S&P, Nasdaq Notch Weekly Decline Despite Good CPI Numbers Array ( [cookie] => 814e6e-34d3fa-d69da3-b8584d-aff4a9 [current_usage] => 1 [max_usage] => 2 [current_usage_crypto] => 2 [max_usage_crypto] => 2 [lock] => [message] => [error] => [active_member] => 0 [subscriber] => 0 [role] => [visitor_id] => 176655 [user_id] => [reason] => Usage under limits [method] => ) 1 and can accesss 1

Our Views

Equites faded hard after the July CPI release on Thursday. July Core CPI came at +0.16% MoM, solidly below Street consensus of +0.22% and after an initial rally until 10am, equity markets saw steady selling until 2pm before stabilizing. Was there anything in the CPI report, or even market developments today that explained the -1.5% selloff between 10am and 2pm? We spoke with several macro investors today and in general, they pointed to the surge in long-term yields as triggering caution. But nobody can quite explain why they surged.

Earlier this week, we highlighted that the S&P 500 has gained post-CPI release 7 of the last 9 times. Of the last 9 CPI reports, Core CPI came below consensus three of the nine times. Each of those three saw S&P 500 decline into CPI release. Three out three times, the S&P 500 rallied over the next 5 days, 50 to 240 points. Even though equities were flat on Thursday, we still expect this to be the case in the coming week.

The key question is whether the current pace of core CPI of sub-0.20% MoM is sustainable. And our view is yes. In our view, the glidepath for inflation is lower and arguably on a better trajectory than many see and this will influence stocks more so than the knee-jerk reaction on Thursday.

- SPX low looks close and might bottom at 4425-55 over next 2-3 trading days.

- Gold and Silver weakness has helped counter-trend exhaustion signals to appear.

- Despite Healthcare’s strength, the group has not broken out vs. SPX to suggest outperformance.

- We posit that the recent decline in volatility can be attributed to competing forces, (1) positive industry-specific tailwinds, and (2) negative macro headwinds.

- In our view, the recent dip in macro correlations can be attributed to unique catalysts, notably the BlackRock ETF application. Without further industry-specific catalysts, it’s likely that traditional macro correlations return.

- There are reasons to be optimistic about the near-term macro setup, including potential stimulus from a deflationary China and the possibility of the DXY rolling over on a softer-than-expected CPI print.

- Bitcoin’s price, now near the 200-day moving average at around $27k, has historically faced significant resistance at this level, suggesting limited short-term downside risks.

- Core Strategy – Despite seasonal headwinds and the potential for lackluster liquidity conditions to persist, we maintain our view that the risk asymmetry this year remains to the upside, and it would be irrational to take much risk off the table with so many potential positive catalysts on the horizon.

- With Congress in recess, the White House has submitted a request for more spending, including for Ukraine, border security, and disaster relief.

- House Republicans will likely oppose the proposal, as some of them voted earlier to eliminate spending for Ukraine altogether.

- Next week’s release of the July FOMC meeting minutes might provide insight into Fed thinking about future policy.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 fell 0.3% to 4,464.05. The Nasdaq declined 1.9% to 13,644.85, and Bitcoin rose 1.12% to about 29,364.40.

- July CPI numbers showed that inflation remains on a glide path lower, providing more reason for the Fed to stop its rate hikes for this cycle.

- August continues to be a choppy month, but we remain cautiously constructive.

“I've been all over the world and I've never seen a statue of a critic.” ~Leonard Bernstein

Good evening:

Consistent with previous Fundstrat warnings, the second trading week of August continued to be choppy. Ultimately, the S&P 500 and the Nasdaq both fell for their second consecutive week. It was the first time the Nasdaq has notched back-to-back losing weeks this year.

For Fundstrat Head of Research Tom Lee, the biggest news came in the form of economic data releases, especially Thursday’s CPI release. Core CPI came in at 0.16%, beating Street expectations of 0.22%. For Lee, this was a good print. “I think some people are going to try to quibble with it, but it's a great number – that’s under 2% annualized. Now we’ve had low readings for the last couple of months and the Fed can look at the trajectory of inflation and be confident that the path has definitely hooked lower. So therefore hikes are going to come out and interest rates should reflect this too.”

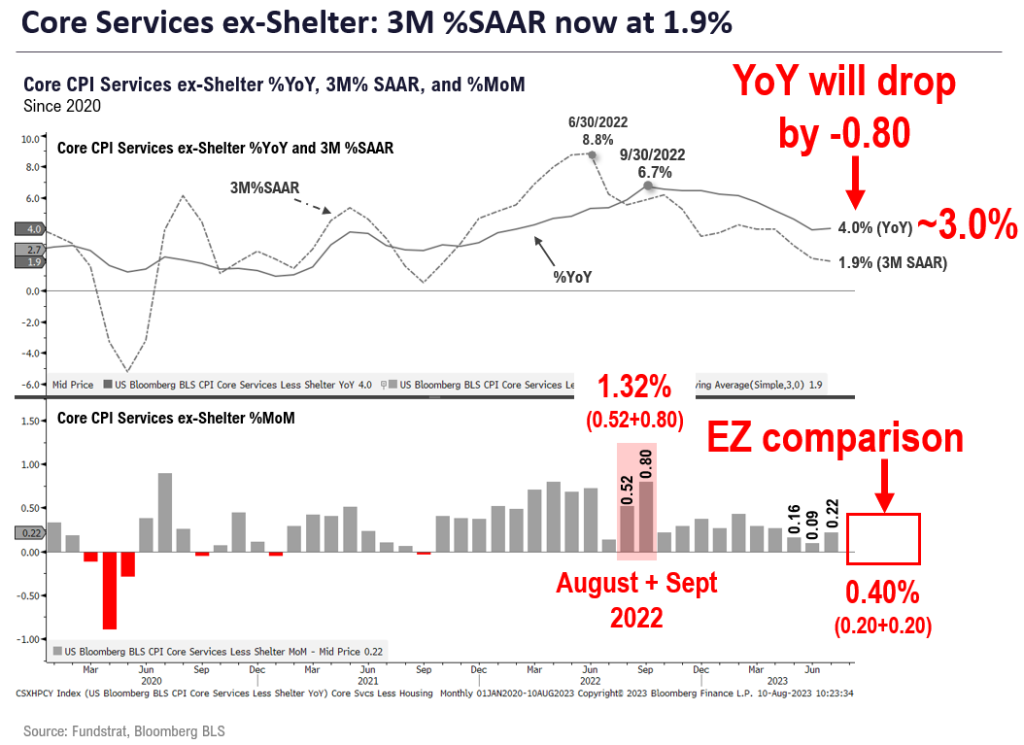

Diving deeper, Lee noted that Core goods came in down -0.33% MoM. “This is exactly what we wanted to see,” he said. But “arguably, the figure that probably mattered the most in the July CPI report was ‘Core services ex-housing,’ which is Core CPI Services minus Shelter.” He pointed out that Fed Chair Powell has discussed the analogous PCE figure, and San Francisco Fed President Mary Daly has also talked about how “we need to see core services…get to 2% on a sustainable basis.”

“So the Fed will be watching this ‘Core Services ex-housing’ figure,” Lee asserted. “And we know housing is on a glide path lower.” This is shown in our Chart of the Week:

“There was an optical issue with this CPI report,” Lee noted. “The headline number went up again, because oil prices are up. But I don't think the Fed is going to hike interest rates because of oil.” He explained, “As you know, Fed is trying to quash demand-side through monetary policy. That's really housing and used cars and the kinds of things that they control. I think oil has to go a lot higher for that to actually play a part in the Fed’s decisions here.”

Lee did concede that stocks were flat on Thursday despite the good CPI numbers, rising in the morning before falling later in the day. “But in our view, the glide path for inflation is lower and arguably on a better trajectory than many see. The key question is whether the current pace of core CPI of sub-0.20% MoM is sustainable. And our view is yes. I think July CPI probably confirms that the Fed is done hiking interest rates for this cycle.”

Head of Technical Strategy Mark Newton chimed in: “I echo Tom's comments about the good likelihood that the Fed is done.” Lee and Newton moved on to a discussion about the shorter-term tactical outlook for the rest of the month, with Newton noting that “this week has been very choppy and overlapping. So everybody's wondering the same thing – do we have more to go on the downside or has the market bottom really been churning in recent days?”

In Newton’s view, “I do think that a bottom to this recent pullback is near. A lot of my cycle studies say it should happen either this week or early next week. This also gels with the intra-month seasonality trends on pre election years for August, which show that early month pullbacks should bottom by right around the ninth [trading] day of August and start to turn higher.”

Shifting to look a little further out, Lee made an observation about recent labor union-related news. “We saw some big news items recently involving unions. We heard about negotiations involving the UAW [United Auto Workers]. The UPS agreement with its unions was also prominent because the size of the pay increase was so big. This won't be in PPI yet, but I think people are going to start to wonder if PPI might creep up because now you're going to have to think about how labor costs are going to go up. So it could be one of those things that becomes like its own story.”

Summing up his current views, Lee concluded, “August is a tough month for stocks, but I don't know if I’m ready to conclude that this month is kind of a write off. It might be tough, but I think things are going the right way.”

Newton said “I am intermediate-term bullish. In the short run, I've been a little negative but the market really hasn't been down all that much. The S&P is down less than 3% from the peaks that were seen back in July, not that large of a sell off. I don't think S&P gets down under 4425, so the risk-reward for being short is pretty poor.”

However, from a technical perspective, “it's going to be important for the S&P to really get over this 4540 level,” Newton said. “That’s sort of my line in the sand where I think okay, that's been exceeded and we might get above July highs and start to turn higher towards 4700 or above. I think we're close. I'm thinking despite it being choppy, it's still right to buy dips. September should actually be a bullish month.”

Elsewhere

The Biden administration has banned American private-equity and venture-capital investment in Chinese companies involved in quantum computing, advanced semiconductors, and some aspects of artificial intelligence. It also imposed a requirement that such firms notify the Treasury department of any investment in Chinese firms involved in artificial intelligence and semiconductors.

The Bank of England has asked former Fed Chair Ben Bernanke to review the British central bank’s forecasts after a series of inflation predictions that proved to be significant underestimates, sparking criticism from multiple members of Parliament.

The California Public Utilities Commission has given approval for driverless taxis to operate in San Francisco. The decision clears the way for robotaxis operated by two companies, Waymo (owned by Alphabet) and Cruise (owned by GM), to operate robotaxis 24/7. The decision came despite vocal opposition from first responders concerned about the automated vehicles’ potential for impeding emergency services.

China’s economy continues to show troubling signs, with its CPI officially showing deflation and trade in decline. China’s July CPI dipped 0.3% in July YoY, and its PPI fell 4.4% YoY. Both imports and exports declined sharply in July, officials reported. Exports fell for the third consecutive month, declining by 14.5% YoY as shipments to the U.S. and EU both fell. Imports shrank for the fifth straight month, down 12.5% YoY. The numbers come amidst reports that economists in China have been pressured to put more of a positive spin on their views in order to boost public confidence.

U.S. credit-card debt has exceeded the $1 trillion mark for the first time, according to the New York Fed. The data shows that credit-card balances climbed 4.6%, or $45 billion, driven in part by elevated interest rates (Bankrate reports that the average credit-card interest rate is currently 20.53%.).

The UK economic growth beat expectations in the second quarter, with GDP expanding 0.2% instead of staying flat. The UK Office for National Statistics attributed the results to warmer weather in June (as well as a public holiday to celebrate the coronation of King Charles III) helping to boost consumption.

And finally: Argentina has passed a prohibition against foreign soccer fans tearing up the country’s currency during matches. The Argentine peso has become so devalued due to triple-digit inflation that fans from other countries (notably, Brazil and Chile) have taken to ripping up peso notes to taunt Argentine fans and soccer players, but now the act will be punishable by up to 30 days in prison.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

The minutes from the July 26, 2023 FOMC meeting.

Est.: -0.7% Prev.: 1.1

Surveys the opinions of about 200 business executives in New York State regarding business conditions. Conducted by the New York Fed, the survey uses 0.0 as a neutral-opinion reference point.

Est.: 56 Prev.: 56

A gauge of the sales conditions in the national housing market, based on a monthly survey of home builders.

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+20.60%

|

+4.30%

|

+88.10%

|

View

|

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 814e6e-34d3fa-d69da3-b8584d-aff4a9

Already have an account? Sign In 814e6e-34d3fa-d69da3-b8584d-aff4a9

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 814e6e-34d3fa-d69da3-b8584d-aff4a9

Already have an account? Sign In 814e6e-34d3fa-d69da3-b8584d-aff4a9