Short-term trends are bullish as SPX and QQQ have finally broken out of their respective triangle consolidation patterns, which had been established roughly three months ago, and both SPX and QQQ made new all-time highs and all-time daily high closes as of today, Monday 2/18/25. The US Dollar has also broken down, while Treasury yields could trade largely range-bound in the near term as the correlation between Treasuries and Equities is partially unwound. Equal-weighted S&P 500, DJ Transportation Avg., DJIA, and Russell 2000 have not yet achieved the breakout seen in SPX and QQQ, and this likely takes some time. However, sentiment regarding tariffs and their possible negative implications for the US Stock market has gotten quite bearish for both the Equity and Bond markets in recent weeks, which is arguably a positive. While seeing a broad-based rally across Equal-weighed indices like RSP would help in having more conviction on the longevity of this rally, at present, it’s right to be long, looking to buy any dips that happen between now and February expiration. Upside SPX targets lie at 6300, then 6650.

Technicals of 5 Favorite Tom Lee’s Top Stock Ideas

Meta Platforms (META 0.58% – $716.37) – Pullbacks make META quite attractive

The recent 20-day winning streak represented the longest winning streak of any NASDAQ 100 Index component going back since 1990.

-Lack of DeMark-based exhaustion combined with stellar ongoing uptrend represents an attractive opportunity at current levels and in any weakness, technically speaking.

-Pullbacks to $683-$695 would represent a very appealing risk/reward area of support.

-Following a short-term pullback, further gains up to $800 are possible into mid-year 2025.

-Valuation has neared $2 trillion for the first time on recent gains.

-Despite near-term overbought conditions, META remains worthy of being on the “Top Stock” list given its great technical trend and bullish intermediate-term momentum.

Meta Platforms, Inc.

J.P. Morgan (JPM 0.33% - $279.95) No signs of JPM peaking as the rally continues

-JPM remains one of the top stocks in the entire Financials universe.

-While momentum has gotten stretched, price has not shown any evidence of turning lower or breaking its ongoing uptrend in a manner which would suggest a topping process has begun.

-Further gains are likely to be near $300 without much trouble before this stalls at resistance.

-DeMark exhaustion is premature on both weekly and monthly timeframes. Thus, barring any evidence of trend failure, it’s still highly likely that JPM can push even higher.

JP Morgan Chase & Co.

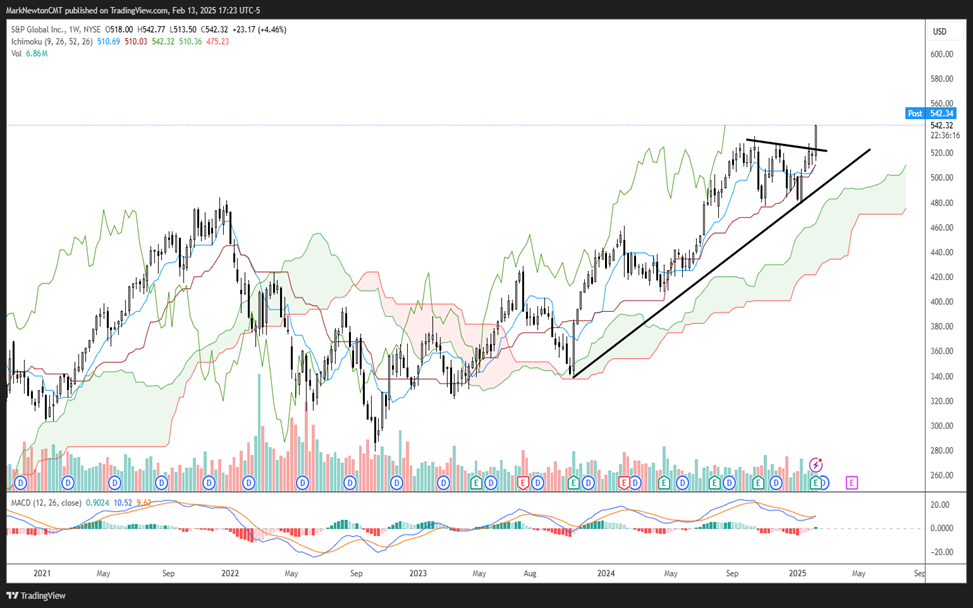

S&P Global (SPGI- $543.77) Beautiful base breakout

– Pushing back to new highs helps to officially confirm the base breakout, which began back in late 2021.

-The initial breakout back to new highs in late 2024 required consolidation, but this looks complete as of this past week.

-The triangle pattern that began last September has been resolved with this week’s move back over $528.

-Consolidation over the last five months has helped to relieve overbought conditions and makes this technically attractive following its breakout back to new highs.

-Upside targeted resistance lies at 595-600, then $669.

S&P Global Inc.

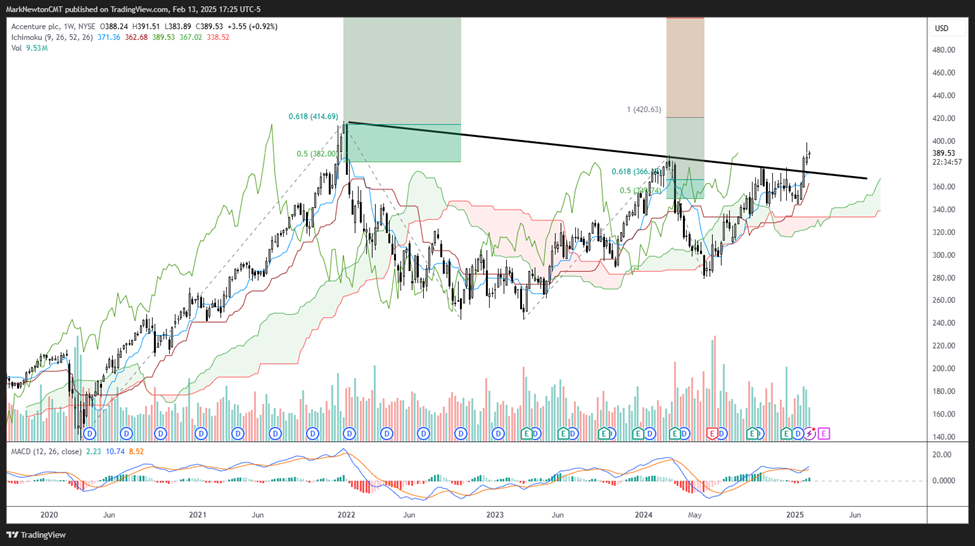

Accenture (ACN – $387.56) Lengthy base breakout is bullish

-Breakout to the highest weekly close since early 2022 makes this attractive for a coming challenge and move over all-time highs near $417.

-ACN breakout above the three-year triangle pattern bodes well for additional gains back to new all-time highs.

-Structurally, the act of having exceeded both March and October 2024 highs has successfully exceeded a three-year Cup and Handle pattern formed in early 2022.

-The initial resistance zone lies at $417-$422 and over, which would lead up to $477 and then $511.

Accenture plc

Amazon.com (AMZN 0.70% - $226.65) Pullback brings opportunity

-Minor backing and filling haven’t caused any harm to the longer-term uptrend from last August 2024 lows.

-The area near 224-226 looks important along with the uptrend line, given the presence of Ichimoku Cloud support, which I feel should hold AMZN on this most recent decline.

-February’s weakness has helped to alleviate recent overbought conditions on daily charts and has slightly helped the weekly overbought condition heading into early February.

-Technical structure continues to look excellent as the breakout of 2021 peaks resulted in a surge above $240 before minor consolidation took hold.

-Movement back above February peaks of $242.52 expected that should result in a rally to $269 with a maximum intermediate-term resistance near $314.

Amazon.com, Inc

Super SMID Technical Longs

Hims and Hers Health – (HIMS -1.09% - $58.50) Support- $49, $44; Resistance- $70, $75.

Applovin – (APP -0.08% - $496.00) Support- $440, $417; Resistance- $530, $665.

Spotify – (SPOT -0.21% - $630.56) Support- $581, $552; Resistance- $700, $715.

Interactive Brokers Inc. (IBKR 1.33% - $235.53) Support- $220, $205; Resistance- $259, $275.

Carvana (CVNA 4.78% - $284.53) Support- $268, $235; Resistance – $338, $376.