Wall Street loves non-GAAP measures of corporate success, whether it be EBITDA or free cash flow. In the age of artificial intelligence, my take is that the hottest new metric for seeing how companies are faring will become revenue per employee.

The idea behind this quite simple measure, calculated by dividing the revenue generated by the number of employees, is that corporations are pining to grow more with fewer staff so they can boast buzzwords like efficient, lean, and nimble.

Early signs suggest that executives of flashy tech stocks are eager to grow this number bigger and bigger to show how much edge they have.

“We’re planning to grow our revenue … while decreasing our number of people,” Palantir Chief Executive Alex Karp told CNBC in an interview last month. “This is a crazy, efficient revolution. The goal is to get 10x revenue and have 3,600 people. We have now 4,100.”

Failing to achieve that is not an option for Palantir PLTR 4.29% and other tech behemoths. That’s because a jump in productivity was heralded as the Second Coming to justify pouring incomprehensible levels of money into AI.

So the natural next step in the revolution is to see productivity measures go up across the board for a wide swath of companies — and especially for tech because they’re the ones that started this AI mania. Otherwise, it’ll just look like “do as I say, not as I do.”

The Federal Reserve Chair Jerome Powell made similar comments this week.

“You need skills to benefit, but if you have those skills, then technology makes you more productive. That’s what we need,” he said. “Incomes can only rise if productivity is increasing. We’re sort of working as many hours as we can work now, so it really is down to how much output can you have in an hour, and that’s productivity.”

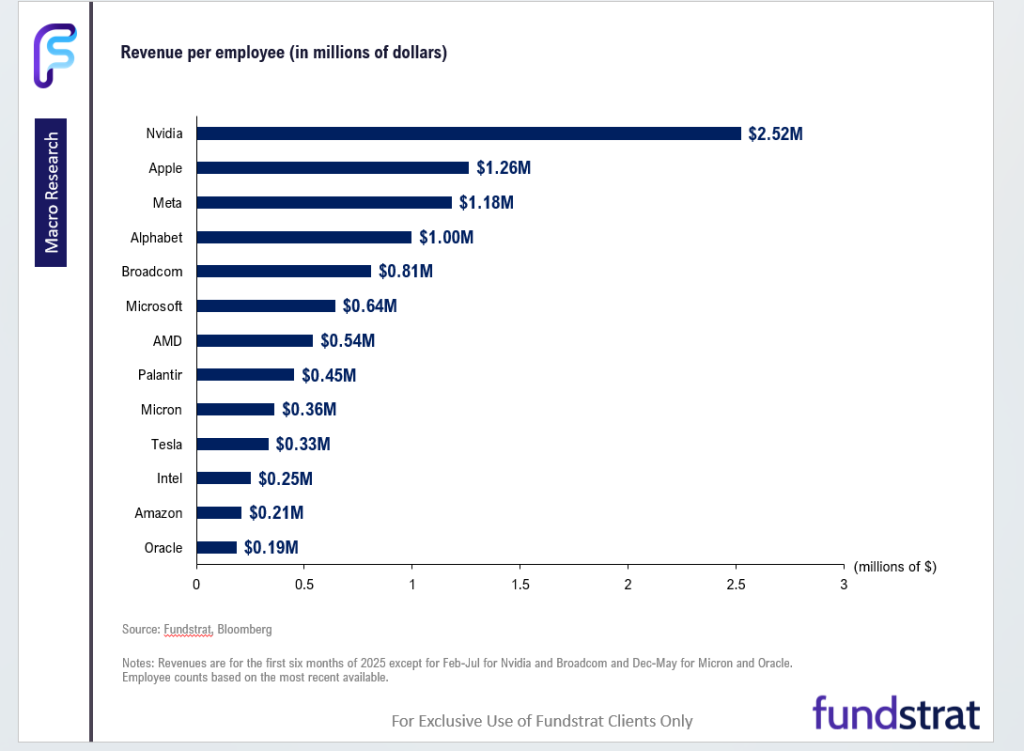

As it stands, Nvidia NVDA 1.56% is so far ahead of the pack on the basis of revenue per employee that it kind of doesn’t even look like others are trying, according to data put together by our Macro Data Scientist Alex Wang.

The chipmaker’s revenue might not be the highest among the Magnificent Seven, but one could argue that it now matters as much or more that it has the lowest number of employees (denominator) of the group, contributing to its huge revenue per employee metric. Its shares are up 29% this year.

Just to give you an idea of the scale, Meta Platforms META 2.30% has the second lowest number of employees at 75,945, but that’s still more than double of Nvidia’s 36,000. Meta’s revenue per employee is at $1.18 million, while Nvidia’s at $2.52 million. Meta shares have added 24% in 2025.

Apple AAPL 0.69% has the second highest level of revenue per employee in the Magnificent Seven at $1.26 million, with shares up 4.8% this year.

Among the smaller players, Broadcom AVGO 2.17% is doing pretty well for itself, with its $810,000 value for revenue per employee. AMD’s AMD -1.45% is at $540,000. But still there’s a long way to go to catch up to Nvidia. Shares of Broadcom and AMD are up 44% and 32%, respectively.

On the bright side, it’s worth noting that this key metric has been inching up for most of the companies we mentioned in the chart from 2022, when AI really took over the world by storm.

Since then, use of AI has indeed started helping workers in saving hours and becoming more productive, according to a Federal Reserve Bank of St. Louis research published in June.

“On average, genAI users would need to work 5.4% more hours to complete their work without genAI, implying 1.4% time savings across all workers (including non-users),” the research said.

That’s about 2.2 hours for a 40-hour-a-week worker.

Another interesting point in the research was that their estimates suggest that each hour spent using genAI increases the worker’s productivity for that hour by 33%.

That’s all great and all, but there’s always the worry that companies can try to artificially inflate that number by slowing down hiring or cutting staff.

Meta, for example, has frozen hiring in its coveted AI division. That’s a real quick turn of events for a company that was shelling out millions of dollars just a few months ago to attract employees who can lead the AI charge.

A broader labor market slowdown, exacerbated by an immigration crackdown, can also cause that revenue per employee number to go up for the wrong reasons. Right now, the latest example of that comes from the overhaul of the H-1B visa program, which requires a $100,000 fee.

Tech companies are the biggest beneficiaries of the H-1B program, so I’ll be closely watching this to note the impacts on the revenue per employee metric. Perhaps the president’s changes to the program will force the currently employed staff to really amp up their AI usage, which would increase productivity. After all, workers in the information technology industry are the biggest users of ChatGPT, according to a report by OpenAI.

Conclusion

A greater emphasis placed on revenue per employee would show that tech companies are doubling down on their bet against human capital in the pursuit of superintelligence. As these companies figure out how to sustainably make money from their investments in AI, maybe the next measure can be profit per employee. I hope we can widely cite that next year.

As always, Signal From Noise should not be used as a source of investment recommendations but rather ideas for further investigation. We encourage you to explore our full Signal From Noise library, which includes deep dives on agentic and sovereign AI, the military drone industry, the presidential effect on markets, the America First trade, ChatGPT’s challenge to Google Search, and the rising wealth of women. You’ll also find a recent update on AI focusing on the TikTok demographic and investments tied to the space race.