-

AAPL

-

$228.76

-

-0.10%

-

$228.88

-

$229.93

-

$225.71

Ticker Appearances

Daily Technical Strategy

What AAPL’s underperformance says about the weeks ahead

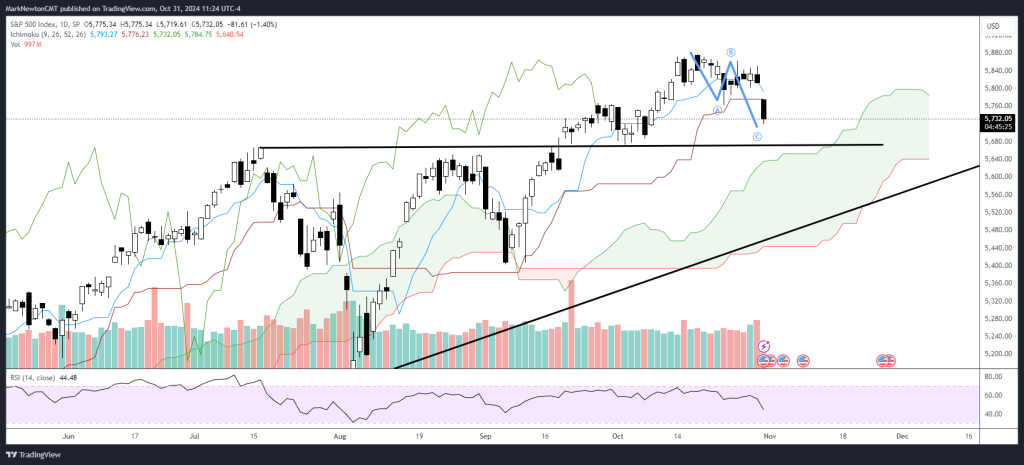

EQUITY TRENDS REMAIN BULLISH FROM EARLY AUGUST BUT STRUCTURALLY HAVE REACHED A KEY UPSIDE TARGET THAT LIKELY RESULTS IN CONSOLIDATION THIS WEEK BEFORE ADDITIONAL GAINS...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Software continues to make strides vs. Semiconductors

EQUITY TRENDS REMAIN BULLISH FROM EARLY AUGUST BUT HAVE SHOWN MILD CONSOLIDATION OVER THE LAST TWO WEEKS WHICH HAS RESULTED IN A 2% DECLINE IN...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

First Word

"Iffy" October behind us. But election uncertainty likely weighs on much of November.

VIDEO: It is clear that the winner of the 2024 Presidential election will not be decided on 11/5 evening, but could be a drawn out...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Expecting temporary bottom & push back to new highs on Tech strength

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE REACH THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

⚡ FlashInsights

Daily Technical Strategy

Short-term breadth has gotten abysmal, but MSFT, AAPL, AMZN might help temporarily

FOR THOSE WHO MISSED IT, YOU CAN VIEW MY TESLA STOCK UPDATED TECHNICAL ANALYSIS & CYCLES WITH HERBERT ONG HERE. EQUITY TRENDS REMAIN BULLISH BUT...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

What AAPL’s underperformance says about the weeks ahead

EQUITY TRENDS REMAIN BULLISH FROM EARLY AUGUST BUT STRUCTURALLY HAVE REACHED A KEY UPSIDE TARGET THAT LIKELY RESULTS IN CONSOLIDATION THIS WEEK BEFORE ADDITIONAL GAINS...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Software continues to make strides vs. Semiconductors

EQUITY TRENDS REMAIN BULLISH FROM EARLY AUGUST BUT HAVE SHOWN MILD CONSOLIDATION OVER THE LAST TWO WEEKS WHICH HAS RESULTED IN A 2% DECLINE IN...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

First Word

"Iffy" October behind us. But election uncertainty likely weighs on much of November.

VIDEO: It is clear that the winner of the 2024 Presidential election will not be decided on 11/5 evening, but could be a drawn out...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Expecting temporary bottom & push back to new highs on Tech strength

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE REACH THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Short-term breadth has gotten abysmal, but MSFT, AAPL, AMZN might help temporarily

FOR THOSE WHO MISSED IT, YOU CAN VIEW MY TESLA STOCK UPDATED TECHNICAL ANALYSIS & CYCLES WITH HERBERT ONG HERE. EQUITY TRENDS REMAIN BULLISH BUT...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Breadth starts to tail off while many just concentrate on NVDA

EQUITY TRENDS REMAIN BULLISH, YET SPX IS CLOSE TO SEVERAL PROJECTED TARGETS NEAR 5900 WHICH SHOULD SLOW THIS RALLY DOWN AS IT NEARS THE END...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

What AAPL’s underperformance says about the weeks ahead

EQUITY TRENDS REMAIN BULLISH FROM EARLY AUGUST BUT STRUCTURALLY HAVE REACHED A KEY UPSIDE TARGET THAT LIKELY RESULTS IN CONSOLIDATION THIS WEEK BEFORE ADDITIONAL GAINS...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Software continues to make strides vs. Semiconductors

EQUITY TRENDS REMAIN BULLISH FROM EARLY AUGUST BUT HAVE SHOWN MILD CONSOLIDATION OVER THE LAST TWO WEEKS WHICH HAS RESULTED IN A 2% DECLINE IN...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Expecting temporary bottom & push back to new highs on Tech strength

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE REACH THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Short-term breadth has gotten abysmal, but MSFT, AAPL, AMZN might help temporarily

FOR THOSE WHO MISSED IT, YOU CAN VIEW MY TESLA STOCK UPDATED TECHNICAL ANALYSIS & CYCLES WITH HERBERT ONG HERE. EQUITY TRENDS REMAIN BULLISH BUT...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Breadth starts to tail off while many just concentrate on NVDA

EQUITY TRENDS REMAIN BULLISH, YET SPX IS CLOSE TO SEVERAL PROJECTED TARGETS NEAR 5900 WHICH SHOULD SLOW THIS RALLY DOWN AS IT NEARS THE END...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21

Daily Technical Strategy

Software breakout should help drive further relative strength within Tech

SHORT-TERM US EQUITY TRENDS LOOK TO HAVE TURNED BACK HIGHER LAST FRIDAY FOLLOWING A CHOPPY PERIOD OF CONSOLIDATION IN RECENT WEEKS. DESPITE A PLETHORA OF...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 80a3af-34a1ae-37e696-a1190c-19ce21

Visitor: 80a3af-34a1ae-37e696-a1190c-19ce21