-

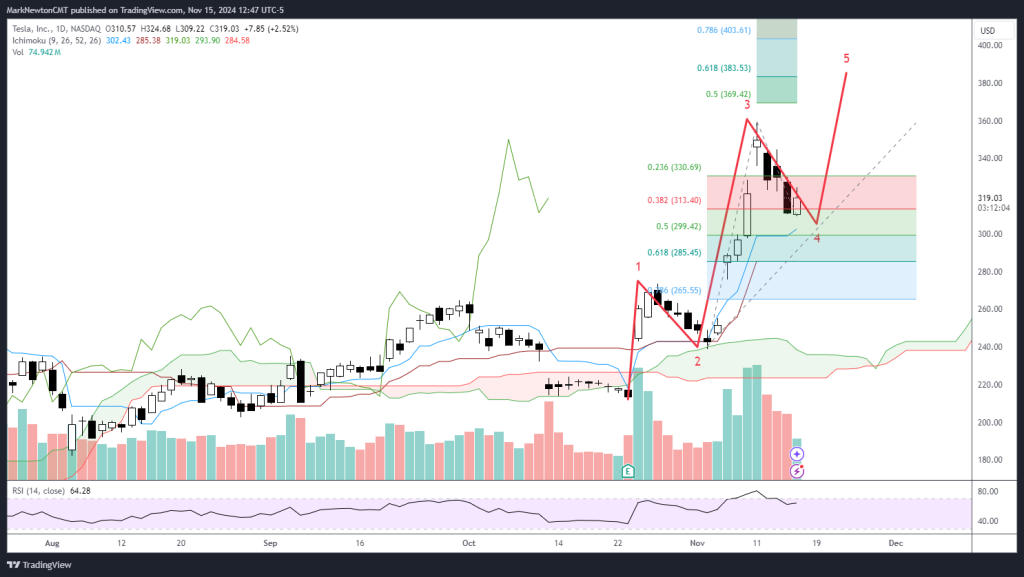

TSLA

-

$422.14

-

-3.22%

-

$425.51

-

$447.08

-

$417.64

Ticker Appearances

Live Technical Stock Analysis

LIVE Technical Stock Analysis December 2024

Mark will be conducting a live Webinar session for the most popular stocks requested by our subscribers. Mark will give his quick take (45 sec-1-minute...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

⚡ FlashInsights

Daily Technical Strategy

Top Technical Large-cap Ideas

EQUITY TRENDS FROM AUGUST REMAIN BULLISH, BUT YET THERE’S BEEN SOME NOTICEABLE DIVERGENCE THAT’S CROPPED UP WHEN VIEWING SPX AND QQQ VS. THE EQUAL-WEIGHTED SPX...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

First Word

November Top Stock Ideas and Super SMID Granny Market Update + SMID Granny November Rebalance +27 adds/ -25 deletes.

TO DOWNLOAD THE SLIDE DECK FOR OUR MARKET UPDATE WEBINAR, PLEASE CLICK HERE. INVESTMENT IDEAS: TOP LARGE-CAP STOCK PICKS + SUPER SMID GRANNIES As we...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

QQQ has pulled back down to initial support

EQUITY TRENDS REMAIN BULLISH BUT HAVE BEGUN TO SHOW SOME MINOR DOWNSIDE VOLATILITY, WHICH WAS THOUGHT POSSIBLE GIVEN THE RECENT DETERIORATION IN MARKET BREADTH, BEARISH...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

⚡ FlashInsights

Live Technical Stock Analysis

LIVE Technical Stock Analysis December 2024

Mark will be conducting a live Webinar session for the most popular stocks requested by our subscribers. Mark will give his quick take (45 sec-1-minute...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Top Technical Large-cap Ideas

EQUITY TRENDS FROM AUGUST REMAIN BULLISH, BUT YET THERE’S BEEN SOME NOTICEABLE DIVERGENCE THAT’S CROPPED UP WHEN VIEWING SPX AND QQQ VS. THE EQUAL-WEIGHTED SPX...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

First Word

November Top Stock Ideas and Super SMID Granny Market Update + SMID Granny November Rebalance +27 adds/ -25 deletes.

TO DOWNLOAD THE SLIDE DECK FOR OUR MARKET UPDATE WEBINAR, PLEASE CLICK HERE. INVESTMENT IDEAS: TOP LARGE-CAP STOCK PICKS + SUPER SMID GRANNIES As we...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

QQQ has pulled back down to initial support

EQUITY TRENDS REMAIN BULLISH BUT HAVE BEGUN TO SHOW SOME MINOR DOWNSIDE VOLATILITY, WHICH WAS THOUGHT POSSIBLE GIVEN THE RECENT DETERIORATION IN MARKET BREADTH, BEARISH...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

First Word

October Top Stock Ideas and Super SMID Granny Market Update

VIDEO: With 2024 Presidential election only 6 days away, we caution against STDS or "Stock Market Derangement Syndrome" as we believe markets should fare well...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Top Technical Large-cap Ideas

EQUITY TRENDS FROM AUGUST REMAIN BULLISH, BUT YET THERE’S BEEN SOME NOTICEABLE DIVERGENCE THAT’S CROPPED UP WHEN VIEWING SPX AND QQQ VS. THE EQUAL-WEIGHTED SPX...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

QQQ has pulled back down to initial support

EQUITY TRENDS REMAIN BULLISH BUT HAVE BEGUN TO SHOW SOME MINOR DOWNSIDE VOLATILITY, WHICH WAS THOUGHT POSSIBLE GIVEN THE RECENT DETERIORATION IN MARKET BREADTH, BEARISH...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Technology has achieved a minor breakout ahead of Earnings

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

TSLA could help Discretionary push up into early November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Breakouts in Materials, Discretionary are bullish; Healthcare is being lowered to Neutral, technically

SHORT-TERM US EQUITY TRENDS ARE BULLISH AND LIKELY BEGIN TO ACCELERATE HIGHER INTO MID-OCTOBER BEFORE FINDING MUCH RESISTANCE. DESPITE THE BEARISH SEASONALITY TRENDS, IT’S HARD...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2