Gains in US Equities this week represent the start of the much-needed first push off the lows, which helps to make the strong technical case that our early April lows likely constitute a meaningful bottom for US Equities. The combination of phenomenal market breadth, coupled with strong leadership from Technology and stabilization in the bond market during a time of mass pessimism, is promising that US Equities should avoid a bear market and the economy could avoid a 2025 recession. Intermediate-term progress, however, will certainly take some time, given ongoing negative weekly momentum at a time when just 33% of all SPX stocks are above their 200-day moving average. Overall, short-term resistance could begin to materialize next week, given that NASDAQ has now achieved four consecutive 1% days of gains. The area near 5600 in SPX could prove important into next week, and allow for some consolidation. However, it’s unlikely in my view that corrections prove too severe nor long-lasting before starting a larger rally back to new highs. Thus, as discussed, a “two-steps forward, one-Step back” looks to still be in effect, with the two steps forward part off the 4/7 lows possibly complete into next week.

Four solid days of gains have helped SPX to recoup the prior lows that were broken in mid-March on both SPX and QQQ. While DJIA and RSP have not yet accomplished this feat, this is seen as very bullish structurally, suggesting that our April 7th lows likely represent the lows for Spring 2025.

Key positives have to do with the following:

-Strong market breadth with Advance/Decline (A/D) and A/D volume both showing very strong bullish percentages on multiple occasions over the last two weeks.

-Breakout in Technology following this sector, having held at intermediate-term support in its relative relationship to SPX.

-VIX and High Yield spreads have both collapsed in the last two weeks.

-Bond market having stabilized following the rapid ascent in rates during the period directly leading into 4/7 SPX lows.

-Cycle composites turning higher in April which pinpointed a low in the first half of April and push higher into May.

-Pessimism remains extraordinarily elevated.

-DeMark signals were triggered (and subsequently confirmed) on 60, 120, 180, 240-minute charts as well as daily charts of SPY within 1 day of the 4/7 low in SPY.

I’ll list some of the negatives and what still needs to be accomplished for intermediate-term conviction early next week. (For now, let’s end the week on a good note.)

S&P 500 Index

As seen above, the trajectory for SPX very well might play out according to the arrows above. This would imply a possible near-term peak developing next week. This might be followed by a 38-50% pullback to the progress having made since 4/21 swing lows.

Precious Metals might show minor weakness into May before bottoming and pushing back to new highs

Precious metals along with precious metals stocks have begun a mild correction at a time when the Dollar has stabilized ever so slightly, and some reversal in many of the Haven trades have taken place. Note that USDJPY USDCHF have all started to turn higher. I suspect this is a temporary development for Gold and its pattern suggests this should be a simple “ABC” Elliott-wave style corrective decline before price pushes back to highs.

Overall, I suspect that a pullback into May has begun which will take Gold down to between 3130-3164, and might also result in temporary weakness for Gold stocks and Silver. Upon completion, there should be a push back to new highs. Thus this appears like temporary weakness only. The two-day correction from 4/22-4/23 looked important, and likely will be followed by a similar move lower in price and time before this completes.

A 100% alternate projection arrives at 3130, and this also is near a 61.8% Fibonacci retracement of the entire April rally, making this zone a good target for gold weakness to find support.

CFDs on Gold (USS / OZ)

VIX looks to have support in the low 20s next week

CBOE Volatility Index (VIX) in the last 2 weeks has nearly erased its entire backwardation spread, which got to over 20 points between Spot VIX and 3-month Futures in early April. Note, VIX going to yearly highs & then erasing more than 50% of its value has brought “implied vol” down to levels that are normally appealing given no real evidence of meaningful tariff negotiation having gotten underway yet between US and China, or Japan, or EU, and VIX shows technical support in the low 20’s.

As shown below the 4-hour chart has broken down again under lows of the last few days, and seems likely that VIX might briefly undercut 24 into early next week before trying to stabilize and bounce. At present, DeMark indicators on 60-min, 180-min, 240-min, and also Daily charts remain premature to bottom.

However, some indication of intra-day VIX lining up with exhaustion will be in place likely by early next week for those looking. Thus, in terms of Equity markets, one could expect another couple days of gains before some stalling out potentially and consolidating in a manner that might lead VIX higher.

For now, I suspect VIX might still have another 7-10% down.

CBOE Volatility Index – VIX

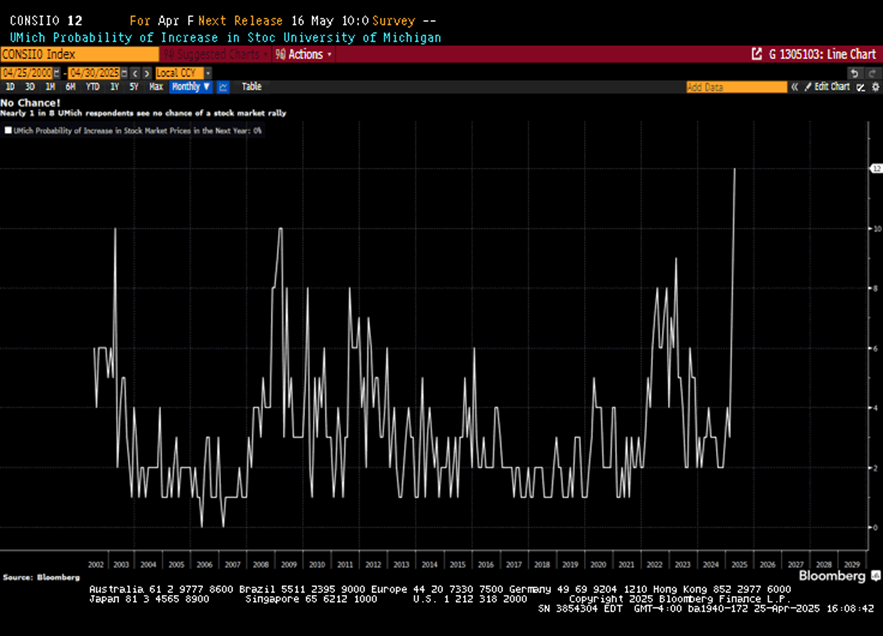

University of Michigan Sentiment data has never been this negative

Recent survey results seem to show extraordinarily negative sentiment, which dovetails with the record number of bearish weeks above 50% in AAII data.

As shown below, 12% of all respondents surveyed believe there is zero chance of a stock market rally in the next year.

Bloomberg data shows this is far and away the most negative that people have been in the 22-year history of this indicator.

CONSIIO Index