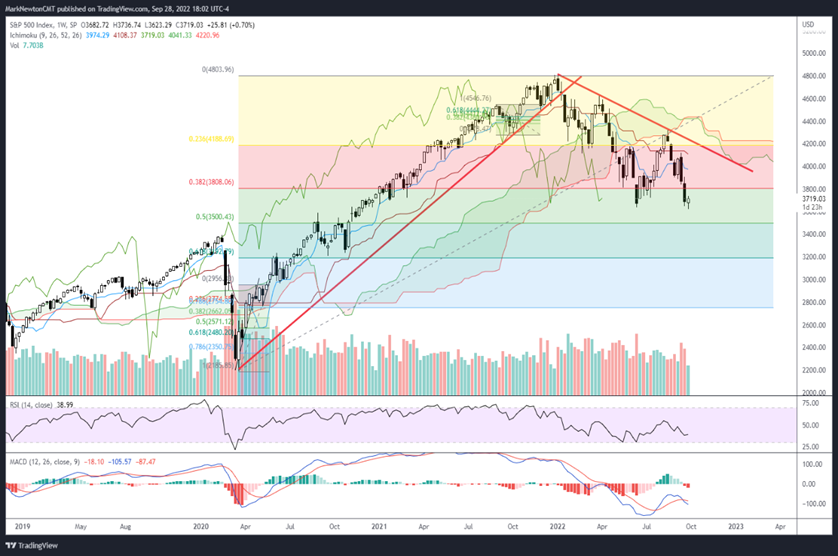

Markets have begun a bottoming process in my view, and while it’s tough to rule out a test and minor break of this week’s lows, the downside should prove limited into next week and provide the start of a liftoff for Equities in Q4. While Technology was quite weak back in late August, it’s been acting far better in recent weeks, and ^SPX and QQQ 2.65% have held their ground at June lows better than the Equal-weighted ^SPX. Overall, it’s hard to make much of one-day’s rally in Equities, Treasuries and decline in the US Dollar, but a push back to new highs in ^TNX and DXY should create selling opportunities in the week ahead and buying opportunities for stocks. Most cycles suggest October 4-7th should be key for a market bottom.

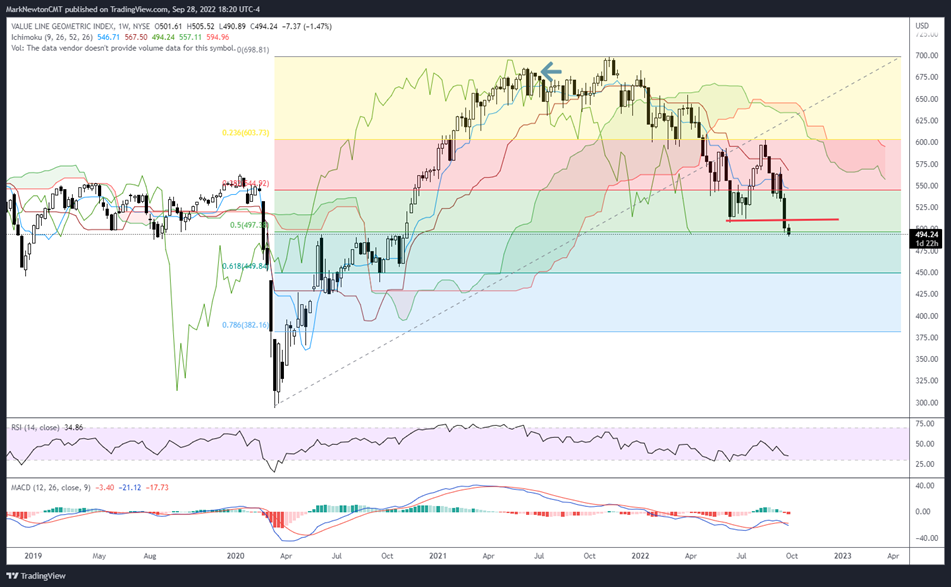

Value Line has proven weaker than SPX but at 50% retracement level

Similar to how I discussed markets starting to wane last Spring 2021 when eyeing equal-weighted Value Line Geometric Average, a 1700 stock equal-weighted index of US stocks, I feel that it’s particularly important now in watching whether markets can bottom into next week.

Importantly, Value Line has just reached the 50% retracement zone of its 2020-2021 rally which normally can offer good support.

However, prices have actually breached June lows, making the “equal-weighted” market weaker than ^SPX, or QQQ 2.65% , both of which remain above June lows.

This largely stems from some of the high growth Technology names which have held up relatively better in recent weeks, and I suspect that the NY FANG index might prove to be an important outperformer in October-December if/when Treasury yields start to roll over.

Growth has held up surprisingly well vs. Value in recent weeks

In the last week, we’ve seen Growth break out vs Value above a six-week downtrend, when eyeing S&P Growth Index ETF, vs S&P Value Index ETF.

Interestingly enough, despite the seemingly non-stop Equity index decline at work, Technology has outperformed Energy, Utilities, Real Estate, Financials, Communication Services, and Materials in the rolling one-week period.

While this ratio requires more strength to regain the larger uptrend from Spring lows which was broken, recent outperformance is Growth is encouraging. Meaningful weakness in Treasury yields between October-December could drive this ratio much higher, in my view.

Recent relative strength in Financials very well could prove short-lived if rates start to weaken, as this provided some strength in many parts of Financials, notably regional banks and Insurance.

Overall, it looks right to favor Growth vs Value in small size here, looking to add on evidence of Treasury yields breaking their parabolic uptrend.