If there is anything the world can rely on, it is that time will pass, children will be born, daughters and sons will see the world differently from mothers and fathers, and new generations will supersede previous ones every twenty years or so.

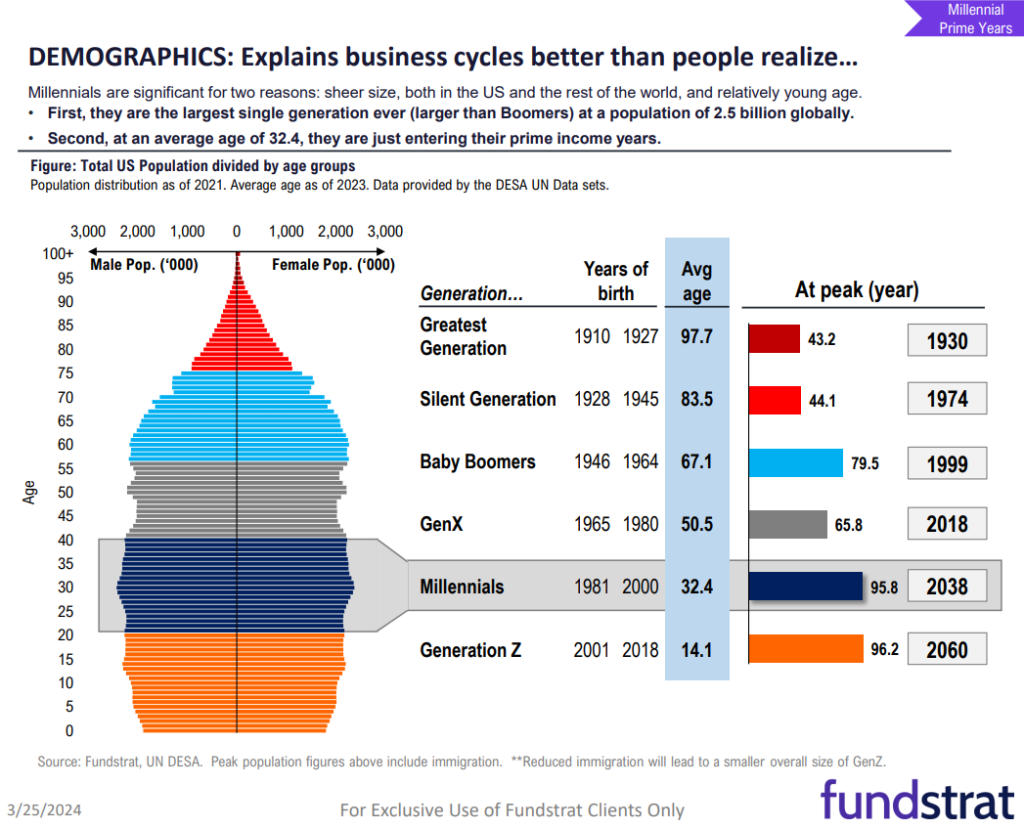

Concurrently with the rise of industrial-scale P.R. and advertising, the last seven generations of people born in the U.S. and the rest of the world have been given thematic identifiers, the better to denote them for purposes of understanding them and, let’s be honest, sell to them. There was the Greatest Generation, born with the 20th century (and through the 1920s), the Silent Generation, born just before the Depression and through the end of WWII, the Baby Boomers, born from after WWII through the introduction of the birth-control pill in 1964, Generation X, running from the following year through 1980, Generation Y or The Millennials – a moniker that identifies people born from 1981 through 1996, the post-Millennials or Generation Z (or Zoomers), born between 1997 and 2014, and finally Generation Beta, being conceived and born as we speak.

Today we will concern ourselves with the millennials, who, while the eldest of them may be waiting for grandchildren, are, as a demographic unit, just coming into their own, socially and economically, in a way that won’t be ignored and should be heeded by anyone who wants to be apprised of consumption trends and the myriad ways in which they impact capital markets.

Having been keen followers of the millennials for some years now, we believe them to be more sensitive than ever to the watchwords credibility, authenticity, and personality. To the extent that it is possible or advisable to generalize the behavior of a hundred million people, anyone who wants their custom will need to understand the foundational psychology of the cohort.

Millennials are especially sensitive to and vigilant of perceived power dynamics, specifically the following: hierarchies (the anyone-can-post-and-comment ethos of social media has created a preference for a flatter social/communication landscape); the value/downside of tradition; the value of long experience; received wisdom/morality; the elites vs. the common man, the idea of narratives vs. stories vs. facts (expressed as ‘fake news’, ‘gaslighting’, relativism, et al, but also as distrust of consensus / prevailing opinion), privacy (seeking to keep their personal data out of the hands of large corporations), and being sold to (preferring an “honest review” by an influencer to an ad by a paid spokesperson).

As a result, a major theme with this cohort is empowerment, in the form of: direct contact / easy access (see flat society, above), seeking the comfort that comes with having your preferences catered to (free shipping for online shopping, food and similar items delivered within the hour in cities, pervasive gamification: missions, levels, badges, points, and leaderboards everywhere: from social media to workplace learning to productivity apps, etc., and baseline low-level entertainment quotient (emojis, animated gifs, et al.)); radical autonomy (increasingly available WFH and similar tech-enabled, location-agnostic labor models, accessibly priced electric scooters/bikes, wireless (noise-cancelling) headphones, 3D printing, etc.); cause/meme-themed shopping and investing: ESG, DEI, GameStop/AMC, Robinhood, etc.); and, finally, their increasing influence in the markets, stemming from a pronounced value-seeking outlook and rising financial clout (on the back of being good savers and recipients of the massive wealth transfer from boomers).

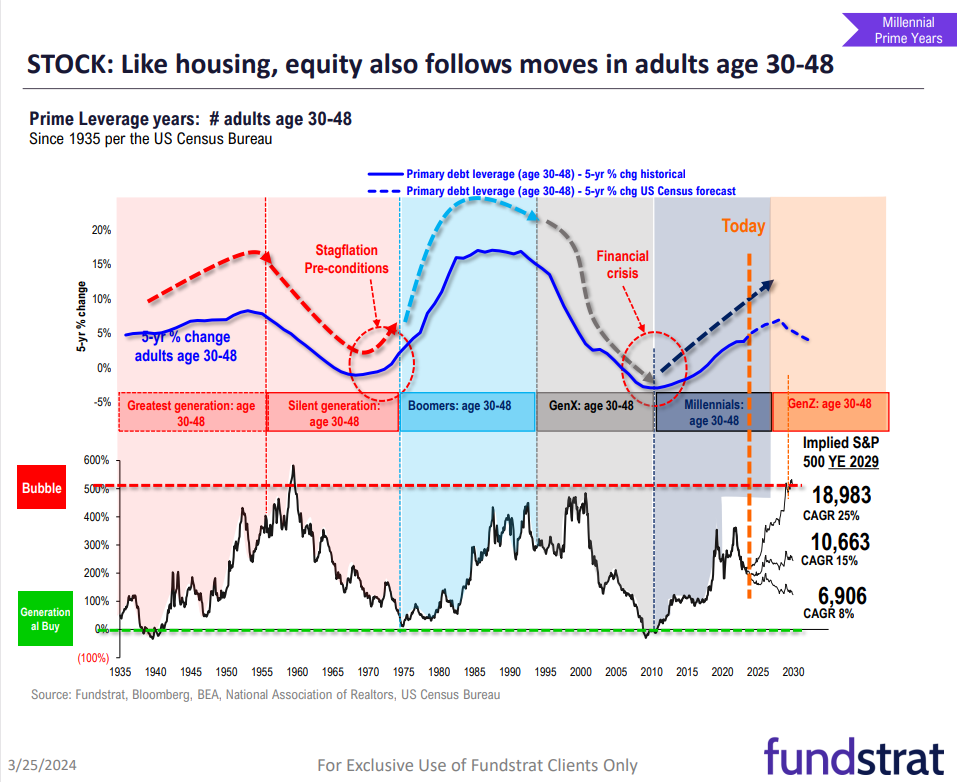

From psychology we move to another meaningful bouquet of characteristics. Another pattern the world can rely on, and one we have covered before, is that, while biology often determines destiny for individuals, demographics are destiny for economies.

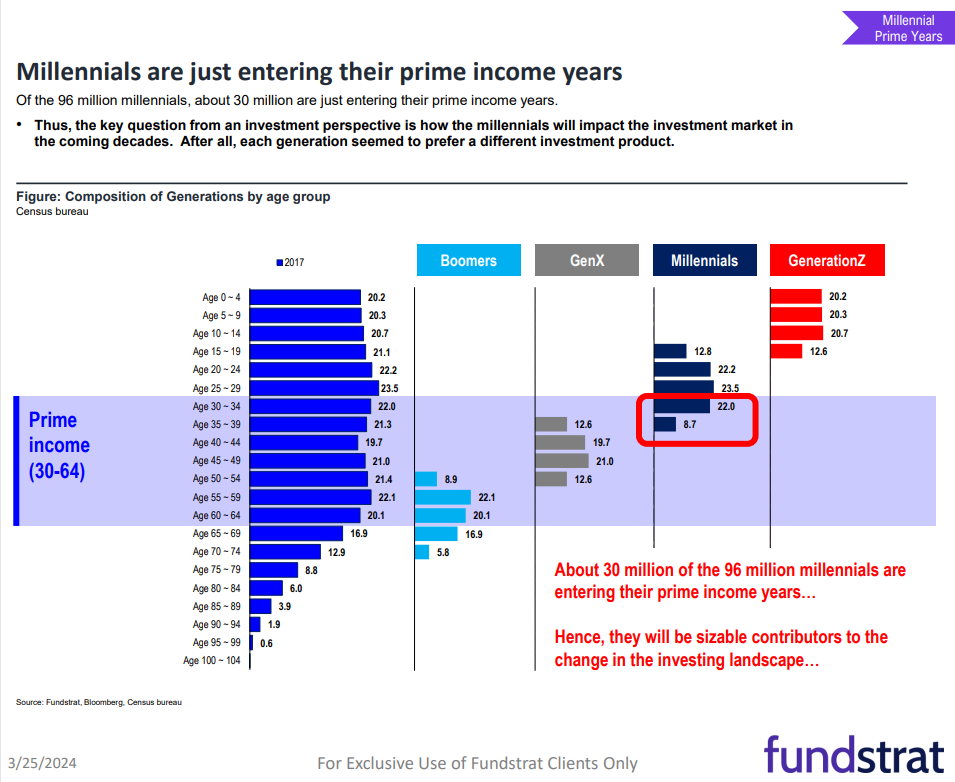

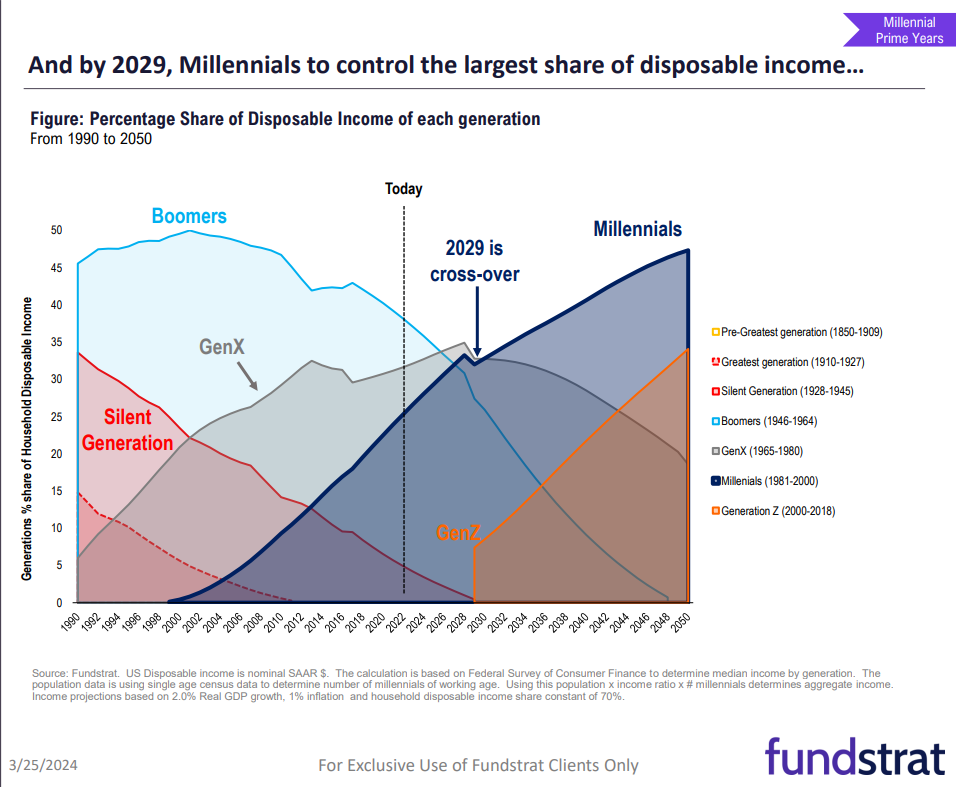

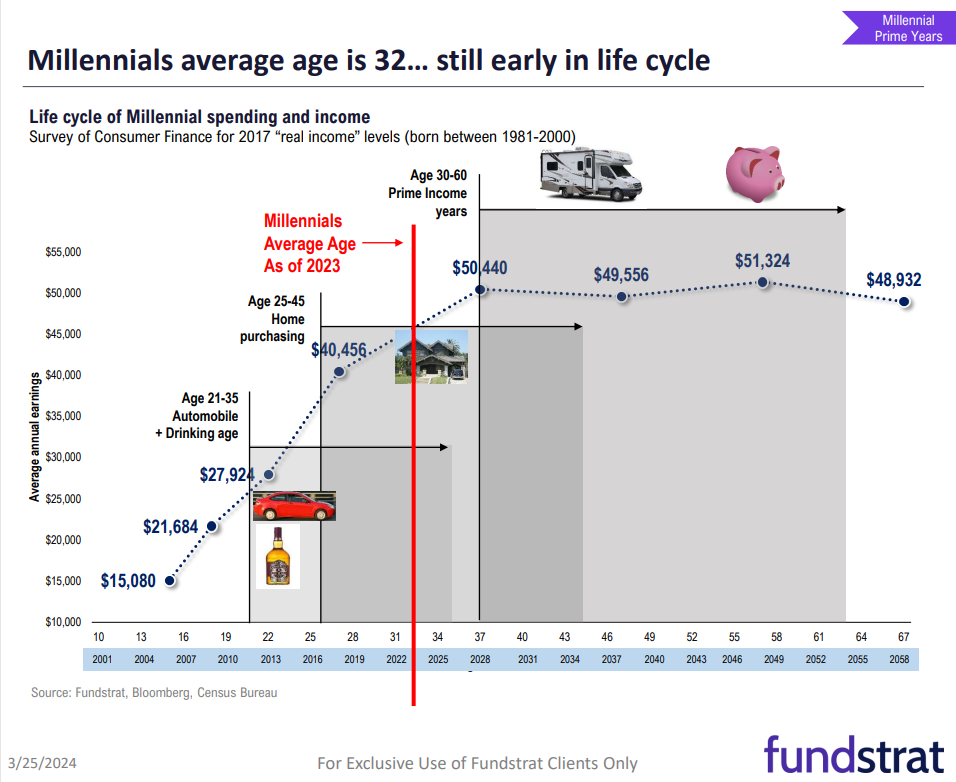

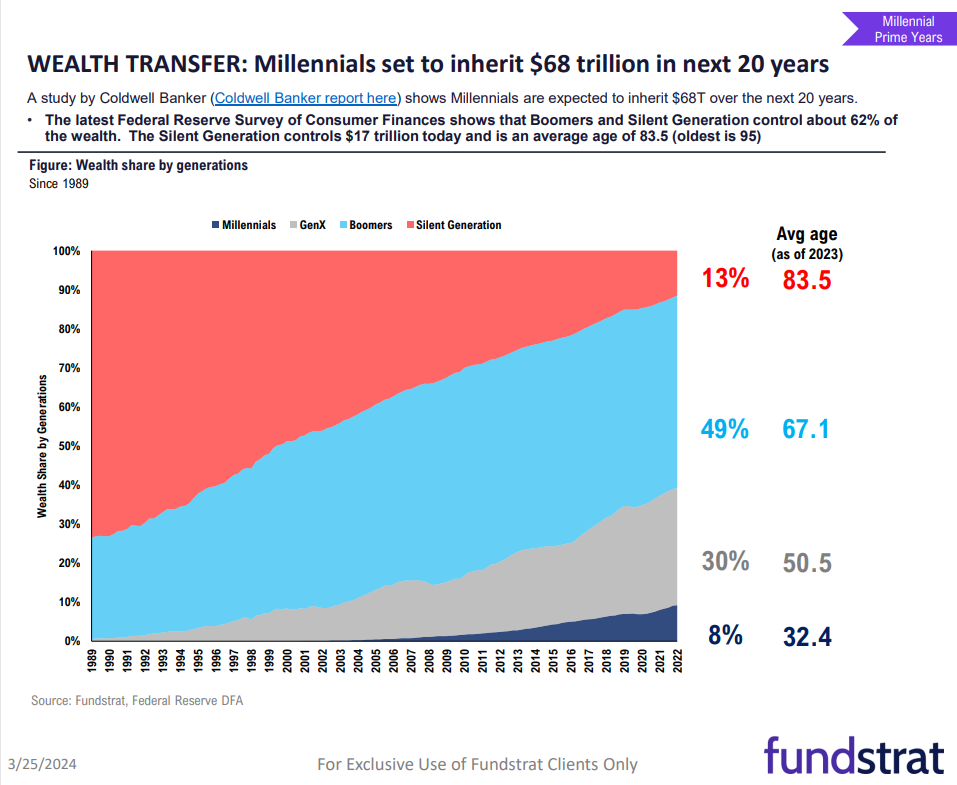

Some hundred million strong, and just entering their prime earning years, millennials are poised to make an impact on the U.S. economy that will rival even that of their once-hippie grandparents – the boomers – who are in the midst of passing on a large chunk of their wealth to their children’s children. More on that below.

It’s clear that the size of the cohort as well as its increasing access to wealth, both earned and inherited, is making millennials more influential players in the financial markets, while the companies that cater to their needs (to the extent that the latter can be identified and meaningfully attributed to such a large group) stand to be buoyed by millennials’ buying power.

Their financial future is promising, to say the least.

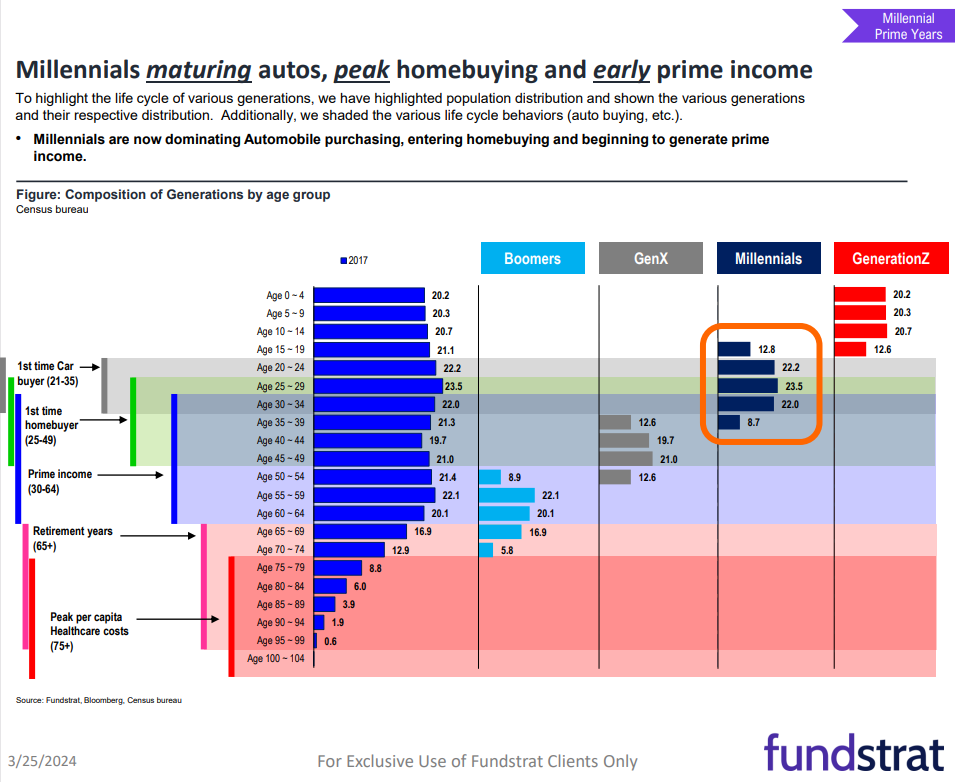

While millennials are the most educated generation in history, they have so far lagged behind the earnings of their predecessors at the same stage of life. Sure, on average, millennials have delayed key financial milestones like homeownership, but this trend is starting to change.

Click here to watch the replay of the full webinar

Another universal truth is that the young eventually become middle-aged, and then old. Trends we once thought permanent, such as urbanization, were quickly reversed due to the massive disruption of the COVID-19 pandemic. Remote work and perceptions of cities as unsafe led to a reversal of urbanization, though it’s unclear to what extent this shift will last. Similarly, the pandemic accelerated the adoption of e-commerce, in which millennials participate unabashedly.

One trend the pandemic could not alter is the ironclad link between demographics and bull markets as well as rises in consumer spending. Since consumer spending makes up the lion’s share of U.S. economic activity, the entrance of the largest, most educated generation into its peak earning and spending years is a significant tailwind for the U.S. economy. While millennials may have more diverse income sources than their parents, and while they’ve delayed checking off traditional milestones such as homeownership, they are poised to inherit trillions of dollars as a cohort, which will only add fuel to the fire that their economic activity promises to be.

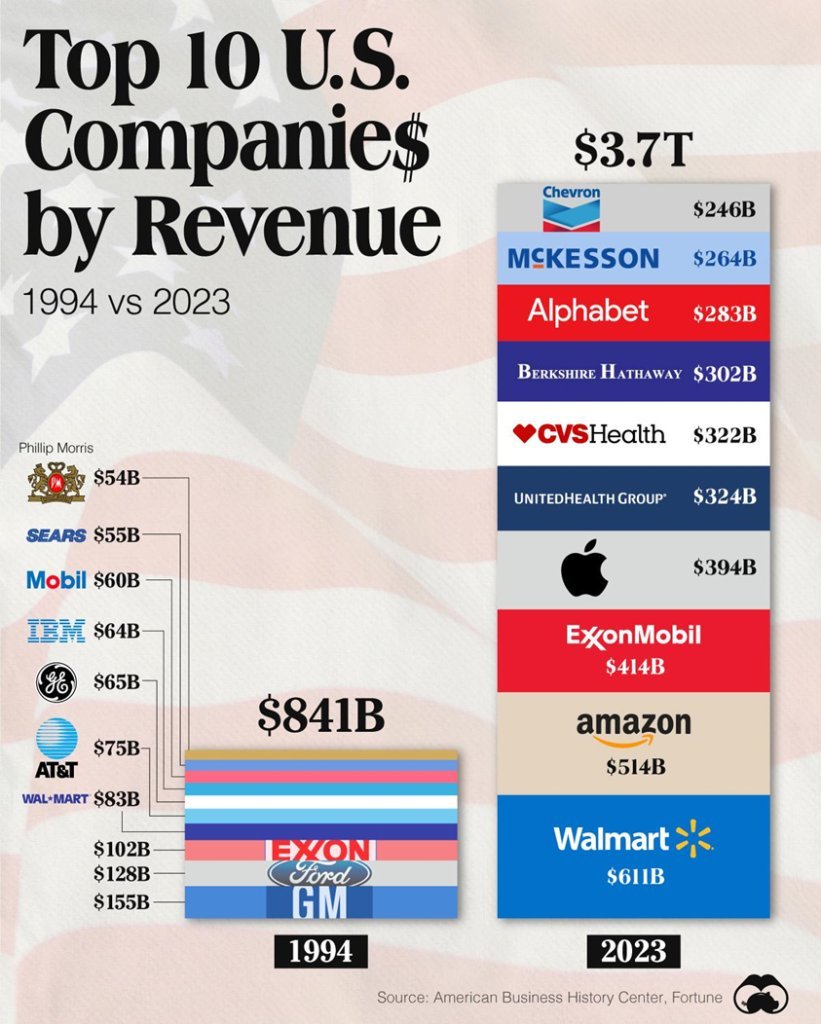

A key strength of the American economy is its ability to continuously spawn new, disruptive companies that displace incumbents – a feature not seen in every developed economy. The age of maximum economic engagement tends to coincide with the founding of groundbreaking companies. Millennials have already contributed innovative new enterprises to the American business landscape, and more will surely follow. We should remember that the pioneering innovations of baby boomer entrepreneurs were market outperformers for years, and some still are today.

Click here to watch the replay of the full webinar

… and the most valuable companies at the boomers’ peak vs. the most valuable ones today are:

Via Voronoiapp

When they’re not creating wealth by starting new companies or building careers, as any generation – only, in their case, on a much grander scale – millennials are receiving wealth in the form of an inheritance. Indeed, over the next 20 years, they are set to receive some $68 trillion.

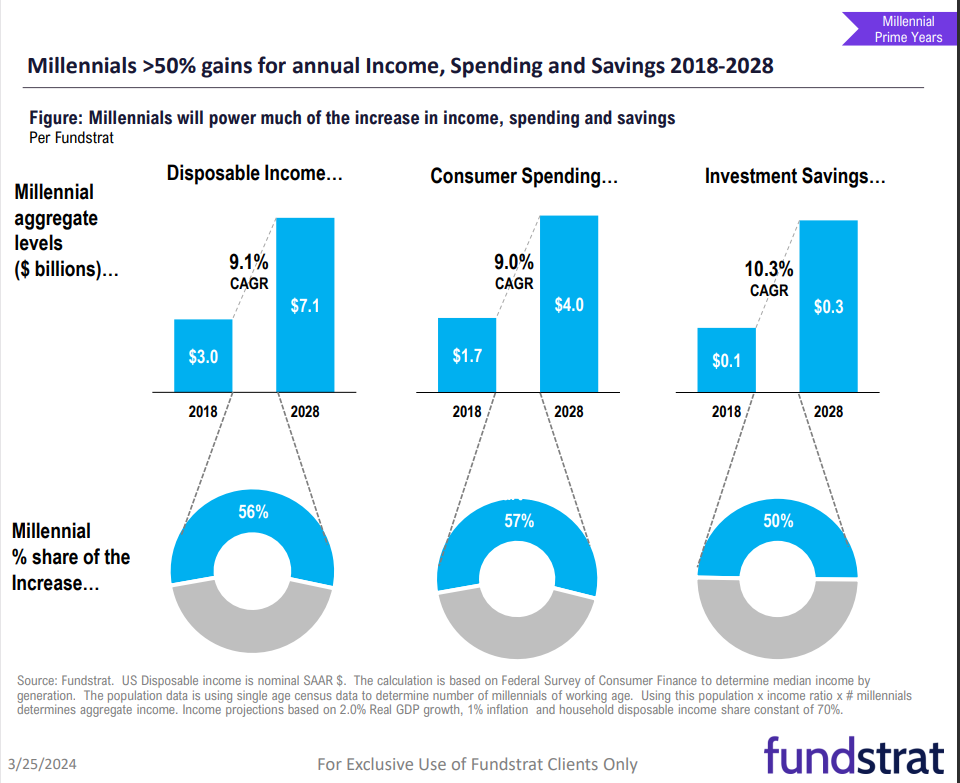

At the moment, we are quite literally in the middle of a period of large gains in disposable income, spending and savings for millennials.

Naturally, these gains, especially gains in disposable income, translate into more spending, and given their much studied specific spending preferences, we can expect millennials to move the markets more and more as they progress through the prime years of their economic impact.

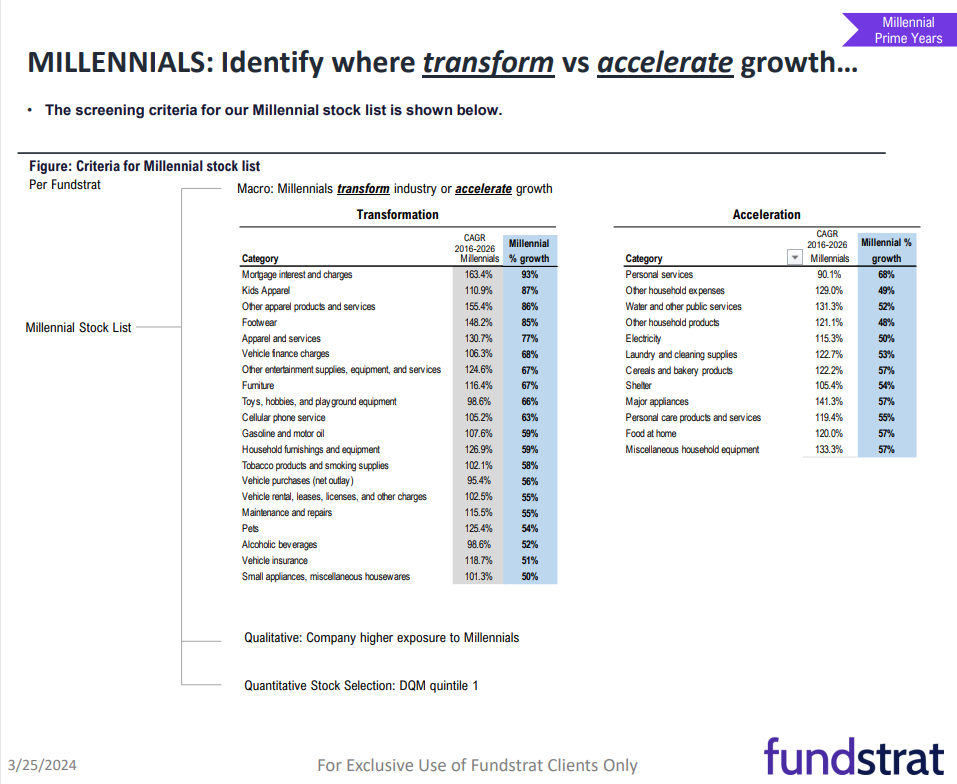

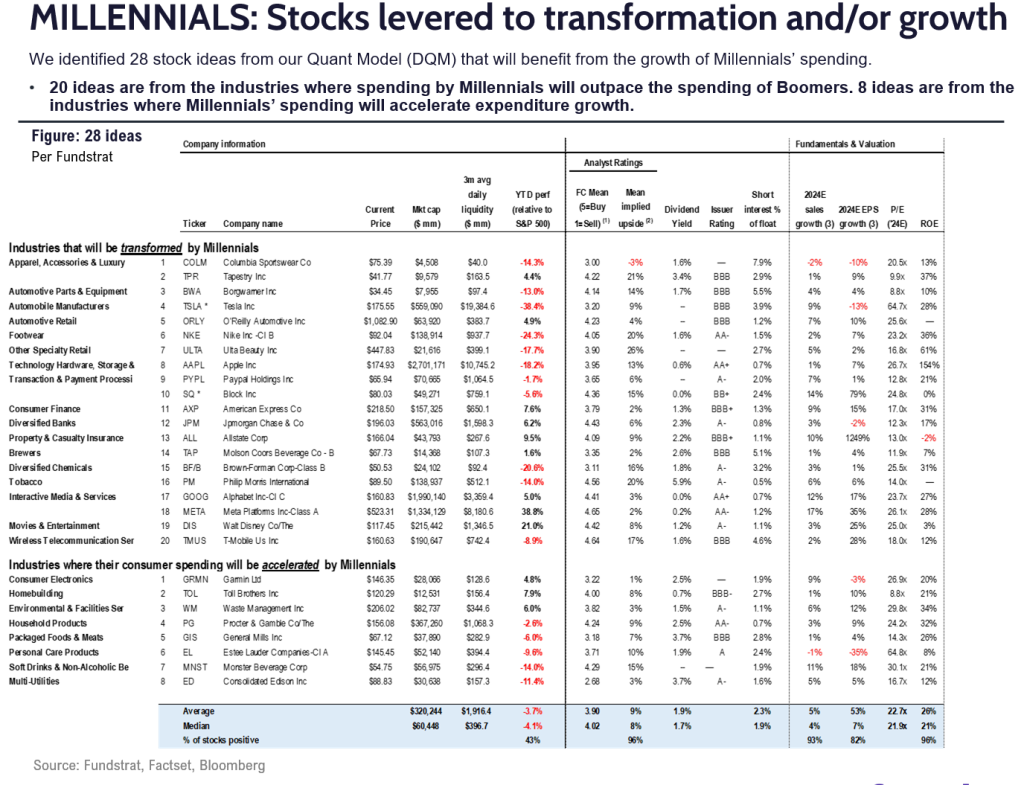

Digging deeper, we have identified two lists of industries whose exposure to millennials as clients will, in the first case, accelerate their growth and, in the second, transform growth. We present them below.

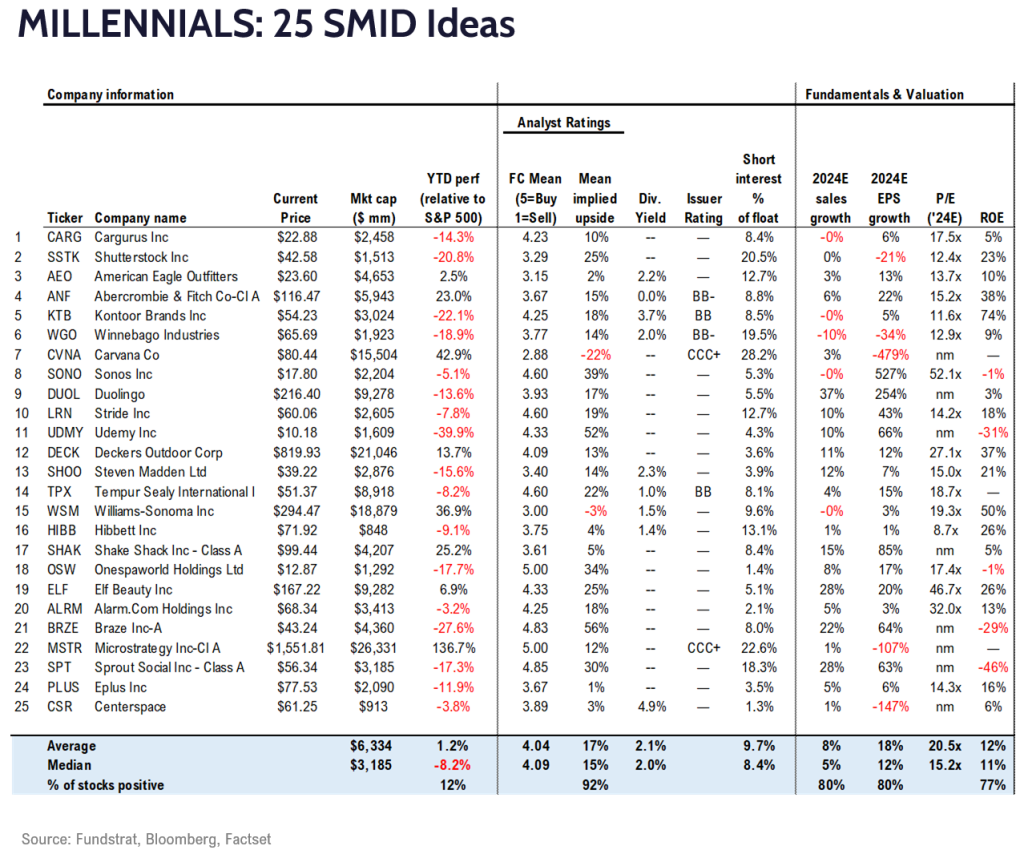

We have further identified specific companies whose growth is poised to be accelerated or transformed, as well as, separately, a number of small- and mid-cap stocks that stand to benefit from the tremendous economic power of millennials.

ULTA (Ulta Beauty, Inc.): Ulta Beauty is a leading beauty retailer that offers a unique combination of mass and prestige cosmetics, skincare, haircare, and fragrance products. The company operates over 1,200 stores across the United States, providing consumers with a one-stop-shop experience for all their beauty needs. Ulta’s broad merchandise assortment, appealing loyalty program, and focus on an engaging in-store experience have allowed it to capture market share and become a dominant player in the highly competitive beauty industry. With continued expansion opportunities, investments in omnichannel capabilities, and a strong brand, Ulta appears well-positioned for sustained growth.

AXP (American Express Company): American Express is a premier global payments and travel company. It is best known for its credit card products, which cater to consumers and businesses. AmEx differentiates itself through its focus on premium and affluent customers, offering rewards, benefits, and customer service that appeal to this lucrative segment. The company also operates a successful global merchant network and corporate payments business. Despite facing increased competition in the payments industry, AmEx boasts strong brand loyalty, diversified revenue streams, and disciplined risk management, which make it an attractive long-term investment.

JPM (JPMorgan Chase & Co.): JPMorgan Chase is one of the largest and most diversified financial services firms in the world. It operates through four main business segments: Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking, and Asset & Wealth Management. JPMorgan’s scale, diversification, and industry-leading capabilities in investment banking, commercial lending, asset management, and other areas have allowed it to consistently generate strong financial performance. The company’s disciplined risk management, technological innovations, and strategic acquisitions position it well to navigate the evolving financial landscape.

TAP (Molson Coors Beverage Company): Molson Coors Beverage Company is a leading global brewer with a portfolio of iconic beer brands, including Coors Light, Miller Lite, and Molson Canadian. The company has operations in the United States, Canada, Europe, and other international markets. While facing headwinds from shifting consumer preferences toward spirits and craft beer, Molson Coors has worked to revitalize its core brands, expand into adjacent categories like hard seltzers, and optimize its operations. The company’s strong brand recognition, distribution network, and focus on cost efficiencies could help it navigate the challenging beer industry environment.

DIS (The Walt Disney Company): The Walt Disney Company is a diversified global entertainment and media conglomerate. Its business segments include Media Networks, Parks, Experiences and Products, Studio Entertainment, and Direct-to-Consumer & International. Disney’s vast intellectual property, including iconic brands like Marvel, Pixar, and Star Wars, as well as its world-class theme parks and growing direct-to-consumer streaming offerings, make it a unique and valuable asset. Despite facing pandemic- and corporate governance-related disruptions, Disney sees its long-term growth prospects as strong as it continues to leverage its brand power and adapt to the evolving media landscape.

GRMN (Garmin Ltd.): Garmin is a leading manufacturer of global positioning system (GPS) navigation and wearable technology products. The company’s diverse product portfolio includes fitness trackers, smartwatches, aviation equipment, marine electronics, and outdoor recreation devices. Garmin has established a reputation for quality, innovation, and technology leadership in its key markets. As consumer demand for connected devices and wellness tracking continues to grow, Garmin appears well-positioned to capitalize on these trends and expand its market share.

TOL (Toll Brothers, Inc.): Toll Brothers is one of the nation’s leading builders of luxury homes. The company operates in twenty-four states, primarily targeting affluent buyers in the move-up, empty-nester, and active adult markets. Toll Brothers is known for its high-quality construction, thoughtful design, and amenity-rich communities. Despite near-term headwinds from high interest rates and economic uncertainty, the company’s focus on the luxury segment, strong brand recognition, and land banking strategy position it well to navigate market cycles and capture long-term growth opportunities in the residential housing industry.

ANF (Abercrombie & Fitch Co.): Abercrombie & Fitch is a major American retailer of casual clothing, accessories, and personal care products, primarily targeted at teenagers and young adults. The company operates over 850 stores worldwide under the Abercrombie & Fitch, Abercrombie Kids, and Hollister Co. brands. While experiencing challenges in recent years amid shifting consumer preferences, the company has worked to revitalize its brand and product offerings. With a focus on improving online sales and expanding its international footprint, Abercrombie & Fitch appears poised for a potential turnaround, though the highly competitive teen apparel market remains a headwind.

DECK (Deckers Outdoor Corporation): Deckers Outdoor is a leading designer, marketer, and distributor of innovative footwear and apparel. The company’s portfolio of premium brands includes UGG, Koolaburra, HOKA, Teva, and Sanuk. UGG, its flagship brand, is a global lifestyle brand known for its iconic sheepskin boots. Deckers has successfully diversified beyond UGG in recent years, expanding its product lines and distribution channels. With strong brand recognition, a focus on innovation, and growing demand for its outdoor, comfort, and lifestyle products, Deckers appears well-positioned to capitalize on consumer trends and drive further growth.

ELF (e.l.f. Beauty, Inc.): e.l.f. Beauty is a fast-growing cosmetics company that offers high-quality, affordable beauty products. The company’s product portfolio includes color cosmetics, skincare, and other beauty essentials sold under the e.l.f. and e.l.f. SKIN brands. e.l.f. has found success by offering prestige-quality formulas at accessible price points, appealing to a diverse customer base. The company has a strong omnichannel strategy, selling through its own e-commerce platform as well as major mass retailers. With a focus on innovation, expanding product lines, and growing its digital presence, e.l.f. Beauty appears poised to continue its momentum and gain market share within the highly competitive color cosmetics industry.

In summary, we can say that, buoyed by the large size and wealth-transfer time frame of their grandparents’ (boomers’) generation and the U.S. economy’s determination to cater to their specific tastes, millennials have every chance of being the engine of the domestic economy over the next 20-plus years, and the companies we spotlight above – both in the general market as well as the small- and mid-cap categories – should be well positioned to benefit from the trend.

As usual, Signal From Noise should serve as a starting point for further research before making an investment, rather than as a source of stock recommendations. Although the names mentioned above each have the potential to benefit from the growing purchasing power and wherewithal of millennials, this alone should not be the basis of a decision to invest.

We encourage you to explore our full Signal From Noise library, which includes deep dives on the path to automation and opportunities arising from the ever-increasing global water crisis. You’ll also find a recent discussion of the Magnificent Seven, artificial intelligence, and the rise of Generation Z.