“The surest foundation of a manufacturing concern is quality. After that, and a long way after, comes cost.” – Andrew Carnegie

“In the future, the world will be divided into two groups: those that can supply semiconductors and those that only receive them. Those are the winners and the losers.” That starkly binary assessment was made not by Donald Trump, or Joe Biden, or indeed any U.S. politician. It is the view of Akira Amari, the former head of Japan’s Ministry of Economy, Trade and Industry. There is little doubt that most of Washington shares that view, and so do the leaders of many countries around the world.

The ubiquity of and necessity of access to semiconductors is hardly new. For nearly two decades, most of us have been walking around with a cutting-edge chip constantly in our pockets or purses; some of us have two or three on us at all times. Policymakers around the world have pursued more secure semiconductor supply chains ever since the Covid-19 pandemic caused shortages around the world, especially given the rise of China and Beijing’s increasing willingness to flex its growing influence. The AI frenzy, which shows no signs of slowing, added to that, and so did Trump’s dramatic shift in foreign and trade policy.

One way to look at this geographically broadening attention to semiconductors is to examine Taiwan Semiconductor Manufacturing Corporation’s (TSM 4.34% ) expanding operations around the world. As most likely know, TSMC is by far the largest fabricator of chips in the world, and its over 90% dominance in the most advanced chips, such as those used in cutting-edge AI and the latest flagship smartphones, frankly shows little sign of disappearing any time soon.

Admittedly, TSMC obtained considerable assistance from the Taiwanese government, which provided a financial cushion needed to mitigate the considerable risks that accompany the need to constantly upgrade chipmaking factories and equipment. It’s possible the U.S. government could have similarly assisted American chip companies, but we’ll never know: American chip companies never asked for such help, and at the time, it would have horrified free-market adherents for the U.S. government to unilaterally force such a move. (We will return to this matter later.)

The Taiwanese government had a compelling reason for helping Morris Chang start TSMC. It foresaw that such a company, if it achieved market dominance, might become so important to the global economy that the rest of world would intervene against any Chinese attempt to retake Taiwan by force, in effect serving as a “silicon shield.” Simply put, Taiwan was playing 3D chess while China was playing 2D chess.

It’s a formidable shield: a Bloomberg Economics analysis suggests that a Chinese blockade of Taiwan could cost the global economy $5 trillion — including the impact on China. The locals are well aware: “Taiwan will be okay,” an ordinary Taipei cab driver told an MIT Technology Review reporter, “because TSMC.”

Yet with Europe, the U.S., and other countries in Asia increasingly concerned about China’s proximity to Taiwan and TSMC’s fabs, TSMC has been pressured to diversify its operations away from Taiwan. Though its most advanced technology will remain in Taiwan, TSMC has agreed to diversify its operations. Either alone or in partnership with local companies, TSMC is spending tens of billions opening fabs in Arizona; Dresden, Germany; Kumamoto, Japan; and Singapore. It is further expanding overseas operations in other directions, for instance with a EUR 10 billion chip design center planned for Munich.

While these plans have implications for the robustness of Taiwan’s silicon shield, the takeaway for us is that everyone now wants to be fab-ulous. (We couldn’t resist.) Even as every country acknowledges TSMC’s importance and dominance, there’s a broadening desire to move it away from “too big to fail” status.

Take Japan, for example, where TSMC’s operations are viewed positively. Yet the Japanese government longs for a return to the 1980s, when Japan — not the U.S., nor Taiwan – was the world’s biggest producer of computer chips. (Perhaps not coincidentally, this was also when Japan, not China, was still the world’s second largest economy.)

In 2022, the Japanese government began a process that culminated in a public-private partnership to create a new “pure-play” chip fabrication company called Rapidus that has raised $11.2 billion in pledged backing (as of this writing) and partnerships – not just from the Japanese government, but major names like SoftBank, Sony, and MUFG, along with non-Japanese partners like IBM 2.53% , ASML 0.61% , and, perhaps most critically, Cadence (CDNS 3.87% ) and Synopsis (SNPS 5.03% ), providers of AI-driven chip-design products.

Rapidus’ first fab has already been completed in Sapporo (yes, where the namesake beer is made), with hopes that by 2027, it will compete with TSMC in producing cutting-edge chips.

Here’s the important bit: While Rapidus is undoubtedly seen as a potential TSMC competitor, the Japanese company proposes a different business model, operating at a smaller scale but offering customers the option for smaller batch sizes, faster speed, and more extensive customization.

Japan’s chip focus makes sense, given its former dominance, but even India, which does not have a meaningful history of semiconductor design or production, now wants to enter the race. As CNBC reports, the country has just committed $18.2 billion to build a comprehensive domestic semiconductor supply chain – design, fabrication, testing, and packaging.

And then there’s the U.S.

Advanced U.S. chip companies have largely gone fabless since TSMC’s inception, happy to let Chang’s company aggregate the risks associated with chip manufacturing and enjoy the benefits of economies of scale.

But not all of them have.

Notably, Intel never really gave up on making its own chips, remaining an integrated device manufacturer or IDM that both designs and fabricates its own chips. It remains one of the largest IDMs in the world, though Samsung is even larger.

That hasn’t always seemed like a great idea: Capex often accounted for 20% of Intel’s revenues or more, and even with such expenditures, Intel has struggled to match the manufacturing-technology advances of TSMC. Though there had previously been talk of Intel offering foundry services (i.e., manufacturing on behalf of other chip designers) to mitigate those costs, such efforts have resulted in lackluster results.

Chip designers have been wary of giving a direct competitor access to their designs, even for manufacturing purposes.

Just as importantly, Intel found itself unable (or perhaps unwilling) to match TSMC’s white-glove level of customer service, which made working with TSMC not just easier and more pleasant, but highly likely to yield significantly superior results.

Speaking generally of TSMC’s competitors, chip-industry expert Claus Aasholm noted: “While TSMC has leading-edge competitors, they are struggling to attract customers, regardless of technology or price. They know that TSMC takes care of their customers over the long term.”

However, the renewed focus on securing semiconductor supply chains has given Intel an advantage: Most of Intel’s foundries are located in the U.S. (It also has one fab each in Ireland and Israel.) This proved to be advantageous in Intel’s relations with the U.S. government: it became the largest beneficiary of President Biden’s CHIPS act, awarded up to $19.5 billion in financial incentives, including grants, loans, and tax credits.

President Trump’s onshoring focus only intensified the U.S. government’s interest in supporting Intel. In a move that startled free-market adherents, Trump on Aug. 22 converted some of the CHIPS act money into a 9.9% equity stake in Intel, purchased at a steep discount relative to market prices at the time. It’s clear where Trump’s focus was: The transaction included a five-year warrant that allows the U.S. to expand its stake in Intel if the company’s ownership interests in its foundry business ever dip below 51%.

Though government ownership in private enterprise is unusual for the U.S. (Trump also got the U.S. government a “golden share” stake in U.S. Steel and equity stakes in MP Materials, Trilogy Metals, and Lithium Americas), it’s worth noting that in addition to Taiwan’s stake in TSMC, GlobalFoundries (GFS 3.16% ) is in effect majority owned by the U.A.E. through its Mubadala sovereign wealth fund, which holds an 82% stake. And let’s not forget Rapidus, which gets direct funding from the Japanese government.

Given the Trump administration’s interventionist approach to Intel, this stake arguably sent a signal about how to curry favor with the White House. Softbank (SFTBY) might have seen it coming, announcing its own $2 billion investment in Intel right before the U.S. deal was finalized, and Nvidia took a $5 billion stake on Sept. 18.

Following the Nvidia announcement, Wolfe Research’s Chris Caso observed, “What’s unclear is whether this represents token cooperation intended for political purposes, or if it’s the start of a wider collaboration that would more significantly benefit INTC.” (Nvidia’s Jensen Huang said the Trump administration “had no involvement” in its decision to enter into a deal with Intel, while suggesting that the president would nonetheless have been “very supportive” of it.)

Aside from the political benefits, it’s not clear how Nvidia benefits from this deal. Though the deal would have Intel coupling Nvidia’s graphics chips with its PC CPUs, that’s unlikely to represent a significant source of added revenue for Nvidia. Meanwhile, Nvidia agreed to incorporate Intel CPUs into Nvidia’s data-center products.

The joint statement released by Nvidia and Intel announcing the deal appear to be tacit confirmation of which company stands to benefit more: “We appreciate the confidence Jensen and the Nvidia team have placed in us with their investment and look forward to the work ahead as we innovate for customers,” Intel CEO Lip-Bu Tan said in the statement. Though not mentioned in the deal, it’s possible that the collaboration will someday result in Nvidia shifting some of its manufacturing away from TSMC to Intel, but that’s likely to depend on how well Intel can implement its advanced 18A fabrication process.

All of this has likely pleased longtime Intel shareholders. INTC 5.68% stock had largely underperformed its competitors’ shares for years, including a 60% decline in 2024. Yet largely due to the developments described above, the shares have nearly doubled in price YTD. The shares surged as much as 10% immediately after the company’s Oct. 23 post-close earnings call, during which CFO David Zinsner noted that the investments from the government, Softbank, and Nvidia have provided “operational flexibility.” He also told analysts that “demand is much stronger than we anticipated.

The cutting edge

Yet despite this, it’s not entirely surprising that numerous analysts covering the company have maintained stock-price targets well below INTC’s current $40 levels. Questions remain about whether Intel is a good business to invest in over the long term – even for the likes of Nvidia or the U.S. government. Much of that has to do with the company’s fabrication business.

For example, Intel originally budgeted $20 billion for new fabs in Arizona and another $20 billion for fabs in Ohio. Between construction-related inflation and technology hurdles, projected costs for the Arizona fabs are now at $32 billion and $28 billion for the Ohio plants. The “Ohio One” facility in particular is being delayed, with the plant not expected to become fully operational until 2030-2031.

On the positive side, Intel’s Fab 52 in Arizona is now fully operational, producing chips using its latest 18A process (the moniker Intel uses for its bleeding-edge 2-nanometer node process). Independent testing has yields slightly below the 70% level generally regarded as the minimum required for commercial viability, but observers believe that Intel will achieve this benchmark before the end of 2025 if it hasn’t already done so.

That puts Intel roughly on par with TSMC’s efforts to implement its own 2-nm manufacturing. Though some reports have some TSMC 2-nm yields at 90% or better, it is still in the pilot production phase. (As is typical, practically all of TSMC’s 2-nm capacity for 2026 has already been reserved in advance by Apple and AMD. Intel’s analogous foundry capacity is largely unspoken for.)

Legacy chips

Advanced chips get a lot of press attention, and rightly so. Yet when it comes to national security, legacy chip technologies are arguably as important. The shortage that caused such problems for automakers after the COVID pandemic didn’t involve AI chips, but legacy chips. Such older chip designs often underlie cutting edge technology in automobiles, advanced weapons systems, and medtech devices, to say nothing of everyday consumer electronics and appliances. Such products, while vital, do not need the high performance, minuscule size, and efficient power consumption required by AI hyperscalers and flagship iPhones. In such cases, the long, proven track records of older chip technologies are arguably more important and valuable.

Stocks related to legacy chip technologies have underperformed in 2025. ON Semiconductor (ON 0.81% ), Texas Instruments (TXN -2.96% ), and GlobalFoundries are down 18.9%, 9.7%, and 17.4% YTD, respectively, while Analog Devices (ADI 0.46% ) is up a healthy but unspectacular 12.5% over the same period. (ON, TXN, and ADI are IDMs that both design and manufacture, while GlobalFoundries is a pure-play foundry.)

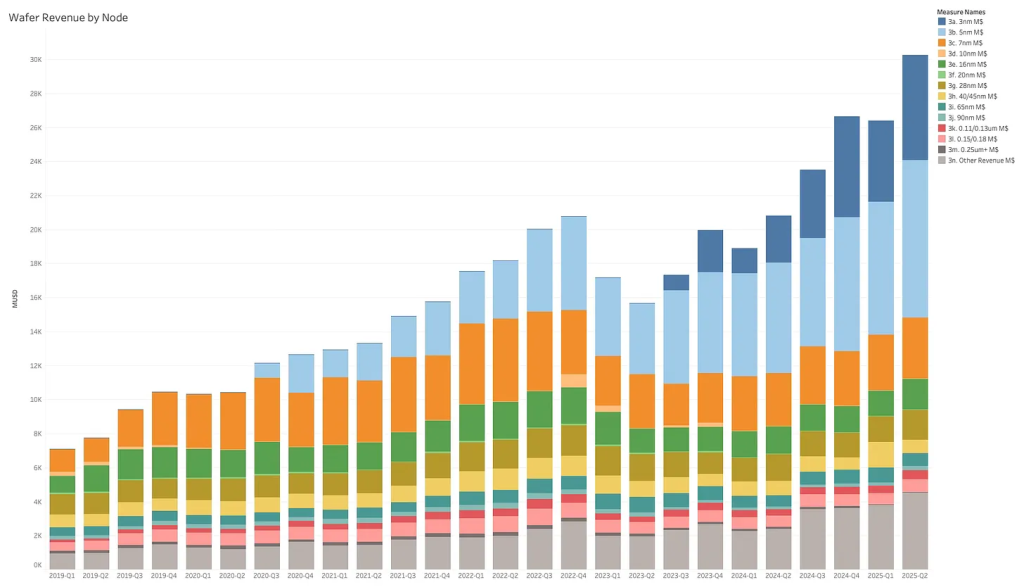

It is perhaps understandable why such companies might seem less attractive to investors. As the chart below illustrates, makers of legacy chips (28 nm and larger) see demand growth that is more moderate and less explosive than demand for advanced chips.

Another issue with such legacy chip companies is that many of their fabrication facilities have long been located in the U.S., making them less likely to be the major beneficiaries of federal largesse. Analog Devices, Texas Instruments, and GlobalFoundries have each received CHIPS and other government assistance to renovate, expand, and build facilities in the U.S., but the sums awarded have been far less than those awarded to leading-edge chipmaking companies being induced to build new operations in the country.

Yet as the chart above also shows, legacy chipmakers benefit from demand that is stable and unlikely to disappear anytime soon – a luxury for an industry in which executives often joke that demand and supply rarely achieve anything resembling parity for much more than an hour or two. It’s also worth noting that node size is not a perfect proxy for technological sophistication: new and sophisticated designs sometimes deliberately opt for such node sizes for reasons unrelated to cost. What’s more, the importance of such capabilities to national and economic security remains high — and, apparently, increasingly recognized.

Consider the Dutch government’s takeover of Nexperia on Oct. 13. The Chinese-owned Dutch company competes with the likes of ON, TXN, and ADI in providing chips and electronic components for use in automobiles. Although it does not deal in cutting edge technology, its expertise at manufacturing efficiency was nevertheless deemed important enough for U.S. officials to reportedly pressure the Dutch government to wrest control of the company from its Chinese CEO on national security grounds.

While we suggested elsewhere that Dutch authorities might have had bigger, but indirect, objectives in mind when making this move, the importance of its technological knowhow is still significant. Nexperia has since declared that a “force majeure” event had taken place, using this to claim exemption from its contractual obligation to deliver chip shipments to automakers. The Alliance for Automotive Innovation, whose members include General Motors, Toyota, Ford, Volkswagen, BMW, Mercedes-Benz, and Stellantis, has warned that if shipments remain suspended, the chip shortage could force a halt to global production within a few weeks.

For now, Nexperia is unable to ship its finished products to customers. While most of Nexperia’s fabrication takes place in the Netherlands, the chips are packaged in China, and Beijing has barred Nexperia’s Chinese divisions from exporting the finished product.

This brings us to another aspect of semiconductor supply-chain security.

Beyond Fabrication: Testing, Dicing, and Packaging

On Oct. 17, Nvidia announced that it was now producing its current Blackwell flagship AI processors, which use an upgraded version of the 5-nm fabrication process, at TSMC’s fabs in Arizona. Despite the widely acknowledged importance of this milestone, many observers noted that the U.S.-manufactured Blackwell wafers still need to be sent to Taiwan for testing, dicing, packaging, and testing, at least for now. These complex steps – generally regarded as separate from the fabrication process – are required before a chip can be installed into a server, computer, or other device. And much of it is still done overseas.

Testing involves determining the yield of the wafer, identifying those potential chips that are free of error and thus, usable. (As an example, a Blackwell wafer will have as many as 61 potential chips etched onto it, but unavoidable errors resulting from the complexity of the fabrication process mean that only 40 or so are likely to be free of error.) Those that can be used are then diced – precisely cut into individual chips, or die. The resulting die, still very fragile, must then be mounted onto a protective package of plastic or ceramic, with metal pins and contact points that will be used to attach the chip onto a circuit board for installation in a device.

Although offshore testing and packaging represents another vulnerability in the U.S. semiconductor supply chain, it is one that is also being addressed. While TSMC offers in-house advanced testing, dicing, and packaging operations through its facilities in Taiwan, an American company, Amkor (AMKR 3.10% ), has become one of the largest Outsourced Semiconductor Assembly and Test (OSAT) providers in the industry, with a 17% market share that is second only to the 26% share occupied by Taiwan’s ASE (ASX 5.71% ).

Supported by a $407 million grant from the CHIPS Act, Amkor is in the process of building a new advanced packaging and test facility in Peoria, Ariz., deliberately co-located to work with the output of TSMC’s nearby facilities in Phoenix (about 13.5 southeast) to produce end products for the likes of Apple and Nvidia.

Amkor won’t be alone. As much as $7.86 billion CHIPS Act incentives awarded to Intel have been allocated toward building out advanced packaging capabilities in nearby Chandler, Ariz. (about 22.5 miles southeast of TSMC) – as well as in New Mexico, Ohio, and Oregon.

The demand for onshoring of such processes has not received much attention from the general public, but it remains important for both advanced and older technologies. Even though makers of legacy chips operate multiple fabrication plants in the U.S., much of their testing, dicing, and packaging is still done abroad, particularly in Southeast Asian countries like Malaysia, Thailand, and the Philippines, through a mix of in-house and OSAT facilities.

To date, the Trump administration has not made any public comments related to onshoring such activities, but given the White House’s obvious focus on self-sufficiency and sovereign security, that could change. If so, it would arguably boost demand for testing and packaging equipment, such as machines made by the likes of Applied Materials (AMAT 1.17% ), KLA Corporation (KLAC 1.28% ), and Teradyne (TER 3.32% ).

Conclusion

Many observers argue that Nvidia is the most important company in the world, and there are certainly strong arguments to support their contention. Yet another cohort has long asserted Taiwan Semiconductor Manufacturing Company is more deserving of that title. What good are those chip designs if they can’t be turned into a physical product, after all?

The same can be said about the rest of the semiconductor industry. The geometrically growing demand for computing power has important investment implications for not just the chip designers that tend to grab headlines, but also specialized chip manufacturers as well.

As always, Signal From Noise should not be used as a source of investment recommendations but rather ideas for further investigation. We encourage you to explore our full Signal From Noise library, which includes deep dives on the AI Merry-Go-Round, space-exploration investments, the military drone industry, the presidential effect on markets, ChatGPT’s challenge to Google Search, and the rising wealth of women. You’ll also find a recent update on AI focusing on sovereign AI and AI agents, the TikTok demographic, and the tech-powered utilities trade.