“Do you wish to rise? Begin by descending. You plan a tower that will pierce the clouds? Lay first the foundation of humility.” — Saint Augustine

Many of us have seen the wildly popular and highly rated Dirty Jobs with Mike Rowe, which ran for no fewer than eight seasons on the Discovery Channel. Specializing in dangerous and difficult jobs, apprenticing himself to everyone from organic sheep farmers to junk removal specialists, half-relishing, half-dreading the attendant grime and slime, and entertaining us with frequent zingers and slapstick, Rowe used his platform to extol the all-too-rare-these-days virtues of hard, real, honest work – much of it manual, all of it necessary to run the world in which we live.

No doubt thanks in part to Rowe, while almost every sector of higher education is seeing fewer students registering for classes in the last few years, many vocational programs are filled with young people choosing trade school over a traditional four-year degree, while more college graduates are going back to school to learn skilled trades

It’s often a hard, dirty job to build and maintain the bones of a country, but without the men and women creating, running, renovating, and upgrading those bones, we would have no base in which to root our society and way of life. America’s infrastructure is crucial to its present and future success, and foundational to the performance of its financial markets. As such, it is the subject of today’s Signal From Noise.

The Infrastructure Bill

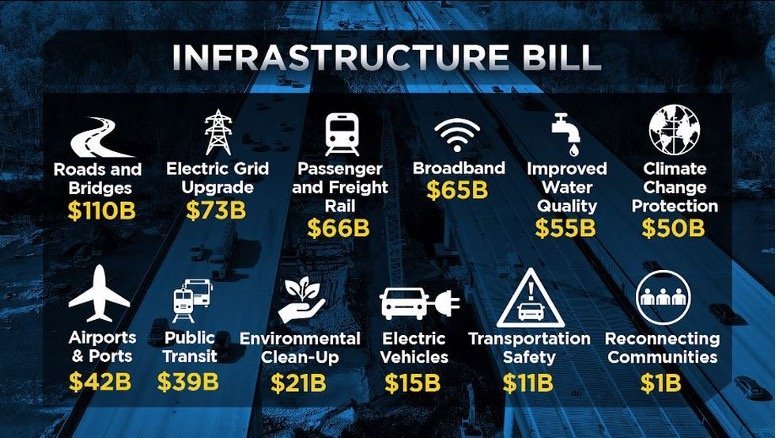

On November 5, 2021, the U.S House of Representatives passed the Infrastructure Investment and Jobs Act (IIJA), aka Bipartisan Infrastructure Law (BIL), which was signed into law ten days later. IIJA authorized $1.2 trillion for transportation and infrastructure spending, with $550 billion of that figure going toward investments and programs categorized as new. The size of the investment underscores the many needs of U.S. infrastructure, a diverse network underpinning everything from daily commutes to national security, including funding for roads and bridges, rail, transit, ports, airports, the electric grid, water systems, broadband, and other priorities.

Source: Closeup.org

The U.S. is at once grappling with aging structures, emerging technologies, and a growing need for sustainable solutions. Decades of underinvestment and deferred maintenance have left many systems vulnerable to extreme weather events, cyberattacks, and other disruptions. The 2021 Texas power grid failure and the devastating hurricanes of recent years are stark reminders of this fragility. Consequently, investments increasingly focus on building infrastructure that can withstand shocks and bounce back. This includes flood-resistant bridges, smart grids with distributed generation, and cyber-secure information networks.

Resilience has thus become the watchword, spurred by the sobering realities not just of extreme weather events, but also cyber threats. From flood-resistant bridges to smart grids with distributed generation, investments flow into systems that can weather storms and bounce back stronger. Sustainability is no longer a fringe concept but a driving force, pushing for decarbonization and resource efficiency. Renewable energy sources such as solar and wind, coupled with advancements in energy storage, are rewriting the rules of the energy sector. Finally, as data security increasingly critical, the need for a robust and secure digital infrastructure becomes ever more pressing, demanding investments in high-speed broadband and cyber-secure networks.

Some of the more prominent infrastructure companies are: Fluor and Jacobs Engineering, providing engineering and construction expertise for complex infrastructure projects; United Rentals (URI) and Caterpillar (CAT), ubiquitous at construction sites, provide heavy machinery; Tesla (one of our Sleeping Grannies) and ChargePoint (CHPT) help support the transition to greener energy via their charging networks. What’s more, the landscape is far from static, with mergers and acquisitions shaping the contours of the sector, such as the 2021 purchase by Vulcan Materials (VMC) of U.S. Concrete in the aggregates subsector, or the purchase by Brookfield Renewable of Duke Energy’s utility-scale renewable energy business.

Subsectors

Transportation

The bedrock of American commerce, U.S. transportation infrastructure faces challenges manifold. Traffic congestion continues to plague major cities, while rural areas struggle with crumbling roads and bridges. One in 5 miles of highways and major roads, and 45,000 bridges, are in poor condition. Public transit systems, often underfunded and outdated, require revitalization to compete with cars. America’s public transit infrastructure has a multibillion-dollar repair backlog representing more than 24,000 buses, 5,000 rail cars, 200 stations, and thousands of miles of track, signals, and power systems in need of replacement.

Highways and Bridges: Prominent companies in this subsector include Fluor (FLR), Granite Construction (GVA), and Jacobs Engineering Group (J).

Airports: According to some rankings, no U.S. airports rank in the top 25 of airports worldwide. Key U.S. airport operators are Honeywell International Inc. (HON) and Rockwell Collins (COL).

Railways: U.S. passenger rail lags behind the rest of the world in reliability, speed, and coverage, while China already has 22,000 miles of high-speed rail, and is planning to double that by 2035. Union Pacific Corporation (UNP), Norfolk Southern Corporation (NSC), and CSX Corporation (CSX) are leading companies in this subsector.

Ports: Major players in the port infrastructure subsector include The Greenbrier Companies, Inc. (GBX), Matson, Inc. (MATX), and Seaspan Corporation (ATCO).

Energy Infrastructure

Energy: The energy sector is undergoing a profound transformation, driven by concerns about climate change and energy security. The shift toward renewable energy sources such as solar and wind demands investments in smart grids and energy storage solutions, as well as transmission upgrades. Companies such as NextEra Energy, a giant in renewable energy production, and Tesla, with its solar panels and home energy storage batteries, are at the forefront of this transition.

a. Renewable Energy: NextEra Energy, Inc. (NEE), Brookfield Renewable Partners (BEP), and Clearway Energy (CWEN) are prominent companies in the renewable energy subsector.

b. Utilities: Dominion Energy, Inc. (D), Duke Energy Corporation (DUK), and American Electric Power Company (AEP) are notable companies in the utility infrastructure subsector.

c. Charging: U.S. market share of plug-in EV sales is only one-third the size of the Chinese EV market. The IIJA has made much of supporting the goal of building a nationwide network of 500,000 EV chargers to accelerate the adoption of EVs, reduce emissions, improve air quality. With U.S. EV adoption down, when that goal might be attained is less than clear, but one of the major players in this space are Tesla (TSLA), whose proprietary Level 1 charging network is the largest in the U.S. Tesla has begun allowing non-Tesla vehicles to access its Supercharger network in advance of its connector being adopted as the North American Charging Standard (NACS) starting this year.

Meanwhile, the rise of electric vehicles presents both opportunities and challenges for charging infrastructure and grid integration. Companies such as Tesla and ChargePoint are leaders in building EV charging networks. While promising reductions in emissions, EVs create a new challenge for charging infrastructure and grid integration. Companies such as Crown Castle (CCI) and American Tower (AMT) are taking up that challenge, using their extensive networks of cell towers to strategically position themselves to become the backbone of connected EV charging infrastructure.

Water

Aging water infrastructure wastes water through leaks and exposes families to lead. Currently, up to 10 million American households and 400,000 schools and child care centers lack safe drinking water. Investing in water treatment technologies, desalination plants, and resilient distribution systems is paramount, and companies such as Xylem are leaders in developing solutions for water efficiency, treatment, and leak detection systems.

Water Utilities: American Water Works Company (AWK), Aqua America (WTRG), and California Water Service Group (CWT) are key players in this subsector.

b. Wastewater Treatment: Companies such as SUEZ (SEV), and Xylem Inc. (XYL) are prominent in the wastewater treatment infrastructure subsector.

Telecommunications

a. Telecommunication Services: AT&T Inc. (T), Verizon Communications Inc. (VZ), and T-Mobile US (TMUS) are leading companies in this subsector.

b. Data Centers: Equinix (EQIX), Digital Realty Trust (DLR), and CyrusOne (CONE) are prominent players in the data center infrastructure subsector.

c. Digital Infrastructure: High-speed broadband access has become essential for education, healthcare, and economic development, yet more than 30 million Americans live in (mostly rural) areas lacking broadband infrastructure providing minimally acceptable speeds. According to the latest OECD data, among 35 countries studied, the U.S. has the second-highest broadband costs. Expanding broadband availability, particularly in rural areas, and ensuring cybersecurity for critical networks are top priorities. Companies such as Google Fiber, Lumen (LUMN) and Frontier Communications (FYBR) are actively involved in bridging the digital divide. Cybersecurity, too, looms large, with companies such as Palo Alto Networks (PANW) and Fortinet (FTNT) standing out.

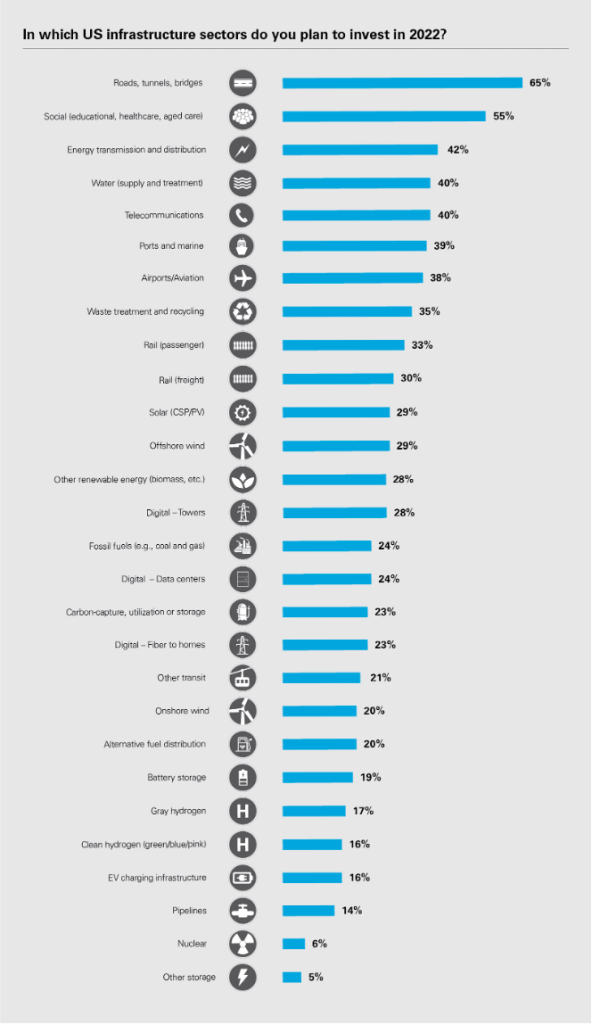

Source: White & Case

Technical Analysis

Below we present a technical analysis of the infrastructure industry, its subsectors, as well as a number of publicly traded U.S. companies, performed by Mark Newton, CMT, Fundstrat’s Global Head of Technical Strategy.

Following a stellar two-year rally off of 2020 lows, Infrastructure has trended largely sideways since early 2022; arguably, this range-bound consolidation began in early 2021, nearly three years ago. While we expect that 2024 can bring about some strength in this area, we’ll need to see convincing signs of IFRA, the iShares US infrastructure ETF, breaking out above its resistance that has kept this trading range-bound in recent years.

This daily chart from Bloomberg shows the extent of this consolidation. We expect it will be difficult to have too bullish of an opinion in the very near future until this breakout can occur.

Source: Bloomberg, Fundstrat

Renewables have proven to be far and away the weakest area within the Infrastructure space over the last couple of months, as Treasury yields have started to push back higher in late December. While we suspect that Renewables should eventually start to turn back higher, this will likely depend on a combination of 1) interest rates starting to trend back lower and 2) public perception turning a bit more open-minded to match the enthusiasm from early 2020. The pushback on alternative energy and renewables in recent months seems to be directly coinciding with a period of underperformance, as many projects are being shelved. Technically, however, it’s directly related to rates pushing higher, as projects in the space are highly capital-intensive.

Telecoms have begun to turn sharply higher over the last few months, and this seems like a technically promising area in the near term. Stocks such as VZ and T, which had suffered sharp drawdowns in recent years, have all shown technical evidence of bottoming, which makes them more attractive; what’s more, many of them pay no less attractive yields. On evidence of a larger decline in yields from spring into summer of 2024, we expect that yield-sensitive groups such as Telecoms could show some outperformance. However, given the resilience of the U.S. economy and an eventual push back higher toward highs in rates in late 2024 or 2025, we suspect Telecom stocks are likely to underperform. Thus, the short-term bounce for this group appears to be tactical-only.

Utilities. From a technical perspective, most defensive groups (including Utilities) have been under pressure in recent months, and Utilities (based on Sector SPDR ETFs, such as XLU) have thus far proven to be the worst-performing group year-to-date (YTD), with returns down 5-plus percent. We expect a near-term bounce in this group in the spring, so buying into Utilities might make sense for investors who wish to diversify outside of Technology and/or who might be seeking yields. However, we suspect that XLU is a likely underperformer in 2024. As with Telecoms, a bounce will likely prove temporary.

Transportation has lagged the movement in U.S. benchmark indices such as SPX and NASDAQ toward new all-time highs. The DJ Transportation Avg. at present remains lower by roughly 5% off all-time highs. While various rail stocks as well as truckers look quite bullish technically, these stocks are still lagging the broader Industrials space, as well as with the broader market.

Overall, we favor an eventual move higher in Infrastructure, although it’s difficult to say whether this will be led by Renewables, Utilities, or Telecom. Transportation, along with the broader Industrials space, looks more attractive than other subsectors, and might offer some areas for selective outperformance. It makes sense now to concentrate on the larger trend, connecting highs in IFRA this year for evidence of a technical breakout. At present, this is premature, but it could happen in 2024.

As usual, Signal From Noise should serve as a starting point for further research before making an investment, rather than as a source of stock recommendations. Although the names mentioned above each have the potential to benefit from government investment in infrastructure, this alone should not be the basis of a decision to invest.

We encourage you to explore our full Signal From Noise library, which includes deep dives on the path to automation and opportunities arising from the ever-increasing global water crisis. You’ll also find a recent discussion of the Magnificent Seven and the rise of Generation Z.