Stock Losses Mount After Soft Jobs Report

Our Views

- This has been a disappointing week for markets because each day of this week the S&P 500 has had a “bearish engulfing” pattern — a higher open and a down close.

- As we noted earlier this week, the prevalence of bearish engulfing patterns is common since the April 2025 lows, but this still is unsettling.

- The S&P 500 and equities are overbought. So a bit of consolidation is expected. But we believe the risk/reward for stocks remains favorable. And we think stocks will likely be higher two weeks from now.

- This still remains the “most hated” V-shaped stock rally. We view Bitcoin as a leading indicator and thus, we expect stocks to reattain all time highs, which Bitcoin achieved last week. We see S&P 500 reaching 6,600 by year-end.

- The combination of near-term overbought conditions, rising sentiment, and breadth deterioration is certainly on the radar as SPX nears a seasonally difficult period.

- Overall, it’s still technically right to favor that this rally can continue into mid-August before some consolidation gets underway, which gels with post-election year seasonality.

- Key to watch will be interest rates, the U.S. Dollar, and any further evidence of additional breadth deterioration.

- QRA: No hawkish or dovish surprises. Treasury will maintain coupon auction sizes, favor bill issuance, and double the frequency of long-end buybacks. The TBAC also flagged stablecoins as a potential new demand source for T-bills.

- President’s Working Group: Light on Strategic Bitcoin Reserve details, but Bo Hines confirmed budget-neutral BTC accumulation is underway and hinted the government may not yet fully know its BTC holdings—likely the gating item.

- Price Action: BTC and ETH rebounded sharply after Powell’s speech, signaling market resilience and a willingness to look past the hawkish tone.

- Overall Takeaway: Liquidity remains favorable. Given no major negative surprises today, the near-term bias stays constructive.

- Tariff Day has arrived, and although Canada and Mexico have yet to reach trade deals with the U.S., there are reasons to expect that the impact should be blunted until they do.

- President Trump has resumed his attacks on Federal Reserve Chair Jerome Powell amidst disappointing jobs numbers, cutting short the détente that seemed to follow the president’s visit to the Fed’s headquarters last week.

- There are reports that the administration might try to put a “shadow chair” in place to increase pressure on Powell to cut rates.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 fell 1.6% this week to close at 6,238.01 points, while the Nasdaq Composite lost 2.2% to end at 20,650.13. Bitcoin was at USD 113,351.30 on Friday afternoon.

- Fundstrat Head of Research Tom Lee thinks Friday's soft jobs report could persuade the Federal Reserve to make "insurance cuts."

- Head of Technical Strategy Mark Newton views Friday’s declines as a buy the dip opportunity, similar to what Lee suggested.

“Pain is inevitable. Suffering is optional.” — Haruki Murakami

Good evening,

Stocks didn’t pull through in a challenging week.

The S&P 500 tumbled 1.6% this week, its worst week since late May, while the Nasdaq Composite fell 2.2%.

At the beginning of the week, there were signs of optimism. A trade deal with Europe was struck, and officials from the United States and China agreed to extend the trade truce to mid-August to give themselves time to reach an agreement. Both of those were considered positive developments ahead of the Aug. 1 midnight deadline for resuming tariffs.

That date ended up being pushed to Aug. 7 with new rates pushed upon many countries, such as 35% on Canada and 39% on Switzerland.

Since investors were already on edge Friday, it didn’t help when the much-awaited jobs report for July painted an abysmal picture for the labor market, further dragging down stocks and sending yields tumbling.

It was perceived as so bad that President Trump said he directed his team to fire the Bureau of Labor Statistics commissioner.

The U.S. added 73,000 jobs last month, much lower than the 100,000 economists’ estimated. What was even more worrisome is that the numbers for the previous two months noted larger-than-normal revisions. The May number decreased to 19,000 from 144,000 and the June number fell to 14,000 from 147,000.

It could be argued that stocks didn’t fall even more afterward because a softer labor market strengthens the case for the Federal Reserve to cut interest rates this year, which in turn would boost stocks

“The economy is solid and soft enough that the Fed needs to make insurance cuts,” Fundstrat Head of Research Tom Lee wrote on Friday.

Just on Wednesday, the Federal Reserve said it would keep interest rates unchanged, with chair Jerome Powell arguing that the board wants to be cautious in case tariffs lead to inflation. But Friday’s market reaction shows that investors are betting that worries about a weakening labor market will take precedence over any potential inflation.

“The inflation story from goods is hardly going to have traction if the jobs market is soft. Consumers will not tolerate it. So the Fed will soon capitulate on its stance,” Lee wrote.

Powell also took Wednesday as an opportunity to reiterate his stance that the Fed remains independent, saying that “you could argue we are a bit looking through goods inflation by not raising rates.” Even though that made investors nervous, Lee said it was a clear sign that the Fed is showing its independence.

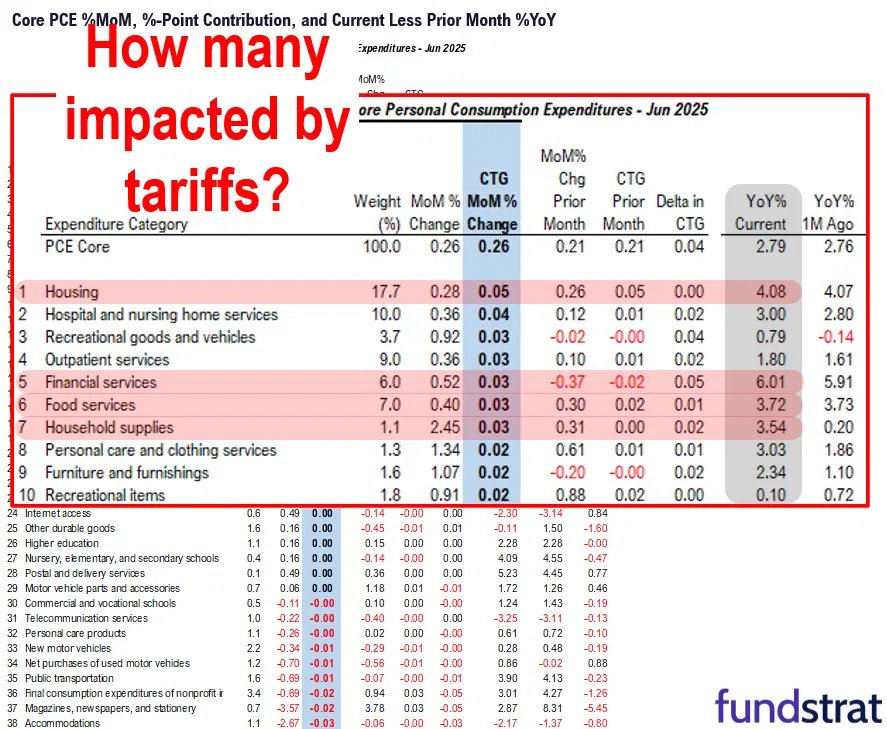

One other reason why Lee thinks the case for the Fed to keep rates steady is weakening is because the central bank’s preferred inflation gauge came in lower than expected. On Thursday, the PCE index showed that inflation in June rose in line with expectations. The top contributors were housing, financial services, food services and household supplies, which were unlikely to have been impacted by tariffs. Of that, Lee said “we understand why the Fed is on hold, but to us, inflation is not necessarily accelerating.” Our Chart of the Week has more details:

So Lee recommended to investors that Friday’s declines were an “obvious buy the dip moment.”

Head of Technical Strategy Mark Newton agrees. “I do feel that today’s dip is buyable and should begin to stabilize by next Monday or Tuesday at the latest,” he wrote.

Newton recommends tech stocks, even though many of the heavyweights’ earnings failed to impress investors this week. Amazon shares fell 8.3% a day after earnings, and Apple tumbled 2.5%.

He expects that this bull market can continue into mid-August before some consolidation gets underway, which gels with post-election year seasonality.

“For now, I see further downside as being short-lived and largely contained.”

Elsewhere

El Salvador President Nayib Bukele had a big win this week. Lawmakers abolished presidential term limits, allowing Bukele to run for re-election indefinitely. The small Latin American country has provided help to President Trump’s immigration crackdown this year by agreeing to jail tens of thousands in what many call inhumane conditions. Recently, some evidence was uncovered of secret negotiations between Bukele’s government and the MS-13 gang.

ChatGPT is getting an upgrade. OpenAI is expected to release GPT-5 next month, which will be its most advanced large language model. Chief Executive Sam Altman described using the chatbot as a “here it is moment,” adding that he “felt useless relative to the AI” after it quickly and effectively helped to respond to an e-mailed question with which he had struggled.

India is taking over China in another area. Analysis published by research firm Canalys this week showed that Indian-made devices accounted for 44% of the devices shipped to the U.S. in the second quarter, up from 13% last year. The total volume of smartphones made in India jumped 240% year-over-year, Canalys wrote.

And finally: The White House announced this week that its historic building will be getting a new addition. The president has ordered the construction of a $200 million ballroom, which he said will be funded by himself and “other patriot donors” instead of government dollars. “People are slopping down to the tent. It’s not a pretty sight. The women with their lovely evening gowns . . . their hair all done, and they are a mess by the time they get there,” the president said.

Important Events

Est.: -4.9% Prev.: 8.2%

Est.: -9.3% Prev.: -9.3%

Est.: -$61.7b Prev.: -$71.5b

Est.: 224k Prev.: 218k