-

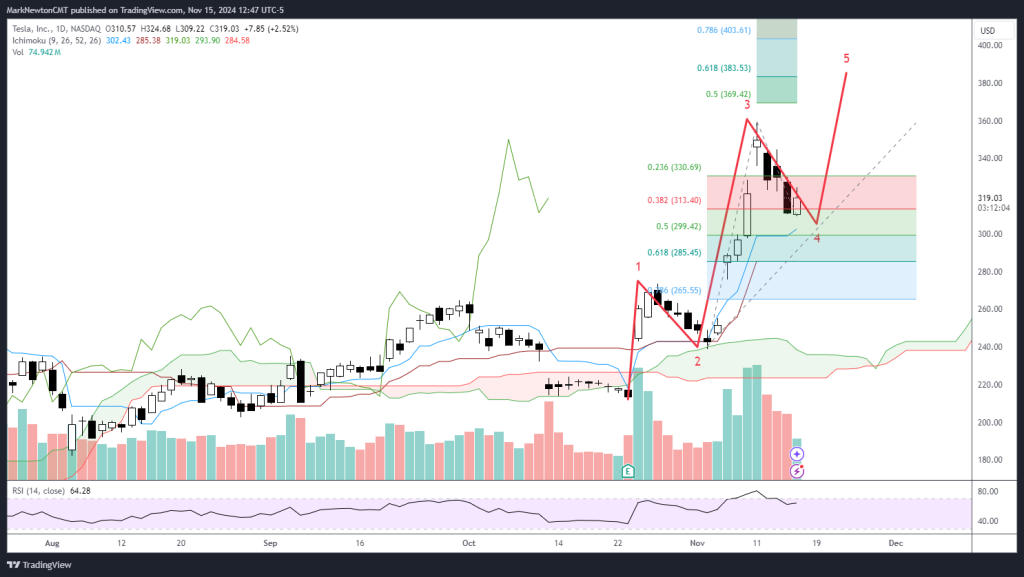

TSLA

-

$340.65

-

-0.40%

-

$343.81

-

$347.99

-

$335.28

Ticker Appearances

Daily Technical Strategy

QQQ has pulled back down to initial support

EQUITY TRENDS REMAIN BULLISH BUT HAVE BEGUN TO SHOW SOME MINOR DOWNSIDE VOLATILITY, WHICH WAS THOUGHT POSSIBLE GIVEN THE RECENT DETERIORATION IN MARKET BREADTH, BEARISH...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

⚡ FlashInsights

⚡ FlashInsights

Daily Technical Strategy

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

First Word

October Top Stock Ideas and Super SMID Granny Market Update

VIDEO: With 2024 Presidential election only 6 days away, we caution against STDS or "Stock Market Derangement Syndrome" as we believe markets should fare well...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

Technology has achieved a minor breakout ahead of Earnings

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

QQQ has pulled back down to initial support

EQUITY TRENDS REMAIN BULLISH BUT HAVE BEGUN TO SHOW SOME MINOR DOWNSIDE VOLATILITY, WHICH WAS THOUGHT POSSIBLE GIVEN THE RECENT DETERIORATION IN MARKET BREADTH, BEARISH...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

First Word

October Top Stock Ideas and Super SMID Granny Market Update

VIDEO: With 2024 Presidential election only 6 days away, we caution against STDS or "Stock Market Derangement Syndrome" as we believe markets should fare well...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

Technology has achieved a minor breakout ahead of Earnings

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

TSLA could help Discretionary push up into early November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

First Word

Light macro week, but heavy 3Q24 EPS season. 112 cos report (>20% index) with 25 being Industrials. Stay on target.

VIDEO: We are entering the "heart" of earning season with 112 cos reporting this week, or >20% of S&P 500. So far, this has been...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

QQQ has pulled back down to initial support

EQUITY TRENDS REMAIN BULLISH BUT HAVE BEGUN TO SHOW SOME MINOR DOWNSIDE VOLATILITY, WHICH WAS THOUGHT POSSIBLE GIVEN THE RECENT DETERIORATION IN MARKET BREADTH, BEARISH...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

Technology has achieved a minor breakout ahead of Earnings

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

TSLA could help Discretionary push up into early November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Daily Technical Strategy

Breakouts in Materials, Discretionary are bullish; Healthcare is being lowered to Neutral, technically

SHORT-TERM US EQUITY TRENDS ARE BULLISH AND LIKELY BEGIN TO ACCELERATE HIGHER INTO MID-OCTOBER BEFORE FINDING MUCH RESISTANCE. DESPITE THE BEARISH SEASONALITY TRENDS, IT’S HARD...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74

Technical Strategy

September Top Stock Ideas and Super SMID Granny Technicals

TOP STOCK IDEAS NVIDIA - NVDA -1.62% -Three month triangle consolidation arguably does not signify technical weakness, but should lead NVDA back to new all-time highs...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In f5fd92-e22639-fa7c92-d9b71b-181f74

Visitor: f5fd92-e22639-fa7c92-d9b71b-181f74