Gold’s relentless, parabolic rise was once considered unthinkable by anyone who’s not a goldbug, but that is no longer the case. Even regular investors now are battling the feeling of missing out, wondering if it’s too late to get in.

Last year, gold rose 64% to over $4,300 a troy ounce, making the S&P 500’s fourth straight annual advance of over 15% look like peanuts.

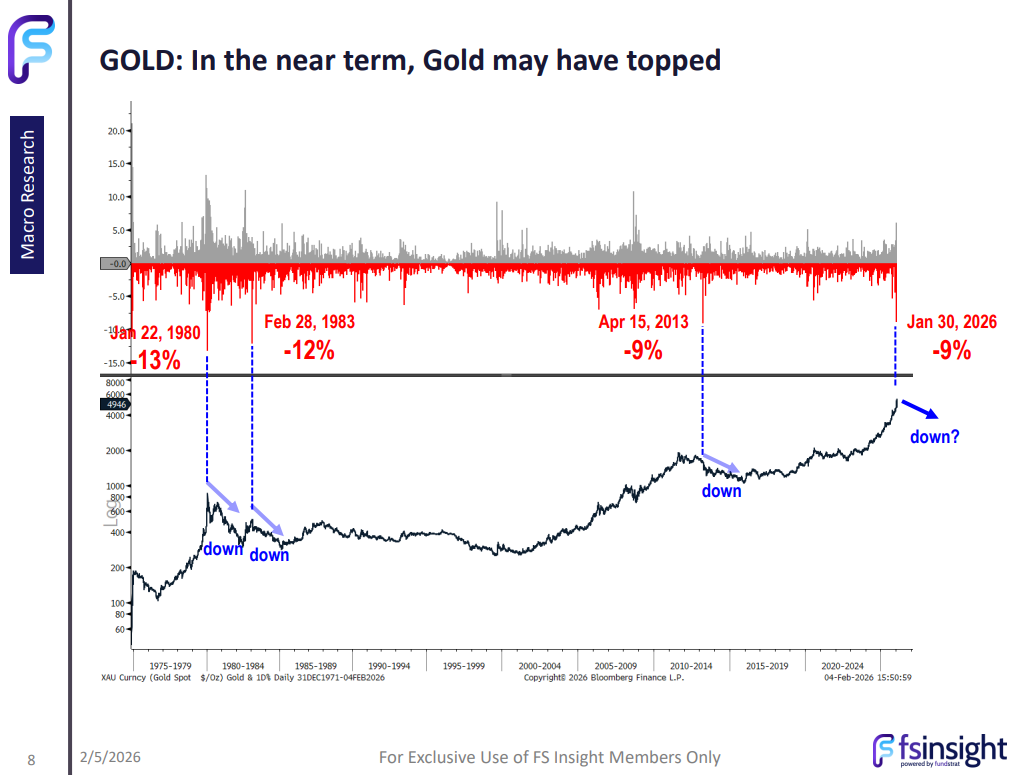

Much to the surprise of many, the rally has extended into the new year, with gold prices eclipsing the $5,000 milestone in recent weeks. They closed at $4,980 on Friday, up 15% so far in 2026. The ride up this year, however, has been anything but smooth. Never-before-seen one-day drops are being followed by historic rallies, which has added to the volatility.

The move up is part of the broader commodities bull run that started back in 2020. For gold, in particular, the Covid-19-spurred run to safety was a godsend, adding 24% in just that year alone. Since 2020, gold’s roughly 222% advance has outperformed the S&P 500’s about 110% rally. However, there’s an increasing number of signs that the rally is losing steam.

Fundstrat Head of Research Tom Lee said Thursday in a webinar to clients that gold has likely topped in the near term. Head of Technical Strategy Mark Newton has the same view, expecting that gold’s entire run-up from 2025 will unwind in the coming months.

Still, for those who don’t want to miss out on the next gold bull run, it’s always advisable to allocate a small portion of your portfolio to precious metals as part of a healthy diversified portfolio. Gold’s centuries-old status as a haven metal can particularly help protect portfolios against steeper losses during times of market upheaval when the risky assets like stocks and crypto and even the less risky assets like Treasurys tumble.

What moves gold?

Traditionally, gold prices are driven by geopolitical tensions, government bond yields, and the U.S. dollar. While some of these drivers hold true in today’s market conditions, others don’t.

For example, many investors argue that increased conflicts around the world and worries about even more have indeed helped bolster gold’s appeal as a haven. A 10% drop in the last year in the value of the greenback, too, has contributed to gold’s rise. When the dollar becomes weaker, gold, which is priced in dollars, becomes cheaper to overseas buyers.

However, a textbook relationship that hasn’t held up recently is that between gold and Treasurys. As a nonyield bearing asset, gold is unattractive to those who are looking for a regular income, so when Treasury yields are rising, there’s little incentive for investors to buy gold.

Currently, the 10-year Treasury yield is at 4.207%, up from 3.738% three years ago, but that hasn’t weighed much on gold. Some investors believe that’s due to worries about the growing U.S. debt pile and declining status of its sovereign debt reducing the appeal of holding Treasurys, even if they pay around 4% in yields.

Another way to look at that relationship is by looking at real rates, defined as the nominal interest rate minus the rate of inflation. When real rates are low, gold’s appeal as an asset that pays no interest surges, but that hasn’t held up in recent years. Even as real rates have remained elevated last year, gold prices have risen.

Arguably, the biggest driver of gold prices over the past five years has been aggressive global central bank buying as part of a broader de-dollarization trend. Gold accounts for about 17% of all global foreign reserves, up from 13% in 2021, according to the IMF.

What are the signs that the top is in?

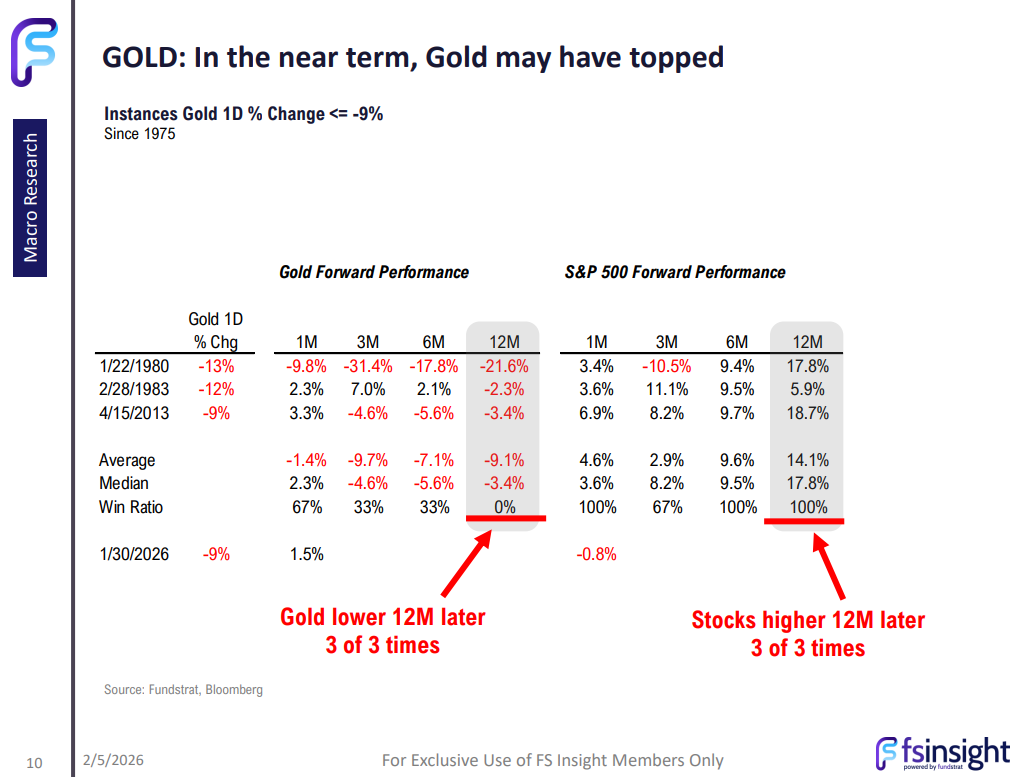

When gold prices fell 9% on Jan. 30, marking the fourth worst decline since 1975, Lee said that was a sign that the top might be in. The other three times gold posted a decline of similar magnitude, historical data show that prices had peaked in the near-term and were down 12 months later, according to Lee.

Technical signs, too, suggest that we are closer to a short-term top than a bottom, Newton said.

“I think we’re overdue for a correction, but it doesn’t make me want to short it. I’m still long,” he said.

With the next Fed chair expected to be dovish, rates are likely going to come down, which Newton believes can help precious metals.

For Lee, he believes that “we are approaching a point where I do think you probably need to have some kind of commodity exposure to gold.” He pointed out that gold’s network value is around $35 trillion, which is almost worth the S&P 500, excluding the Magnificent Seven, at $40 trillion.

With that being said, here’s how investors can get exposure to gold:

Gold ETFs

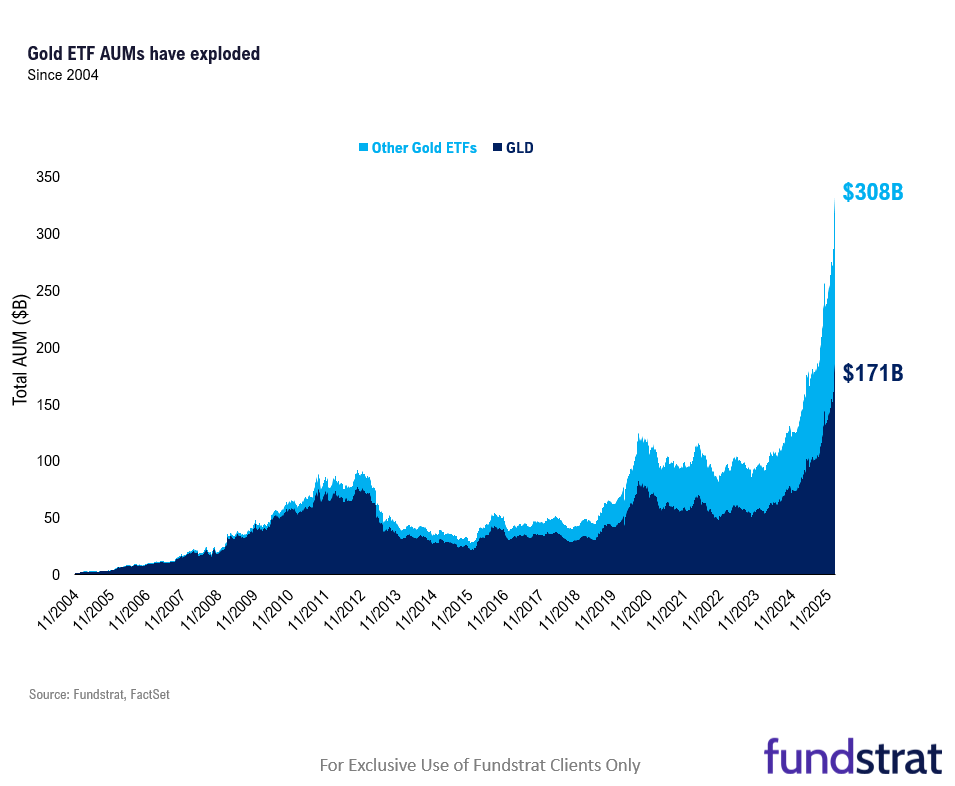

Gold ETFs are a little different than your regular ETF. Many are physically backed by gold, so when you are buying a share of the ETF, you technically own a fractional, undivided interest in the trust’s assets, which is composed of bars of gold sitting in a vault.

So when it comes to picking a gold ETF, investors should focus on the expense ratio, bid-ask spread (important for big trade blocks), and other trading costs. Since gold doesn’t pay an income, ETF prices move higher when the price of the underlying moves up and flows increase.

The most popular gold ETF is SPDR Gold Shares ETF (GLD 1.27% ), which was the first physically-backed gold ETF in the market back when it was launched in 2004. Since then, it has grown to over $170 billion in assets under management and easily dominates the gold ETFs space.

Though it has a slightly higher expense ratio (0.40%) than other ETFs, it has some of the lowest bid-ask spreads, with the 30-day media bid-ask spread at 0.01%. For those who trade regularly, lower bid-ask spreads are more important than lower expense fees.

Here’s some other options to look into:

- iShares Gold Trust (IAU 1.24% ) is the second-largest gold ETF by assets, currently managing approximately $80 billion. It came out in 2005 as a direct competitor to GLD 1.27% but with a significantly lower expense ratio of 0.25%. It balances a relatively low fee with high enough liquidity to keep bid-ask spreads tight.

- SPDR Gold MiniShares (GLDM 1.25% ) was introduced by State Street in 2018 and can be a low-cost alternative. With an expense ratio of 0.10%, it is one of the cheapest ways to gain physical gold exposure in the market today. Despite its “mini” branding, it has surged to about $30 billion in assets, proving that for long-term investors, the 30-basis-point saving over its older sibling (GLD 1.27% ) is a powerful draw.

- GraniteShares Gold Trust (BAR 1.31% ) launched in 2017 and boasts an expense ratio of 0.175% and manages roughly $1.7 billion in assets.

Gold miners and gold mining ETFs

Shares of gold miners are also a way to get exposure to gold. Because a miner’s profit margins are highly levered to the spot price of gold, a move in the metal can result in a significantly larger move in the stock, so the potential for outsized gains comes with outsized risks.

Mining is also a capital-intensive business prone to environmental lawsuits, labor disputes and shifting geopolitical regulations.

Their stocks have struggled to keep up with the broader market during the S&P 500’s decadeslong tech bull run. However, the materials sector, which is home to many of the miners, has begun to catch a bid in the 2026 rotation to defensive and cyclical names, so investors are looking closer at the space.

In Lee’s 2026 market outlook, Lee and Newton highlighted several materials names, with two of them dabbling in the gold space.

- Royal Gold Inc. (RGLD 1.84% ): Based in Denver, Colorado, Royal Gold operates differently than a traditional miner. It is a “streaming and royalty” company, providing upfront capital to mining projects in exchange for the right to buy a percentage of the gold produced at a fixed, lower price. This model provides gold exposure while shielding the company from the direct operational risks of running a mine.

- AngloGold Ashanti (AU 1.35% ): Headquartered in Johannesburg, South Africa (with its primary listing now on the NYSE), AngloGold is one of the world’s largest independent gold mining companies. It manages a massive, geographically diverse portfolio of operations across Africa, Australia, and the Americas, providing exposure to gold production on a global scale.

If you’d rather own a basket of gold miners, you can also buy gold mining ETFs. But again, many of them have overlaps, so it’s best to focus on which ETF has lower costs.

- VanEck Gold Miners ETF (GDX 1.76% ): GDX provides exposure to the “senior” miners—the largest, most established companies in the space like Newmont (NEM 1.98% ) and Barrick Mining (B 0.77% ). It currently manages about $30 billion in assets with an expense ratio of 0.51%.

- iShares MSCI Global Gold Miners ETF (RING 1.84% ): This ETF tracks an index of global companies that derive the majority of their revenue from gold mining. Its primary differentiator is its cost, with an expense ratio of 0.39%, making it significantly cheaper than GDX’s 0.51% fee.

- Sprott Gold Miners ETF (SGDM 1.87% ): This ETF uses a “factor-based” approach. Instead of just buying the biggest miners, it weights companies based on their revenue growth, free cash flow yield, and the lowest long-term debt to equity. It focuses on large-cap miners listed in the U.S. and Canada, aiming to provide a higher-quality basket of companies. Its expense ratio is 0.50%

Physical gold

If you’re craving the tangible experience, you can always just own physical gold given that storage concerns are not an obstacle. Coins are highly liquid and easier to resell but they carry higher premiums. Bars have lower premiums per ounce, but of course, are bulky to sell. There’s also jewelry, but this also carries a premium.

Conclusion

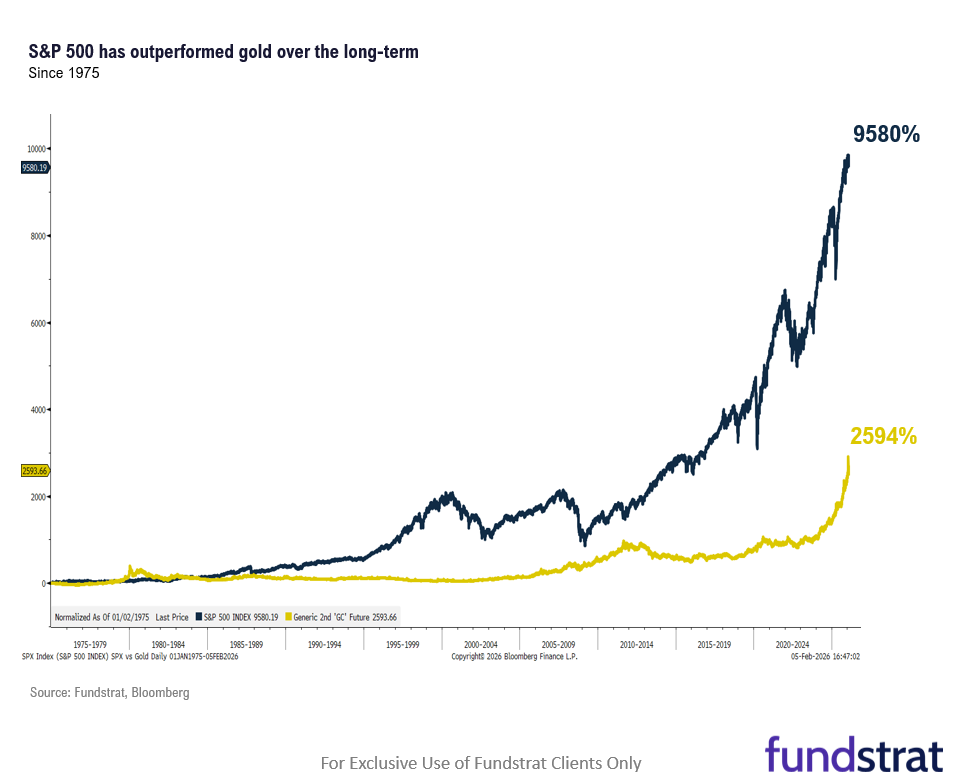

Gold prices have indeed popped off since the turn of the millennium, up 1,597%, running laps around the S&P 500’s 362% advance. But in the grand scheme of things, most of us invest for a much longer time frame, not just 25 years. Since 1975, gold prices are up 2,621%, while the S&P 500 has added 9,557%, highlighting that over long periods of time, stocks tend to outperform. Still, it’s prudent to consider adding some gold because its status as a haven doesn’t seem to be going away any time soon.

As always, Signal From Noise should not be used as a source of investment recommendations but rather ideas for further investigation. We encourage you to explore our full Signal From Noise library, which includes deep dives on quantum computing, race to onshore chip fabrication, the AI Merry-Go-Round, space-exploration investments, the military drone industry, the presidential effect on markets, ChatGPT’s challenge to Google Search, and the rising wealth of women. You’ll also find a recent update on AI focusing on sovereign AI and AI agents, the TikTok demographic, and the tech-powered utilities trade.