“Citius, Altius, Fortius – Communiter” – Motto of the Olympic Games

The Games of the XXXIII Olympiad are approaching, with opening ceremonies scheduled for July 26, 2024. Paris will become only the second city to host the Summer Games three times (having previously hosted in 1900 and 1924). The other is London, which welcomed athletes in 1908, 1948, and 2012. Los Angeles, which hosted in 1932 and 1984, is scheduled to host a third time in 2028.

The formidable athletes of these games are sure to embody the classic Olympic aspirations – to go “faster, higher, stronger – together.” These noble and inspirational ideals, however, are undeniably intertwined with more pragmatic fiscal matters. Bluntly, large sums of money are required to put on this showcase of athleticism, heart, and ambition, and much of it is raised through corporate sponsorships.

Corporate money has become an increasingly large part of the Games in the last half century. As University of Liverpool law professor Amandine Garde and strategy consultant Neville Rigby wrote in their study on food marketing at the Olympics, “From having a comparatively low level of sponsorship half a century ago, the Games have become highly commercialized, reflecting the marked trends in recent decades that have transformed sports sector deals which account for a significant proportion of the global sponsorship market.”

For Comcast (CMCSA -0.88% ), whose NBC network has the U.S. broadcast rights to the Games of the XXXIII Olympiad, the Paris Olympics are already a success. The company noted on April 11 that it had already sold $1.2 billion in advertising, on track to achieve a new sales record in its Olympic history. This represents a significant increase from the last summer Olympics in Tokyo, which took place in 2021. (NBC has signed an agreement to broadcast the Games in the U.S. all the way through 2032.)

One possible reason for this added excitement is that Paris will mark yet another milestone in our return to a non-pandemic world: these will be the first Games without any COVID-related restrictions for live attendance of the events since the pandemic emerged in early 2020. The Tokyo games, originally scheduled for 2020, were delayed until summer 2021 due to the global outbreak, and even when held, allowed no live spectators. Most events at the 2022 Winter Games in Beijing were also closed to live spectators. For the U.S. audience, the Paris games also have the advantage of a more convenient time zone for live viewing of events.

So amidst the commercial excitement of corporate Olympic sponsors, we thought it would be interesting to see if such sponsorship has any observable correlation with stock performance. Our examination involves stock performance of those companies that participate in the highest level of sponsorship – the Olympic Partners (TOP) program. TOP sponsors are also known as worldwide sponsors.

Each company negotiates its TOP agreement with the International Olympic Committee (IOC) independently, with costs typically estimated to run into the hundreds of millions of dollars. TOP partners are expected to provide ongoing support over multiple years (not just the years in which Games are held). This support includes money, products and services, and sometimes, personnel and technical expertise. The IOC selects TOP partners not just by monetary contribution, but also what kinds of non-monetary support they can provide to the Games. Beyond that, the terms – including the length of the sponsorship and the obligations (financial and otherwise) – can vary widely.

In the words of the International Olympics Committee (IOC), TOP sponsors are granted “exclusive marketing rights and opportunities within a designated product or service category, including partnerships with the IOC, all active [National Olympics Committees], their Olympic teams, [relevant] OCOGs, and the Games themselves.” (An OCOG is responsible for organizing the Games of a specific year and location.) Succinctly, TOP sponsors get preferential access to Olympic broadcast advertising and the right to use Olympic imagery and designations on their products (including the Olympic rings and flame). Where relevant, they are also the sole provider of goods and services within their designated categories to athletes, spectators, and other participants during the Games.

We have limited our examination to those involved with the Summer Games, which are significantly larger than the Winter Games. (The Paris Games, for example, are expected to involve 10,500 athletes from 206 countries. In contrast, in the most recent Winter games (Beijing 2022), just 2,897 athletes from 91 countries participated, roughly in line with other Winter Games. Unsurprisingly, global viewership of Summer games also tends to be much higher.) We have further limited our examination to those publicly traded companies that, by the time the Paris games end on August 11, will have been TOP sponsors for at least three Summer games since 2000.

There are nine such companies, seven of which are publicly traded in the U.S. (The other two are the Korean diversified conglomerate Samsung and the French IT company Atos.) For each of these companies, we will look at the stock-price performance of the company in question.

Specifically, we will examine:

- Whether a worldwide sponsor’s stock price tends to do better in Olympic years relative to its own annual average returns (ex-dividends)

- Whether a worldwide sponsor’s stock price does better in Olympic years relative to the stock price of one of its major competitors. This will include a look at whether the sponsor’s stock demonstrates better returns than its competitor during Olympic years both on an absolute basis and relative to their respective historic averages.

In this way, we hope to see whether there is any likelihood of a stock-price boost for Olympic worldwide sponsors in years when the Summer Games are held and their association with the Games are most visible.

All returns are calculated exclusive of dividends, taxes, and expenses.

Coca-Cola Co (KO 0.04% )

Coca-Cola has provided financial backing to the Olympic Games every year since 1928, and it became an inaugural member of the TOP Program in 1986. In 2019, Coca-Cola extended its agreement with the IOC until 2032. In a departure from its previous history, Coca-Cola opted to become a co-worldwide sponsor with China’s Mengniu, a major dairy company. The beverage giant also has licensing agreements with the respective National Olympic Committees of all 205 nations participating in Paris.

As a TOP sponsor, Coca Cola will once again provide its array of beverages (including its Powerade sports beverage) to athletes, officials, and spectators during the Torch relay and both the Olympic and Paralympic Games.

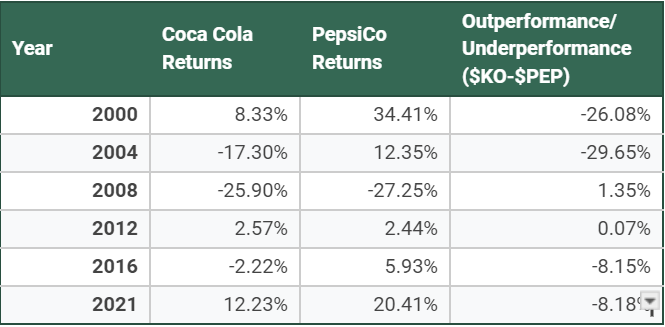

From 2000-2023, Coca Cola stock averaged 3.13% annual returns. Shares of its longtime rival PepsiCo (PEP -0.31% ) averaged 6.57% returns. Thus, Coca-Cola stock has underperformed PepsiCo shares by an annual average of 4.44% during this period. As the table below shows, Coca-Cola shares do not seem to have benefited from the company’s sponsorship. Its stock performance generated above-average returns in just two out of six Olympic years. Furthermore, KO 0.04% managed to cut their average underperformance relative to PepsiCo in just one of the six years we examined.

Omega (Swatch Group) (SWGAY)

The iconic watch brand has played a role at the Olympic games since 1932, serving as official timekeeper for 30 (going on 31) times. Its current agreement with the IOC extends through the 2032 Games in Brisbane, Australia.

In its role as a worldwide sponsor, Omega will provide timekeeping devices, photographic systems (e.g., photocells and photo-finish cameras), starting blocks, and starting pistols at all relevant events, along with personnel to help install and operate them. Omega will also provide the public scoreboards at all Olympic events.

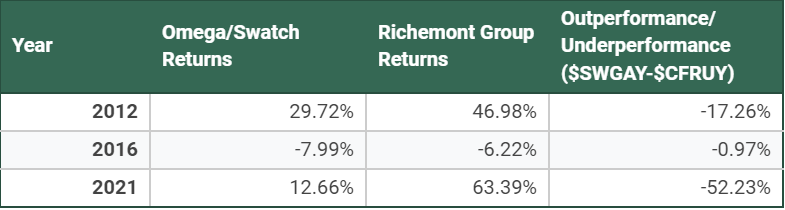

Omega is a subsidiary of the Swatch Group. U.S. investors first gained the ability to invest domestically in the Swatch Group ADRs on March 22, 2010. From that time to the end of 2023, its shares have returned an annual average of 12.24%. During the same period, ADRs for Compagnie Financiere Richemont (CFRUY), a luxury watch company whose brands include Panerai and IWC, have returned an average of 10.29% a year. Thus, on average, the Swatch Group stock outperformed Richemont Group shares by 1.95% a year during this period.

During the three Game years available for examination, Swatch Group shares have twice delivered above-average returns on an absolute basis. The story is slightly different when measured against Richemont Group: for all three Game years, shares in the Swatch Group failed to match their average annual outperformance over its rival.

Panasonic (PCRFF)

A TOP Partner since 1987, Panasonic will provide large-scale video screens, projectors, cameras, and audio/visual systems, as well as digital broadcasting equipment. Panasonic will also be the official provider of DJ turntables for Breaking (breakdancing), which will make its debut as an Olympic event in Paris. The company’s current agreement expires this year.

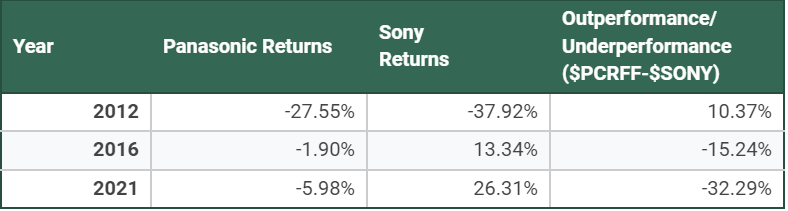

Panasonic shares first became available domestically to U.S. investors on November 4, 2008. Since that time, they have had an average annualized return of negative 3.55%. During the same period of time, Sony (SONY 1.62% ) returned an average of 9.22%. Panasonic shares have underperformed relative to Sony by an average of 12.77%.

During years with Summer Games, Panasonic shares have delivered below-average returns two out of three times. They have also failed to meet the historic average underperformance relative to its competitor, Sony, two out of three years.

Visa (V -0.25% )

As a worldwide sponsor since 1986, Visa will once again be providing payments-related products and services in Paris, including contactless payment terminals and an Olympic-themed mobile-payment app. Its current IOC agreement will run until 2032.

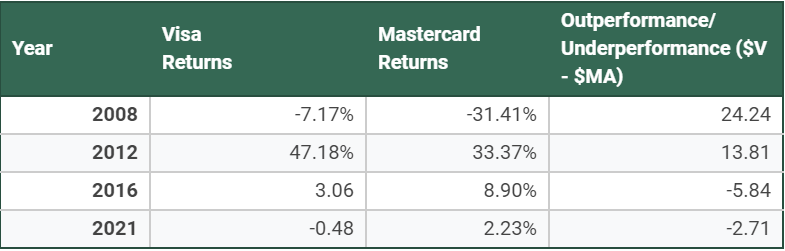

Visa went public on March 19, 2008 (Day 288). Since then, it has returned an average 21.78%. Mastercard (MA 0.25% ) has notched average returns of 22.65% annually. On average, Visa shares have underperformed those of Mastercard by 0.87% per year. Out of four Olympic Game years (note that we prorated based on Visa’s inception date on March 19, 2008), Visa shares have beaten their average on just one occasion. However, relative to Mastercard, its shares have generated above-average outperformance twice.

Procter & Gamble (PG 0.06% )

A TOP Partner since 2010, Procter & Gamble will provide an array of personal-care and household products and services to athletes and staff at the Athletes’ Village. It will also be designing and providing the podiums on which athletes will stand to be presented with their medals. P&G’s agreement runs until 2028.

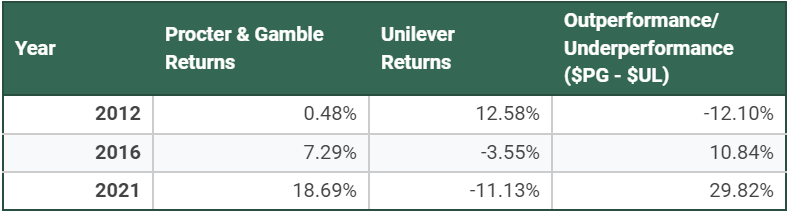

In the period from January 3, 2012 to December 29, 2023, PG 0.06% returned an average of 6.76%. During that same period, Unilever returned an average of 1.48% per year. In other words, during this period, PG 0.06% outperformed by an average of 5.28% each year.

We examined three Summer Games years during this period, and PG 0.06% recorded above-average returns in two of them. Relative to Unilever stock, PG 0.06% shares also beat historical average outperformance two out of three times.

Bridgestone (BRDCY)

Japan’s Bridgestone has been part of the TOP program since 2014, and it will work with fellow sponsor Toyota as the provider of the “official tire” of the Games. Its expertise in rubber technology will also be applied to the use of gloves, wheelchair hand rims, and other adaptive devices used by athletes in the Paralympics. Its current agreement expires this year.

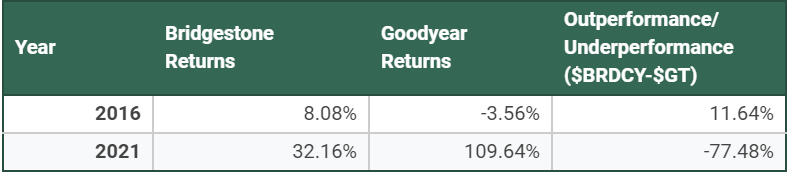

Since the beginning of 2014 to the end of 2023, BRDCY has returned 8.67%, an average 0.83% per year. During the same period, Goodyear Tire & Rubber (GT 1.34% ) has returned an average of negative 9.5% per year.

Toyota (TM 2.20% )

Toyota joined the TOP program in 2015, the first worldwide sponsor to bring physical-mobility expertise to the Games. Its current agreement expires in 2024, and the carmaker has indicated that it will terminate its sponsorship of the Games at that time, reportedly dissatisfied with how the IOC spent Toyota’s sponsorship money.

In Paris, Toyota will be providing the Games with a fleet of passenger vehicles to help transport athletes and spectators. Though best known for its automobiles, Toyota will also provide hundreds of personal mobility devices for those who have difficulty walking, including wheelchair pullers, electric people movers, and seated scooters.

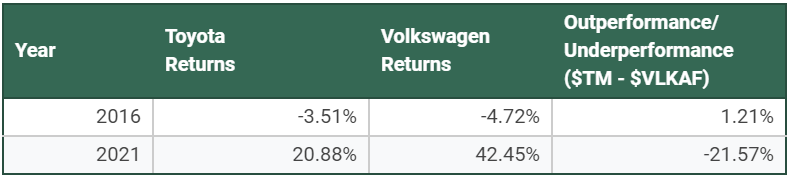

From 2015 to 2023, Toyota stock returned an average of 4.29% each year. During this same period, Volkswagen (VLKAF) declined an average of negative 5.61%. On average, Toyota thus outperformed Volkswagen by 9.9% a year.

In summary

Our inquiry has not yielded any conclusive results. In some of these cases, we were comparing stock-price performance from just two or three years. We also saw wild fluctuations in the annual stock returns of either a worldwide sponsor or its competitor from year to year, which arguably raises the likelihood that other factors outside of the Olympic Games affected the companies involved. Furthermore, although we tried to choose a closely similar competitor to compare to the Olympic worldwide sponsors, in most cases there were still significant differences in their respective businesses.

Nevertheless, perhaps what we failed to find – any strong correlation between stock-price outperformance and global sponsorship of the Olympic Games – is enough to deprioritize sponsorship as a factor to consider when deciding whether to invest in a company in an Olympic year. As always, Signal From Noise should be used as a source of ideas for further research rather than as a source of investment recommendations. We hope you enjoy the Games, nonetheless.

In the meantime, we encourage you to explore our full Signal From Noise library, which includes deep dives on investments related to natural disasters and an update to our overview of the semiconductor industry. You’ll also find a recent discussion of weight loss-related investments, artificial intelligence, and the Millennial generation.