey

- 4/29 9:00 AM ET: Feb S&P CS home price 20-City MoM

- 4/29 10:00 AM ET: Apr Conference Board Consumer Confidence

- 4/29 10:00 AM ET: Mar JOLTS Job Openings

- 4/30 8:30 AM ET: 1Q A GDP QoQ

- 4/30 8:30 AM ET: 1Q ECI QoQ

- 4/30 10:00 AM ET: Mar Core PCE MoM

- 5/02 8:00 AM ET: Apr Jobs Report

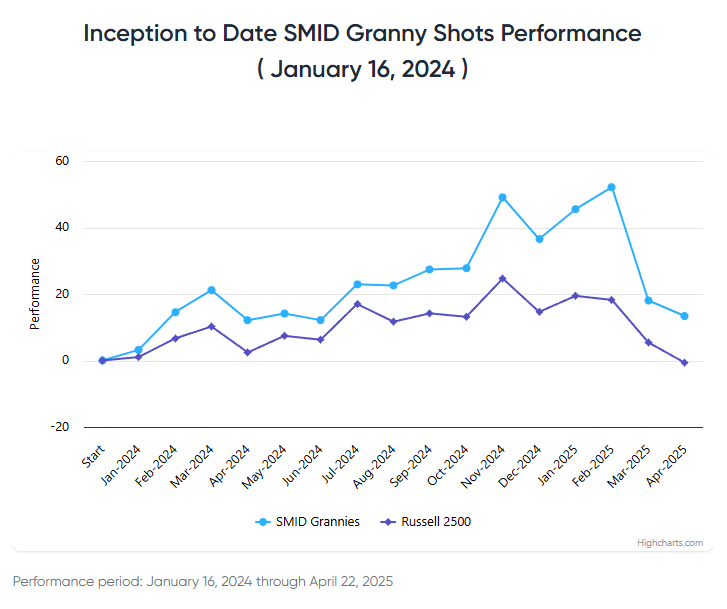

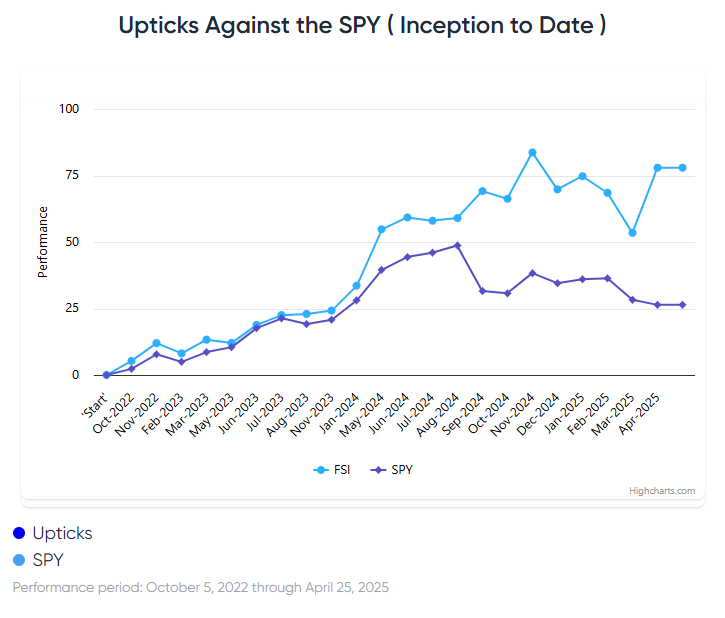

Stock List Performance

In the News

| More News Appearances |