-

META

-

$586.75

-

-1.48%

-

$590.58

-

$603.11

-

$580.00

Ticker Appearances

Daily Technical Strategy

Commercial Services, Transports, and TSLA all discussed

WEDNESDAY’S EQUITY RALLY PROVED CONSTRUCTIVE AND WENT A LONG WAY TOWARDS SUGGESTING THAT A RALLY BACK TO NEW HIGHS FOR THE MAJOR INDICES SHOULD BE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

First Word

November Top Stock Ideas and Super SMID Granny Market Update + SMID Granny November Rebalance +27 adds/ -25 deletes.

TO DOWNLOAD THE SLIDE DECK FOR OUR MARKET UPDATE WEBINAR, PLEASE CLICK HERE. INVESTMENT IDEAS: TOP LARGE-CAP STOCK PICKS + SUPER SMID GRANNIES As we...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

⚡ FlashInsights

Daily Technical Strategy

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

First Word

October Top Stock Ideas and Super SMID Granny Market Update

VIDEO: With 2024 Presidential election only 6 days away, we caution against STDS or "Stock Market Derangement Syndrome" as we believe markets should fare well...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

First Word

Sept jobs report - upside vs 150k consensus better. Watch the VIX to sense when Oct "iffy" period ending.

VIDEO: We are watching the VIX to get a sense when the "iffy Oct" period might end, both VIX falling below 17 and VIX term...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

Daily Technical Strategy

Commercial Services, Transports, and TSLA all discussed

WEDNESDAY’S EQUITY RALLY PROVED CONSTRUCTIVE AND WENT A LONG WAY TOWARDS SUGGESTING THAT A RALLY BACK TO NEW HIGHS FOR THE MAJOR INDICES SHOULD BE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

First Word

November Top Stock Ideas and Super SMID Granny Market Update + SMID Granny November Rebalance +27 adds/ -25 deletes.

TO DOWNLOAD THE SLIDE DECK FOR OUR MARKET UPDATE WEBINAR, PLEASE CLICK HERE. INVESTMENT IDEAS: TOP LARGE-CAP STOCK PICKS + SUPER SMID GRANNIES As we...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

Daily Technical Strategy

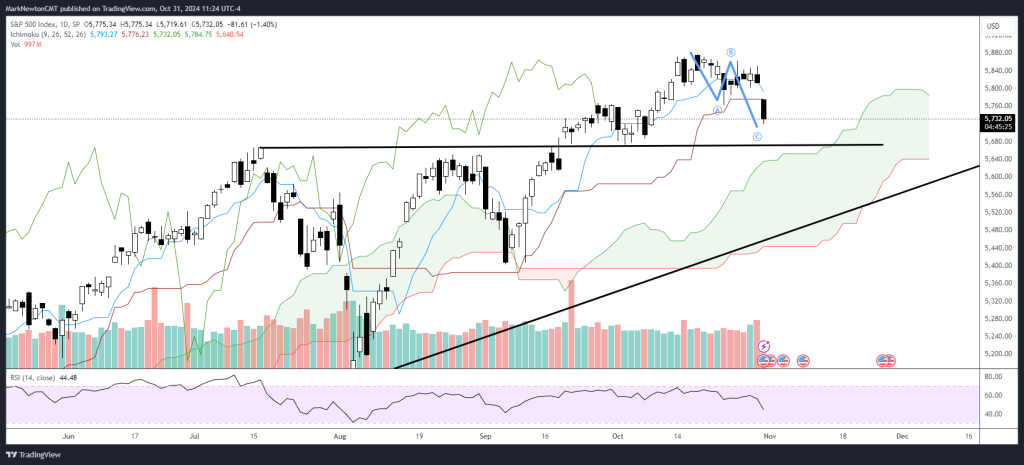

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

First Word

October Top Stock Ideas and Super SMID Granny Market Update

VIDEO: With 2024 Presidential election only 6 days away, we caution against STDS or "Stock Market Derangement Syndrome" as we believe markets should fare well...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

First Word

Sept jobs report - upside vs 150k consensus better. Watch the VIX to sense when Oct "iffy" period ending.

VIDEO: We are watching the VIX to get a sense when the "iffy Oct" period might end, both VIX falling below 17 and VIX term...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

Live Technical Stock Analysis

LIVE Technical Stock Analysis October 2024

Mark will be conducting a live Webinar session for the most popular stocks requested by our subscribers. Mark will give his quick take (45 sec-1-minute...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

Daily Technical Strategy

Commercial Services, Transports, and TSLA all discussed

WEDNESDAY’S EQUITY RALLY PROVED CONSTRUCTIVE AND WENT A LONG WAY TOWARDS SUGGESTING THAT A RALLY BACK TO NEW HIGHS FOR THE MAJOR INDICES SHOULD BE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

Daily Technical Strategy

Top Ideas and Super SMID Granny picks heading into November

EQUITY TRENDS REMAIN BULLISH BUT FRAGILE AS WE NEAR THE END OF OCTOBER. STOCKS, TREASURY YIELDS, AND THE US DOLLAR LOOK TO ALL BE CLOSE TO...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

Technical Strategy

September Top Stock Ideas and Super SMID Granny Technicals

TOP STOCK IDEAS NVIDIA - NVDA 2.96% -Three month triangle consolidation arguably does not signify technical weakness, but should lead NVDA back to new all-time highs...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

Daily Technical Strategy

Bullish reversal as Growth starts to make a comeback

SHORT-TERM TRENDS FOR US EQUITIES REMAIN NEGATIVE BUT WEDNESDAY’S REVERSAL DID HAVE THE MAKINGS OF BEING IMPORTANT FROM A TRADING STANDPOINT, AND OCCURRED ON CAPITULATORY...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

Daily Technical Strategy

NKY looks to have bounced at key support; Meanwhile a bounce in Natural Gas looks likely

THE MONDAY MELTDOWN FINALLY SHOWED SOME KEY ELEMENTS OF FEAR WHICH SUGGESTS THAT THIS SELLOFF COULD BE NEARING CONCLUSION. WHILE THE SPX AND QQQ’S 3%...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28

Daily Technical Strategy

SPX, QQQ give more compelling evidence of bottoming as dovish Fed delivers

SPX AND QQQ LOOK TO HAVE BOTTOMED AND SHOULD RESUME THEIR PUSH UP TO NEW ALL-TIME HIGHS INTO AUGUST. BOND YIELDS HAVE BROKEN DOWN SHARPLY...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 036ab8-6547a6-cf8512-7b95b8-269f28

Visitor: 036ab8-6547a6-cf8512-7b95b8-269f28