The excessive focus by so many technical traders on the short-term overbought condition of the Standard & Poor’s 500 index (SPX) is misplaced. Focus should be on the longer-term accelerating bull market.

When equity markets begin to trend following break-outs, short-term indicators, such as relative strength index (RSI), often remain overbought for extended periods of time.

I continue to caution investors from attempting to micromanage near-term pullbacks at the risk of missing the bigger underlying uptrend. To reiterate my recent recommendation, add to cyclicals on pullbacks and use the current bounce in defensive stocks and bonds to reduce exposure.

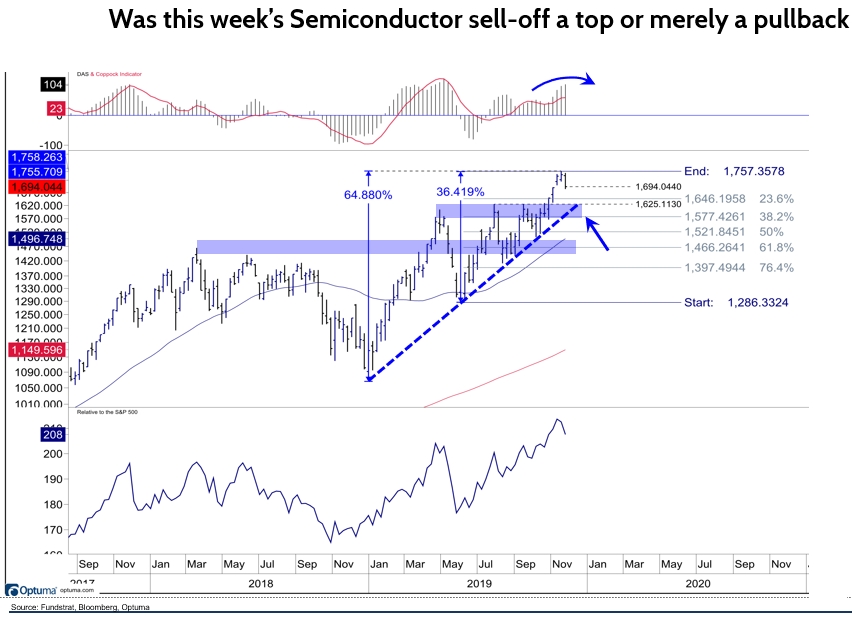

Semiconductors sold off sharply this week, led lower by semiconductor capital equipment, raising concern that their bull cycle was ending. I have focused on this group multiple times as one of the reasons to remain bullish through 2019. After all, semis relative performance bottomed in advance of the SPX in October of 2018 and has led through the year.

The SOX semi index has rallied 65% from its cycle low, 36% of which developed since May. Given the group often leads bigger market reversals, clients are questioning whether this week’s weakness is signaling a more ominous downturn for equities. My view is their recent weakness is short-term and part of a healthy pullback in an ongoing uptrend.

Note in the chart below the SOX’s price trend remains positive with higher highs and higher lows in place, as the 2019 linear uptrend remains intact and the price remains above a rising 50-day simple moving average. There is little technical evidence at this point to conclude a major top is developing. After such a strong surge in 2H 2019, a

pullback is hardly surprising with support levels starting at 1625 down through to 1500 round numbers. For a group as volatile as semiconductors, steep pullbacks are not uncommon in an ongoing bull cycle. Be patient and use weakness in the balance of Q4 to increase exposure.

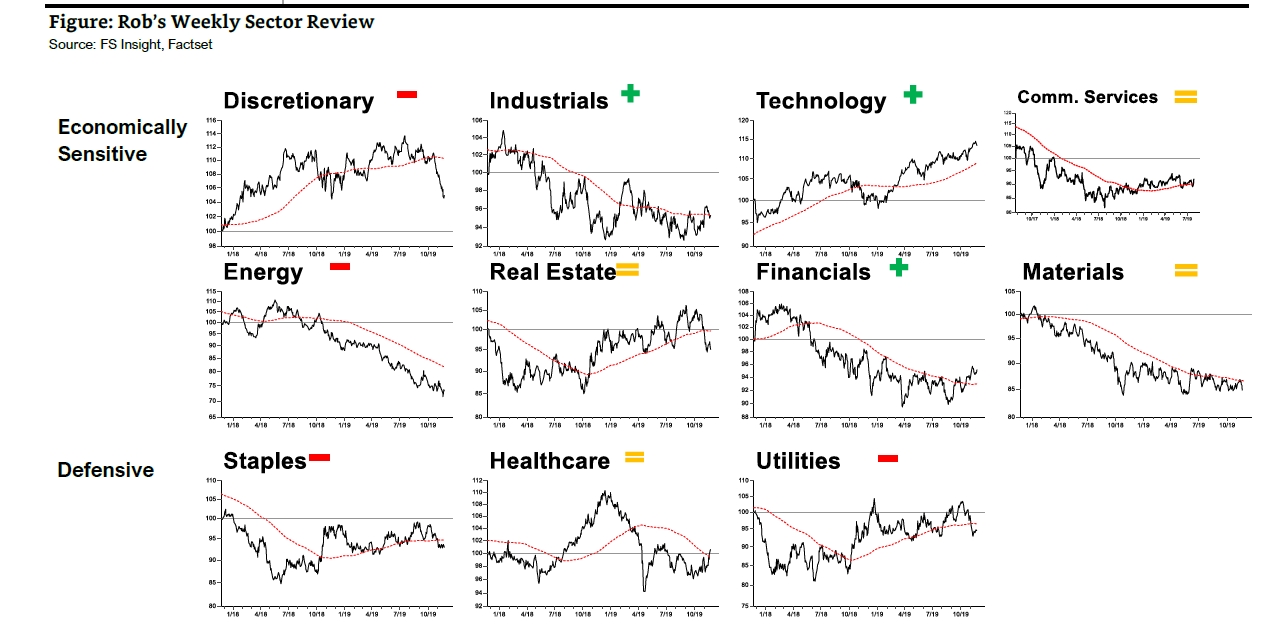

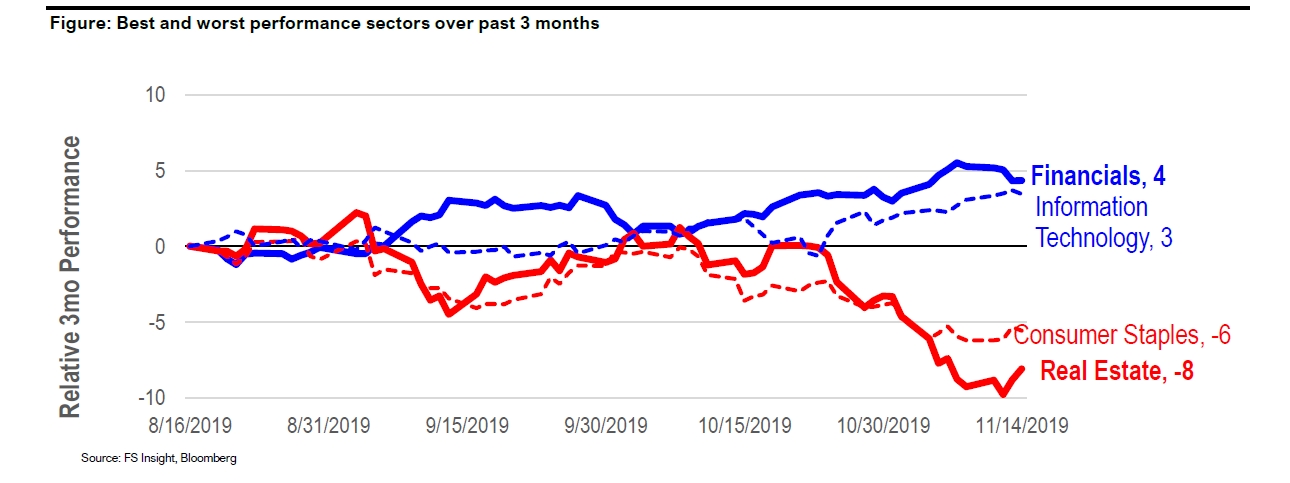

Noteworthy: Technology’s longer-term trend intact with a short-term pullback underway. Financials are in the early stage of reversing their 2018-2019 downtrend and remain above their 200-dma. Industrials are also showing evidence of reversing their longer-term downtrend. Remain overweight.

Defensive sectors, notably utilities and staples, are oversold short-term but have yet to stage any meaningful upside. Remain underweight.