Stocks Turn Negative to Start November

Our Views

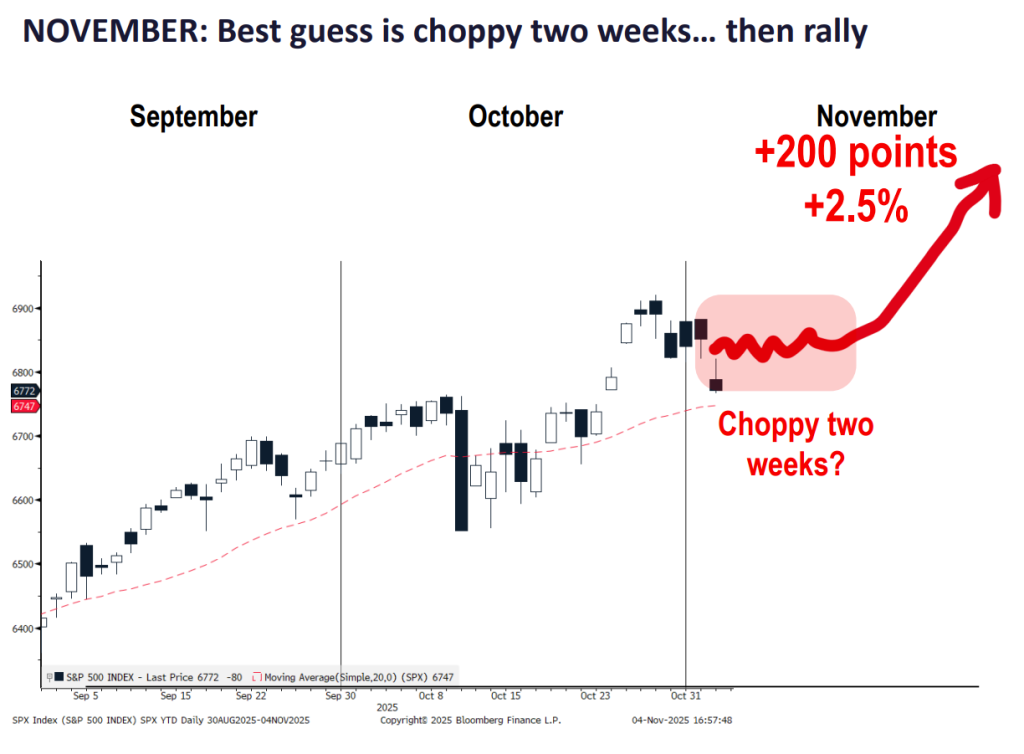

- We had anticipated the possibility of a choppy two weeks to open November, and this seems to be materializing.

- A growing wall of worry is likely behind this week’s choppiness. Some of those worries include recent bearish comments about a purported AI bubble from well-known investor Michael Burry, the continued shutdown of the federal government, private-credit worries, and possibly the results of Tuesday’s mayoral race in New York City.

- However, walls of worry eventually get resolved, at which point they become tailwinds. That’s a large part of why we continue to believe November will be an up month and see dips as buyable.

- Also note that October marked the sixth consecutive month that stocks were up. Historical precedents going back 100 years suggest the likelihood that the seventh month, November, will also be positive.

- Near-term US Equity trends are bullish, and SPX and QQQ have pulled back from the highs of the trading channel down to near the lows over the past week. Despite Thursday’s U.S. equity index lows not holding, the undercut of this support does not turn the trend bearish.

- Technology has weakened this week, but has not broken down, and Technology ETFs like XLK and RSPT both are trending near the uptrend line support, which should be important as this first week of November comes to a close.

- Overall, I expect that US stock indices have entered a much choppier trading environment between now and the end of November. Ideally, this might play out as follows: A short-term rally back to new highs for SPX and QQQ which is then followed by some backing and filling back down to revisit the lows of this channel again into late November. This would align with my cycles and provide a very attractive entry point into late November or the first week of December, before a push back to new high territory.

- Supply-adjusted coin days destroyed continues to trend higher, indicating distribution from older holders to newer investors. While this can pressure price action in the short term, it often precedes stronger bases for subsequent advances once selling pressure subsides.

- Bitcoin’s MVRV ratio is approaching the 1.7–1.8x range, which has represented a favorable “buy zone” this cycle. The 50-week exponential moving average, another key cyclical support level throughout this cycle, is also being tested.

- The ongoing government shutdown remains a primary macro overhang, tightening liquidity and weighing on risk appetite. We see a resolution as likely to ease liquidity constraints and support a recovery in crypto markets.

- The federal government shutdown continues, and repeated attempts in the Senate to re-open have failed to show any meaningful forward progress.

- Each party feels that it has the strategic advantage in the negotiations.

- Key Democratic victories on Tuesday have some reading an early warning signal for Republicans in the midterm elections, though those are a year away.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 fell 1.6% this week to 6,728.80 points. The Nasdaq Composite tumbled 3% to end at 23,004.54. Bitcoin was at USD 102,857.70 on Friday afternoon.

- Fundstrat Head of Research Tom Lee expects that stocks will gain for the seventh consecutive month in November despite the wall of worries.

- Head of Technical Strategy Mark Newton is impressed by the stock market’s ability to ignore government shutdown worries.

“Why is it that foolishness repeats itself with such monotonous precision?” ― Frank Herbert, God Emperor of Dune

Good evening,

Investors’ unwavering exuberance for stocks over the past three straight weeks showed signs of cooling down this week.

The S&P 500 declined 1.6%, with four of 11 sectors finishing in the red. The Nasdaq Composite lost 3%, wrapping up its worst week since April.

But the S&P 500 remains 2.4% off its all-time highs, while the Nasdaq is 4% away, even as the economy gears up for day 39 of the longest-ever shutdown in history.

“It’s a testament to the stock market that we have this shutdown, and we’ve been pretty resilient,” Fundstrat Head of Technical Strategy Mark Newton said during our weekly huddle. “When that’s resolved, we will have some money that will be thrown in a lot of different areas that will be helpful.”

The declines were primarily led by shares of highflying tech stocks coming back down to earth. Palantir’s performance was perhaps the most notable, with its shares sliding 7.9% a day after its earnings on Monday showed that revenue climbed to another record, and it even has robust commercial contracts.

But its extremely expensive valuations have drawn skepticism from investors. Among the most prominent of the skeptics was Michael Burry, the investor of the book and movie “The Big Short,” who disclosed that he is betting on Palantir’s declines, likely fueling even more declines.

Burry’s far from the only one cautious about this rally. Goldman Sachs Chief Executive David Solomon and Morgan Stanley Chief Executive Ted Pick said they expect drawdowns of more than 10% in the next year. That may have also contributed to spooking investors, as it just validated their fears that AI enthusiasm might be a bubble.

Even with the recent declines, Head of Research Tom Lee expects that November will be an up month for stocks, especially once investors are done climbing this wall of worry that includes everything from the government shutdown to the result of the New York City mayoral race and private credit stress.

“Keep in mind that worries, especially walls of worries, eventually get resolved, and then they become tailwinds,” Lee said.

Our Chart of the Week has more details:

“In our view, equities will be up this month,” Lee said in his Macro Minute video. “How many times in the last 100 years, has the market been up six months in a row through October? It’s been six times. And if you look at November, only 1942 was flat, so every other month was positive. I’d say the odds are good.”

The median gain in those six cases was 2.5%.

According to Lee, in November, the S&P 500 is likely to go up another 200 points. He expects that there will be a couple choppy weeks in the beginning but then a rally later in the month.

He likes that third-quarter earnings show that margins are expanding for seven out of 11 sectors, a welcome surprise for those who had thought that margins would collapse by this quarter because of tariffs.

He also said this week that the AI supercycle remains alive and well.

Newton’s in agreement with Lee there. “For those worried about a larger correction, you need to see evidence of that in stocks like Nvidia, Apple, Alphabet, and Tesla, and they all still look very, very good,” he said. “So it's tough to make too bearish a case.”

Elsewhere

Tesla shareholders overwhelmingly approved a record-setting $1 trillion compensation package for Elon Musk. The proposed stock award is contingent on Musk leading the company to achieve a variety of milestones involving market cap, vehicle sales, and, perhaps most prominently, sales of his proposed "robot army." If he achieves all milestones, Musk could end up with a 25% stake in the company.

The White House has added 10 minerals to its critical materials list, deemed essential to national security. They include silver, copper, and metallurgical coal. Other additions include lead, phosphate, silicon, uranium, and rhenium. A material's inclusion on the list increases the likelihood that tariffs might be imposed to encourage domestic production.

A UPS cargo jet crashed in a fiery explosion in Louisville, Ky., killing 13 including its three crew members. Federal investigators said after its early Tuesday morning takeoff, the plane's left wing caught on fire and one of the plane's three engines fell off. The plane, an MD-11 made in 1991 by McDonnell Douglas, was en route to Honolulu.

The Trump administration continues to resist court orders to pay full November SNAP benefits amidst the continuing shutdown, asking an appellate court to approve the payment of just 65% of them. A federal district court had previously ordered the U.S. Department of Agriculture to use so-called Section 32 funds to make up any shortfall in the Congressionally approved contingency fund.

The National Retail Federation predicted anemic holiday hiring this year, but also record holiday spending. The NRF said retailers' seasonal workforce this year would likely total between 265,000 and 365,000, sharply down from the 442,000 hired last year and the lowest level in 15 years. The trade group attributed the drop to a desire to cut spending to compensate for higher costs caused by tariffs. Nevertheless, the NRF said that resilient consumer spending patterns had contributed to its optimism for the upcoming season, with sales expected to top $1 trillion for the first time and potentially even hit $1.2 trillion.

Apple is reportedly moving beyond the premium market, with plans to release a low-cost, low-powered laptop in early 2026. The move represents a divergence from previous pledges not to devalue its brand with low-end offerings. The machine will reportedly use the same processor as its iPhone and a small, lower-end LCD display, selling for under $1,000.

And finally: After 208 years, the Farmers' Almanac will call it a day. Its 2026 edition will be the last ever, the publishers announced this week. The mainstay has given Americans two centuries of around-the-house tips, home remedies, social commentary, and most famously, its long-term weather predictions based on a methodology that still remains a closely guarded secret. It's worth noting that the Farmers' Almanac, which began publication in 1818, is not to be confused with the rival Old Farmer's Almanac, which has been in publication since 1792 and has no plans to stop.