As we inched toward 2022, the market was aware of inflationary dynamics and the start of monetary tightening. But investors were blindsided when both factors impacted markets more than anticipated. Thus, investors went from high levels of greed to a position of fear, while the S&P 500 registered its first annual decline since 2018 and its worst year since 2008.

Into 2023, the question becomes: Can the Fed accomplish a soft landing that curbs inflation?

Nobody knows for sure, and the future is uncertain. According to Bloomberg, the average forecast expects the S&P 500 to end 2023 at about 4,000, the most bearish outlook since 1999. The range in predictions represents the widest dispersion since 2009.

In other words, there’s a lot of noise out there, and that’s where Signal From Noise comes in. This column presents you with ideas to consider, away from the crowded financial news space, away from the latest trend in vogue. Oaktree’s Howard Marks, a billionaire, says, “the short run is by far the least important thing. What matters is the long run. We try to buy the stocks of companies that will become more valuable, and the debt of companies that will repay their debts. It’s very simple. Isn’t that a good idea?”

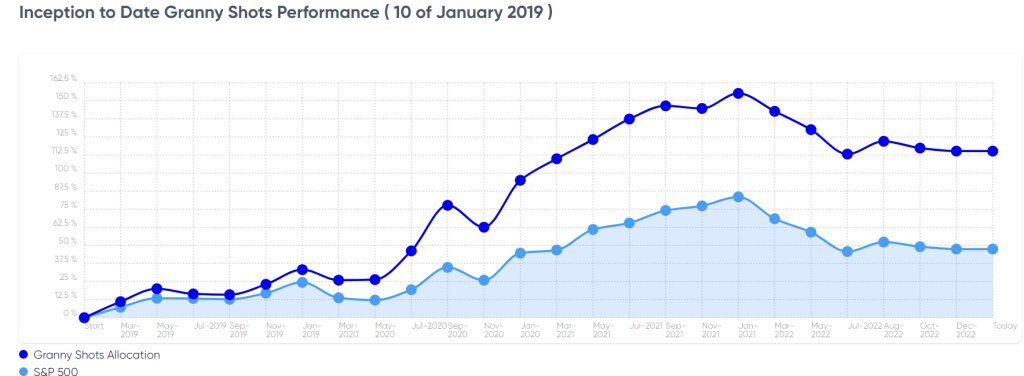

Think long-term, away from the daily headlines: That’s our philosophy with Signal From Noise, a column whose stock picks often derive from our Granny Shots, a basket of stocks that has (through Dec. 28) outpaced the S&P 500 by 67.74% since 2019. In 2022, the list beat the market again, by 4.02%, led by Tom Lee’s additions in energy, healthcare, and other defensive areas. Utilities and healthcare stocks are outperforming the S&P 500 this year by the widest margin in decades, and those gains have offset losses in beat-down growth names such as Amazon and Tesla.

The portfolio also beat the benchmark partly because of additions like Genuine Auto Parts (+27% through Dec. 28), O’Reilly Automotive (+21.4%), CF Industries Holdings (+22.81%), Devon Energy (+33.60%), and EOG Resources (+40.52%).

So, where do the opportunities lie? What could lift markets is a shift by the Fed. Inflation is far above the 2% target, but it has waned in recent months. If the U.S. central bank taps the brakes on rate increases in 2023, stocks could rally, though there hasn’t been a clear indication from Fed Chair Jay Powell that the Fed will cut. The Fed hasn’t raised rates so far, so fast since Chairman Paul Volcker’s assault on inflation at the end of the 1970s. Two recessions followed.

Few would be surprised if the economy shrinks into a recession in 2023; it would be one of the most widely forecasted recessions ever. But not a single recession has been spotted by economists a year in advance: Economists missed the 1990, 2001, and 2008 recessions completely. Maybe this time will be different. We know that stocks tend to bottom before the economy does, as we often say: “Price moves faster than fundamentals.”

Even if 2023 is similar to 2022, there will be opportunities on the long side. As we saw this year, bear markets are often interrupted by sharp counter-trend rallies.

View From Above

Most Americans recall the rising gas prices of early summer when the Consumer Price Index peaked at 9% year over year – the highest since 1981. It’s now 7.1%, falling sharply. Until this year, rock bottom rates since 2008 had driven investors to take bigger and bigger risks, pushing stocks to record highs.

Then rate hikes early this year hit everything everywhere, all at once. The pandemic housing boom is a bust, the S&P 500 is down about 20% for the year, as the higher-rate environment propels less risk. Typically when stocks fall, investors turn to bonds. Not this year. With rates on newly issued bonds moving higher, investors dumped older bonds. Crypto, once touted as a hedge against inflation, sold off like most other risk assets, creating a domino effect of failed crypto companies. Tech stocks have cratered, with Amazon, Netflix, and Meta losing all of their pandemic-era gains – and then some.

While investors took a bath on tech and crypto, energy stood out as the surge in the value of oil and gas drillers, refiners, and fuel marketers came from a surge in crude oil prices. Healthcare also outperformed as investors began going to defensive names amid the Federal Reserve’s aggressive fight against inflation.

Despite the most rapid financial tightening conditions in a generation and the turmoil in financial markets, the U.S. economy is entering 2023 in decent shape. Job growth remains resilient, consumers have ample savings to support spending, and corporate earnings are at or near record levels. Yet a strong labor market and high inflation have kept the Fed on its tightening trajectory. Housing is plummeting at its fastest pace since 2008.

If there’s a silver lining, it is that stock valuations are considerably cheaper than they had been.

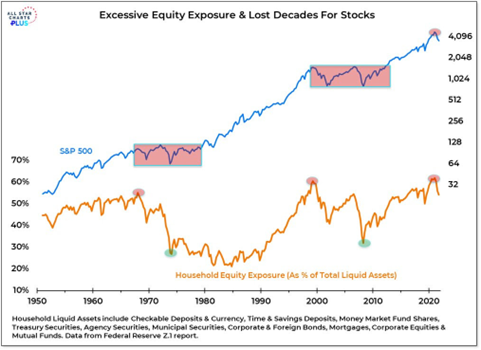

Yet market returns are typically in the red during midterm election years, and 2022 was no different. Despite widespread pessimism, as you can see, household equity levels remain near record highs, and many new investors who flooded into markets in 2020 are still in the green.

Avoiding Groupthink

At times throughout 2022, our research heads have disagreed on the direction of markets. Sometimes, it’s merely a matter of differing time horizons. Other times, the methodologies diverge. For example, Mark Newton’s technical analysis purposely disregards fundamental factors to maintain his findings’ purity and avoid bias. Whereas Brian Rauscher’s work is rooted in earnings and the mantra, “Don’t Fight the Fed.”

We understand that dichotomies can confuse readers, but it’s an unavoidable side effect of having multiple research heads looking at markets through different lenses. The range in our research is essential, and we seek to avoid groupthink, when a group of people makes non-optimal decisions spurred by the urge to conform. (Our research heads do agree sometimes. This year, they have generally been positive on energy and healthcare, for instance. And now, they agree that inflation has peaked, even if they disagree about what will happen next.)

Whatever the market conditions, FS Insight provides the tools that global market participants need. Amid the uncertainty, we seek to help investors manage risk and capture opportunities. We provide research and education to inform and educate, so that you may determine the best investments for your circumstances or clients.

Previous Signals

When our research heads, including Tom Lee, warned of a “treacherous first half,” they weren’t mincing words. While FAANG and Bitcoin have struggled, Lee believes Technology and Energy are places to be again in 2023.

And when Energy stocks fell in mid-summer, we reiterated their attractiveness. In August, we highlighted healthcare – a staple of Mark Newton’s 2022 strategy – as an area investors should still consider highly. All our stock selections in this column come from our research team, including fundamental, technical, and quantitative research. We generally recommend utilizing these Granny Shots considerations with a longer-term horizon, not for short-term trades, but every investor has unique circumstances, risk tolerance, and objectives.

Revisiting Some of the Most-Read Notes from ‘22

Why Energy Could Continue Its Incredible Run (June 16)

As the market tumbled into June, we reiterated our constructive view on the energy sector. Tom Lee remains positive on energy, per his 2023 Outlook on Dec. 14. We believe we’re amid an energy super-cycle, and quality companies in the space have more room to run, along with their attractive dividends.

Healthcare Showing Promise (Aug. 4)

Even as the market plunged into a bear market, healthcare stocks have been spared from the carnage with substantial dividends to help investors sleep well at night in these turbulent times. The sector finished about flat on the year, far better than the S&P 500, and we remain constructive on Amgen, Humana, and UnitedHealth.

Five Stocks Amid The Economic Rise of Millennials (April 7)

COVID-19 rocked the world and derailed many existing trends, but one that remains intact is the economic rise of the most educated generation in history. We highlighted American Express, Expedia, and Lululemon, among others, for longer-term oriented investors looking to benefit from the rise of Millennials.

Final thoughts

We will highlight future opportunities in our 2023 Signal From Noise columns, plus deep dives into making better investment decisions, lessons from legendary investors, and rebounding from turbulent years such as 2022. Editions will continue to run every other week, publishing on Thursdays.

Your feedback is welcome and appreciated. What do you want to see more of in this column? Let us know by replying to this email. We read everything our members send and make every effort to write back. Thank you. Our entire organization wishes you and your family a healthy, happy new year full of peace and prosperity.

–FS Insight Team