Markets have stabilized ahead of the long holiday weekend, and a near-term bounce up to 3830-3860 looks to be happening to kick off Q3 on a good note. Near-term, active traders should look to sell into this bounce next week, expecting that 3946 should not be exceeded before prices roll over to test and take out 3636. Sector-wise, this past week has been marked by steady outperformance by the Defensive groups, while Automobiles, Metals and Mining, Internet retailers, and Semiconductors have been very hard hit. In general, this month looks to be a pivotal one for US Equity markets and should also coincide with lows in Treasuries and Cryptocurrencies. However, at present, until technical structure improves and/or signs of capitulation on a move to new monthly lows happens, it’s right to continue to be selective and favor defensive groups. Bottom line, one should avoid trying to buy dips aggressively until ample evidence of stabilization happens and/or signs of downside exhaustion appear. SPX should likely bottom out just below 3600, with 3505 being very strong 50% range support.

Performance has largely been defensive this past week

When doing a quick scan on the SPX GICS Level 3 sub-sectors over the past week, we continue to see strong performance out of the defensive groups like Utilities and Staples. Insurance stocks have fared the best lately within Financials and substantial outperformers over many Money Center Banks. Meanwhile, Aerospace and Defense has made a comeback after a couple failed breakouts. Yet this group has held up relatively much better than others within the Industrials complex.

Overall, this remains an environment for small, not big, bets, but Healthcare, Utilities, Staples remain groups which should outperform for July. Energy is thought to be a sector laggard along with Materials given recent reversals of trend in Commodities. Crude is thought to not surpass $114 before turning back lower to the mid to low 90’s. Yet, Energy remains a long-term bullish bet, and declines into July should prove to be excellent buying opportunities.

Outside of these groups, Financials as a group look close to reversing higher; Yet for now, it’s important for Treasury yields to start to reverse higher before putting too much trust into this important sector.

Technology should bottom out this month, but it’s thought that Large-cap Technology names that constitute the “FAANG” group likely show the best performance. Semiconductor issues have begun to drop off sharply and look early to buy. Moreover, the high-growth Technology stocks will likely continue to underperform until some meaningful evidence of rates peaking starts to play out. As has been discussed, I’m expecting rates to turn higher into mid to-late July.

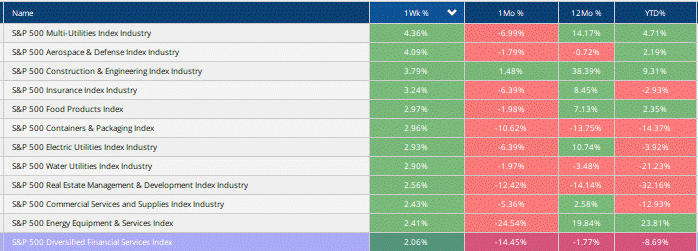

Finally, retailing woes should continue to present a difficult environment for Consumer Discretionary. This latter group was listed as an underweight in my 2022 Technical Outlook, and I expect this sector to continue to struggle. Below is a breakdown of the specific sub-sectors which have performed the best over the last rolling week (ranked by one-week % return)

Utilities continuing to show excellent progress and should be overweighted in July

Utilities have now begun to sharply outperform with rates having pulled back hard in the last two weeks. This volatility in interest rates very well might continue, but Utilities outperformance is thought to be occurring largely due to difficult market conditions more than due to Treasury rallies.

Multi-Utilities were higher by over 4% in the rolling 5-days, while Electric and Water Utilities were both up by over 2.5%.

Importantly, XLU has just exceeded the former low which was thought to offer some resistance to this rise. A stalling out lasted merely 3 days before XLU broke back out in Thursday’s trading. This act of having regained $70 near May lows should help to push XLU higher to $74 without much trouble, with further resistance near $77.

While some of the laggard Utilities like FE had great weeks (+5%), most of the outperformance was made by the leaders like ED, ATO, WEC, AEP, XEL and CMS which remain within 10% of 52-week highs. Overall, this group looks preferred to still overweight in July, despite the recent outperformance.

Semiconductor issues have weakened substantially vs most of Tech

Interestingly enough, while many of the larger cap Tech names like AAPL, AMZN, MSFT, GOOGL have held up in resilient fashion above May lows, the Semiconductor group has lagged sharply in recent weeks.

The intermediate-term chart of PHLX Semiconductor Index (SOX) vs the Invesco Equal-weighted Technology ETF (RYT) shows how pronounced this breakdown has been lately. As charts show, the initial warning sign happened in May for Semis, with a breakdown of the relative trendline vs. Technology extending back to 2019. The bounce attempt into late May held right where it needed to and failed to recoup this uptrend before rolling back over.

The subsequent break of May lows in relative terms, keeps Semiconductors in a laggard position, and a group that should likely still underperform in the month of July. Despite AMD, AMAT, LRCX and NVDA being down over 20% in the last month, these stocks all look a bit early to bottom out.

Technically I prefer TXN, AVGO and NVDA, though opportunities to buy dips likely won’t materialize until the 2nd to 3rd week of July.

Happy July 4th– Have a safe happy holiday weekend!