Recent earnings reports suggest that consumers of all economic backgrounds will keep spending money as long as they can spot a good deal. Some retail stocks are better positioned than others to benefit from that spending pattern in this typically busy holiday quarter.

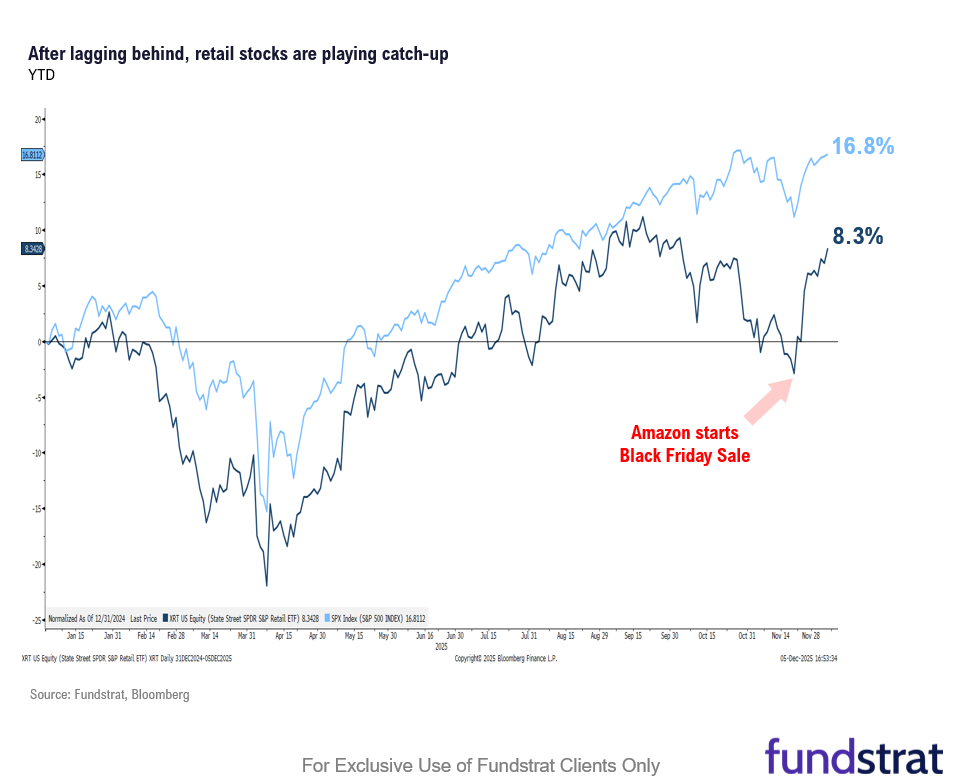

The SPDR S&P Retail ETF (XRT 0.66% ), considered to be a gauge of what’s happening in the retail segment, has recovered in recent weeks to gain 8.7% year-to-date. It’s now off 39% from its 2025 lows hit in April.

The S&P 500, in comparison, is up 17% this year.

Retailers’ recent attempts to catch-up have revived an old Wall Street adage that investors should never bet against U.S. consumers’ penchant for owning material goods, even if they are tightening their belts.

Shockingly strong consumer spending since the pandemic broke out in 2020 helped keep the economy afloat despite higher interest rates, inflation, and tariffs worries. But there are always worries looming about how long it can continue at this pace.

As the biggest driver of economic growth, what happens to consumer spending is important to watch because it can easily dictate the future direction of monetary policy set by the Federal Reserve. Spending levels that are too strong could signal to the Fed that it does not need to cut rates to prop up the economy – and in fact might need to be more vigilant for signs of rising inflation. Conversely, weak spending might tell Fed officials that lower interest rates could help.

And it’s particularly important to parse through retailers earnings now to get insight into how shopping ahead of Christmas is shaping up. Many shoppers wait to make purchases until items go on sale, so the last quarter of the year is supposed to be a blockbuster one.

Luckily, if Black Friday numbers are any indication of future spending, then consumers look to be healthy for the most part.

- A record number of 202.9 million consumers shopped during the five-day holiday weekend from Thanksgiving Day to Cyber Monday, which is up from 197 million last year and tops the 2023 record of 200.3 million, according to a National Retail Federation press release.

- U.S. retail sales, excluding autos, were up 4.1% on Black Friday compared to last year, according to Mastercard SpendingPulse.

- Data from Adobe Analytics show that U.S. online spending on Black Friday hit a record $11.8 billion.

Since Nov. 20 (when Amazon started its Black Friday sales), the biggest contributors to the retail ETF’s advance have come from the following:

- Ross Stores has added 11%

- American Eagle has added 32%

- Dollar General has added 33%

- Dollar Tree has added 23%

- Walmart has added 14%

- Macy’s has added 18%

They’re all outperforming Nvidia’s 2.2% decline and the S&P 500’s 3.4% gain over the same period.

There’s a clear trend underpinning that jump. Retailers either (1) need to attract consumers from all income segments via bargains or (2) offer deals that attract higher- and middle-income consumers to help make up for the lower-income ones pulling back.

Those look like to be the winners in this K-shaped economy, which refers to the widening gap between the higher- and lower-income consumers.

Let’s take a look at TJX, for example. As the parent company of T.J. Maxx, TJX primarily caters to financially constrained consumers, but since they have so many discounts going most of the year, it’s benefitting TJX (TJX -0.02% ), according to its recent third-quarter earnings release.

TJX is “strongly positioned as gifting destinations for value-conscious shoppers this holiday season,” said Chief Executive Ernie Herrman in a news release. Shares have risen 5.1% since Nov. 20. The retailer raised its full-year sales and profit guidance, as well. It’s up 27% this year.

Ross Stores raised its fourth-quarter sales forecast, as well. Its third-quarter same-store sales increase of 7% was “broad-based across all income levels.”

“We didn’t see any distinction between the lower [or] higher-income customers,” said Ross Stores’ (ROST -0.66% ) Chief Operating Officer Michael Hartshorn during the earnings call.

Ross is feeling good about the holiday season. “We are optimistic about our prospects for the holiday season, driven by our ongoing focus on delivering quality, branded merchandise at exceptional value,” Chief Executive Jim Conroy said in the press release.

Shares are up 17% this year.

At Best Buy, the same trend is playing out. Its Chief Executive Corie Barry said shoppers are “willing to spend when they need to or when there is innovation” on a call with reporters, according to The Wall Street Journal.

It’s attracting lower-income and younger shoppers with less expensive versions of popular electronics, Barry said.

The most important point made by Barry, though, is that she estimates “60% of U.S. consumers are spending less freely than high-income shoppers but still will open their wallets when there is a need or a deal,” according to the story.

Best Buy (BBY 0.03% ) shares are down 0.3% since Nov. 20.

It also increased its full-year sales and profit outlook. It’s down 14% this year.

Another example comes from American Eagle, which gave bullish holiday guidance. The apparel retailer also raised its full-year forecast in its earnings recently.

It expects fiscal fourth quarter comparable sales to grow between 8% to 9%, up from an expectation of about 2.1%. American Eagle (AEO 0.47% ) shares are up 35% this year.

The other set of retailers winning are those which can woo the wealthy to post sales increases without needing to rely as much on their traditional customer base of financially stretched consumers.

That seems to be the key to succeed in the current K-shaped economy.

In September, lowest-income households’ spending growth was at 0.6% from a year ago, whereas that same growth was at 2.6% and 1.6% for higher- and middle-income households, respectively, according to Bank of America Institute research.

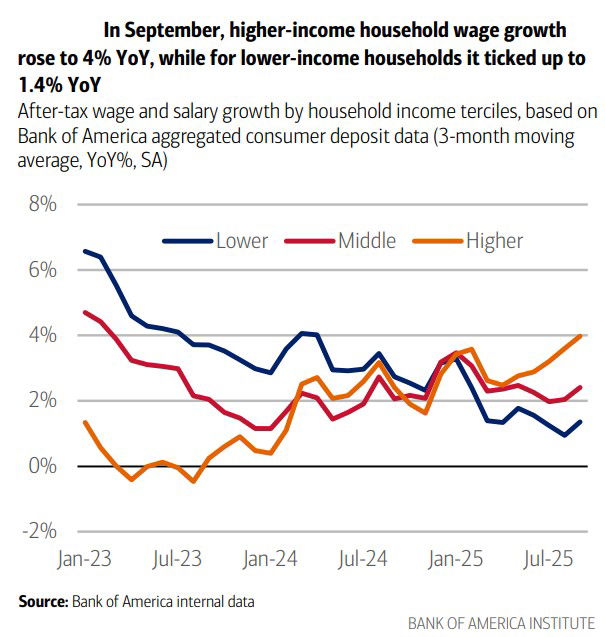

The gap could be partially because of softer wage growth gains in the lower-income cohorts. The research said that higher-income household wage growth in September increased to 4% from the previous year, while for lower-income households, it edged up to 1.4%.

Another theory that has gained a lot of traction recently is that higher-income spending is benefitting from wealth effects. “The discretionary spending of the top 5% of households by income tends to widen compared to the middle-income cohort when the S&P 500 is rising,” the researchers wrote.

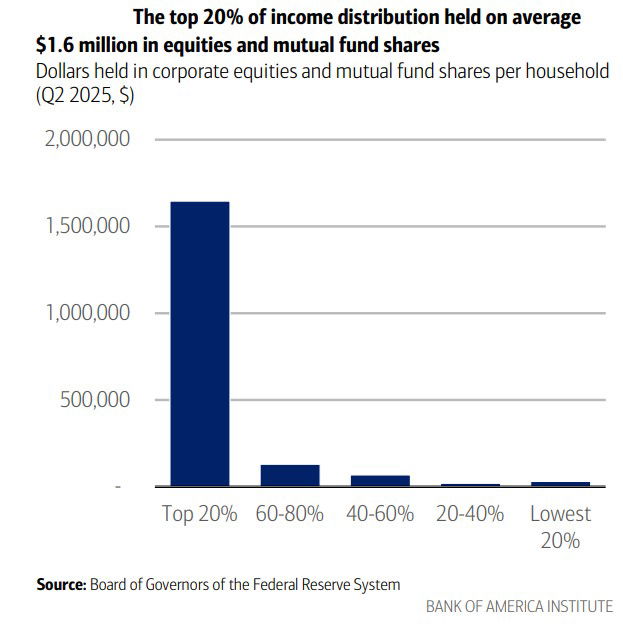

What’s even more mind boggling from the research is that the top 20% income bracket households held an average of $1.6 million in equities and mutual fund shares, which is more than 10x the $130,000 for the next 20% in the income distribution.

There are reasons to believe that the gap may not narrow any time soon, given that data for the labor market continues to be mixed.

U.S. employers have laid off 1.17 million workers through November this year, the highest level since 2020, according to a recent Challenger, Gray & Christmas job report.

The Bureau of Labor Statistics’ September jobs report, which was released in November due to the shutdown, says the U.S. economy created 119,000 jobs, higher than expectations of a 50,000 increase. The unemployment rate, however, edged higher to 4.4%, up from forecasts of 4.3%. However, many investors and economists assigned little weight to this report, arguing it was stale. They’re instead looking forward to the November release on Dec. 16, which would come out a week after the Fed’s Dec. 9-10 meeting.

For now, consumer confidence continues to deteriorate. Data from the Conference Board showed that confidence in November fell to its lowest level since April.

“Mid-2026 expectations for labor market conditions remained decidedly negative, and expectations for increased household incomes shrunk dramatically, after six months of strongly positive readings,” said Dana M. Peterson, chief economist at the Conference Board.

And that shaky sentiment is perhaps being best captured via earnings of Walmart, Dollar General, and Dollar Tree.

Walmart (WMT 0.65% ) earnings show that the retail chain is seeing love from all types of consumers, but the biggest gains are coming from higher-income shoppers. Contrasting that, executives said they’re noting “moderation in spending in the low-income cohort.”

“We’re leaning into price rollbacks, and making both everyday essentials, and seasonal celebrations more affordable for customers, and members,” said Walmart chief financial officer John David Rainey.

Walmart is “going into the holiday pretty optimistic,” he added. Shares are up 28% in 2025.

Earnings from Dollar General and Dollar Tree this week painted the same picture. Shares are up 75% and 60% this year.

The former’s chief executive Todd Vasos noted “disproportionate growth coming from higher-income households.” Michael Creedon, chief executive at Dollar Tree, said 60% of its new customers came from households earning more than $100,000 a year and 30% were from those with incomes between $60,000 and $100,000.

Dollar General (DG 0.69% ) reported earnings that came in better than expected, while Dollar Tree (DLTR 1.00% ) beat on both sales and earnings.

But at the same time, that doesn’t mean that lower income consumers have disappeared. Creedon said in the earnings call that “lower-income households are depending on us more than ever.” He added that average spending by that segment per visit grew more than twice as fast as that by higher-income households.

Five Below (FIVE 0.96% ), a quirky discount retailer, beat earnings recently, as well. Adjusted earnings came in at 68 cents per share, nearly three times higher than the 24 cents expected from analysts polled by LSEG. It’s expanding stores, benefiting from the same wave of excitement that’s lifting other discount retailers. Its shares are up 75% this year.

Of course, it wasn’t enough for some retailers to just beat sales expectations and raise their full-year sales and earnings outlook, such as Macy’s (M -2.07% ). The department store retailer said topline could continue to get impacted by choosy consumers and tariffs raising prices.

Its Chief Executive Tony Spring said in an interview with CNBC that the company is taking a “prudent view” of the fourth quarter because of tougher comps from last year. Additionally, it doesn’t have good insight into how its target base of upwardly mobile but financially strapped consumers, which he called the “aspirational customer,” may do in the holiday quarter.

“We’re pleased with the fourth quarter to date, but we have a big holiday in front of us,” he said on CNBC.

Its shares are up 38% this year.

Conclusion

There’s always going to be concerns that it’s unhealthy for the economy to be driven by the top consumer segment but until there’s signs of deterioration there, those worries are arguably misplaced. Retail earnings suggest consumers will keep spending as long as they can spot good deals, which bodes well for what retailers could report after the holiday season. Even with the recent rallies, many retailers’ shares are trading at cheaper levels than hot tech stocks like Nvidia, making them a potentially attractive investment. The only retailers mentioned in this piece that are trading at higher multiples than Nvidia are TJX and Walmart.

As always, Signal From Noise should not be used as a source of investment recommendations but rather ideas for further investigation. We encourage you to explore our full Signal From Noise library, which includes deep dives on the race to onshore fabrication, AI Merry-Go-Round, space-exploration investments, the military drone industry, the presidential effect on markets, ChatGPT’s challenge to Google Search, and the rising wealth of women. You’ll also find a recent update on AI focusing on sovereign AI and AI agents, the TikTok demographic, and the tech-powered utilities trade.