After rallying some 25% from the December, 2018, low it shouldn’t be surprising to see US equity investors take some money off the table, particularly in face of increasingly uncertain US-China trade tensions. But, as I’ll point out, that’s likely to be short-lived.

The weekly technical indicators I have featured here over the past few weeks have signaled the growing risk of pullback developing in the second quarter. However, as always, once equity markets begin to decline, investor sentiment quickly pivots to the negative, reinforcing already worrisome headlines in a sort of self-perpetuating spiral lower. With most stocks selling off quickly this week, it’s certainly understandable investors remain nervous and quick on the sell trigger.

From a technical analysis perspective, however, there are early signs the sell-off is likely to be a passing storm. Why?

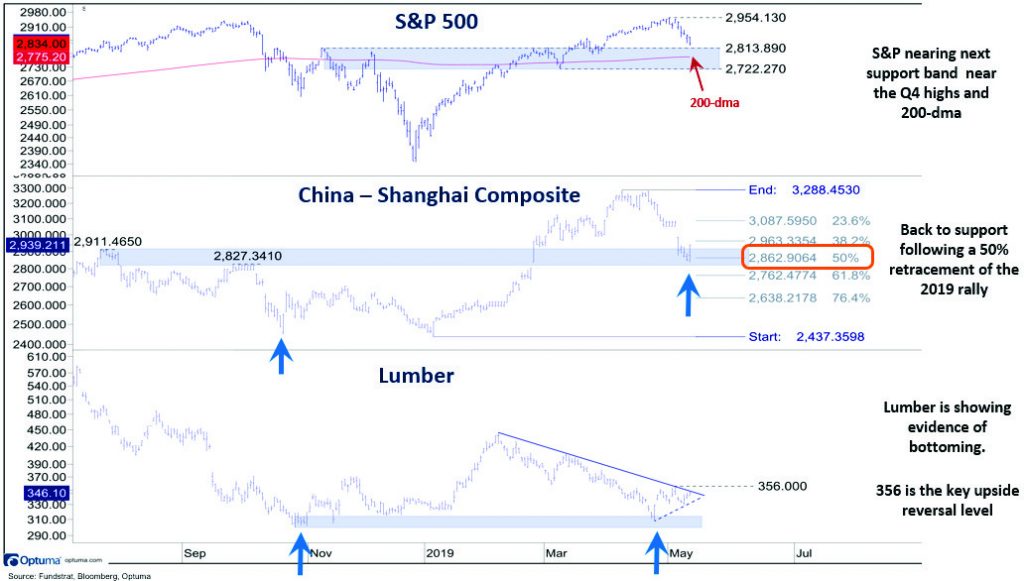

First, shorter-term trading indicators are becoming oversold as the S&P 500 corrects back to its first important support range near the Q4 2018 trading range highs (2814), its 200-day moving average (2775) and the March pullback lows (2722).

Secondly, China’s Shanghai Composite, which peaked in early April, well in advance of the S&P 500’s highs, is already showing early evidence of bottoming near an important support range between 2800-2900. (See chart below.) This support band is meaningful given it coincides with the highs in July and October 2018 which conveniently is at a 50% retracement of the 2019 rebound. Here again, like the S&P 500, short-term technical indicators are oversold and supporting a rebound.

Lastly, as one of many economic commodity barometers, lumber is showing evidence of bottoming following a pullback from its February highs.

What is FS Insight?

FS Insight is a market-leading, independent research boutique. We are experts in U.S. macro market strategy research and have leveraged those fundamental market insights to become leading pioneers of digital assets and blockchain research.

Tom Lee's View

Proprietary roadmap and tools to navigate and outperform the equity market.

Macro and Technical Strategy

Our approach helps investors identify inflection points and changes in equity leadership.

Deep Research

Our pioneering research provides an understanding of fundamental valuations and risks, and critical benchmarking tools.

Videos

Our macro and crypto videos give subscribers a quick and easy-to-understand audiovisual updates on our latest research and views.

US Policy Analysis

Our 40-year D.C. veteran strategist cuts through the rhetoric to give investors the insight they need.