Summary

- Nvidia is a semi-conductor juggernaut with one of the most impressive track records of growth on Wall Street in recent history. The current price of the stock is $713.00.

- The company’s talented management and personnel are likely to continue improving as talent chases stock gains in Silicon Valley, furthering an ongoing virtuous cycle.

- Their strategy, growth, and continued dominance in critical areas of the semi-conductor business make us think this company is developing a competitive moat on par with the hallowed FAANG names.

- NVIDIA is a member of our Granny Shots portfolio, and we’ll discuss which tactical and strategic themes qualify it for inclusion.

- The valuation compared to peers reflects the impressive growth, intangible capital advantages, and undeniable positive momentum the company has been delivering.

There is a reflexive tendency in investing to pick things with lower valuations in the hopes that they will catch up to peers. This is the almighty mean reversion that was written about by Mr. Graham and popularized by Mr. Buffett. However, sometimes a stock’s valuation is going up for precisely the right reason; because results are consistently so good, many people want to own the stock. Thus, we have a case of a wolf in wolf’s clothing, one of the most competitively fierce companies in an industry with back-breaking competition and capital intensity.

Barking down the wrong tree even briefly in terms of capital allocation can forever impair a company’s advantage in the semi-conductor business. Nvidia has done the opposite and has made all the right moves in the chip business to establish the kind of impregnable durable advantage only enjoyed by the highest valued stocks on the market. Moreover, Nvidia’s durable and developing edges in the software, self-driving, design, cryptocurrency, and artificial intelligence aspects of the chip business are even more impressive because it is fabless. There are significant advantages to the strategically adept company’s approach.

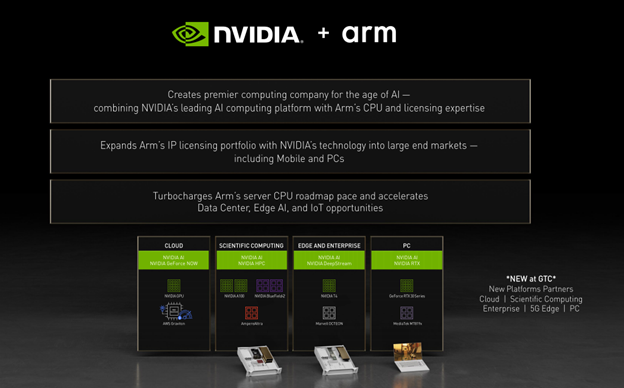

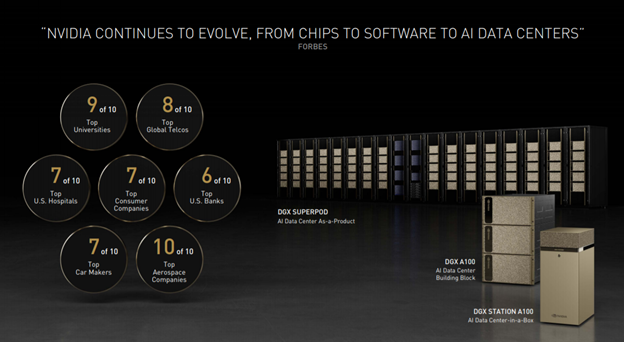

Rather than the $10 billion fabs, Nvidia’s assets are more intangible and hard to replicate or imitate. As a result, this company has established a 1990s Intel-Esque dominance in its respective dominated corridors of the chip market in a pretty capital-light fashion comparably, particularly for this industry (not of course counting largest potential merger in industry’s history with ARM). As a result Nvidia is a full-stack computing company with software optimization of its hardware solutions. This led KeyBanc analyst John Vinh to recently say “We think Nvidia is uniquely positioned to dominate and monetize these end-markets which in aggregate represent a $90 bn TAM.”

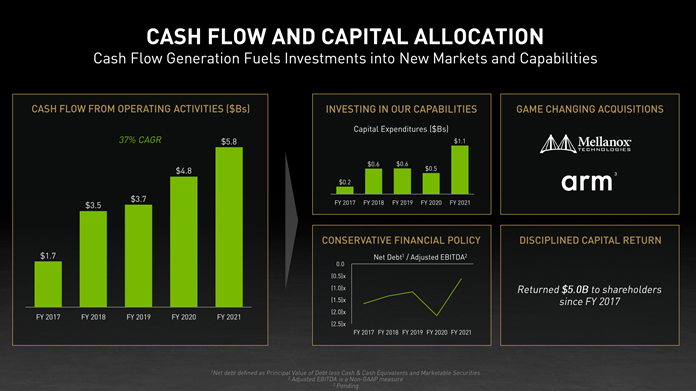

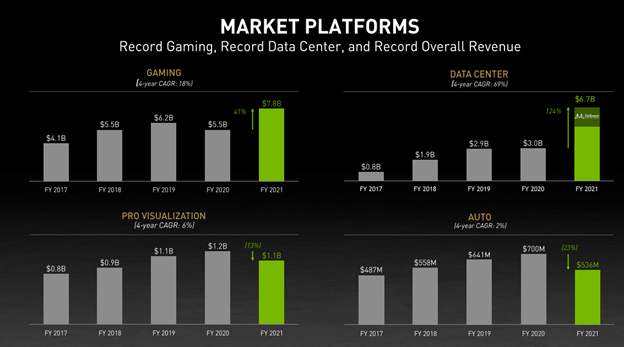

Source: Nvidia 2021 Investors Day Presentation

As far as where management has put capital? Well, pretty much exactly where you’d want it to facilitate growth rates that simply smoke the rest of the industry, which is even more impressive when you consider the company’s valuation is in the hundreds of billions. You don’t get many companies in the hundreds of billions getting 84% YoY revenue growth even with easy comps. This point makes us less receptive to one of the main criticisms of Nvidia that it has a higher valuation than its peers. Yes, because its progress is visible and its advantage is durable, its premium and pricing power is increasing. While investor logic about buying undervalued assets is often a good way to screen stocks also consider this perspective. Would you bet against Napoleon simply because he had just won seven battles in a row and thus is likely to lose the eighth? Probably unwise.

Sometimes picking a stock can be simple. Sometimes you want to own something simply because the company keeps smashing expectations out of the park and has elevated itself quite meteorically from a videogame graphics card niche firm to a company perhaps more integral than any to the coming artificial intelligence revolution and what many are calling the fourth industrial revolution. The stock is also differentiated from many of its hardware-centric peers by having cutting-edge software and design capabilities. It is undoubtedly an A-lister in the chip world and vies for the edge with Apple in the competition to be TSMC’s most valued customer.

Sometimes Picking Winners Is Just As Easy As Picking Winners

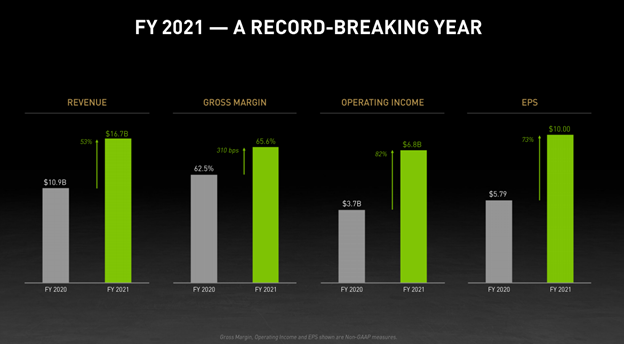

If you want to pick a stock that simply seems to be winning, has a hand of four aces when it comes to supply dynamics and pricing power, and its products are absolutely essential for many areas at the absolute vanguard of human innovation, not to even speak about the company’s abilities that meet this sanctified standard. Nvidia was the third best performing stock in the S&P 500 in 2020, with an annual price gain of 121.9%. Earnings per share grew even faster than revenue; flying high at 106% to an incredible $3.03 per diluted share. The key growth engines this quarter were the gaming business and the even more lucrative data center business, but many more opportunities are in the works.

Source: Nvidia 20201 Investor Day Presentation

The stock has gained nearly 3,500% since 2015. This has been an incredible run, and thus, it may be one of those names that you sat out on and are now wondering if it’s too late to purchase the stock. We think the answer is decidedly no for a number of reasons. First, this stock just put up record revenue numbers in Q12021.

Source: CNBC

There is very little reason to suspect this will be a unique event. The company’s management has several pots in the oven that are all incredibly promising from a growth perspective. Jensen Huang’s kitchen is smelling quite delicious, so to speak. The story of how this company became a niche video game graphics card company to what is likely now one of the most important companies on the planet is a long, winding, and nuanced one. However, it has generally been marked by outperformance and exceeding expectations and hence our title; The Cisco Kid. This is because, in the end, the Cisco Kid always wins the gunfight, saves the damsel in distress, and always saves the day, no matter how fraught with peril his exploits are.

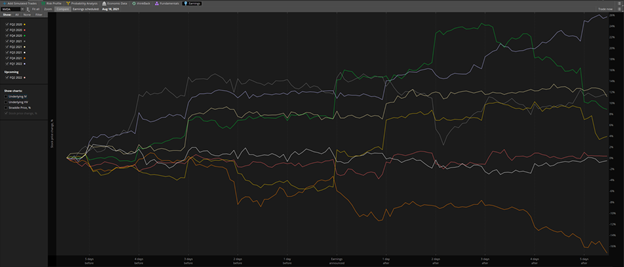

Look at Nvidia’s stock performance after earnings in the last eight quarters. You can see the chances of a disappointing miss are low, but they can also have severely adverse pricing effects, which we’ll elaborate on in our risks section. Not exactly Cisco Kid numbers which had a formulaic script for every episode, but missing only that one out of eight is certainly nothing to snuff at. From a shareholders perspective Nvidia’s tendency to be ‘the fastest on the draw’, competitively speaking, makes us think the title is suited to the company.

Source: Thinkorswim

We do not say this in a cocky way and don’t want it to be construed as hubris. We know anything could happen and that the future is uncertain. However, in Silicon Valley, when a company gains as much momentum and consistency for genuine economic earnings beats, it’s tough to stop them. Part of this is that a virtuous cycle happens concerning talent. Not just any talent, some of the most talented individuals in the world. People in the valley want to go to the companies whose stock options will pay the highest, and thus the positive momentum is continued by the influx of the best talent. It’s always a significant advantage in one of the most highly specialized industries in the world to have your pick of the litter when it comes to top talent!

Firing On All Cylinders

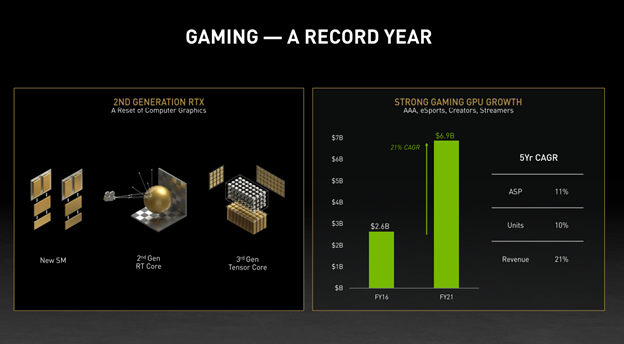

The company had suffered some reputational setback in the Gaming community as it appeared to have a strategy preferential to the higher-margin server business. Shareholders have certainly not minded this shift. However, the pricing power that Nvidia is now wielding and appearing to use toward the advantage of EPS growth is stunning given the shortage which is interesting and intersects with cryptocurrency. Thank you to our crypto analyst Armando Aguilar for providing the equity side with some background on Nvidia’s application to crypto!

Source: Nvidia 2021 Investor Day Presentation

Nvidia’s primary product in which it has a significant edge is GPUs that are also particularly good for the complicated computation needed to mine cryptocurrency. Only about 2%-6% of their sales were likely due to mining, but as cryptocurrency continues to grow in popularity and move toward a more ubiquitous status in our society, we see this as a major source of growth for Nvidia. Their monetization efforts, which take advantage of their key strengths of providing customers an added level of customization and performance not before available, is likely to succeed in our view. We are bullish on crypto long-term and think Nvidia’s products will play a key role in many mining operations.

Source: Nvidia Company Reports

Their launch of specialized cryptocurrency mining processors (CMPs) are expected to bring high-margin revenue to the company. The chip shortage has put the gaming community at odds with the crypto community as they vie for the same chips to be used for different purposes. The creation of the chips specifically for crypto mining are expected to mitigate some of the shortage. Based on Ebay sales prices which are significantly higher than MSRP, scarcity is definitely occurringto a wide degree.

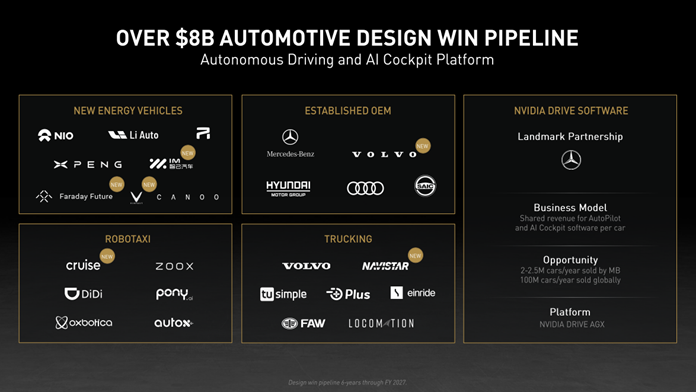

If you want to know why Nvidia is trading like a FAANG in terms of its premium valuation, please consider this fact. The far less known Tegra Processors are essentially self-contained computers on a chip that are either associated with Nvidia’s DRIVE software (used by Tesla and Volvo) or its SHIELD gaming product. Growth has been faster than expected and we suspect being able to lure the best and the extensive collaboration with over 80 relevant companies in the space is a major advantage here not easily replicated by competitors. Nvidia has one of the leading eco-systems around autonomous driving and betting against it here would likely be folly. The market opportunity for these chips in the next few years is the entire size of this quarters record revenue.

Source: Nvidia 2021 Investors Day Presentation

For the core business of GPU’s, which constitutes the vast majority of revenue estimates for how rapid it will grow, they are likely to continue being revised upward in our estimation. The potential market opportunity, as estimated by Trefis who admits it may be conservative, is an astronomical $30 billion. We see the virtuous cycle, in terms of human capital following the best capital appreciation of equity, will continue to refine and enhance this advantage. We do indeed concur with Trefis that their estimate could be conservative. All these growth initiatives are occurring while there are good things happening at record levels in GPUs and gaming and the company is enjoying the prosperity from its most successful product lineup ever.

Source: Nvidia 2021 Investors Day Presentation

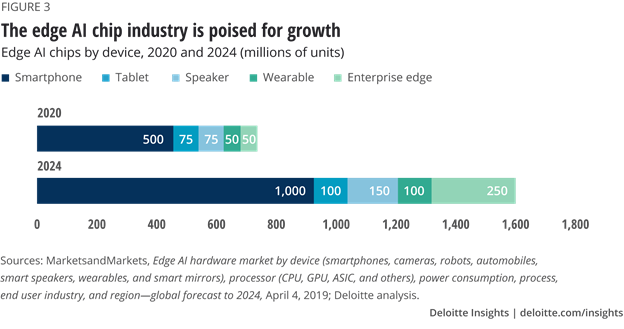

Another thing; the use cases and needs for AI chips across industries appear to be proliferating on an exponential scale. So again, even with this company at record highs and high-flying valuations, we think a lot of the sell-side could potentially be underestimating the upside in this stock. This coupled with management’s track record of delivering and of bold actions, like the potentially very accretive merger with England’s ARM, give the company multiple paths to continued share price appreciation in line with its performance over the last five years.

Why Nvidia is a Granny Shot

Nvidia meets two of our themes to qualify for being a Granny Shot: one is tactical and one is strategic. The first is the “Seasonality” tactical theme. This is actually a bit of a misnomer in the case of Nvidia because what the stock is really undergoing is a pretty acute shortage that is likely to endure for a couple reasons and over many seasons. The benefits to the stock and the company’s pricing power should outlast the immediate term and is one of the reasons why it’s so hard for analysts to properly catch Nvidia’s runaway positive momentum on several fronts with their forecasts.

Source: Nvidia Company Reports

The strategic theme that landed Nvidia on our Granny Shots list is, of course, the AI/Automation theme. It is not a hyperbolic statement to say Nvidia is likely the most important company in the world with regard to the future of AI and the ability to democratize it economically across many industries. The company has some major advantages already in the client it serves and it will likely only continue gaining more and more critical mass in various areas as its march toward S&P 500 Hall of Fame status continues.

Risks And Where We Could Be Wrong

The price of the spotlight and seeming perpetual success can obviously be a hard fall in the event of underperformance or significantly missing targets. As Jimmy Cliff once wisely said, the harder they come, the harder they fall. This risk though, given the professionalism and premier track record of the current management team seems unlikely particularly since they don’t have all their ‘growth eggs’ in one basket as the saying goes. Like we said, one of the main reasons we like this company is that there are multiple different dimensions and product specialties with which significant growth is not only possible, but seems highly likely given the preferences of relevant consumers.

As you saw above, the downside in the rare event that the market does not love Nvidia’s earnings the downside risk is considerable, particularly given that this is a momentum name. However, if you’re a computer graphics company that all of the sudden becomes the primary way most industries on the planet will utilize the immense efficiencies available to them by integrating AI into their antiquated processes, well then, you’re definitely going to have some P/E expansion. We realize some people may reflexively look at a stock near its 52-week high and avoid it. We think this would be a mistake in this name, although, given the rapid price appreciation, there is certainly a degree of risk associated with this dimension.

Technological innovation and capital intensity are quite high in the semi-conductor industry. Thus, competition from other firms is always a risk, but, as we said, much of the positive momentum helps mitigate this. It’s hard to get out-innovated when you can afford to hire all the best minds in a particular sub-field or specialty. Nonetheless, rivals like AMD have been making some inroads against the company in certain areas, though it could be argued to be a result of the company prioritizing higher-margin data centers which has proven prescient and profitable like most management decisions recently.

One of the key risks here has to do with the fact that Nvidia’s second largest geographic source of income is mainland China. The accelerating ‘cold war’ over military and technological dominance converges in a particularly acute way on the semi-conductor industry. However, it also gathers most acutely on the physical fabrication plant side as major strategic assets. Nvidia has a lot of sales to China currently not considered sensitive, but heating up of tensions or conflict could jeopardize this significant revenue source. The bifurcation and fragmentation of the market could prove problematic for revenues, but on the other hand, Nvidia and the US semi-conductor industry are likely to get some pretty significant subsidization and concessions from Uncle Sam in the name of national security.