Through 2020 and into 2021, it’s all about earnings per share growth for the Standard & Poor’s 500 index and potential U.S. equity returns. As noted last week, I see 10% plus EPS growth and that should translate into another double-digit equity return next year as investors begin to discount EPS of 2021 some12 months from now.

Of course, it’s a Wall Street axiom that every year profits matter and 2020 is no different. Over the long term it’s true. However, in the short term sometimes EPS can matter less than price/earnings ratios (P/E)—and vice versa—for example. Let’s look at the big picture over the past few years. Remember, that the SPX EPS shot up over 20% in 2018 to $162 from $131, thanks mainly to a one-time Federal tax cut. Yet the result was a market that was down 6% in price. In 2019, earnings are essentially flat at $163 estimated, with a few days left, from in 2018, yet the market has soared about 30%.

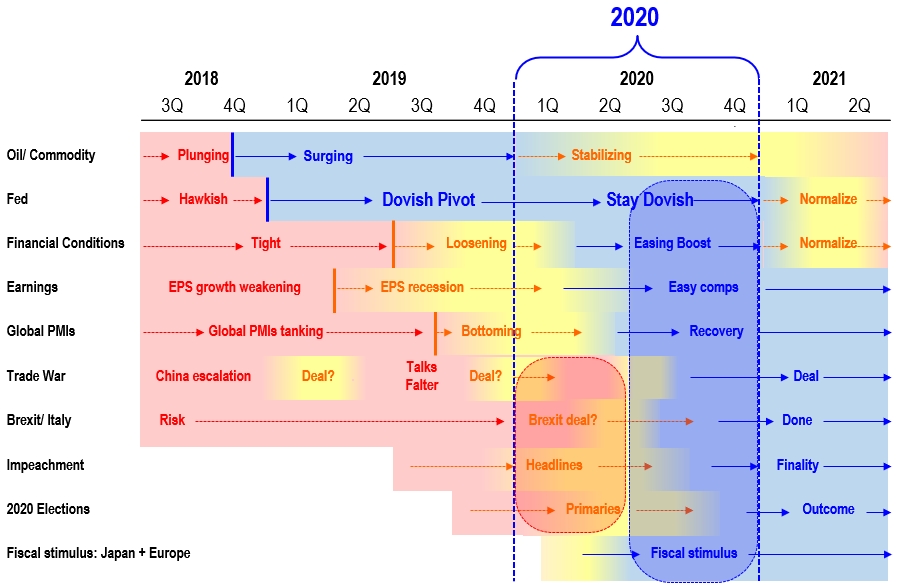

Clearly there were other things hampering investor sentiment in 2018, and those things generally, as I have outlined from time to time, were the Federal Reserve, which was tightening when it shouldn’t have; a global economic growth slowdown, and trade war between the U.S. and China, among other countries. All this appears to be behind us for the most part and because there was a bear market in the fall of 2018—on an intraday basis—the market has now reset, let’s say, to move on earnings from here, as it normally does.

Hence, I believe that EPS will matter more in 2020, the opposite of 2018-2019.

Indeed, the SPX EPS and price have roughly tracked each other since 2009, but as shown below, there are times where P/E led, and times where EPS led. Again, the last 2 years have been about P/E (de-rated in 2018, re-rated in 2019), but in 2020 and beyond, I view EPS being the key.

I realize this is mere a “crude comparison” but in my view, 2018 was a proper bear market and a reset of economic and fundamental expectations. And while many date this bull market from March, 2009, I suggest that 2020 is in many ways Year 2 of a newish bull market, analogous to 2010.

I stated at the start of this year that “2009 was the best analog for 2019” for U.S. equity markets, and I believe this remains correct. Thus, I see 2020 equity moves mirroring 2010’s (year 2 of that bull market), with some headwinds in the first half of the year.

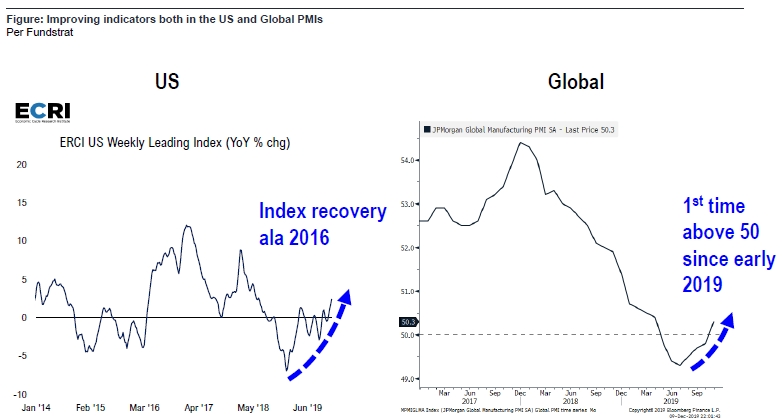

Where do I get my confidence that the entire year will be better? I think the Purchase Managers Indexes have bottomed and the 2020 global economy will be better than 2019’s drowsy growth. The leading indicators, such as the Economic Cycle Research Institute leading index and those global PMI indexes are all pointing to the same general picture: that the persistent economic weakness from mid-2018 through 2019 is ending and setting the stage for an improved growth outlook in 2020.

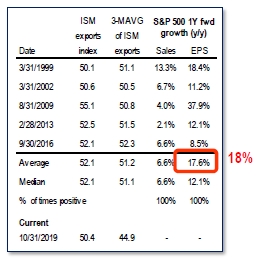

The October ISM Exports posted a 50.4 print, a sharp rebound from September’s 41.0, lowest since the Great Recession. As shown on nearby table, each 1-point increase in ISM Exports adds 0.6% to S&P 500 EPS growth. The recent ISM reading of 50.4 is 9.4 points higher than September. History suggests the SPX EPS growth should rise by 545 basis points. I believe this recovery reflects abating of oil shock, weakening greenback and generally improving conditions.

In a nutshell, I see in the next year reviving “Animal Spirits” as PMI indexes bottom, plus an accommodative Fed and potential fiscal support will equal EPS upside— and by extension an SPX rise.

Bottom line: Given that, my forecast is for the SPX to reach about 3,450 (from about 3235 currently) in our base case, or a bit less than 18 times price/earnings ratio on that $178 EPS. My best case scenario is for $184 EPS, to which we apply an 18 multiple for a level of nearly 3600 on the SPX.

Figure: Comparative matrix of risk/reward drivers in 2020

Per FS Insight

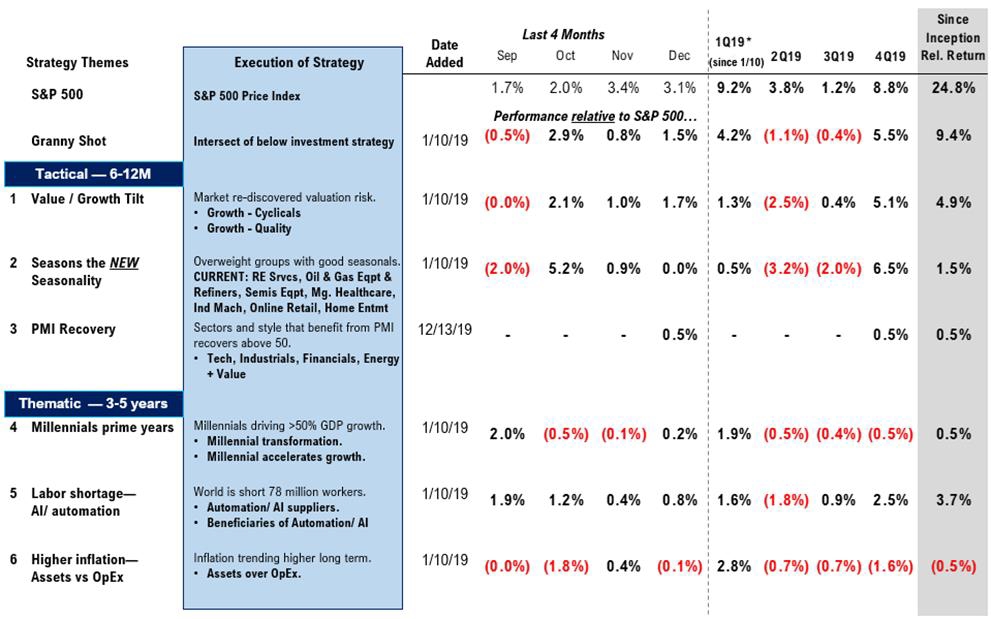

Figure: FS Insight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019