SPX and QQQ failed to break down meaningfully enough to think that markets have peaked out for the Fall. While the correlation briefly reversed today, as Bad news on the economy actually did prove to be bad news for the stock market, this has not been the trend all year. Bond yields accelerated lower on the dovish Fed, with the 2-year nearly having reached December 2023 lows and TNX now having retreated under 4.00%. Meanwhile, US Dollar looks to be “next in line” to break down to new monthly lows. Small-caps underperformed in recent days, but still look more attractive than Large-caps for outperformance over the next 3-5 weeks. Technology has had an abnormally big effect on SPX, but it’s the breakout to new highs in Healthcare, Industrials and Financials strength that seems important to concentrate on. Overall, I don’t feel its right to be bearish, despite Thursday’s sharp drop, and will stay bullish barring a break of 5390.

A couple things are important to reiterate following Thursday’s decline:

-Stock indices sold off violently, yet breadth wasn’t abnormally negative

-No evidence of fear-based selling as TRIN registered 1.63 reading, the lowest all week

-Four sectors finished positive out of 11 in Thursday’s session: REITS, Utilities, Healthcare, and Staples.

-Healthcare Sector SPDR ETF (XLV 1.07% ) made a new all-time high today. This follows the move in Industrials Equal-weighted ETF (RGI 1.08% ) yesterday which pushed back to new all-time highs.

-Uptrends for SPX, QQQ, IWM remain intact despite the one-day decline.

-While my fear gauges remain muted (not complacent, nor fearful) there does seem to be an abnormally high level of concern from investors regarding Thursday’s price action.

Overall, it’s still tough for me to put too much credit into Thursday’s price action as to having “changed the trend” or “broken any trend” and uptrends remain intact.

This would only change on a daily close under July lows of SPX-5390.95. QQQ has strong support at 449-450 and until/unless 449 is broken, I’m willing to bet that Technology also is bottoming, and I cannot get too negative following this pullback.

IWM 1.29% remains the most bullish of the three, and has barely moved since pushing up aggressively to new multi-month highs into mid-July. IWM’s strong pullback certainly did result in short-term breakout attempts failing above the recent range. However, this likely finds strong support near 213-216 and should not face much more selling pressure.

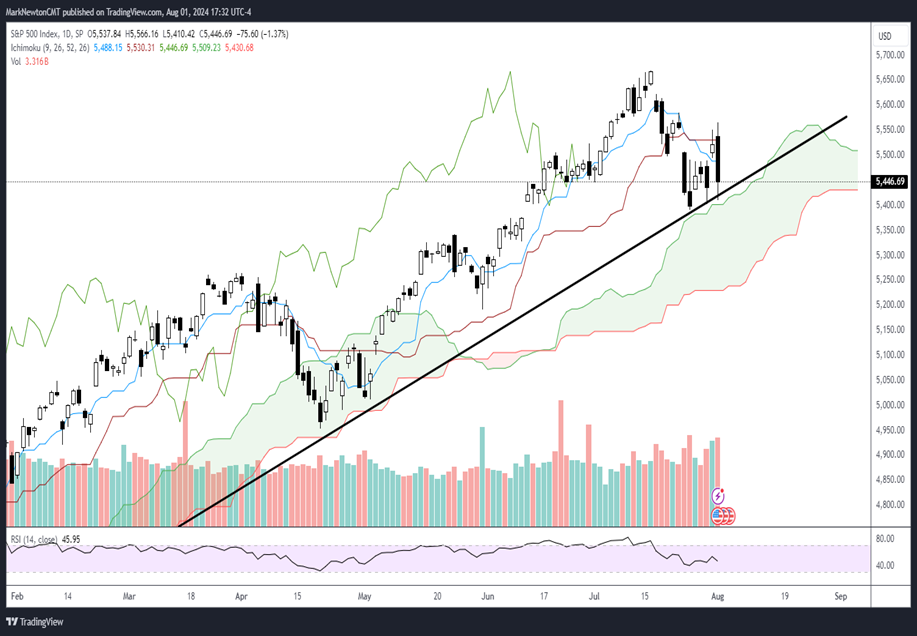

As shown below on ^SPX daily charts, while this did take some wind out of the sails on Stocks following Treasuries, it’s hardly sufficient to argue that the correlation is broken and has begun to unwind. We’ll need to see much stronger evidence before weighing in too negatively.

S&P 500 Index

Treasury Yield breakdown might have been abnormally severe in recent days, but is still bearish and Stock indices should rally on weakness in yields.

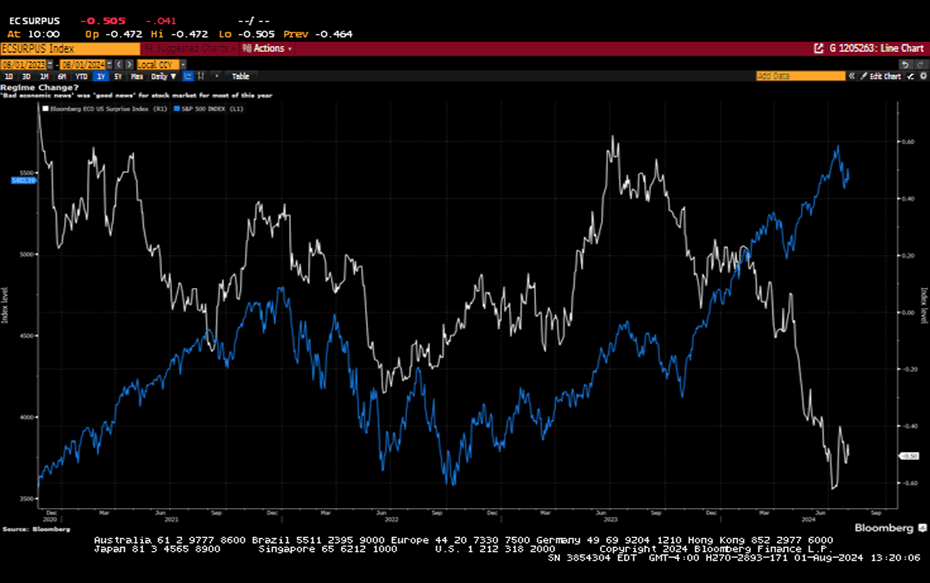

It’s interesting to see the extent that bad news has proven to be good news for stocks this year so far.

Weak economic data that fails to meet expectations (as shown by Citigroup’s US Economic Surprise index) has resulted in stock indices pushing higher as Fed rate cuts have grown more certain for September. Thus, as weaker Economic data resulted in yields breaking down, stocks have rallied.

However, when one looks back at 2022 and 2023, this certainly was not the case, and good news led stocks higher while bad news (defined as when economic data misses expectations) has proven to be negative for stock indices.

Overall, it’s hard to see one day of this correlation not working as proving to be evidence that yields going lower are negative for Stock indices. US Treasury yields (^TNX) did drop much quicker in recent days than has been the case in recent months, and 4.00% was an important psychological number.

Yet, my target for Yields is 3.78% into September, or only around 20 basis points (b.p.) lower. Given that the market seemed to be quite comfortable with the Fed’s comments and roughly 70 bps of Cuts are now priced into the market into year end (as per Swap data) it’s tough taking Thursday’s stock market selloff as thinking “bad news” now causes stocks to fall.

Overall, I expect Stock indices to bottom and turn higher given the recent Treasury yield decline, and until SPX proves the “Bears” correct by dropping under 5390, it should be right to expect some stabilization and a coming rally.

Citigroup’s US Economic Surprise Index

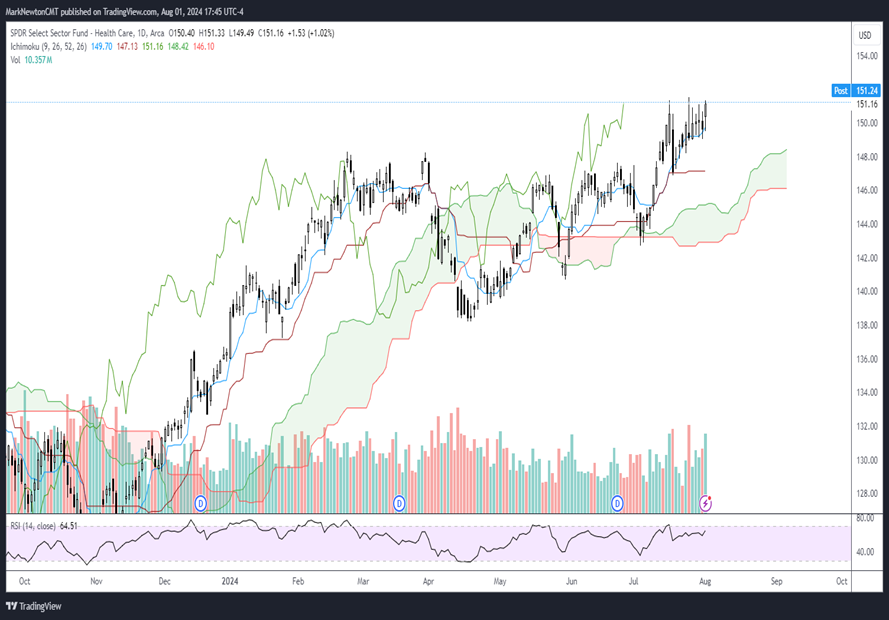

Healthcare SPDR Select Sector Fund ETF has now pushed back to new all-time highs

While many won’t choose to use Healthcare’s strength as their narrative for Thursday’s trading, XLV is the latest ETF to push back to new all-time high territory.

Despite Healthcare having underperformed this year, there has been some evidence of strengthening during Healthcare’s best seasonal two-month stretch of the year, which is normally June into July.

Given that Industrials Equal-weighted ETF (RGI 1.08% ) just broke out to new all-time highs on Wednesday, it’s hard to see this sector strength as being too negative for the US Stock market despite some above-average selling for Technology.

Healthcare SPDR Select Sector Fund ETF

Small caps minor failed breakout doesn’t cause them to lose appeal as trends remain intact

IWM’s decline Thursday failed to cause sufficient damage to expect that Small-caps are peaking relative to SPX, nor peaking on an absolute basis.

Small-caps showed the second worst performance of the year following a very visible failed breakout yesterday, which backed off sharply after IWM had briefly pushed to new monthly highs.

As I said this morning in Flash Insights, Small caps don’t look to have peaked based on the combination of daily charts and momentum, nor DeMark, nor wave structure.

IWM should be overweighted technically and additional absolute strength should allow this to push higher to test 236, then 244.

Support could materialize at 213-216 and likely helps IWM stabilize before pushing back higher.

As always, it’s helpful to know where this could be wrong. I feel that undercutting May’s prior peaks of $209.77 should be unexpected, and would postpone any rally while this reaches $205-$206. At present, this latter thesis is not my base case scenario and it’s hard to make too much out of one day’s trading.

Russell 2000 ETF