Once-in-a-generation amount of circular investments into artificial intelligence are like a merry-go-round right now. Investors, much like kids, are jumping over backwards for a ride. The worry is that after a while, they’re going to start to get sick and dizzy and do anything to get off.

With all due respect to the bulls, the bears aren’t being completely irrational here. If all this is indeed a bubble and if it indeed pops, then it’ll ruin the fortunes of scores of investors and plunge economies into a downturn. Still, let me try to assuage some of these fears anyway.

It’s like when my friends and I Venmo each other the same $30 for when we get dinner every week. It’s not a problem as long as another set of $30 is available as actual real money that can pay for the next dinner.

First, what are the bubble troubles?

Without AI investments, the gross domestic product rate would have grown a mere 0.1% in the first half of the year instead of the 1.57% it did grow, according to research by Harvard economist Jason Furman.

That means the economy’s fate is inexplicably intertwined with that of AI, so when the investments start looking circular, it’s a concerning sign.

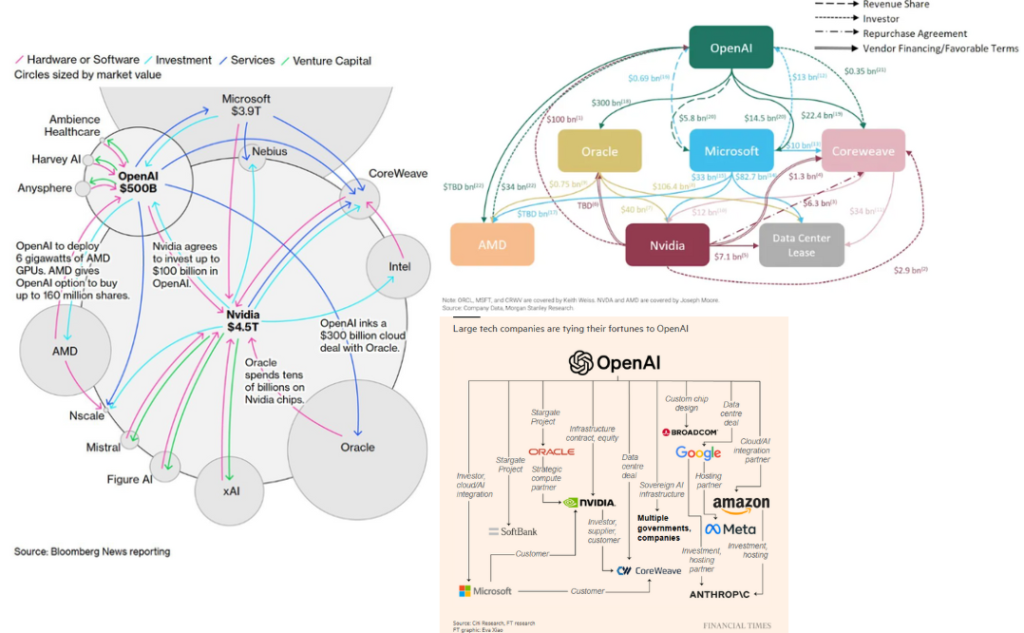

For example, OpenAI announced just this week that it’ll buy chips from Advanced Micro Devices. It’ll also get a warrant that allows it to own as much as 10% of AMD AMD 0.81% . OpenAI has also said it’s going to pour billions into CoreWeave CRWV -0.66% and an even bigger sum into Oracle ORCL 2.47% in the coming years.

Keep in mind: It’s widely known that the ChatGPT maker doesn’t have that much money so far for all these investments it keeps promising. Yet, it keeps fueling massive share-price booms. AMD has jumped 30% this week, while Oracle has added 21% since the news was announced.

Now, here’s where the circle picture will start becoming clearer.

OpenAI’s one of those unique players that’s a benefactor and also a beneficiary. So is Nvidia NVDA -2.16% . The AI stalwart announced last month that it’ll invest an eye-popping $100 billion into OpenAI over the next decade. It’s making a smaller commitment to Intel INTC 0.84% and CoreWeave, as well.

I’d like to remind everyone here that a bubble is shaped like a circle, and these are…ahem…circular investments. Is that a little too on the nose?

But corny dad jokes aside, it’s fair to wonder how much of this AI hype is even being fueled by real demand at this point.

Arguably, the biggest plot hole of the AI narrative might be that there’s no set number for how much of this AI infrastructure that companies are racing to build will even be needed, a point that one of our macro data scientists, Alex Wang, flagged to me. The AI leaders have no way of knowing that because companies are still trying to find out ways to monetize AI.

Even with the massive investments in pursuit of superintelligence, it’s unclear if society can reach that next level by just aggressively building out data centers. OpenAI says that the breakthrough would come with “serious risk of misuse, drastic accidents, and societal disruption,” and some other skeptics, such as the “Godfather of AI” Geoffrey Hinton, are even more worried.

What’s the bull view here?

You can also tell how concerned investors are about this by just the number of circular flow chart variations I’ve seen this week alone. However, in my opinion, this is one of the biggest contrarian indicators supporting the constructive view of AI. It means the enthusiasm hasn’t run ahead of itself.

Also consider that large circular investments are necessary whenever a new technological breakthrough happens, so that scale can be achieved faster.

That’s what drove OpenAI to partner with AMD, which is a laggard in the chips race but still a competitor to Nvidia, even though Nvidia is investing in OpenAI. Clearly, OpenAI understands how much more important it is to build-out faster than to play corporate politics.

There is no other way around it.

Comparing AI’s large-scale buildout to previous periods in history doesn’t work either because AI is so unique in that respect. You’d be wrong to compare it to the railroad boom or fiber-optic grids.

“We are in a phase of the build-out where the entire industry’s got to come together and everybody’s going to do super well,” OpenAI Chief Executive Sam Altman said in an interview with AMD Chief Executive Lisa Su. “You’ll see this on chips. You’ll see this on data centers. You’ll see this lower down the supply chain.”

And you can tell that the deal with AMD has even Nvidia’s Chief Executive Jensen Huang perhaps a little jealous.

“I’m surprised that they would give away 10% of the company before they even built it. And so anyhow, it’s clever, I guess,” Huang said on CNBC’s Squawk Box this week. By built it, he is referring to AMD’s upcoming MI450 chip series.

Huang said he regrets not investing more into OpenAI. That’s the level of conviction he has for compute power.

Also even if the investments are circular, they’re happening because these companies are noting demand for it and thus inclined to invest in other companies. This was also a point raised by CoreWeave Chief Executive Michael Intrator this week on CNBC.

He said the circular investment idea is “fundamentally flawed,” adding that “it’s of the day, and it’ll pass because the fundamental drivers in the market are enormous.”

Conclusion

I know the market is not delusional about AI investments. Here’s why: When The Information reported this week that Oracle’s internal documents show that the cloud computing business had been generating thinner margins than other areas of its business and below what Wall Street was expecting, Oracle shares fell close to 7%. That’s healthy to see after its exuberant post-earnings rally. Contrary to what most may expect, it’s good when investors punish a stock for missing expectations, because that shows they’re acting rationally. Since then, shares have completely recovered, likely because it’s so obvious that it’ll take some time for margins to grow.

The investments into AI may be circular but the demand isn’t.

“I’m far more worried about us failing because of too little compute than too much,” said Greg Brockman, OpenAI’s president and co-founder.

As always, Signal From Noise should not be used as a source of investment recommendations but rather ideas for further investigation. We encourage you to explore our full Signal From Noise library, which includes deep dives on hot new metrics on Wall Street, agentic and sovereign AI, the military drone industry, the presidential effect on markets, the America First trade, ChatGPT’s challenge to Google Search, and the rising wealth of women. You’ll also find a recent update on AI focusing on the TikTok demographic and investments tied to the space race.