Key Takeaways

- We break down the multi-faceted Electric Vehicle (EV) revolution that is going on across the global economy and identify relevant adjacent industries and trends.

- There are many ways to get exposure to such a massive technological trend. We believe to fully realize the benefits of a secular technological trend you must have a long-term time horizon.

- We focus on five companies benefitting from the trend in different ways, up and down the supply chain. The names have been previously covered in this column or appear on our Granny Shots stock list, or are newest stock list Brian’s Dunks.

- We include technical analysis on the names from our Head of Technical Strategy, Mark Newton, to assist potential investors with identifying actionable price entry points.

“If the twentieth century was about cars giving us independence, the twenty-first will be about giving us independence from cars.”

-Justin Erlich, Former Head of Policy for Autonomous Vehicles at Uber

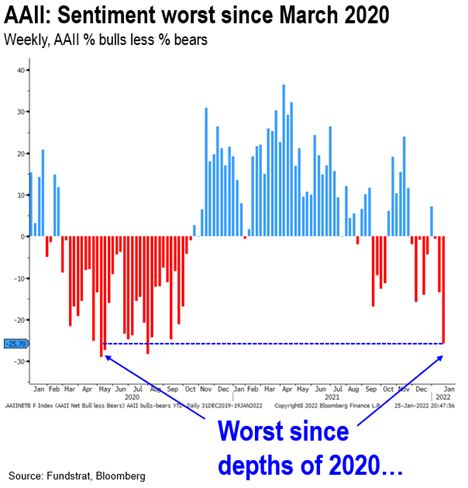

When our subscribers asked our Head of Research, Tom Lee, which trends he thought would most profoundly affect markets in the future, he mentioned the rise of electric vehicles. Now below, you can see our top EV picks across multiple dimensions of the ongoing revolution in mobility! We want to show you which EV names we’ve landed on using our evidence-based approach to research to help simplify the EV trend from an investing perspective. We also want to give you multiple paths to get exposure. When times are volatile like they’ve been in the past week, it can be a great time to pick up stocks benefitting from longer-term trends at lower prices, or lower your cost basis in names you believe in. Tom Lee’s recent First Word highlighted some promising developments in markets.

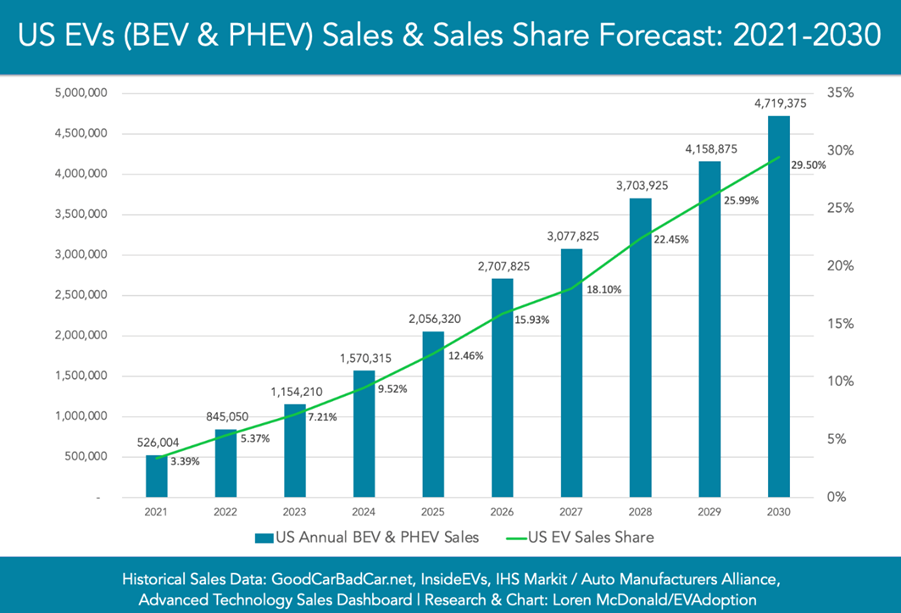

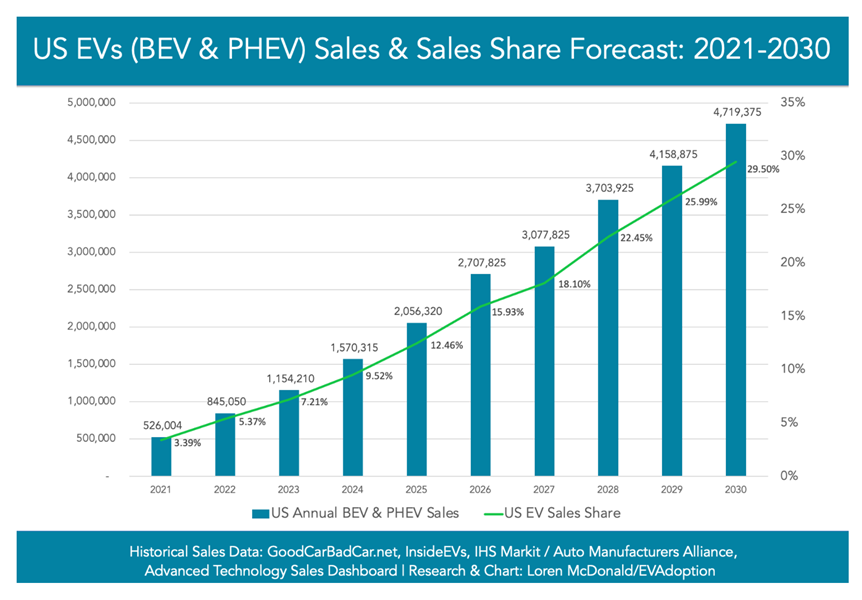

While many are looking for the “next Tesla” in exciting new companies with sleek designs and big promises, the EV revolution is so widespread that it will eventually affect many aspects of the global economy. Thus, we see many ways to get exposure to this key emerging technology particularly for investors with longer time horizons. In that case, many different types of companies are anticipated to benefit from the trend, from materials to key elements in the multi-faceted supply chains needed to build a new fleet of battery-powered and, in the future, driverless vehicles.

There has been some very scary and unsettling market turmoil recently. One of the ways we like to select investments is to identify companies that should benefit from big, thematic trends. This is how we select stocks in our Granny Shots Portfolio. We’ll give you our top EV pick from this portfolio below, along with other multi-faceted approaches to benefitting from the rise of the battery electric vehicle that seems inevitable and which is also being highly encouraged by governments across the world.

In this publication we will present you with 5 stocks benefitting from different aspects of the multi-faceted rise of EV. We will also pair this publication with technical analysis from our Head of Technical Strategy Mark Newton for assistance in determining good entry points to these names.

Different Ways Of Getting Exposed: EV Is a Transformational Trend

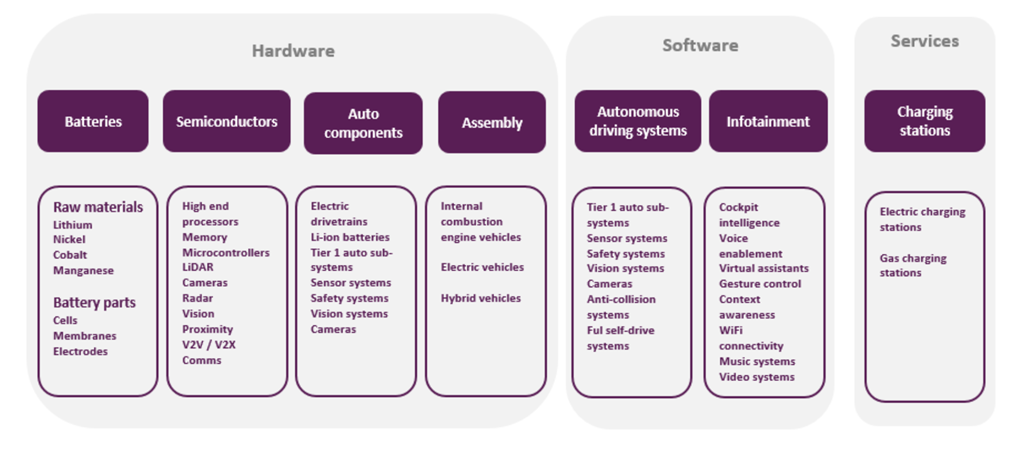

Margins are pretty thin on cars, and consumers are very fickle in their consumption patterns and brand loyalty. Since the EVs require significantly higher amounts of commodities like high-quality steel, lithium and semiconductors, production in a tough business has only become more difficult. This also means margins can be thinner right now on EVs than ICE vehicles. We like to get exposure to companies that help narrow this gap, even though they don’t make vehicles themselves. We’ll give you a great example of such a stock below.

We will look not only at direct exposure to the electric vehicle manufacturers but also other innovative ways to get exposure. We will revisit the following five areas and pick a stock from each.

- Materials

- Supply Chain

- Chips (semiconductors)

- Autonomous Driving

- Auto Manufacturers

Materials

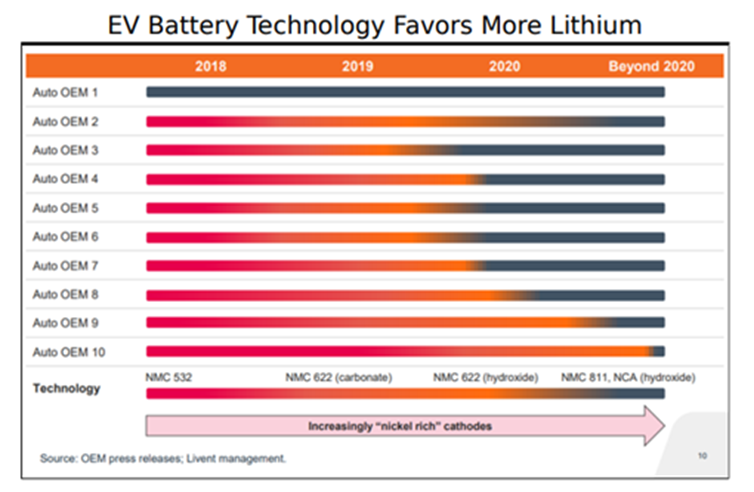

A great area to get exposure to EV is in the materials that will be needed as demand rises. One of the key areas for competition between manufacturers is battery technology, which is at the crux of successfully competing with ICE alternatives. Electric vehicles have only recently become a commercially viable alternative to ICE vehicles, and there is an incredibly complicated competition between those producing electric cars.

Regardless of who comes out on top on this dimension of the competition, they will surely need lots of lithium for their batteries as demand for electric cars grows so will demand for this crucial commodity at the heart of the EV revolution. We have a leading miner that we believe outshines peers and has excellent assets and capital discipline.

Supply Chain

The supply chains for ICE and EV vehicle production are both incredibly complex and hard to manage. New producers like Tesla have cutting edge manufacturing facilities, but lag on dealer and service networks. Legacy manufacturers have sprawling networks of factories and suppliers across the entire globe. They have vast networks of dealers and credit arms to lend directly to customers. Legacy auto manufacturers are also beholden to Unions where new entrants often have streamlined and modernized labor arrangements.

Don’t be fooled and think only new-fangled companies will be benefiting from the Electric Vehicle trend. Legacy auto producers across the world are now firmly committed to joining the EV revolution as well and we’ll let you know which ones we think have the best prospects for success.

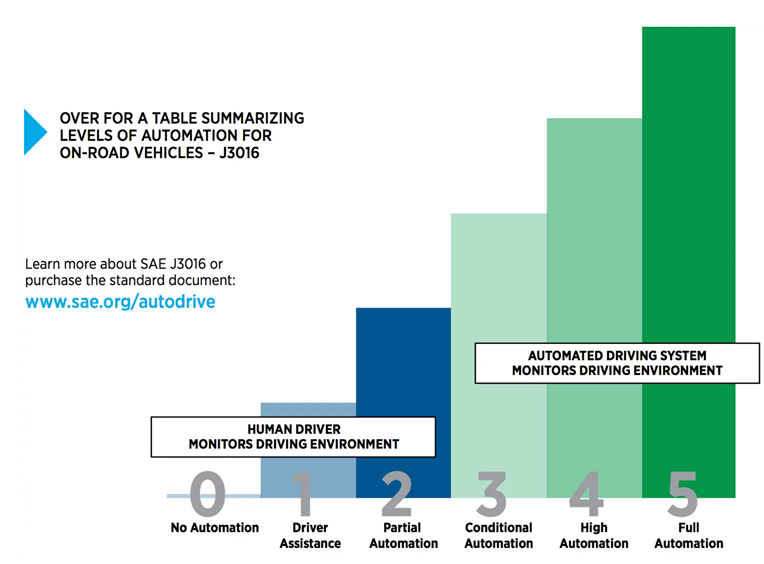

Autonomous Driving

One area that has become essential for those who crave future success in the developing battle of EV supremacy is making the first fully autonomous vehicle with no need for a driver. We will give you our favorite pick for this crucial emerging Technology from our famous Granny Shots stock list below. Our Head of Technical Strategy, Mark Newton, also has some actionable technical analysis on this name as well. Check out his recent 2022 Outlook.

To illustrate just how big the competition has gotten, even Apple is said to be developing an EV that will be fully autonomous within the next three to four years. So, even companies you may not associate with electric vehicles are seeing the massive opportunity playing out. Below, we will discuss some of the dynamics of the developing engineering race to build fully autonomous systems. In the future, it seems who leads in this area of the technological revolution that is going on will be amongst the most successful.

Which companies are leading this profound race to change the nature of driving forever? Below, we will take you through what has been described as one of the most complex engineering problems in human history. We’ll have details on those out ahead early in this highly consequential technological arms race. Imagine how much productivity would be unlocked in your day if your daily commute was a time to get work done instead of staring at break-lights!

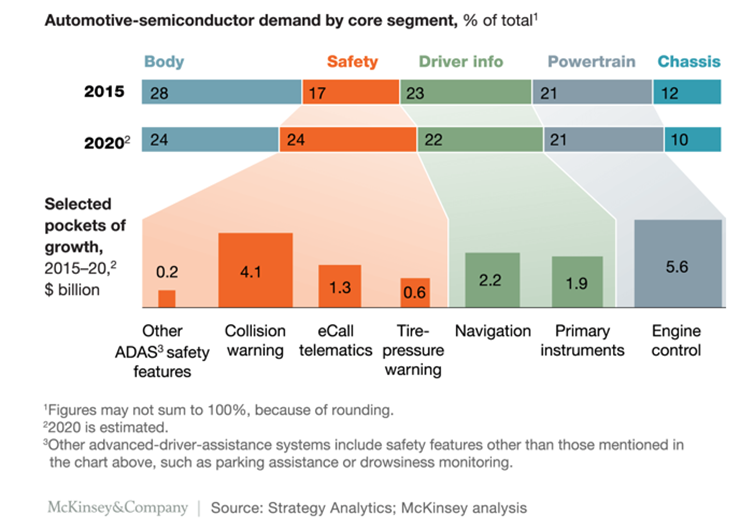

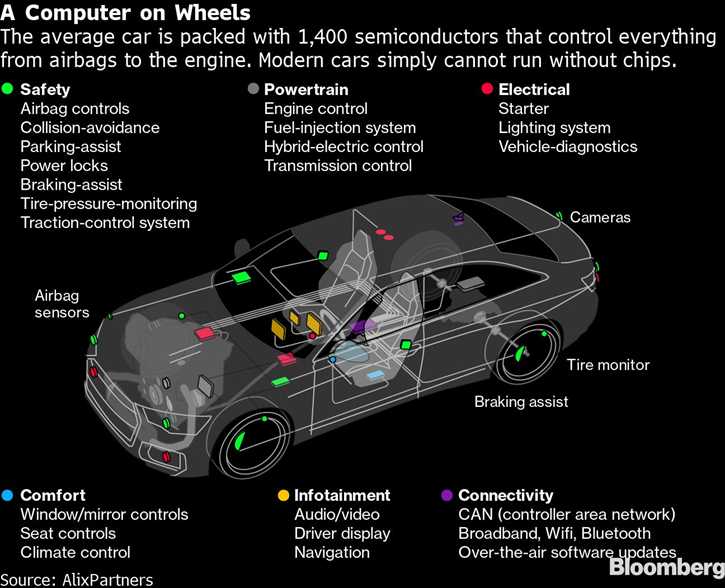

Chips (Semiconductors)

As cars have essentially become more of a moving computer, the amount of semiconductors in them has exponentially increased. The severity of the industry’s dependence on chips was starkly highlighted when a fire at the Renesas plant caused massive disruptions in supply chains and production schedules across the entire auto industry. Much more chips will be needed in the EVs of the future.

However, as autonomous driving becomes a more essential and ubiquitous product, the demand for chips at the leading edge will skyrocket. Successful autonomous driving is very computing power-intensive, and some of the leading chip companies you may not expect to be closely tied to the current auto-manufacturing supply chain will have an outsized role in the future dominated by self-driving cars. We’ll be giving you a leading chip name we expect to benefit from increasing auto demand for cutting edge chips needed in autonomous driving.

Electric vehicles with autonomous capability will need lots of the most advanced chips in order to function effectively and this will be a major source of demand that will help a larger trend that has been going on since COVID-19 roiled markets; chip manufacturers that were once notoriously cyclical are becoming much more structural. We have a great pick from our newest stock list, Brian’s Dunks, if you haven’t checked it out you must! We expect this name to benefit as the demand for chips from auto-manufacturers becomes more and more voracious.

Auto Manufacturers

The manufacturers that are having the most EV sales may surprise you. Which are making inroads creating the high levels of brand value and appeal that is at the heart of successfully selling cars? The answers may be less obvious than you think. We analyze some of the key vehicles that have been introduced so far as well as some that will enter markets soon. We will tell you which companies have a good understanding of the unique sizzle between the consumer and product that defines why people buy cars.

There are a lot of different approaches to successfully monetizing an EV project, but if consumers don’t want the product, then shareholders won’t like the outcome. Did you know, for example, that many of Ford’s flagship products have become electric? They tested an innovative brand strategy of rebooting old and iconic ICE legends into new and updated battery-electric versions. The Mustang is now electric, and the Hummer will be soon as well!

We give our favorite stock pick from a product and sales perspective below. Which companies are best positions to get a big share of the growing EV pie? We’ll break down our favorite picks with technical analysis for you below.

Our Top Five EV Picks with Technical Analysis

Materials- Albemarle (ALB -0.91% )

We’ll start up the supply chain and move down. This is literally a ‘picks and shovels’ play to the EV revolution because it is a lithium miner. Lithium is an essential component in the batteries that are at the crux of this trend and as BEVs begin to comprise more and more of total auto sales, the demand for lithium will grow in tandem. Lithium mining is an oligopoly, and we think Albemarle has the best profile compared with its competitors. Lithium mining is very capital intensive and Albemarle has the best physical assets in the world.

We also like the capital discipline and experienced management team the company has. They have other divisions besides lithium mining that are profitable as well. We did an article on this name on October 21st, 2021 called Albemarle: A Steady Materials Name Benefitting From More Than EV.

Technical Analysis

ALB- 208.03- Albemarle has the dubious distinction of having broken intermediate-term uptrends from 2020 at the same time it’s violated a technical formation known as a Head and Shoulders pattern which spans back since August 2021. Volume picked up on the support violation of mid-December lows, and until this can be recouped (Requiring a weekly close back up above $220), this looks like an underperformer. Downside targets under $191 lie near 171 which is a 50% retracement of its rally up from 3/2020. Rallies back up above $220 would serve to improve its technical structure, which for now, remains vulnerable.

Supply Chain-Aptiv (APTV -0.70% )

Aptiv is a true phoenix from the ashes story. The company used to be one of GM’s key suppliers, Delphi, and was considered to be many the straw that broke the camel’s back leading to the post-GFC auto bankruptcies, most notably of GM itself. Now, it is a leading supplier to car manufacturers getting into EV. Like the last pick, this company being further up the supply chain is a benefit. It will benefit no matter which of the major OEM’s end up becoming dominant in EV.

Importantly, Aptiv is reducing the comparable cost of producing BEV vehicles compared to their ICE predecessors through its Smart Vehicle Architecture. It also has key software that help EVs function better and more efficiently. We did an article on this name on July 15, 2021 entitled The Oracle of Aptiv. The marriage of new assets it has acquired like NuTonomy mixed with its massive legacy production capacity has been virtuous in our opinion and make it likely to be a leading supplier to EV manufacturers regardless of which firms build the most successful models.

Technical Analysis

APTV- 136.62- Short-term oversold, but trends remain negative for Aptiv following its break of a trend channel extending back since early 2021. This support violation near 150 caused some acceleration which managed to violate October 2021 lows during January’s trend deterioration. Thus, APTV now trades at the lowest levels since last Spring, but this area near 135-137 seems to be providing a bit of support near lows made during May of 2021. An oversold bounce looks near, but likely finds resistance at 145-150 which cause some overhead supply to any bounce in the weeks to come. Trends will remain bearish until/unless APTV can reclaim 150 which would help this stock regain its trend channel and former lows. At present, this remains unattractive, despite a bounce likely occurring in the next 4-6 weeks.

Chips (Semiconductors)- Taiwan Semiconductor Manufacturing Corporation (TSM -1.03% )

TSM is the undisputed leader in the production of the leading-edge chips that are required for autonomous driving to be successful. Many ICE cars only required chips from several generations in the past, however, the intense computing demands of autonomous driving means that the very best chips that TSM specializes in producing are what’s necessary for the task. Semi-conductor producers have been notoriously cyclical in the past, but things like booming demand for autonomous driving chips and other requirements from an ongoing digital transformation are making them more structural.

We recently did an article on the company called TSM: Conducting Moore’s Orchestra. The stock is also one of the Mid-Range Jumpers on our newest stock-list, Brian’s Dunks.

Technical Analysis

TSM- 121.20 – Short-term weakness looks nearly complete, and TSM is nearing a good risk/reward area to buy dips, which lies at $115-$118. This represents an area just above December 2021 lows which also lines up with trendline support from last Fall. Looking back, TSM found strong resistance right near early 2021 peaks, as 1/13/22’s close came within $1 of the peak from mid-February 2021. The subsequent weakness occurred during a similar move in the Semiconductor sector but looks likely to find strong support heading into February. Overall, TSM appears like an attractive risk/reward opportunity to buy into any further selling which might happen over the next week, and rallies over the next 4-6 weeks likely help this get back over $130.

Autonomous Driving- Tesla (TSLA 0.74% )

Tesla has been on our Granny Shots stock list since its inception. Of course, the company is mostly known for its leading EV luxury models and has an exciting product line-up. However, despite the controversy around the stock, Tesla is not valued similarly to its OEM peers because it is more of a technology company than the others. With a long time horizon, we believe Tesla is one of the best companies to own for the trend. We recently did an article in November 2021 on the company called Tesla: The Beginning of a Dynasty.

The company’s innovation-first culture has resulted in making major strides in the technological race that will be difficult for peers to catch up to. They have done a lot of the groundwork in autonomous driving and we think they will continue to be a leading company in the area as demand for EVs continues to rise. It’s unclear who the ultimate winners in the developing competition to dominate EV and the future of mobility will be, but it’s hard to imagine a world where Tesla isn’t amongst them.

Technical Analysis

TSLA 867.94- Tesla looks to be in the final stages of its decline from early January 2022. The break of $899.94 on a close would constitute an official breakdown to the lowest levels since October 2021 and should allow for a bit more pullback down to $819 before any real stabilization. This represents a 50% retracement of its prior Low to high range from Spring of 2021 and should provide support to buy dips over the next 1-2 weeks. At present, Momentum is negatively sloped on daily charts and not yet oversold, so this breakdown likely causes a bit more weakness before TSLA can find support and turn back higher.

Auto Manufacturers- General Motors (GM -0.75% )

General Motors is featured on our brand new Brian’s Dunks stock list. This list gives you access to a quantitative model designed to find investing opportunities with great risk/reward ratios. GM is entering the EV world in a big way. Whereas, many large automakers could have previously been considered as giving lip service to EV, now they are putting their money to work in furtherance of the goal. The company just announced it was investing $7 billion in four new electric vehicle plants in Michigan.

Their new CEO Mary Berra is taking on Tesla directly to become the world’s number one EV seller. The company is releasing about 30 new electric models in the next few years and projects that it will overtake Tesla as the number one seller of electric vehicles by the middle of the decade. It has also made huge investments in the infrastructure necessary to put its money where its mouth is. We think this is a revitalized firm with a viable strategy for EV growth and have favorable readings on the name from Brian Rauscher’s Earnings Revision Model.

Technical Analysis

GM- 52.11- Short-term negative as part of a neutral pattern over the last year, and further weakness looks likely into early February to near 48-49 before this finds support and starts to rally. Overall, GM had a failed breakout into January of this year which had cleared numerous prior peaks before reversing and turning back lower. Its recent weakness undercut December 2021 lows but has found some temporary support at 49.37 which looks to be a minor stopping point. Overall, insufficient evidence of GM turning higher in recent days suggests a final bout of weakness might be in store before this can start to rebound after its pullback in recent weeks. Bottom line, risk/reward looks more favorable at present compared to a few months ago, but a bit more weakness still appears likely to 48-49.

What About An ETF for Electric Vehicles? Our Picks Ranked From Technical Perspective

The Global X Autonomous & Electric Vehicles ETF (DRIV- $27.25) remains trending down from mid-November, but should be nearing an area to buy dips which lies at 26-26.50 over the next 1-2 weeks. Its longer-term pattern is more neutral than bullish or bearish and this recent weakness has simply helped to alleviate overbought conditions which occurred after this stretched higher during a big surge from September into November of last year. Momentum remains negatively sloped near-term, as per MACD, but RSI is nearing oversold levels, and it’s thought that the weakness in this space likely is nearing its conclusion into early February 2022.

Our Head of Technical Strategy, Mark Newton Ranks our picks from a technical perspective.