Weak Jobs Report Reinforces Bets on Rate Cut This Month 1 and can accesss 1

Our Views

- I do think the Fed remains supportive of cuts. Fed Chair Powell said that at Jackson Hole, and Chris Waller, who is considered to be favored to be nominated as the next Fed Chair, also reiterated his support earlier this week on CNBC for a Fed rate cut.

- Contrary to consensus, I think September is going to be an up month because the Fed has been on hold for a year, and now they’re likely going to cut in September. It’s only happened twice in the last 50 years—September 1998 and September 2024. Stocks did well in both months, up 6% in 1998 and 2% in 2024.

- Next Thursday is the August CPI report, and that’s the last major report before the Fed makes its decision on Sept. 17.

- Overall, despite the lack of price weakness at present, I suspect the next 2-3 weeks might prove difficult before a rally materializes to carry SPX back to new highs into early October.

- Bottom line, I suspect that 6500-6550 might serve as strong near-term resistance for SPX, while 6250-6300 could mark support on pullbacks in the weeks to come.

- Following a minor drop in September, my expectation is for SPX to rally back to new highs. It will be imperative to keep a close eye on breadth and any evidence of trend reversal over the next 2-5 trading days, which would fall into this key technical window for a potential reversal.

- ETH Finds Buyers – ETHBTC found support today, suggesting ETH could resume participating alongside BTC and SOL.

- Macro Setup – Gold continues to front-run a regime where the Fed cuts into a stable economy with solid employment and above-trend inflation.

- Data Check – Manufacturing PMI showed green shoots via new orders and depleted inventories, while JOLTS came in soft but stable with hires down and layoffs steady. The jobs-per-unemployed ratio dipped below 1, a metric likely on the Fed’s radar.

- Liquidity & Seasonality – September seasonality remains weak, but October is historically strong for crypto. TGA refill and Treasury issuance over the coming weeks could be a short-term headwind.

- President Trump continues in his efforts to remake the Federal Reserve Board ahead of the Sept, 17 rate-setting meeting of the FOMC.

- Since Fed Chair Jerome Powell’s Jackson Hole remarks, anticipation for a 25 bps cut has gotten stronger.

- Meanwhile, the administration’s tariff policy is likely headed for a Supreme Court review, with the White House hoping the high court will reverse lower court decisions ruling against the legality of the tariffs.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 added 0.3% to 6,481.50 this week, while the Nasdaq Composite rose 1.1% to 21,700.39, while bitcoin was at USD $111,463.10 on Friday afternoon.

- Fundstrat Head of Research Tom Lee says that stocks will rally in September, despite negative seasonality effects.

- Head of Technical Strategy Mark Newton has the opposite view, but expects any pullback to be minor.

“Even if you aren’t sure of yourself, pretend that you are…most people prevaricate.” — Anna Wintour

Good evening,

Calls for an interest-rate cut in September grew louder this week after economic data showed that the jobs market is slowing down dramatically.

The S&P 500 hit a fresh record on Thursday and added 0.3% this week, while the Nasdaq Composite rose 1.1%.

Fresh data released Friday showed the U.S. economy added 22,000 jobs in August, way below the expectations of 75,000 jobs. A big yikes came from the downward revision of the June jobs number—which showed that the economy lost 13,000 jobs—the first contraction since December 2020.

The unemployment rate edged up slightly to 4.3% from 4.2% in July.

Other than hospitality, no other industry reported a gangbusters level of job growth.

The ADP jobs report on Thursday painted a similarly concerning picture. Hiring in the private sector rose by 54,000 jobs in August. Economists were hoping for a gain of 75,000.

But there’s a silver lining in this cooling job market, according to Fundstrat Head of Research Tom Lee.

“This is a downside miss, and it now strengthens the case for the Fed to resume cutting. This is good. Bullish for stocks, especially small caps and crypto,” he wrote Friday morning.

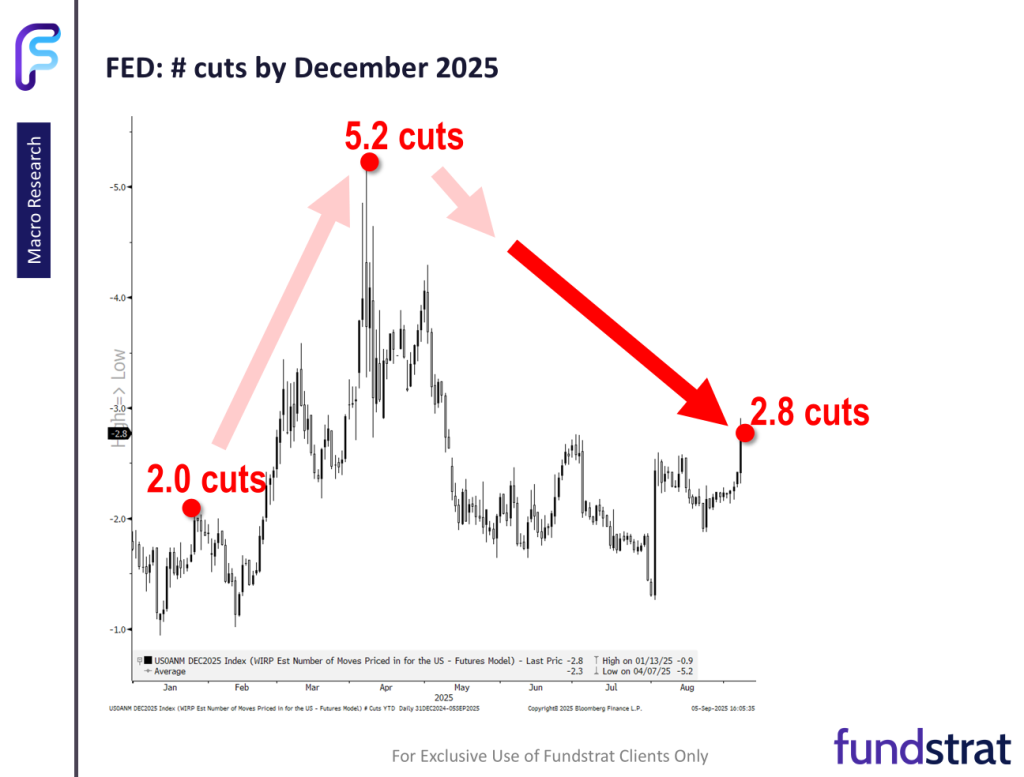

Investors are pricing in a 90% chance that the Fed cuts rates by 25-basis points at its September meeting, and a 71.6% chance of another same-sized cut at the October meeting. Our Chart of the Week has more details:

“The Fed can cut like 25, 50, or even 100-basis points but I don’t think that will really overheat the market,” said Head of Data Science Ken Xuan at our weekly huddle.

Fed Governor Chris Waller showed his inclination toward cutting rates earlier this week as well, which Lee highlighted. Waller said, “I think we need to start cutting rates at the next meeting and then we don’t have to go in a locked sequence of steps. We can kind of see where things are going because people are still worried about tariff inflation. I’m not, but everybody else is."

Lee said he is paying extra attention to what Waller says, as according to Polymarket, he is the heavily favored pick for the Fed chair.

While Lee believes that the month will defy seasonality constraints, Head of Technical Strategy Mark Newton believes differently.

“I think in the next two or three weeks, we do have a chance of a little bit of a pullback. I think it will prove to be minor,” Newton said.

That’s mostly because he doesn’t believe the idea that “bad news is good news can last too long.” In recent years, when economic data has come in weak, it has sparked hopes of cuts, which typically ended up boosting stocks, but Newton doesn’t think that’ll be the case for a handful of weeks at least.

He’s also concerned about market breadth “drop-off” seen since July. Technology has underperformed sharply—except for Google and Apple, which recovered some of their losses from earlier in the year. This week, Google shares added 10%, while Apple rose 3.2%.

Newton expects the market will rally after the Fed hopefully cuts rates and into October, with the S&P 500 going up to 6,700, representing a gain of 3.4% from its Friday close. If stocks do fall before the Fed’s September meeting, Newton recommends investors to buy it.

Small-caps' recent exuberant rebound has excited him, as well.

“We've seen very good performance in small caps and mid caps, which could come back to the rescue,” he said.

Elsewhere

Kraft Heinz is splitting up into two. One of the companies will focus on shelf-stable meals and will have the brands Heinz, Philadelphia, and Kraft mac and cheese. Another one of them will hold Oscar Mayer, Kraft singles, and Lunchables. Executives hope that with the breakup, the company can better unlock growth to create long-term shareholder value, but it’ll reverse the 2015 deal that led to the creation of Kraft Heinz in the first place.

A federal judge this week said that the president didn’t have the authority to send Marines and National Guard soldiers to California in June. The judge said the move violated laws that had been in place since the late 1800s, according to the New York Times. Similarly, in the case of canceling Harvard’s funding, a judge ruled that that was illegal, too. Both of these rulings are considered to be big setbacks for the Trump administration, but it’s largely expected that the administration will appeal.

Stephen Miran underwent his confirmation hearing for a seat on the Fed board this week. Miran said he would act independently as a Fed governor, but said he wouldn’t resign from his role as the chairman of the White House Council of Economic Advisers. This would be the first time since the 1930s that a sitting member of the executive branch would join the board, according to the Wall Street Journal. There’s merely two weeks left until the Fed's September meeting, so there is a great urgency placed on the decision.

And finally: It’s a new era for Vogue, too, which said that Anna Wintour, who has been the editor for nearly four decades, would step down. Chloe Malle, an editor for Vogue.com, will become the head of editorial content. However, Wintour isn’t disappearing. She is going to keep her office and take on the role of chief content officer.

Important Events

Est.: 100.6 Prev.: 100.3

Est.: 0.3% Prev.: 0.9%

Est.: 0.3% Prev.: 0.2%

Est.: 59.3 Prev.: 58.2

FS Insight Media

Stock List Performance

Small Cap Stock List Performance

| Strategy | YTD | YTD vs Russell 2500 | Inception vs Russell 2500 | |

|

SMID Granny Shots

|

+16.28%

|

+22.97%

|

+47.16%

|

View

|